Some of you might have heard of personal accident insurance policies before, which cover you in the event of injuries and accidents.

The PA Secure policy by NTUC Income is a short-term personal accident insurance plan which serves that purpose by protecting not only yourself but also your family if they encounter any mishaps.

With the NTUC Income PA Secure, you are given the flexibility to choose which plan type you prefer, depending on the sum assured and the premiums you are comfortable with.

If you want to find out whether the NTUC Income PA Secure is right for you, continue reading this review.

Criteria

- Issue age for insured: 15 days old to 65 years old

- Reduced sum insured and subject to NTUC Income’s terms and extra premiums if insured is between the ages of 65 and 75

- Must be living and working in Singapore and must possess a valid Singapore identification document

- Non-guaranteed renewal after end of policy term

General Features

Premium Payment Terms

Depending on your preference, you can choose which plan type (Plans 1 to 3) you prefer, and whether you will be signing up for this policy as an individual, couple, or as a family.

For those who choose to purchase this policy as a couple, the NTUC Income PA Secure will only cover 2 married adults.

If you choose to purchase this policy as a family, you will be covered for at least 1 adult (up to 2 married adults) and any number of children.

You are also given the option to make premium payments annually or monthly.

The table below illustrates the premium payment terms (accurate as of 2023) for the basic policy and the respective optional benefits.

| Basic Policy | ||||||

| Yearly Premiums | Monthly Premiums | |||||

| Plan 1 | Plan 2 | Plan 3 | Plan 1 | Plan 2 | Plan 3 | |

| Individual | $68.63 | $99.92 | $166.55 | NA | NA | $14.50 |

| Couple | $130.41 | $189.85 | $316.43 | $11.36 | $16.53 | $27.55 |

| Family | $196.82 | $287.67 | $479.44 | $17.14 | $25.06 | $41.75 |

| Child and Student Care Expenses (Optional Benefits) | ||||||

| Individual | $18.17 / Insured Person | $1.58 / Insured Person | ||||

| Couple | ||||||

| Family | ||||||

| Event and Staycay Expenses (Optional Benefits) | ||||||

| Individual | $18.17 / Insured Person | $1.58 / Insured Person | ||||

| Couple | ||||||

| Family | ||||||

Do note that the premium rates are not guaranteed, and NTUC Income will inform you of any changes at least 30 days before the change takes place.

For those who choose to make recurring monthly premiums, you can either pay your premiums using recurring credit card payment or by GIRO arrangement.

Renewal

While the NTUC Income PA Secure is designed for a short-term duration, NTUC Income is not required to renew the policy.

Any termination or non-renewal of the NTUC Income PA Secure will then be conveyed to you 7 days before the end of the policy.

However, if the company decides to renew your policy, you will be notified of any new terms and conditions (if applicable) before the renewed policy commences.

Waiting period

For those new to this policy, you should note that NTUC Income does not cover any claims that are directly or indirectly caused by infectious diseases diagnosed within 14 days from the policy start date.

This means that if you are diagnosed with an infectious disease within 2 weeks from your policy start date, you cannot make any claims for any of the benefits listed below.

Table of Benefits

The Table of Benefits below shows the maximum sum assured for the benefits covered by each plan offered by NTUC Income PA Secure.

| Benefits | Maximum Sum Assured per Insured Person | ||

| Plan 1 | Plan 2 | Plan 3 | |

| Accidental Death | $50,000 | $100,000 | $200,000 |

| Permanent Disability

(per Policy Year) |

$50,000 | $100,000 | $200,000 |

| Medical Expenses for Injuries Due to an Accident or Infectious Disease

(per Incident) |

$1,000 | $2,000 | $3,000 |

| Daily Hospital Income per Day

(Up to 50 Days per Policy Year) |

$50 | $100 | $150 |

| Optional Benefits | |||

| Child and Student Care Expenses

(per Incident) |

$500 | ||

| Event and Staycay Expenses (per Policy Year) | $500 | ||

For any of the claims to be valid, it is crucial that you report the incident to NTUC Income within 30 days.

