The NTUC Income PA Guard is a personal accident insurance plan that covers you for injury or in the unfortunate event of you passing away due to an accident while the plan is in effect.

It also allows you to boost your coverage with disability income and hospital income payouts – making your policy even more comprehensive.

But is it any good?

Here’s our review of the NTUC Income PA Guard:

My Review of the NTUC Income PA Guard

The NTUC Income PA Guard is a pretty decent personal accident insurance that offers you a worry-free solution to embrace life’s adventures by protecting you from unexpected accidents.

It’s flexible, allowing you to choose a coverage plan in line with your lifestyle and offers optional benefits to maintain your standard of living and cover hospitalisation expenses.

It also covers you against accidental Death or Permanent Disability as a result of injuries.

For added protection, the NTUC Income PA Guard plan offers extra accidental death coverage of up to $750,000 if an accident occurs while using public transportation.

This can be particularly reassuring if you rely on public transport frequently.

You can opt for supplementary benefits that assist in maintaining your standard of living following an accident.

For instance, you may receive weekly cash payments if you suffer temporary total disability due to an injury.

These payments help cover expenses and ensure you continue to receive income during your recovery.

If you’re hospitalised, the NTUC Income PA Guard provides daily hospital cash payouts, including triple cover for ICU stays, coverage for broken bones or fractures, and more.

You’ll also enjoy a 5% bonus each year on the coverage amount for accidental death, permanent disability, and double indemnity for accidental death on public transport, should you not make any claims

This bonus can accumulate up to 25% if you don’t make any claims for 5 consecutive years.

It’s best, however, to compare personal accident plans to see which plan best fits your needs, whether you want basic coverage or enhanced protection.

It is easier to make an informed decision when you know your options.

It’s also a good idea to seek a second opinion from an unbiased financial advisor. This policy may suit you, but it doesn’t mean you don’t have better options.

If you’d like to get a second opinion, we partner with MAS-licensed financial advisors who can help you with this.

Click here for a free non-obligatory chat.

Let’s now explore the policy in detail:

Criteria

To qualify for the NTUC Income PA Guard, you must meet these criteria.

- Valid Singapore ID documents, which include your NRIC (National Registration Identity Card), student pass, or work pass.

- Reside in or work in Singapore; if you’re travelling outside Singapore, it should be for at most 180 consecutive days.

- Age from 15 days old to 65 years old.

General Features

Premium Terms

Depending on your occupation, the NTUC Income PA Guard categorises you into groups A or B.

Riskier occupations will mean higher costs for premiums, as with most personal accident plans.

Group A Premiums

The NTUC Income PA Guard Group A is suited to individuals employed in the professional, administrative, managerial, or clerical sectors.

If you work outdoors that might include light manual labour but don’t require using tools or machinery, you will also be categorised under Group A.

Since there is less risk of injury or death while working, your premium rates will be based on the table below:

| Group A Premiums | Plan 1 | Plan 2 | Plan 3 | Plan 4 | ||||

| Monthly premium | Yearly premium | Monthly premium | Yearly premium | Monthly premium | Yearly premium | Monthly premium | Yearly premium | |

| Main benefits | $13.42 | $154.43 | $23.72 | $271.81 | $40.88 | $469.55 | $55.81 | $638.20 |

| With optional lifestyle benefits | $18.77 | $216.00 | $32.80 | $375.68 | $56.02 | $643.45 | $73.68 | $846.90 |

| With optional hospitalisation benefits | $16.65 | $191.17 | $29.57 | $340.05 | $49.96 | $573.51 | $67.33 | $768.70 |

| With both optional lifestyle and hospitalisation benefits | $22.00 | $252.74 | $38.65 | $443.91 | $65.10 | $747.41 | $85.19 | $977.40 |

Group B Premiums

With the NTUC Income PA Guard plan, under Group B, your employment involves manual labour using tools or machinery.

It includes security or defence work professions as well as individuals dressed in uniform.

It also covers individuals working in a more risky environment, such as

high altitudes or hazardous conditions.

