The NTUC Income i50 “Home 360” Insurance plan is a comprehensive bundle offering coverage for personal accident and home insurance.

This ensures that you and your loved ones are financially protected in various aspects of your life, both at home and in the event of accidents.

Like the NTUC Income i50 “PA 360” insurance plan, the benefits paid out under the NTUC Income i50 “Home 360” insurance plan depend on the specific event and maximum benefit limits outlined in your chosen plan.

Keep on reading for our review:

My Review of NTUC Income i50 “Home 360” Insurance

The NTUC Income i50 “Home 360” Insurance is a comprehensive personal accident and home insurance plan, perfect for families.

The benefits of NTUC Income i50 “Home 360” Insurance is a combined plan providing coverage for accidents and coverage for your home, thus protecting your valuable assets and well-being.

It protects your home, including building, renovations, and content coverage.

This ensures you’re financially secure against insured and unforeseen events such as fire, theft, floods, and damage caused by bursting water pipes or tanks.

As a homeowner or tenant, you have the public liability benefit, which protects you in the event of an unexpected fire that spreads to your neighbours’ homes.

NTUC Income i50 “Home 360” Insurance also offers coverage on a ‘first loss’ basis, so you won’t have to worry about your home being underinsured.

If your home is unexpectedly destroyed, there won’t be any pro-ration penalty during claims.

This ensures you receive compensation based on your actual loss and up to the maximum benefit limits.

What’s nice about this plan is that the emergency home assistance service offers 24/7 access to these services.

Help is just a phone call away if you encounter issues such as plumbing emergencies, electrical problems, or other home-related crises.

Of course, let’s not forget about the personal accident insurance coverage provided, such as coverage for medical expenses, ambulance fees, daily hospital income, home modifications, and weekly cash, all should you encounter an accident.

Similar to the i50 Insurance “PA 360” – so make sure to read our review of that!

Just like with any other policy, it’s best to compare other personal accident plans to determine which is best for you, whether you’re looking for basic coverage or enhanced protection.

As a result, you are aware of your options and can make an informed choice.

Getting a second opinion from an unbiased financial advisor is also a good idea. Although this policy might be suitable for you, there might be better options out there.

We partner with MAS-licensed financial advisors who can assist you if you want a second opinion.

Click here for a free non-obligatory chat.

Let’s now explore the policy in detail:

Criteria

To qualify for NTUC Income i50 “Home 360” Insurance, you need to meet the following:

- Age should range from 15 days old to 65 years old but may extend to 80 years under certain conditions

- Own, co-own, or be a tenant or co-tenant of premises in Singapore

General Features

Premium Terms

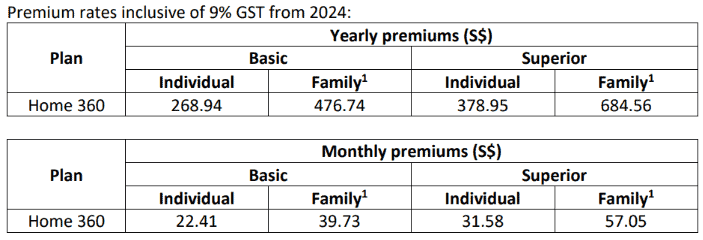

The NTUC Income i50 “Home 360” Insurance premiums are payable monthly or annually but can change from one calendar year to another, as shown in the table below.

This policy defines a family as 2 adults who are spouses and their children, regardless of how many children they have.

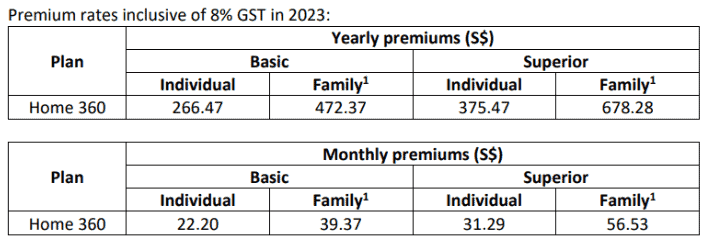

Premium Comparison (PA 360 & Home 360)

On top of the NTUC Income i50 “PA 360” Basic Plan, you can get combined home and accident coverage for just another $84.79 a year.

Below is a table comparison of the 2 plans.

