Hands up, to those among you that are procrastinators.

(Alright, disclaimer here – I’m one among you but need both hands to type, so I’m temporarily keeping my hands down)

Yes, its human nature to procrastinate, and the reasons are myriad –

We are afraid of making a mistake

We might be anxious or afraid of something

We are perfectionists that want to get EVERYTHING right

We fear criticism

We might feel overwhelmed

And so on, ad nauseam.

For all the times that procrastination has cost us dearly (think of the last-minute assignments completed, waiting till “tomorrow” to start that healthy diet), there is one sinister implication of waiting too long when it comes to Life Insurance.

If you are brave enough, read on.

The Scenario

Our protagonist of today’s story is Patrick the Procrastinator.

Patrick is currently 30 years old and does not smoke. He does up to his Life Insurance agent and enquires on the possibility of getting a term plan till he is 98, or 99 ANB (Age Next Birthday) in Life Insurance parlance – which is for the next 68 years.

Here are the specifications:

Death Cover: 500k

Total and Permanent Disability Cover: 500k

Critical Illness Cover: 500k

These amounts are for illustration and will be kept constant.

How much would it cost him each year? And how much would he pay throughout his lifetime?

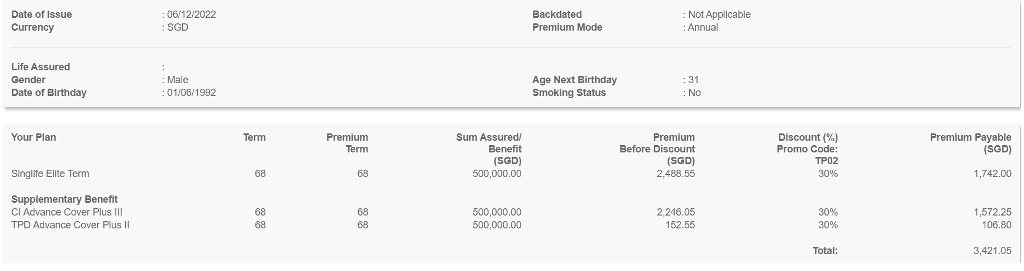

Here’s the Policy Illustration using Singlife’s Elite Term (The results for other Insurers’ term plans are the same, we just happen to use Singlife as an example)

Annual Cost: $3,421.05

Life Time Cost: $3,421.05 X 68 years = $232,631.40

Coverage Term: 68 Years (till he reaches 99 ANB)

Right. Patrick decides then that this decade is better spent on waiting it out, since there are holidays to be had, gadgets to collect, and a mortgage to be paid off. Perhaps then it’s better to save on a decade of premiums and then revisit the same plan when he is 40?

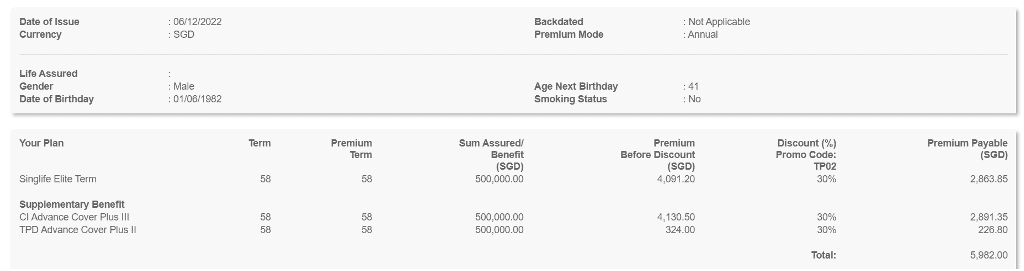

Here’s what the Policy Illustration would look like for 40-year-old Patrick:

Annual Cost: $5,982.00

Life Time Cost: $5,982.00 X 58 years = $346,956.00

Coverage Term: 58 Years (till he reaches 99 ANB)

It’s the exact same plan with the same specifics (coverage amount, and till he reaches 99 ANB) but we can already see that not only has the annual premium increased, but the total lifetime premium amount also has increased.

The reality here: Not only has he lost out on 10 years of coverage by waiting, but he also has to pay more for his remaining years.

Alright, maybe waiting another 10 years would then make it worthwhile for our hero. Patrick sits and lets another decade go by before wanting to take action.

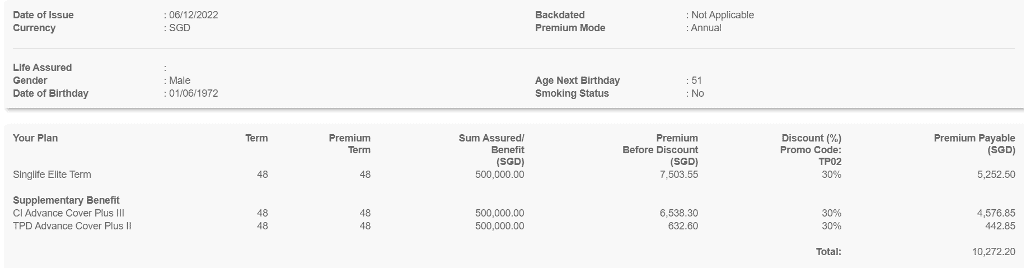

Annual Cost: $10,272.20

Life Time Cost: $10,272.20 X 48 years = $493,065.60

Coverage Term: 48 Years (till he reaches 99 ANB)

Ouch. The annual premium has almost doubled by this decade of inaction, yet the lifetime cost for this policy has also increased (so much for saving on premiums!).

And by waiting, Patrick lost out on yet another decade of coverage.

In a quick glance

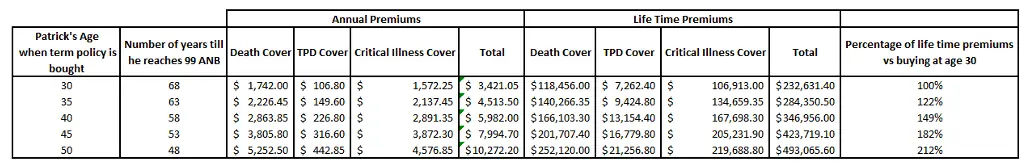

Here’s a table to summarise how much Patrick would have to pay annually and also for the policy lifetime throughout the ages, starting from age 30 to age 50, in 5-year increments.

By waiting for 10 years, the annual premium increase by over 70%. If the wait were 20 years, that annual premium would increase by 200% (3 times of what Patrick would have paid at age 30!)

If that wasn’t bad enough, the lifetime premiums payable keep on increasing – now that is a double whammy if there ever was one.

Moral of the Story

Don’t. Wait.

It’s comfortable to defer and decide later, but we all know that days roll into months, months into years, and years into decades.

By waiting, you are robbing yourself of the opportunity to purchase Life Insurance when it’s cheaper, both in terms of annual premiums and lifetime premiums.

What’s infinitely worse: Should something happen to you prematurely while you have not made that decision to get properly covered, it could be a financial disaster for you and your family.

Act. Now.

This has been a guest post from ClearlySurely.com in collaboration with us at dollarbureau.com. Check them out for more cool and uncommon Life insurance insights!