Group B premium rates are shown in the table below:

| Group B Premiums | Plan 1 | Plan 2 | Plan 3 | Plan 4 | ||||

| Monthly premium | Yearly premium | Monthly premium | Yearly premium | Monthly premium | Yearly premium | Monthly premium | Yearly premium | |

| Main benefits | $24.93 | $286.25 | $44.61 | $511.74 | $72.37 | $830.39 | $103.26 | $1,186.28 |

| With optional lifestyle benefits | $34.93 | $400.71 | $60.87 | $698.67 | $99.12 | $1,137.74 | $136.57 | $1,568.42 |

| With optional hospitalisation benefits | $30.89 | $354.28 | $55.21 | $633.87 | $88.32 | $1,014.50 | $124.35 | $1,428.02 |

| With both optional lifestyle and hospitalisation benefits | $40.89 | $468.74 | $71.46 | $820.81 | $115.07 | $1,321.84 | $157.66 | $1,810.16 |

It is important to inform your insurer in writing about any significant changes in occupation.

If necessary, premiums can change when there are changes in your health condition or occupation, or even if you relocate to a different country, so keep those factors in mind.

Policy Term:

This is a 1-year policy and is renewable yearly.

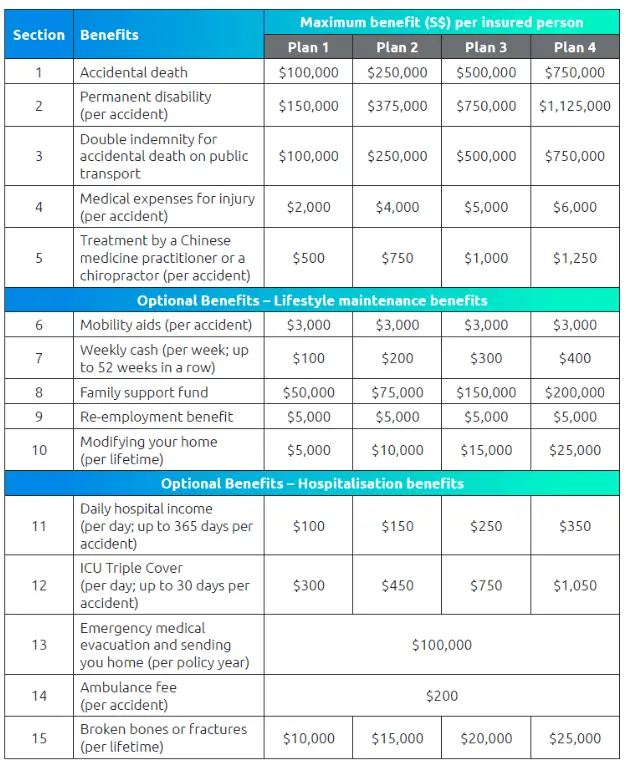

Table of Benefits & Sums Assured

Key Features

Accidental Death Benefit

With NTUC Income PA Guard, the Accidental Death coverage provides a lump sum payout equal to the sum assured.

This benefit applies if you pass on due to injuries sustained from an accident.

The lump sum is up to $750,000, depending on the plan chosen.

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit | $100,000 | $250,000 | $500,000 | $750,000 |

Permanent Disability Benefit

NTUC Income PA Guard’s Permanent Disability benefit is paid out in the event of permanent disability due to an accident that will never allow you to return to work and earn an income.

Below is the maximum benefit payable for each plan per accident.

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit (per accident) | $150,000 | $375,000 | $750,000 | $1,125,000 |

This benefit is intended to assist in managing the financial impact of your disability.

Double Indemnity Benefit (Accidental Death)

For added protection, NTUC Income PA Guard offers extra coverage of up to $750,000 in case of accidental death while using public transportation.

This can be particularly reassuring, especially if you use public transport frequently.

Below is the table of the maximum amounts payable for each type of policy plan.

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit | $100,000 | $250,000 | $500,000 | $750,000 |

Medical Expenses Benefit

NTUC Income PA Guard Medical Expenses benefit assists in covering medical costs incurred if you’re injured and require medical treatment.

NTUC Income PA Guard will refund you for your medical costs per accident.

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit (per accident) | $2,000 | $4,000 | $5,000 | $6,000 |

Complimentary Treatment Benefit

If you encounter an accident injury and need treatment by a chiropractor or a traditional Chinese medicine practitioner, this benefit covers you.

The reimbursement includes costs for consultations, therapies, and other treatments related to the injury per accident.

The table below shows the assured reimbursement amount depending on your chosen policy plan per accident.

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit

(per accident) |

$500 | $750 | $1,000 | $1,250 |

Optional Benefits

You can pay more and get the Lifestyle Maintenance Benefit and or Hospitalisation Benefit within your basic plan per year.

Each optional benefit contains sub-benefits with amounts payable varying in accordance with your primary plan type.

Let’s look at each category.

Lifestyle Maintenance Benefit

Mobility aids benefit (per accident)

With NTUC Income PA Guard, the mobility aid benefit helps with the cost of equipment to aid your mobility after you’ve been hurt in an accident.

This could include crutches, wheelchairs, or artificial legs.

The insurance pays for the rental or purchase of these mobility aids if the medical practitioner deems it necessary due to the accident.

The benefit amount is capped at $3,000 per accident, irrespective of your plan.

Weekly Cash Benefit

This benefit is offered during recovery when you cannot attend income-earning activities.

For each accident, the maximum applicable period is 52 consecutive weeks.

The table below outlines the amounts payable per week as follows.

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit | $100 | $200 | $300 | $400 |

Family Support Fund

With NTUC Income PA Guard, the Family Support Fund can range from $50,000 to $200,000, depending on your chosen plan.

This means that if you’re covered under this benefit, your family will receive this sum in the event of your accidental death or permanent disability, providing financial support to your family when you can no longer do so.

Re-employment Benefit

NTUC Income PA Guard provides a Re-employment benefit, which bridges the financial gap during unemployment and encourages you to re-enter the workforce after recovery.

This benefit, capped at $5,000, irrespective of the plan, can ease the transition from your prior employment to the new employment.

Modifying your home (per lifetime) Benefit

NTUC Income PA Guard ensures that after encountering a severe accident, your home may need to be modified physically or structurally to make it more accessible due to your injuries.

This benefit will help cover the costs of those modifications.

It’s important to note that this benefit can only be claimed once in a lifetime.

The table below outlines the limits for such home modifications.

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit | $5,000 | $10,000 | $15,000 | $25,000 |

Hospitalisation Benefit

Daily Hospital Income (per day; up to 365 days per accident)

With NTUC Income PA Guard, the Daily Hospital Income payout is for each day you are in hospital due to an accident, which helps cover the additional costs.

The benefit is applicable for up to 30 days per accident and a maximum of 365 days.

The table below outlines the daily amount, which varies with the plan type.

| Plan Type | 1 | 2 | 3 | 4 |

| Daily Maximum Pay | $100 | $150 | $250 | $350 |

ICU Triple Cover

With NTUC Income PA Guard, the ICU Triple Cover is an added benefit that covers expenses related to being admitted to the Intensive Care Unit (ICU) due to an accident.

The coverage is provided per day, and the maximum payout you can receive for your ICU stay depends on your chosen policy.

This could be up to $1,050 per day.

The coverage is available for a maximum of 30 days.

Emergency Medical Evacuation

This benefit applies if you travel abroad and sustain an injury in an accident requiring urgent medical evacuation.

Emergency medical evacuation typically involves transporting you to a medical facility where you can receive appropriate care for up to $100,000 per policy year.

The evacuation expense covered can include the costs of sending you back home.

Ambulance fee (per accident)

After an accident, this benefit kicks in to help you with transportation to a nearby hospital in a medical ambulance (with attendants included).

The policy will pay you back for the reasonable and standard cost but is capped at $200 per accident.

Broken bones or fractures (per lifetime)

This is a once-in-a-lifetime benefit that covers specific types of injuries, such as broken bones and fractures.

The maximum benefit amount provided depends on your plan, as shown in the table below.

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit per lifetime | $10,000 | $15,000 | $20,000 | $25,000 |

Summary of the NTUC Income PA Guard

| Cash & Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawals | No |

| Health and Insurance Coverage | |

| Death (Accidental) | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |