Provenance Solitaire is a single premium participating whole life insurance plan that offers protection and investment opportunities with a single, upfront payment.

The policy aims to address protection needs and offers a combination of guaranteed and non-guaranteed benefits.

You can use this policy for legacy planning and safeguarding future generations.

Do you want to learn more about it?

Here is our review of the NTUC Income Provenance Solitaire.

Criteria

- Entry age of insured: 0-75 years

- Entry age of policyholder: 16 years*

- Single premium payment with a minimum sum assured of $250,000

*Parents cannot purchase a policy on the lives of children above 18 years (as per their last birthday).

General Features

Premium Payments

The policy is a single premium, meaning you’ll pay a lump sum only once.

| Minimum sum assured | Maximum sum assured |

| $250,000 | Subject to underwriting |

Policy Term

The NTUC Income Provenance Solitaire is a whole life plan that terminates only in cases of surrender, terminal illness, or death.

Protection

Death & Terminal Illness (TI) Benefit

The amount of the death or terminal illness, the claim is determined based on the age of the insured when the claim event occurs.

| Age of the insured when the claim even occurs | Benefit |

| Before the anniversary, immediately after the insured reaches the age of 85 | 100% of the sum assured and 100% of bonuses, or minimum protection value (whichever is higher) |

| On or after the anniversary immediately after the insured reaches the age of 85 | 100% of the sum assured and 100% of bonuses |

Here are the minimum protection values based on your current age:

| Age of the insured at policy entry date (age last birthday) | Minimum protection value |

| 0-45 | 320% of the sum assured |

| 46-50 | 280% of the sum assured |

| 51-55 | 250% of the sum assured |

| 56-60 | 210% of the sum assured |

| 61-65 | 180% of the sum assured |

| 66-70 | 150% of the sum assured |

| 71-75 | 115% of the sum assured |

Any policy loan and interest shall be deducted from the amount payable as benefits. The policy and its benefits end after the amount is paid to the beneficiary.

Optional Add-On Riders

Provenance Disability Accelerator

Provenance Disability Accelerator is a total and permanent disability (TPD) rider that accelerates your basic policy.

This means that once the benefit is paid, it would reduce the sum assured and any bonus of the basic policy.

Like the main policy, it’s a single-premium payment that offers TPD coverage for a restricted duration.

The minimum protection value of this rider is 320% of the sum assured.

If the policyholder becomes totally and permanently disabled (before the anniversary immediately following the policyholder turning 70) during the duration of this supplementary coverage, the policy will provide the higher of:

- 100% of the sum assured and the pro-rated bonuses of the main policy or

- Minimum protection value as per the following table:

| Age of the insured at policy entry date (age last birthday) | Minimum protection value |

| 0-45 | 320% of the sum assured |

| 46-50 | 280% of the sum assured |

| 51-55 | 250% of the sum assured |

| 56-60 | 210% of the sum assured |

| 61-64 | 180% of the sum assured |

This rider can only be purchased with cash and ends once the TPD benefits are paid to the beneficiary.

The Provenance Disability Accelerator rider terminates once you turn 70 years old.

Key Features

Surrender Benefit

In this whole life plan, the policy’s surrender value comprises a guaranteed surrender value component and a non-guaranteed surrender value component.

Once the single premium is paid, the policy immediately holds a surrender value.

Bonuses

Annual or Reversionary Bonus

Each year, an annual or reversionary bonus is included in your policy.

It is determined based on a percentage of the basic sum assured and the previous year’s bonus.

Once added, this bonus becomes guaranteed, which means you will receive it irrespective of the performance of the participating fund.

Terminal Bonus or Special Bonus

This form of bonus is an additional payment that may be paid when filing a claim, surrendering the policy, or upon reaching maturity.

Future bonuses are not guaranteed because they will not be added to your policy.

Please note that bonuses may have varying rates. Furthermore, your plan will qualify for bonuses only 2 years after inception.

Additionally, the policy does not permit the redemption of bonuses alone.

80% Capital Guarantee

The NTUC Income Provenance Solitaire immediately guarantees 80% of your single premium payment.

Medical Concierge Service

The Medical Concierge Service is provided, offering a free, one-time service with a minimum protection value of $3 million.

Income Treats

This policy lets you enjoy a wide range of exclusive income treats, such as discounted travel vouchers and exclusive nights at top hotels.

NTUC Income Provenance Solitaire Fund Performance

Asset Allocation

Like other participating whole life insurance plans, your premiums are invested in a participating fund, which can have various investment portfolios.

As of December 31, 2022, the investment composition of the participating fund is illustrated in the following table:

| Asset Type | Strategic Asset Allocation | Current Investment Mix |

| Risky Assets* | 36% | 37% |

| Fixed Income, Cash & Others | 64% | 63% |

*Includes equities and properties

Fund Performance

Below are the historical rates of return on investments (after subtracting investment expenses) for the Life Participating Fund.

| 2020 | 2021 | 2022 | Averages over the last 3 years | Averages over the last 5 years | Averages over the last 10 years | |

| Investment Returns | 9.14% | 0.54% | -8.73% | 0.05% | 2.05% | 3.24% |

It’s important to note that evaluating the performance of a participating life fund requires considering various factors, including the fund’s investment strategy, asset allocation, and market conditions.

Additionally, past performance is not necessarily indicative of future results.

Despite the negative performance in 2022, these are decent performances for par funds as they meet the industry average.

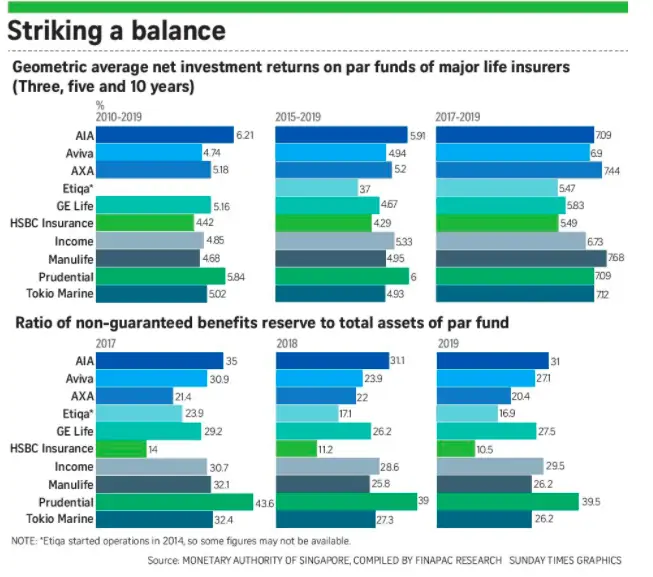

The table below shows the geometric (3, 5, and 10-year) net investment returns of par funds across life insurers in Singapore between 2010 to 2019:

As you can see, NTUC Income has been performing relatively well across all periods, and the negative returns in 2022 were due to the effects of the pandemic that affected every insurer.

However, note that the data is dated and does not reflect future performance.

Total Expense Ratio

Usually, the participating fund incurs expenses, which include various costs like taxation, management, miscellaneous, and investment.

The total expense ratio is the percentage of the overall expenses incurred by the fund in relation to its assets.

The past expense ratios of the Life Participating Fund are presented in the table below:

| 2020 | 2021 | 2022 | Averages over the last 3 years | Averages over the last 5 years | Averages over the last 10 years | |

| Total Expense Ratio | 0.82% | 1.01% | 1.07% | 0.97% | 0.92% | 0.86% |

Here is a table displaying the expense management performance of the leading 8 insurance companies from 2017 to 2019:

| Average Expense Ratio | 2017 | 2018 | 2019 |

| AIA | 1.60% | 1.70% | 1.70% |

| Aviva | 2.54% | 2.58% | 2.80% |

| AXA Life | 8.45% | 5.55% | 4.84% |

| GE Life | 1.82% | 1.59% | 1.71% |

| Manulife | 4.98% | 4.88% | 4.74% |

| NTUC Income | 0.81% | 0.85% | 0.83% |

| Prudential | 2.99% | 2.95% | 2.92% |

| Tokio Marine Life | 1.35% | 1.33% | 1.06% |

| Average of the 8 companies | 3.07% | 2.68% | 2.58% |

NTUC Income is the best in expense management, with the lowest and most consistent ratio in the market – even below the industry average.

Based on their expense ratios, investing via NTUC Income’s par funds could yield higher maturity benefits.

NTUC Income Provenance Solitaire Fees and Charges

The total distribution cost for this product encompasses the expenses associated with advice and other distribution-related charges.

It includes:

- Advice and distribution-related expenses

- Cash payments such as commission and benefits paid to financial advisor

These costs are not extra charges for you, as they are already factored into your premium for this plan.

Illustration of How NTUC Income’s Provenance Solitaire Works

Meet Jackson, a 45-year-old non-smoker who has built a comfortable life for himself and his loved ones. With a wife and 2 children, he dreams of leaving behind a secure inheritance for them.

Currently, Jackson has an impressive sum of $2.5 million in cash.

To ensure his family’s financial well-being, he plans to allocate $1.5 million for their inheritance and $1 million for his retirement.

Determined to uphold his existing lifestyle, he has made the smart decision to sign up for Provenance Solitaire.

By purchasing Provenance Solitaire, Jackson secures a promising future for his loved ones.

With a single premium payment of $528,570 and a generous sum assured of $630,000, he enjoys a minimum protection value of $2,016,000 – 320% of the sum assured.

This ensures peace of mind, knowing that his family will be taken care of financially.

But that’s not all.

By setting aside the remaining balance of $1,971,430, Jackson has the option to invest in a retirement plan or simply save for his golden years.

This wise decision guarantees a worry-free retirement and allows him to live comfortably in the present.

In the unfortunate event of Jackson’s passing at the age of 80, his nominated beneficiaries – his loving wife and cherished children – would receive a generous death benefit of $2,016,000.

This serves as a final testament to his dedication to securing his family’s future.

Here is a table to illustrate:

| Events | Amounts |

| Jackson’s savings at 45 years | $2.5 million |

| Inheritance for wife and 2 children | $1.5 million |

| Retirement plan | $1 million |

| Opts for Provenance Solitaire Policy | – |

| Pays a single premium | Sum Assured – $630,000

Minimum Protection Value- $2,016,000 |

| Balance for investing in a retirement plan or saving for old age | $1,971,430 |

| If he passes away at 80

Death benefit payable to beneficiaries |

$2,016,000 |

| If he passes away at 86

Death benefit payable to beneficiaries (Assuming IIRR-4.25%) |

$2,115,560 |

| If he passes away at 86

Death benefit payable to beneficiaries (Assuming IIRR-3.00%) |

$1,213,162 |

Note that the amount payable depends on the performance of the life participating fund.

Summary of the NTUC Income Provenance Solitaire

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawals | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes, with rider |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders | Yes |

My Review of the NTUC Income Provenance Solitaire

NTUC Income Provenance Solitaire is a single premium participating whole life insurance plan offering decent protection and investment opportunities.

The plan provides a guaranteed 80% cash value from the start of the policy, ensuring some form of security for you.

It includes death and terminal illness benefits, with the option to add TPD coverage through policy riders.

Furthermore, your coverage has a minimum protection value of up to 320%, giving you a boost in coverage in times of higher liabilities.

The premiums paid into the plan are also invested in a participating fund that plays a part in growing your capital and providing you with bonuses in the policy.

The historical performance of the Life Participating Fund has shown average returns over different periods, with some fluctuations in certain years.

Despite these fluctuations, the fund has generally met the industry average, indicating decent performance for participating funds.

If you have a minimum protection value of $3 million, NTUC Income’s Provenance Solitaire provides a free one-time Medical Concierge Service, making life easier when needed.

But the question to ask is, is the NTUC Income Provenance Solitaire good for YOU?

The answer is that it depends.

Everyone has their own financial goals, risk tolerance, and is in various life stages.

So what’s good might not be the best for you – now or in the future.

Thus, we recommend getting a second opinion from an unbiased financial advisor before making a huge financial commitment like this.