If any incident-related costs can be reimbursed from other sources, such as another insurance policy, NTUC Income will only pay out the remaining amount that cannot be recovered from the other sources.

Protection

Accidental Death Benefit

Like most other personal accident insurance policies, the NTUC Income PA Secure provides coverage against accidental death.

If the insured unfortunately passes away due to an accident or infectious disease, NTUC Income will pay their beneficiaries up to the sum assured limit as stipulated in the Table of Benefits.

This payout will be made provided the insured passes on within 12 months from the date of the accident or diagnosis (of the infectious disease).

However, besides the general exclusions, note that this benefit is not claimable if the death is caused by a sickness (such as a heart attack or stroke) or a preexisting disability.

You will probably need a critical illness insurance plan for that.

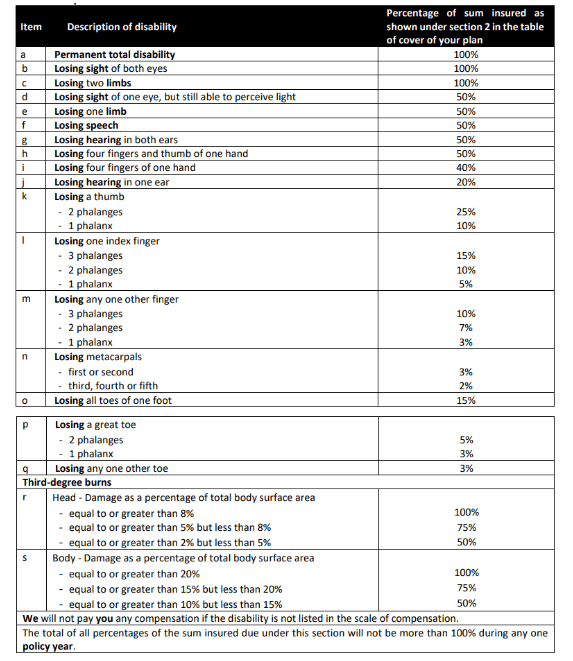

Permanent Disability Benefit

In the event that the insured suffers a permanent disability within 12 months due to either an accident or infectious disease, their loved ones will also be eligible to make a claim under this benefit up to the corresponding limits below.

However, this claim will also reduce any compensation for accidental death if the 2 events happen within the same policy year.

Like the Accidental Death Benefit, NTUC Income will not recognise the claim if the permanent disability occurs due to a sickness (such as a heart attack or stroke) or a preexisting condition.

In addition, you are not allowed to receive additional compensation for any specific disabilities, which is part of a greater condition under this policy.

For example, if you have claimed for the loss of 1 limb, you will not be allowed to make another claim for losing a finger on that same limb.

Medical Expenses for Injury Benefit

To alleviate the rising costs of healthcare in Singapore, the NTUC Income PA Secure ensures that you are covered for any medical, surgical, hospital, dental treatment, and nursing costs, in addition to the cost of medical reports requested by NTUC Income.

To be eligible for this claim, the injury would have to result from an accident or an infectious disease, and the treatment would have to be recommended or requested by a medical practitioner.

The limit of this claim is up to the limit as per the Table of Benefits or up to a period of 12 months from the date of accident or diagnosis, whichever occurs first.

Apart from excluding treatment for injuries caused by sickness (such as a heart attack or stroke) or preexisting conditions, this policy also excludes any claims made for nursing care not provided by the hospital.

Daily Hospital Income Benefit

With most Singaporeans forming part of the working society, it is understandable for one to be worried about losing their income source as they recuperate in the hospital.

Suppose the insured requires hospitalisation after an accident or contracting an infectious disease, they will receive a daily cash allowance to help cover their daily expenses.

However, those looking to claim this benefit should note that the sum assured in the Table of Benefits is for each 24-hour period the insured remains hospitalised and is limited to a maximum of 50 days per policy year.

The benefit will then end once the insured is discharged from the hospital.

Optional Add-On Benefits

Apart from the basic benefits offered under the NTUC Income PA Secure, you can also consider the following add-ons to your policy if you want wider coverage or a slightly more comprehensive policy.

Child and Student Care Expenses Benefit

As the minimum age for one to be insured under this policy is only 15 days old, this benefit might suit you if you are purchasing the NTUC Income PA Secure for your child.

This benefit serves as a form of reimbursement for any child or student care fees incurred by them during the period of hospitalisation or confinement at home if they suffered an injury or contracted an infectious disease requiring:

- 4 or more days of hospitalisation and is unable to attend child or student care; or

- 5 or more days of confinement at home as advised by a medical practitioner and is unable to attend child or student care.

Take, for example, a child whose childcare fees after subsidies are $600 per month.

If the child who is the insured contracts an infectious disease and is hospitalised for 7 out of 20 school days, NTUC Income will prorate the childcare fees and pay you $600 x 7/20 = $210.

It is important to note that to be eligible for this claim, the insured must be enrolled in a Singapore-registered child or student care centre.

Event and Staycay Expenses Benefit

Have you ever felt indignant that you had to cancel your plans or waste any prepaid tickets or entrance fees due to an injury or sickness?

Fret not!

This benefit covers you for precisely that situation if you, unfortunately, require hospitalisation due to an injury or infectious disease that overlaps with your planned activity.

If the overlap requires you to cancel (or shorten) your planned activity or staycation, those who have purchased this optional benefit will be reimbursed with any non-refundable deposit or ticket fees paid by you.

However, if someone else had paid for the ticket or booking first, you would have to provide reasonable evidence that there was a prior arrangement for you to attend the event or staycation.

Events covered under this benefit include any entertainment, recreation, or leisure event in Singapore where a ticket is required for entry.

The ticket or staycation must also be:

- Purchased for the insured person, fully paid for, and for a fixed-date admission;

- Above the cost of $50; and

- In a commercially-run premise with a formal contract for the booking.

Summary of the NTUC Income PA Secure

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability (TPD) | Yes |

| Terminal Illness (TI) | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

My Review of the NTUC Income PA Secure

With the NTUC Income PA Secure, you can rest assured that you will be financially protected in the event of any injuries or infectious diseases.

Apart from providing you with the basic reimbursement of medical expenses, this policy also cushions any impact of your hospitalisation on your income, allowing you to focus on your recovery.

The unique optional benefits offered under this plan also target particular groups of people, with the Child and Student Care Benefit protecting our little ones and the Event and Staycay Expenses Benefit safeguarding teenagers and adults alike.

This works hand-in-hand with the nature of the policy, which focuses on family groups with dedicated plans catered to individuals, couples, and families.

This is very unlike most other personal accident plans that cater to only working adults or children, thus requiring you to purchase multiple plans, which can get confusing at times.

In addition, one unique selling point about the NTUC Income PA Secure is that the premium amounts are independent of your occupation.

With some jobs being riskier than others, it is understandable that some policies may charge you higher premiums since you are more prone to injuries.

Despite this, NTUC Income PA Secure keeps its policy premiums constant regardless of your job’s risk level, making this highly suitable for those who engage in higher-risk work.

You would think that this would mean the premiums would be high as the risk is shared with jobs that are non-high risk, right?

Well, in our comparison of the best personal accident plans in Singapore, the NTUC Income PA Secure is the cheapest PA plan in Singapore!

Overall, the NTUC Income PA Secure aims to provide affordable coverage, financial security, and peace of mind in case of accidents or infectious diseases, allowing you to focus on your recovery without the burden of hefty medical bills.

Nonetheless, with so many options in the market, it is still advisable that you consult a financial advisor or obtain a second opinion to determine if this is the right plan for you.