The NTUC Income Gro Annuity Pro is a single premium participating annuity plan offering you a lifetime of annuity payouts – even after you retire.

Here’s our review of the NTUC Income Gro Annuity Pro, read on to determine if this is the right policy for you.

Criteria

Entry age: 40 – 85 years old on your last birthday

General Features

Premium Payment

The premium payment for the NTUC Income Gro Annuity Pro plan is simple: a minimum single payment of $10,000.

Policy Term

The policy term for NTUC Income Gro Annuity Pro is for the whole life of the insured individual. The policy will continue until the insured individual passes away.

Protection

Death Benefit

If the insured passes away while the policy is in effect, the policy will provide a death benefit.

If the total annuity payments received by the policyholder are less than the initial single premium paid, the difference will be paid out to the beneficiary or the policyholder’s estate.

For example, let’s say you paid a single premium of $10,000 but only received $8,000 in annuity payments before passing away.

In this case, the difference of $2,000 ($10,000 – $8,000) would be paid out as the death benefit.

Any loans you may have taken against the policy and accrued interest will be subtracted before the benefit is paid out.

Once the death benefit is paid, the policy terminates, and no further payments or benefits are provided.

Key Features

Annuity Benefit

The NTUC Income Gro Annuity Pro is an immediate annuity, meaning you will receive monthly payouts immediately for as long as you live.

The annuity payments are designed to provide you with a stable income stream to support your financial needs during your retirement years and beyond.

Surrender Benefit

NTUC Income Gro Annuity Pro will pay a surrender benefit if you decide to surrender or terminate the policy after minimally a year and if the total annuity payments made are less than the initial single premium.

The table below shows the proportion of the single premium that will be paid out minus the total annuity payments made for each policy year up to the fifth policy year.

| Policy Year After Cover Start Date | Surrender value (% of the single premium ) | Deductions |

| 1st | 85 | Total annuity payments & conversion bonus |

| 2nd | 90 | Total annuity payments & conversion bonus |

| 3rd | 93 | Total annuity payments |

| 4th | 95 | Total annuity payments |

| 5th | 100 | Total annuity payments |

Conversion bonus refers to the additional cash value provided if you had exercised the annuity option to buy NTUC Income Gro Annuity Pro.

Bonuses

Annual bonuses

Annual bonuses may be added to your policy each year.

These bonuses are typically calculated as a percentage of the basic sum assured (the initial coverage amount of the policy) and the bonuses accumulated from previous years.

Once they are added to the policy, you are assured that they will be provided to you, no matter how well or poorly the Life Participating Fund performs.

Future bonuses

Each year, the amount of bonuses to be issued to each participating plan is determined by NTUC Income. This includes the NTUC Income Gro Annuity Pro.

These future bonuses are dependent on the profitability of the Participating Fund and are subject to changes.

NTUC Income Gro Annuity Pro Fund Performance

Current Asset Mix

The current allocation of assets closely aligns with the target allocation for the fund as a whole.

The fixed-income portion of the portfolio consists of government and corporate bonds, which are aimed at covering the majority of the guaranteed bonuses.

In order to achieve the objectives and ensure good performance, the fund managers have the flexibility to adjust the investment mix.

They continually assess the performance of different investment options and may change the allocation of funds to maximise returns and manage risks effectively.

Below is the strategic and actual asset allocation as of 31st December 2022:

| Type of Asset | Allocation Goals

(%) |

Actual Allocation

(%) |

| Fixed-Income | 64 | 63 |

| Equities and Properties | 36 | 37 |

| Total | 100% | 100% |

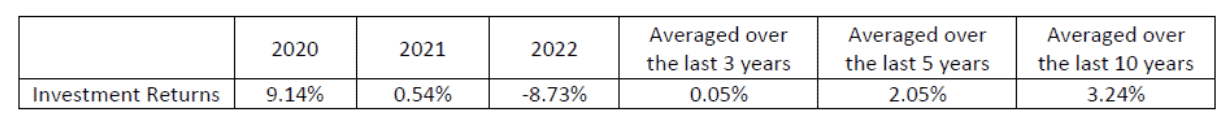

Investment Rate of Return

In participating insurance policies, a portion of the premiums paid by you is allocated towards investments.

These investments are managed in a diversified portfolio of assets such as stocks, bonds, and real estate.

The returns generated from these investments contribute to the overall growth of your policy cash value.

The investment rate of return is important as it determines how effectively the policy’s funds are being invested and how much your policy’s cash value increases over time.

A higher investment rate of return means the cash value will grow faster, potentially leading to higher benefits and payouts in the future.

Below are the historical investment rates for this Participating Sub-Fund between 2020 and 2022:

The fund experienced a sharp decline in 2021 and 2022, reporting a negative return in 2021 compared to a 9.14% return in 2020.

The decline in IRR could have been caused by global economic factors, such as the pandemic.

Please note that the above averages on investment rate of return are not guaranteed and can fluctuate based on market conditions and the performance of the underlying investments.

In contrast, here’s how NTUC Income’s geometric net average returns compare against other insurers in Singapore:

As you can see, NTUC Income performs average to slightly above average when it comes to returns amongst its peers (2010 to 2019). However, you shouldn’t look solely at returns when it comes to participating plans.

Its other features and expense ratios should also be considered when choosing one that’s best for you.

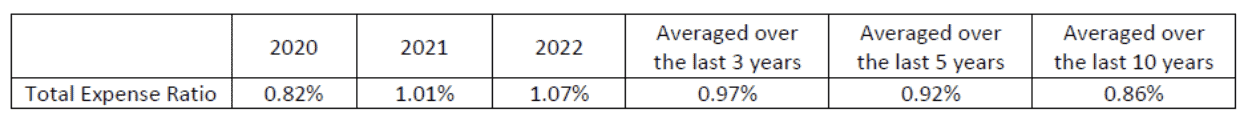

Total Expense Ratio

The total expense ratio helps you understand how the participating fund’s costs can affect a policy’s performance and potential benefits.

It calculates the percentage of expenses incurred by the fund compared to its assets.

When you pay your premiums, the expected expenses are already included in the premium amount.

So, as a policyholder, these expenses are not an extra cost for you.

However, if the actual expenses incurred by the participating fund are much higher or lower than expected, it can affect the non-guaranteed benefits provided by the policy.

Significant deviations from the expected expenses can have an impact on the overall outcomes and returns of the policy.

Below are the past year’s total expense ratios:

Industry Comparison

The below report shows the top 8 insurance companies’ performance from 2017 to 2019 regarding expense management:

Based on the provided data, it can be seen that NTUC Income demonstrates strong expense management, as it has the lowest and most consistent expense ratio in the market and falls below the industry average.

By having the lowest and most consistent expense ratio in the market, NTUC Income is likely able to offer more competitive and cost-effective participating insurance policies compared to its competitors.

This suggests that policyholders with NTUC Income may benefit from higher potential returns and lower costs, resulting in improved overall performance and potential benefits.

However, a comprehensive evaluation includes a range of factors beyond just expense management.

It’s advisable for you to conduct thorough research, seek professional advice, and carefully review the terms and conditions of the plan before making any investment decisions.

NTUC Income Gro Annuity Pro Charges and Fees

The Life Participating Fund has various costs associated with its operations. These costs include commissions, distribution expenses, administrative costs, insurance policy expenses, and more.

Expenses directly related to the Life Participating Fund will be paid by the fund itself. However, some expenses are shared among multiple funds.

In those cases, the expenses will be divided and assigned to each fund, including the Life Participating Fund.

This allocation method ensures that each fund pays its fair share of the overall expenses based on the costs involved in running the business.

The expenses incurred by the Life Participating Fund are already included in the premium paid by the policyholder, so they won’t be charged separately.

This ensures fairness and transparency in the distribution of expenses.

Illustration of How NTUC Income Gro Annuity Pro Works

Introducing Alex – he is 55 years old and wants a plan to provide him with a steady income once he retires.

To achieve this, he decides to purchase the NTUC Income Gro Annuity Pro plan. He needs to pay a single premium of $100,000 to get started.

When Alex reaches age 65, he will receive monthly payments from the NTUC Income Gro Annuity Pro.

The amount he receives each month is not guaranteed and can fluctuate. On average, he can expect to receive around $51.15 per month of non-guaranteed payouts.

However, the plan also offers a guaranteed monthly payout of $70.70 to provide him with more stability.

So, at 65, Alex will receive a combined monthly annuity payout of approximately $121.85 from the NTUC Income Gro Annuity Pro.

This money can help cover his living expenses and provide him with a regular income during his retirement years.

Now, let’s fast forward to when Alex turns 95. Even at this advanced age, he will continue to receive monthly payouts from the NTUC Income Gro Annuity Pro.

The non-guaranteed portion of his monthly payout will increase significantly, reaching around $554.00. He will also receive the guaranteed monthly payout of $70.70.

Thus, at 95, Alex can expect a total monthly annuity payout of approximately $624.70.

This ongoing income can be valuable in meeting his financial needs and ensuring a more comfortable life in his later years.

Summary of the NTUC Income Gro Annuity Pro

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawals | Available |

| Health and Insurance Coverage | |

| Death | Available |

| Total Permanent Disability | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health and Insurance Coverage Multiplier | |

| Death | N/A |

| Total Permanent Disability | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

My Review of the NTUC Income Gro Annuity Pro

NTUC Income Gro Annuity Pro is a decent policy if you’re looking for a steady income throughout your retirement years.

It provides you with regular payments (annuity payouts) for as long as you live.

This means you can enjoy the comfortable and worry-free retirement you have always dreamed of!

Additionally, you have the flexibility to choose how often you receive your annuity payouts.

Whether you prefer monthly, quarterly, half-yearly, or yearly payments, the choice is yours.

This allows you to tailor the payout frequency according to your financial needs and preferences.

While you save and build up your annuity, NTUC Income Gro Annuity Pro also protects you in the event of death.

If something unfortunate were to happen, your loved ones or beneficiaries would receive a payout that provides financial support to help them during a difficult time.

However, the main drawback of this annuity policy is that it doesn’t provide coverage for terminal illness (TI) and total permanent disability (TPD), which leaves you and your loved ones without financial protection in the event of serious health issues.

Although not the main point of a retirement plan, other policies usually provide either or both.

If death, TPD, and TI are what you’re after, consider a term plan or a whole life plan instead.

Otherwise, the NTUC Income Gro Annuity Pro is decent – though there are better annuities in the market.

Nevertheless, it’s best to get a second opinion on whether the NTUC Income Gro Annuity Pro is the best for you, as your needs are unique to you.