NTUC Income’s PrimeShield is an Eldershield supplement which gives you added coverage on top of your basic Eldershield* policy.

It protects you against disability and death at an affordable premium rate.

In this post, we review the benefits and features of NTUC Income’s PrimeShield to determine if it’s the right one for you.

Read on to find out!

My Review of the NTUC Income PrimeShield

I’d say that the NTUC Income PrimeShield offers valuable coverage to safeguard you and your loved ones throughout the entire road to recovery in the event that you suffer from a severe disability.

When a severe disability occurs, a lump-sum benefit and monthly payout kick in to cushion the impact, and your family is also being taken care of through the dependant care benefit.

In addition, NTUC Income’s PrimeShield offers a waiver of premium upon disability, so the insured does not have to fret over paying premiums.

As a congratulatory gift upon your recovery from a severe disability, NTUC Income’s PrimeShield includes a get-well benefit, allowing you to ease into recovery without monetary woes.

Under unfortunate circumstances where the insured passes away while receiving benefits, the NTUC Income PrimeShield also provides a lump-sum death benefit to their loved ones.

My favourite feature of the NTUC Income PrimeShield is its non-forfeiture provision, which protects your policy from lapsing if you cannot pay your premiums.

You just need to fulfil the minimum number of premium payments for your policy to be considered fully paid.

If you miss a premium payment, NTUC Income keeps your policy active by adjusting the benefits you’re entitled.

Even though PrimeShield has a competitive premium rate and comparable benefits, you should also compare it with other Eldershield supplements.

You should also consider getting a second opinion on the NTUC Income PrimeShield, as what’s good for someone else may not be good for you.

So it’s definitely wise to explore other options.

If this interests you, we partner with unbiased financial advisors who can help you with this.

Click here for a free comparison session.

Let’s now explore what the NTUC Income PrimeShield has to offer:

Criteria

To be eligible for PrimeShield, you must meet the following conditions:

- Citizenship: Singapore Citizen (SC) or Permanent Resident (PR)

- Entry Age: 40 to 64 years old (Age Last Birthday)

- ElderShield Plan: Basic ElderShield 300 or Basic ElderShield 400 plan

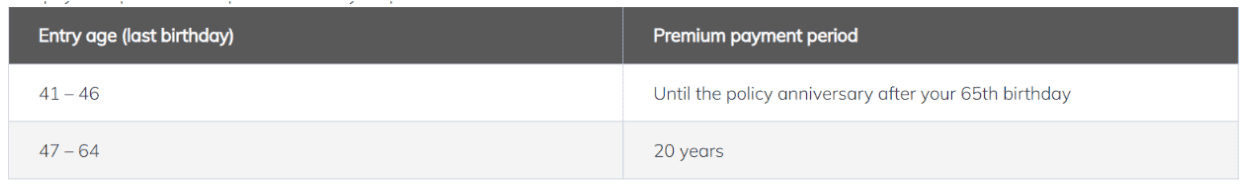

Premium Terms

You’re required to pay yearly premiums according to the following schedule:

Premium Payments

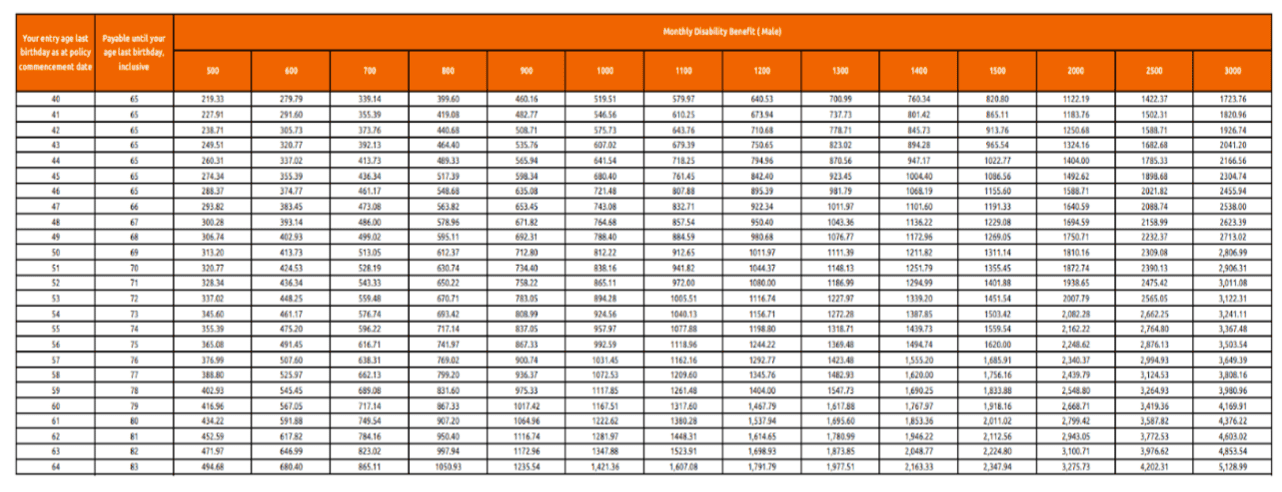

Premium payments are calculated based on:

- Your entry age

- Your gender

- Your chosen monthly disability benefit

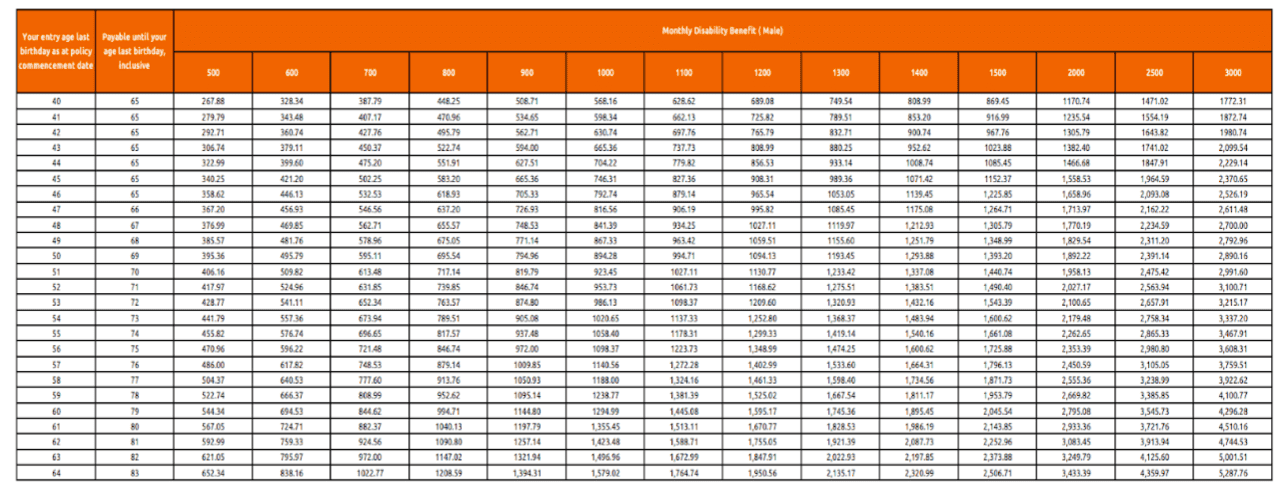

PrimeShield 300 Rates

If you are an ElderShield 300 policyholder, you will be paying PrimeShield 300 rates:

PrimeShield 400 Rates

If you are an ElderShield 400 policyholder, you will be paying PrimeShield 400 rates:

Premium Payment Options

Those who purchase the NTUC Income PrimeShield can make payment for your premiums using your MediSave, up to a maximum of $600 per calendar year, and any excess payable will then have to be paid to NTUC Income in cash.

If your MediSave account does not have sufficient funds to pay the premiums, you can also pay for it fully in cash.

Protection

Monthly Disability Benefit and Lump-sum Benefit

Eligibility

Where the insured becomes severely disabled, he will be given a monthly disability benefit and a one-time payout.

An insured is deemed severely disabled when he is unable to execute 3 out of 6 of the following Activities of Daily Living (ADL):

- Mobility

- Transferring

- Feeding

- Toileting

- Washing

- Dressing

Monthly Disability Benefit

In the event that the insured becomes disabled, NTUC Income will pay a monthly disability benefit for as long as the insured lives.

The monthly disability benefit ranges from $500 to $3,000, depending on the insured’s basic plan. It will be subtracted from any outstanding payables under Eldershield.

The first monthly disability benefit payout would be made on the day right after the deferment period, and subsequent payouts would be made on the same day each month.

Should the insured recover from severe disability or pass away, the benefit would cease on the recovery date or death.

For those who have previously recovered but unfortunately suffer from another bout of severe disability, payouts under this benefit would resume.

Lump-sum Benefit

Upon severe disability, the insured will also receive a lump-sum payout which is 3 times the monthly disability benefit.

This payout will be disbursed immediately after the deferment period.

Do note that this is a one-time benefit which means that it will be deemed terminated once you have claimed it.

Dependant Care Benefit

For those with children, do not worry, as the NTUC Income PrimeShield also provides you with this monthly benefit that is extended to severely disabled insured persons with at least 1 child under 21 years of age.

Under the dependant care benefit, the insured receives an additional 25% of the monthly disability benefit for a maximum of 36 months.

This mitigates any financial setbacks that your family might encounter due to your condition, ensuring that your dependents are well-taken care.

The benefit will kick in after the deferment period.

Here are some details on the eligibility of the benefit:

| Case Scenario | Eligibility for Dependant Care Benefit |

| Insured recovers from severe disability after receiving the benefit | Insured is no longer eligible; benefit ceases on the recovery date |

| Insured passes away after receiving the benefit | Insured is no longer eligible; benefit ceases on the date of death |

| Insured who has recovered from severe disability becomes severely disabled again | Insured is eligible to receive remaining payouts unclaimed during previous disability, up to a maximum of 36 months (in total) |

| Insured’s child or children have exceeded 21 years of age after Income has started paying the benefit | Insured is eligible to receive the benefit till death or recovery |

Get-Well Benefit or Death Benefit

Where the insured recovers from a severe disability while receiving the monthly disability benefit, NTUC Income will issue a one-time get-well benefit payout equal to 3 times your monthly disability benefit.

To receive this benefit, proof of recovery must be submitted and confirmed by NTUC Income’s appointed assessor.

However, if the insured passes away while receiving the monthly disability benefit under this policy, NTUC Income will issue a one-time death benefit payout equal to 3 times the monthly disability benefit.

Key Features

Waiver of Premium

Upon severe disability, NTUC Income supports you financially by exempting you from premium payments until you recover.

Even without making premium payments, your policy remains active, and you will still be entitled to the benefits under his policy.

Premium payments will only resume upon recovery and when the benefits have been fully paid out.

Non-Forfeiture

It is necessary for you to pay yearly premiums until you reach the age indicated on your policy schedule.

However, once you’ve paid the minimum number of premiums, NTUC Income will consider your policy fully paid.

In other words, your policy will not be automatically cancelled if you miss a premium payment!

NTUC Income would instead decrease the benefit payouts you’re entitled to keep your policy active.

Summary of NTUC Income PrimeShield

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |