The NTUC Income i50 Insurance “PA 360” policy is designed to offer personal accident coverage, ensuring that you and your family are financially protected when a personal accident occurs.

NTUC Income i50 Insurance “PA 360” also has the “Home 360” plan for home contents coverage, but that’s for a separate post.

Keep on reading our comprehensive review of the PA 360 version.

My Review of NTUC Income i50 Insurance “PA 360”

The NTUC Income i50 Insurance “PA 360” is an excellent personal accident insurance plan for families looking for comprehensive coverage with premiums starting as low as $0.50 daily.

Accidents can happen when you least expect them, so being prepared is important.

Beyond immediate costs, this policy is designed to support your recovery over time, and the NTUC Income i50 Insurance “PA 360” provides protection and financial support precisely when needed.

This cover can also secure worldwide coverage for medical costs resulting from accidents.

It offers coverage for home modifications and trauma counselling in the unfortunate event of permanent disability.

All the things we have taken for granted are covered in this policy, and these benefits can significantly improve your quality of life after an accident.

For example, the NTUC Income i50 Insurance “PA 360” also takes the worst-case scenario that can occur after an accident, such as accidental death, and provides you with an Accidental Death Benefit.

A child support fund is also available to ensure that the dependent children are cared for academically and otherwise.

To make this plan even more attractive, NTUC Income i50 Insurance “PA 360” further extends its protection to cover 21 infectious diseases.

Hence, whether you choose the Basic or Superior policy, you can be confident that you and your loved ones are well-protected in the event of an accident.

NTUC Income i50 Insurance “PA 360” is comprehensive and also considers many factors, such as coverage for medical expenses, ambulance fees, daily hospital income, home modifications and weekly cash.

However, just like any other policy, whether you’re looking for basic coverage or enhanced protection, it’s best to explore other personal accident plans to see which is the best for you.

This way, you know your alternatives and can make an informed decision.

Also, it’s wise to get a second opinion from an unbiased financial advisor. Just because this policy might suit you, doesn’t mean that there aren’t better options for you.

If you’d like to get a second opinion, we partner with MAS-licensed financial advisors who can help you with this.

Click here for a free non-obligatory chat.

Let’s now explore the policy in detail:

Criteria

The following criteria are needed.

- The age range is between 15 days old and 65 years old but may extend to 80 years under special conditions.

General Features

Premium Terms

The premiums are payable every year but can change each year.

For the NTUC Income i50 Insurance “PA 360”, a family is defined as a maximum of 2 adults who are spouses and any children they may have.

Policy Term

- The policy is annually renewable, subject to the terms and conditions.

Protection

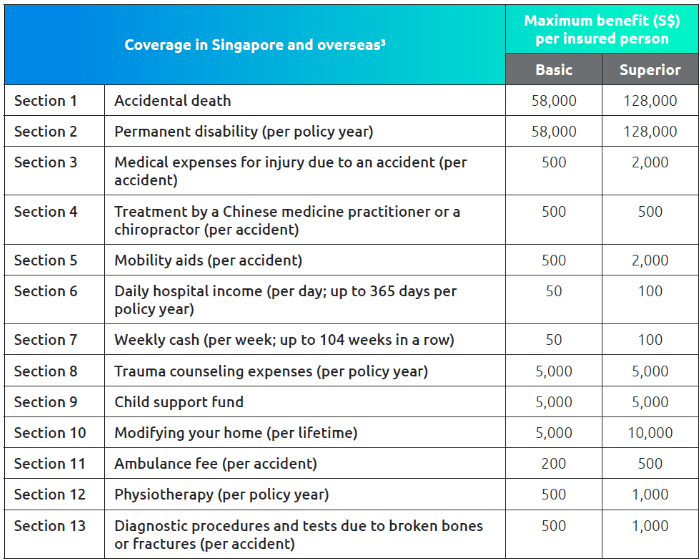

Summary Table of Specified Benefits:

Accidental Death Benefit

The NTUC Income i50 Insurance “PA 360” Accidental Death Benefit covers final expenses. It provides financial safety to the family or beneficiaries in case of an accident.

There is a maximum benefit of $58,000 under the Basic policy and a maximum benefit of $128,000 under the Superior policy.

Permanent Disability Benefit

Permanent disability coverage is crucial if you encounter a long-term disability due to an accident.

These funds can assist with personal care and well-being during your recovery.

With the Basic policy, you can receive up to $58,000 per policy year, and the Superior policy increases this to $128,000.

Medical Expenses Benefit

The NTUC Income i50 Insurance “PA 360” benefit covers the costs of medical treatments following an accident, thus ensuring that your medical expenses are handled, allowing you to focus on recovery instead of worrying about hefty bills.

The Basic policy provides up to $500, while the Superior policy increases it to $2,000.

Key Features

Complimentary Medical Treatment

If you prefer alternative traditional treatment by a Chinese Medicine Practitioner or Chiropractor, this benefit has you covered by offering a maximum of $500 for treatment per accident.

Mobility Aids Benefit

When an accident occurs, mobility aids are sometimes necessary for enhanced body movement.

Funds from NTUC Income i50 Insurance “PA 360” will assist you in acquiring wheelchairs, walking aids, or other equipment which help you regain your independence.

The Basic policy provides up to $500, while the Superior policy offers $2,000 per accident.

Daily Hospital Income

No one enjoys being in the hospital, and what’s worse, the frustration of being unable to work due to the accident doesn’t make it any easier.

The Daily Hospital income benefit eases the financial burden of hospitalisation.

The Basic policy provides $50 per day, while the Superior policy offers $100, helping you cover daily expenses during your hospital stay to concentrate on your recovery.

Weekly Cash Benefit

With NTUC Income i50 Insurance “PA 360”, the Weekly Cash benefit provides additional financial support during an extended recovery period.

The Basic policy offers $50 per week, while the Superior policy increases this to $100 per week for up to 104 consecutive weeks, ensuring financial support during your recovery process.

Trauma Counselling Expenses (per policy year)

Trauma Counselling expenses cover the costs of counselling services following a traumatic accident.

Both the Basic and Superior policies offer a maximum of $5,000 to help you cope with the psychological impact of the accident.

Child Support Fund

With NTUC Income i50 Insurance “PA 360”, the child support fund provides financial help for the care and support of dependent children.

This benefit offers a maximum of $5,000 for both the Basic and Superior policies, ensuring the well-being of your children, irrespective of how many children you have.

Home Modification

As part of NTUC Income i50 Insurance “PA 360,” all possible accident consequences are considered, including modifying your home if necessary.

The Basic policy offers $5,000 for lifetime home modifications, while the Superior policy doubles it to $10,000 per lifetime.

These funds can create a safe and comfortable living environment, especially when you suffer from disabilities due to an accident.

Ambulance Costs

With the NTUC Income i50 Insurance “PA 360”, you have ambulance coverage for transportation.

With the Basic policy, you get $200, while the Superior policy increases the cover to $500.

Again, as before, this policy steps in to help further ease any worries about expenses.

Physiotherapy Benefit

Physiotherapy is crucial for your recovery after a severe accident.

The NTUC Income i50 Insurance “PA 360” Basic policy offers up to $500 per policy year, while the Superior policy provides $1,000, thus ensuring access to physical therapy for a faster recovery.

Diagnostic Procedures & Tests

Diagnostic procedures & tests assist in assessing and treating accidental injuries that may have resulted in broken bones or fractures.

With NTUC Income i50 Insurance “PA 360”, the Basic policy provides up to $500 for diagnostic procedures, and the Superior policy increases it to $1,000, resulting in comprehensive coverage for tests which may be needed to aid your recovery.

Infectious Disease Benefit

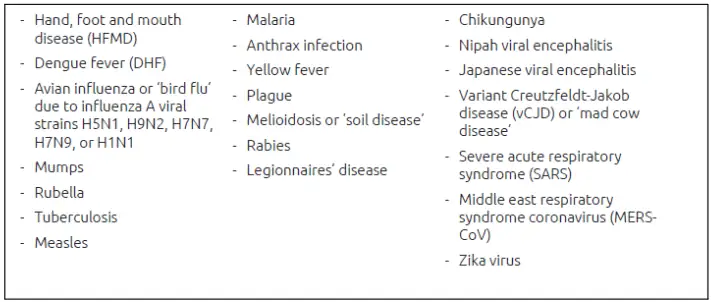

Besides all the other benefits, NTUC Income i50 Insurance “PA 360” provides coverage against 21 infectious diseases regardless of your chosen policy.

Again, this gives you added coverage for complete peace of mind.

The NTUC Income i50 Insurance “PA 360” covered infectious diseases as outlined below.

Summary of NTUC Income i50 Insurance “PA 360”

| Cash & Cash Withdrawal Benefits | |

|---|---|

| Cash Value | No |

| Cash Withdrawal | No |

| Health & Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |