NTUC Income Hospital Care is a hospital income insurance plan that offers you income while in the hospital or recovering at home after discharge.

This plan also covers you while travelling abroad for up to 90 consecutive days.

Read our review of the NTUC Income Hospital Care to determine if this policy suits your needs.

My Review of NTUC Income Hospital Care

The NTUC Income Hospital Care offers a range of valuable benefits to ensure your financial well-being during times of hospitalisation.

In the event of hospitalisation, you can receive a daily hospital cash benefit of up to $300 per day.

If your hospitalisation occurs in the Intensive Care Unit (ICU), you are entitled to an ICU triple cover benefit of up to $900 per day.

It also provides coverage outside of Singapore if your duration abroad doesn’t exceed 90 days for a policy year.

The NTUC Income Hospital Care also covers a range of medical expenses, such as:

- Day surgery expenses incurred in a hospital

- Ambulance expenses for transporting you to the hospital,

- Emergency outpatient expenses to treat injuries resulting from accidents.

Furthermore, this policy has no deductibles, so you can access these benefits without any initial out-of-pocket expenses.

The Home Recovery after the hospitalisation benefit offers up to $150 per day for up to 5 days for each day of medical leave prescribed for your recovery at home immediately after being discharged from the hospital.

This can be used for anything you require, whether for food deliveries, home cleaning, temporary income replacement, or other essential needs.

Medical expenses incurred by visiting a Chinese medicine practitioner or chiropractor due to injury are covered by this policy, provided that the practitioner is registered and has a valid license.

This ensures you have a wide range of access to various medical treatments to aid your recovery.

What’s more, there’s an additional perk for families.

When you and your family members are insured under the policy, you can enjoy a significant discount of up to 20%.

As always, we recommend comparing other hospital insurance policies from different insurance providers before deciding on taking out a plan.

This way, you know your alternatives and can choose a policy that suits you best.

You should also seek a second opinion before making any purchases.

As insurance is a long-term commitment, you don’t want to waste your money paying for premiums only to discover that this policy doesn’t pay out for your use case.

If you need someone to explore alternatives with or get a second opinion of NTUC Income Hospital Care, we partner with MAS-licensed financial advisors who can help you with this.

Click here for a non-obligatory chat.

Now let’s explore the NTUC Income Hospital Care in detail:

Criteria

To qualify, you must meet the following criteria:

- The age range is from 30 days to 65 years, but it may be extended to 75 years under certain conditions.

General Features

Premium Terms

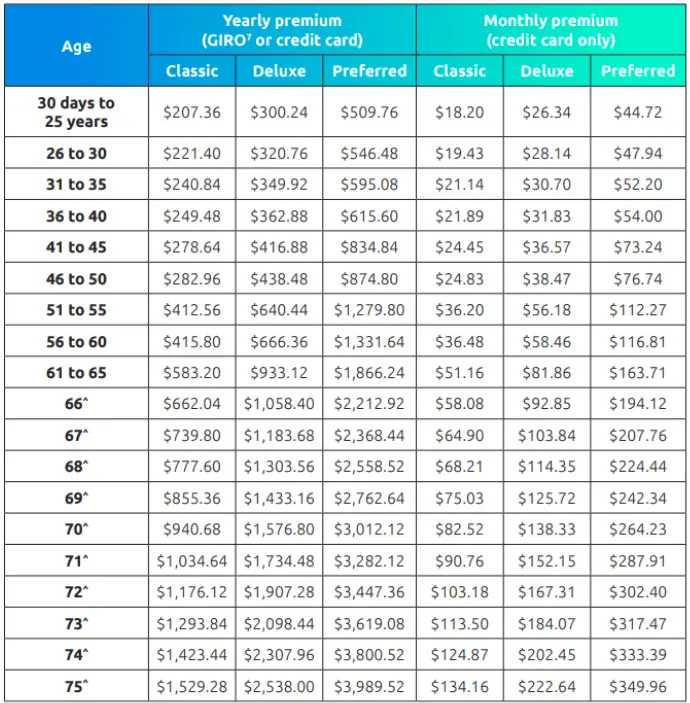

The premiums are payable annually or monthly. A discount may apply if you pay for the premium annually.

The table below depicts annual and monthly premiums:

^Refers to renewals only.

Policy Term

NTUC Income Hospital Care is a yearly policy that can be renewed until you’re 65, but can be extended to 75 years in some instances.

Protection

The coverage provided by NTUC Income Hospital Care is determined by the policy’s conditions and maximum benefit limits.

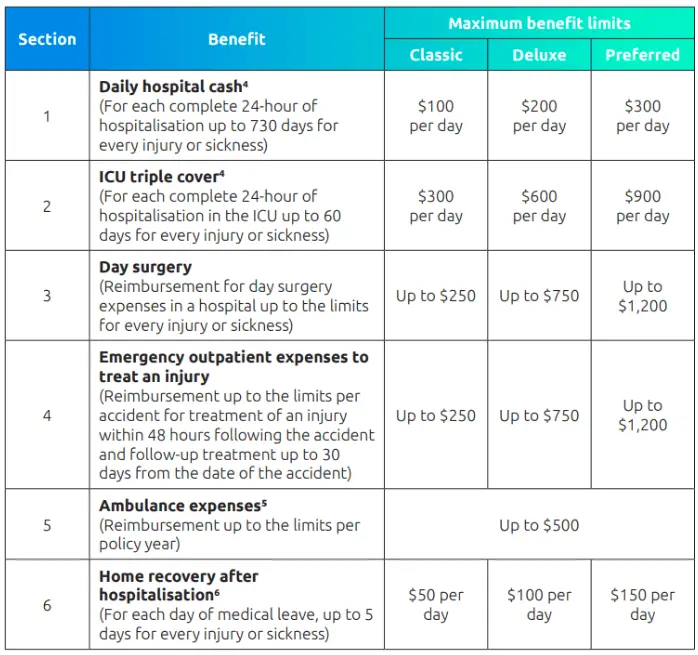

Daily Hospital Cash Benefit

In the case of lengthy hospital stays, NTUC Income Hospital Care can provide you with financial support for each consecutive 24-hour period of hospitalisation.

You can use this benefit for up to 730 days for every injury or sickness.

If you’re hospitalised overseas, this benefit will also be paid out to you for up to 90 days.

The coverage is subject to the policy limit.

ICU Triple Cover

In cases where hospitalisation requires Intensive Care treatment (ICU), with higher associated costs, this policy covers you for those costs.

For every 24 hours in ICU, you’ll receive financial support for up to 60 days for every injury or sickness, subject to the policy limit.

Day Surgery

This benefit offers reimbursement for day surgery-related costs for procedures requiring day surgery.

The coverage extends to the policy limit for every injury or sickness, ensuring such medical procedures do not have a significant financial impact on you.

Emergency Outpatient Expenses

When you require urgent treatment for an injury, this coverage comes to your aid.

The NTUC Income Hospital Care reimburses treatment costs within 48 hours following the accident and follow-up treatment for up to 30 days.

The reimbursement is up to the policy limits per accident, offering financial relief during critical times.

Ambulance Expenses

Ambulance expenses are covered with this policy according to the annual limits.

It’s a noteworthy aspect of the policy as it covers the costs associated with transport during emergencies.

Home Recovery

After you’re discharged and continue your recovery from home, this benefit provides a cash benefit for each day of home recovery, for up to 5 days for every injury or sickness.

Relying on financial assistance through NTUC Income Hospital Care provides you with some breathing space when needed.

Coverage Overseas

The policy provides coverage outside of Singapore if your duration outside the country doesn’t exceed 90 days for a policy year.

Outpatient Medical Treatment By a Chinese Medicine Practitioner

This policy covers medical expenses you incur because of your visit to a Chinese medicine practitioner or chiropractor, provided they are registered and possess a valid practising certificate.

Summary of NTUC Income Hospital Care

| Cash & Cash Withdrawal Benefits | |

|---|---|

| Cash Value | No |

| Cash Withdrawal Benefits | No |

| Health & Insurance Coverage | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |