The NTUC Income Luxe Plus Solitaire is a single premium annuity plan offering you a lifetime of retirement income.

Upon signing up, the policy provides policyholders with monthly cash payouts, starting from the end of the 3rd policy year until the maximum matured age of 120 years, which is more than a century old.

This review aims to provide a better and simpler understanding of NTUC Income’s Luxe Plus Solitaire, including its features, benefits, and potential disadvantages.

Let’s begin.

My Review of the NTUC Income Luxe Plus Solitaire

The NTUC Income Luxe Plus Solitaire is a decent retirement plan that provides you with a lifetime of retirement income.

It offers a unique feature of lifetime monthly cash payouts starting from the end of your 3rd policy year until you turn 120.

This means you can enjoy a steady income stream for the rest of your life, providing financial stability and peace of mind.

Furthermore, the NTUC Income Luxe Plus Solitaire allows you to earn cash bonuses and benefits, adding additional value to your policy.

These extra cash incentives can enhance your overall returns and help you achieve your financial goals faster.

However, it’s important to note that Luxe Plus Solitaire does not include total and permanent disability (TPD) coverage and riders.

Riders typically provide additional protection and flexibility, while TPD coverage offers financial support in the event of a debilitating injury or illness.

If riders and TPD coverage are important to you in an annuity, it may be worth considering other policies that offer these benefits.

The returns on the participating funds are also low, which will impact how much you get in the non-guaranteed portion of your monthly cash benefits.

But to be fair, the pandemic negatively affected investment returns across the board – and NTUC Income was no exception.

Despite this, the NTUC Income Luxe Plus Solitaire remains a solid choice for those seeking long-term financial security and guaranteed acceptance regardless of their health condition.

With its lifetime cash payouts, the option to accumulate cash benefits, and the ability to leave a legacy for your loved ones, NTUC Income’s Luxe Plus Solitaire offers a comprehensive, relatively low-risk solution for building wealth.

As always, we recommend carefully reviewing all policy details, terms, and conditions before making any decisions.

If in doubt, always get a second opinion from an unbiased financial advisor.

You should also explore alternative retirement plans and get a comparison done to see whether the NTUC Income Luxe Plus Solitaire is for you.

We partner with unbiased financial advisors who have helped thousands of our readers with policy comparisons, and they’ll be happy to help you too.

If this interests you, click here for a free non-obligatory comparison session.

Here’s more on what the NTUC Income Luxe Plus Solitaire offers.

Criteria

- Minimum single premium of $100,000

- Policyholders must at least be 16 years old

- The insured person must be between 0 to 75 years old at the time of application

General Features

Premium Payment Term

The policy is a single premium, meaning you will pay a one-time-only lump sum.

The minimum amount allowed is $100,000, subject to underwriting.

Policy Term

The policy term for Luxe Plus Solitaire is 120 years.

Protection

Death Benefit

In the event of the insured’s untimely death, the payout will include the greater of:

- 105% of the net single premium paid after deducting any monthly cash benefits already received, or

- The guaranteed surrender value.

Furthermore, the payout will also include 100% of the terminal bonus (minus any cash bonuses already paid) and any accumulated cash benefits and bonuses.

However, any outstanding policy loan and interest will reduce the total benefit amount.

After the policy is paid, the policy will end.

However, the death benefit won’t be paid out if a secondary insured individual is assigned before the primary insured individual passes away.

Instead, the secondary insured individual will take over as the main policyholder, and the policy will carry on as usual.

Terminal Illness (TI) Benefit

If the insured is diagnosed with a terminal illness, the payout will be calculated as follows:

The higher of

- All monthly cash benefits already received or

- The guaranteed surrender value.

Additionally, the payout will consist of the full 100% of the terminal bonus amount, except for any previously allocated cash bonuses.

The payout will also include any accumulated cash benefits and cash bonuses.

However, any outstanding policy loan and interest will be deducted from the benefit amount payable.

After the terminal illness benefit is paid, the policy will end.

The policy will not pay out the terminal illness benefit if a secondary insured individual has been designated.

Instead, in the event of the insured’s death, the secondary insured will become the new policyholder, and the policy will continue as usual.

Key Features

Cash Benefit

After 3 policy years, you will receive a guaranteed monthly cash benefit of 0.109% of the net single premium, amounting to 1.308% yearly.

You will also receive non-guaranteed cash benefits of up to 2.442% per year, depending on the performance of the participating fund.

The amount is paid every month from the 37th month until your 120th birthday.

You have the option to withdraw the cash or reinvest it at the prevailing interest rate.

Maturity Benefit

When the original insured individual reaches 120 years of age, the maturity benefit is payable.

The policy will pay out 105% of the net premium paid, along with a terminal bonus.

Additionally, any accumulated cash bonuses and benefits will be paid out alongside the maturity benefit.

However, any outstanding policy debts and interest will be deducted from the payout.

Once the maturity benefit is paid, the policy will end.

Appointment of a Secondary Insured Individual:

You have the option to appoint a secondary insured individual while your policy is active.

This is done to ensure continued coverage in the event of the original insured individuals’ demise.

Let’s understand the conditions you must meet to appoint or remove a secondary insured individual:

- The policy premium can only be paid with cash.

- The policy does not have a nominated beneficiary..

- There have been no changes to the ownership of the policy, including trust, assignment or bankruptcy.

The secondary insured can either be yourself (if you are below 65 years old), your spouse (if he/she is below 65 years old), or your child or ward (if they are below 18 years old) when exercising this option.

Please note that you can only exercise this option up to 3 times.

If the original insured individual passes away, the secondary insured individual becomes the new insured for the remaining policy term.

Please be aware that the policy can only have 1 insured individual at any given time.

Policy Surrender

Upon surrendering the policy, the surrender value consists of 2 components:

- a guaranteed surrender value and;

- a non-guaranteed surrender value

The guaranteed surrender value equals 80% of the net single premium paid throughout the policy term.

Bonuses

Cash Bonus

The Cash Bonus becomes payable from the 37th month of the policy until the policy is terminated

Cash Bonus rates are not guaranteed and may change over time.

The Cash Bonus is typically received alongside the cash benefit and can be reinvested at the prevailing interest rate.

Terminal Bonus

The Terminal Bonus is an additional bonus that becomes payable when making a claim, surrendering the policy, or upon maturity.

Similar to the Cash Bonus, future bonuses that have yet to be added to the policy are not guaranteed.

The amount of bonuses allocated to each participating plan is decided by NTUC Income each year

It’s worth mentioning that all guaranteed benefits, including any bonuses that have already been added to the policy, will be provided for, regardless of the performance of the Life Participating Fund.

Guaranteed Acceptance

The policy offers Guaranteed Acceptance, meaning that regardless of your current health condition, you will be accepted for coverage.

Income Benefits

This policy lets you enjoy a wide range of exclusive NTUC Income benefits, such as discounted travel vouchers and exclusive deals at top hotels.

NTUC Income Luxe Plus Solitaire Fund Performance

Asset Allocation

As of December 31, 2022, the investment composition of the participating fund for this whole life insurance plan is as follows:

| Investment Portfolio | Investment Goal | Current Portfolio Mix |

| Risky Investments | 36% | 37% |

| Fixed Income, Cash and Others | 64% | 63% |

While a notable portion of the fund is allocated to risky assets for potential growth, there is also a significant allocation towards fixed income and cash, which provides stability and acts as a safeguard against market volatility.

Fund Performance

Here are the past year returns for the NTUC Income Luxe Plus Solitaire’s funds:

Accurate as of 31 December 2022.

The past investment returns for the Life Participating Fund show a mix of positive and negative performances over the years:

In 2020, the fund achieved a notable return of 9.14%, indicating a successful year with a higher-than-average rate of return.

However, the following year, in 2021, the fund saw a modest return of 0.54%, suggesting minimal growth in its investments.

Unfortunately, in 2022, the fund experienced a challenging year with a negative return of -8.73%, reflecting a significant decline in its investments.

When looking at the average returns over different time periods, we observe that over the past 3 years, the fund had an average return of 0.05%, suggesting a relatively flat performance with minimal overall growth.

Looking at the last 5 years, the fund experienced moderate growth with an average return of 2.05%, though it falls short of stronger returns.

However, over a longer period of 10 years, the fund achieved a more stable and consistent growth pattern with an average return of 3.24%.

These poor performances are probably due to the pandemic – impacting most funds, not just NTUC Income’s.

It’s also important to understand that past performance may not be an indicator of future performance.

Various factors, including changes in investment and economic environments, can impact the performance of the Life Participating Fund.

Further, comparing the performance of one policy in isolation may not provide a complete picture.

Evaluating and comparing the performance of different insurance plans in Singapore can help you make a more informed investment decision

The table below shows the geometric net investment returns of par funds across life insurers in Singapore between 2010 and 2019:

Based on the information gathered, it appears that NTUC Income has been performing relatively well across various periods.

However, it is crucial to conduct further research and compare the performance, features, and offerings of NTUC Income with other plans in Singapore.

This will help gain a more comprehensive understanding and enable a well-informed investment decision.

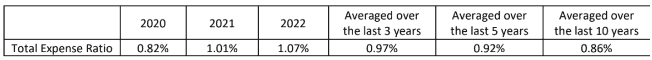

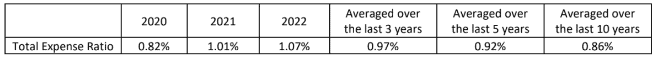

Total Expense Ratio

The total expense ratio is an important metric to consider when analysing a fund’s performance.

The TER represents the total expenses incurred by the fund, including management fees, administrative costs, and other operational expenses, expressed as a percentage of the fund’s assets.

A lower TER indicates more efficient cost management, which can lead to higher returns for investors.

The following table shows the TERs of the fund starting from 2020:

Accurate as of 31 December 2022.

In 2020, the investment fund’s total expense ratio (TER) was 0.82%, representing the costs of managing and operating the fund.

The TER increased slightly in 2021 to 1.01%, indicating a slight rise in expenses compared to the previous year.

In 2022, the TER further increased to 1.07%, suggesting an additional increase in the total costs associated with managing the fund.

When looking at the average TER over different time periods, we observe the following:

Over the past 3 years, the fund has maintained an average total expense ratio (TER) of 0.97%, reflecting the average costs associated with managing the fund during this period.

Looking at the last 5 years, the average TER remained relatively steady at 0.92%, indicating consistent expense levels.

Furthermore, over a longer-term period of 10 years, the fund achieved a slightly lower average TER of 0.86%.

These figures suggest a consistent and well-managed approach to fund operations expenses.

It’s important to note that past expense ratios may not be indicative of future expenses.

The following table shows the expense management performance of the leading 8 insurance companies from 2017 to 2019:

Based on the available information, NTUC Income has demonstrated a lower average expense ratio than other insurers in the industry.

The average expense ratios for NTUC Income ranged from 0.81% to 0.85% over the period analysed.

This suggests that NTUC Income has effectively managed and controlled its expenses relative to industry averages.

However, it’s important to note that expense ratios can vary across different insurance companies and product offerings.

Factors such as company size, business models, investment strategies, and insurance product types can influence expense ratios.

NTUC Income Luxe Plus Solitaire Fees and Charges

Fees and charges cover distribution-related expenses and cash payments such as commissions and benefits paid to financial advisors.

It’s important to note that these costs are not extra charges for you, as they are already included in the premium for this plan.

Illustration of How NTUC Income Luxe Plus Solitaire Works

Robert, a 40-year-old individual, understands the importance of financial stability and has invested $2 million in Luxe Plus Solitaire.

This investment provides him with several benefits.

Starting from the 3rd policy year, Robert receives monthly cash payouts of $6,250.

These payouts provide a steady income for him to enjoy luxurious vacations and purchase high-end luxury items.

In the case of Robert’s unfortunate passing at the age of 85, his family will receive a substantial death benefit of $2,320,000, ensuring their financial well-being beyond his lifetime.

However, let’s imagine a scenario where Robert lives until the age of 120.

In that case, he would receive an impressive total of $5,775,000 in cash payouts from the age of 43 to 120.

Additionally, he would also receive a maturity benefit of $6,020,000.

It’s important to note that these figures are based on the assumption of a long-term average return of 4.25% per annum for the Life Participating Fund.

If the long-term average return is lower, at 3.00% per annum, the total cash payout would be adjusted to $4,260, including a non-guaranteed monthly cash bonus of $2,080.

In this scenario, the total cash payouts from the age of 43 to 85 amount to $2,147,040.

The death benefit in case of Robert’s demise at the age of 85 would be $2,020,000.

If he lives until the age of 120, he would still receive a total of $3,936,240 in cash payouts from 43 to 120. Simultaneously, he would also receive a maturity benefit of $4,820,000.

With Luxe Plus Solitaire, Robert can confidently plan for his future, knowing his financial needs and dreams are secure.

Summary of the NTUC IncomeLuxe Plus Solitaire

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawals | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders | No |