Policy Term

- This plan is renewed annually until age 65 but may extend to age 80 under certain conditions.

Coverage

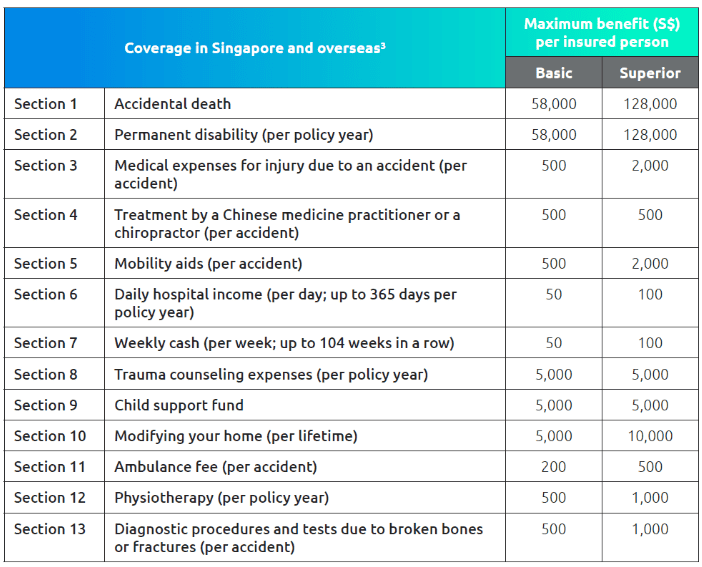

The following table shows the coverage in Singapore and overseas and the maximum benefit per insured person.

Accidental Death Benefit

If you pass away unexpectedly, NTUC Income i50 “Home 360” Insurance provides financial support to your family or beneficiaries, so they are covered and financially secured to handle the final expenses.

Permanent Disability Benefit

If you become disabled long-term due to an accident, the Permanent Disability Benefit helps cover your personal care and well-being during your recovery period.

Medical Expenses Benefit

With NTUC Income i50 “Home 360” Insurance, you are covered for the costs of medical treatments following an accident.

This ensures that your primary attention is to focus on your recovery without worrying about hefty bills.

Complimentary Medical Treatment

Under the NTUC Income i50 “Home 360” Insurance plan, you can choose alternative treatment by a Chinese Medicine Practitioner or Chiropractor to the maximum limit for treatment per accident.

Mobility Aids Benefit

Mobility aids are essential for enhanced mobility after an accident, and they include items such as wheelchairs, walking aids, or other equipment to help you regain your physical independence.

This plan covers the cost of these items up to the specified limit as per your chosen plan.

Daily Hospital Income

The NTUC Income i50 “Home 360” Insurance will reimburse you for your hospital stay.

The Basic plan provides $50 per day, while the Superior plan offers $100, helping cover the daily expenses during your hospital stay so you can focus on getting better.

Weekly Cash Benefit

The cash benefit provides financial support during an extended recovery period.

The Basic plan offers $50 per week, while the Superior plan increases this to $100 per week for up to 104 consecutive weeks, ensuring you have support when needed most.

Trauma Counselling

Trauma counselling expenses cover counselling costs for services following a traumatic accident per policy year.

The maximum benefit is the same, irrespective of whether you have chosen the Basic or Superior plan.

Child Support Fund

The child support fund covers the care and support of your dependent children if you experience an accidental death or permanent disability, ensuring the well-being of your children.

Home Modification

Modifying your home can become necessary after sustaining an accidental injury or disability.

With NTUC Income i50 “Home 360” Insurance, the funds create a safe and comfortable living environment, especially where you suffer from disabilities as a result of an accident.

Ambulance Fee

The plan covers the ambulance fee after having an accident, offering peace of mind, knowing you won’t have to worry about ambulance costs.

Physiotherapy Benefit

Physiotherapy is crucial for your physical recovery after a severe accident.

This plan assists with your recovery by ensuring you have access to the services of a registered Physiotherapist.

Diagnostic Procedures and Tests

Diagnostic procedures and tests are sometimes necessary when treating accidental injuries that have resulted in broken bones or fractures, and this plan has you covered for a comprehensive range of testing.

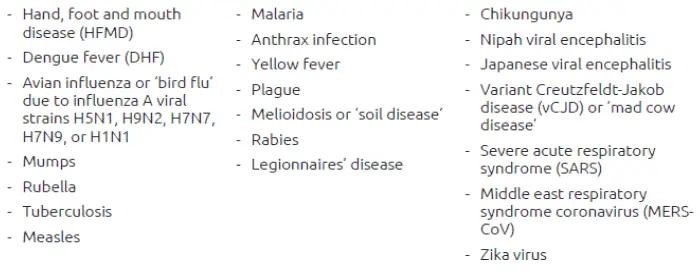

Infectious Disease Benefit

Even when you think this NTUC Income i50 “Home 360” Insurance is an all-arounder plan that covers every aspect of coverage, you also get coverage against 21 infectious diseases, regardless of your plan of choice.

See the coverage in the table below.

Protection for Your Home

The NTUC Income i50 “Home 360” Insurance plan offers extensive coverage for your home, including buildings, renovations, and contents.

These benefits and their limits apply to both Basic and Superior Plans.

Here’s a breakdown of the various coverages and limits.

Loss/Damage/Renovations

This coverage provides financial protection for your home’s structural elements, including buildings & renovations.

The maximum amount available for claims related to such damages is $150,000.

However, an excess payment of $100 applies for each loss or damage caused due to the following events:

- Bursting water tank

- Apparatus

- Pipes

This coverage also applies to natural disasters such as

- Hurricanes

- Cyclones

- Typhoons

- Windstorms

- Earthquakes

- Volcanic eruptions

Loss/Damage to Contents

This plan can safeguard your personal belongings within your home.

The aggregate limit here is $50,000.

However, although several contents in your home may suffer loss or damage, this policy has set sub-limits for different items.

The table below illustrates these sub-limits:

| Type of contents | Sub-Limit Benefit |

| Legal documents | $500 in total |

| Mobile phones | $500 for each item or set and $1,500 in total |

| Bicycles | $1,000 in total |

| Money Laptop, desktop, and tablet computer | $1,000 in total |

| Valuables | $1,500 for each item or set and $5,000 in total |

| All other contents | 5% of the overall section limit for each item, set or pair and up to one-third of the overall section limit in total |

Homeowner/Tenant’s Public Liability

With a maximum benefit of $500,000, the NTUC Income i50 “Home 360” Insurance plan offers you financial security if you’re found liable for accidents or damage that occur on your property.

Other Home Benefits

Additionally, there are handy benefits that come with the plan, as per the table below:

| Benefit | Coverage Limit | Excess Payment |

| Professional Fees | Up to $15,000 | No excess |

| Removing Debris | Up to $10,000 | No excess |

| Loss/Damage To Contents Belonging To Your Domestic Helper | Up to $500 | No excess |

| Replacing Locks & Keys | Up to $500 | No excess |

| Deterioration of Food in the Refrigerator | Up to $500, with $50 excess for the first $50 of loss or damage | $50 for the first $50, then no excess. |

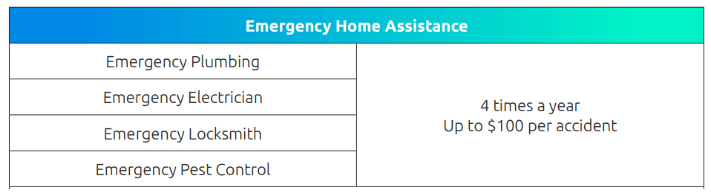

Emergency Home Assistance

The Emergency Home Assistance service offered in the plan is valuable and provided to you to address emergencies related to plumbing, electrical issues, locksmith needs, & pest control.

This service is available 24/7 and subject to your policy’s conditions.

The amount payable per accident is up to $100 but is limited to 4 accidents per year.

It’s essential to note that this service is complementary and separate from the benefits provided under your policy contract.

In other words, it is not an insurance benefit but an additional service to enhance your overall policy experience.

The covered home emergencies are outlined in the table below:

Summary of NTUC Income i50 “Home 360” Insurance

| Cash & Cash Withdrawal Benefits | |

|---|---|

| Cash Value | No |

| Cash Withdrawals | No |

| Health & Insurance Coverage | |

| Death (Accidental) | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |