Great Eastern’s GREAT TripleCare MoneyBack is a non-participating term plan which provides strong financial protection against death for up to 3 times the sum assured till 65 years old.

What’s more, this policy guarantees you 100% of the total premiums you’ve paid upon the end of your policy term, should no claims be made.

Keep reading to find out more!

Criteria

- Minimum Sum Assured: $100,000

General Features

Policy Terms

- Entry Age: 17 to 55 years old

- Coverage till 65 years old

Premium Payments

Premium payments can be made annually, half-annual, quarterly, or monthly.

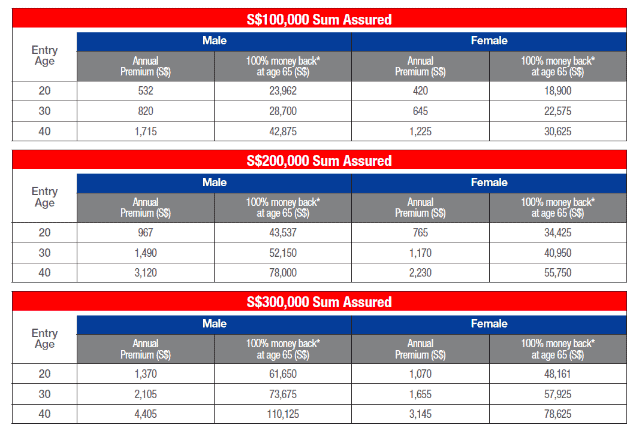

The following table details the annual premiums payable under the 3 available plans:

Changing Your Basic Sum Assured

You may raise a written request to adjust your policy’s basic sum assured.

Requests to raise the policy’s sum assured are subject 3 conditions:

- The adjustment must be within 12 months from your policy’s commencement date

- The adjustment must be within the basic sum assured options offered by this policy

- Evidence of the insured’s insurability must be submitted

Requests to reduce the basic sum assured are only permitted once throughout your policy’s period and are dependent on the basic sum assured options offered by this policy.

Should your request for alteration be approved, your policy premiums will be adjusted to match the new coverage amount.

Where a reduction of basic sum assured occurs, Great Eastern will disburse a partial surrender value corresponding to the reduced basic sum assured amount.

Protection

Death Benefit

In the event that the insured passes away while the policy is active, Great Eastern will disburse a one-time payment to the insured’s beneficiaries.

Any outstanding debts under the policy will be subtracted from the death payout. Once the payout is made, the policy will end.

The table below illustrates the payout entitled under each claim event:

| Claim Event | Death Benefit Payable |

| Death of the insured | 100% of the basic sum assured |

| Death of the insured due to stroke and/or heart attack | 200% of the basic sum assured |

| Death of the insured due to an accident | 300% of the basic sum assured |

Please note that Great Eastern will only pay once for one of the above payouts.

MoneyBack Benefit

If the insured remains alive until the end of the policy period, 100% of the premium payments made since the policy’s commencement date will be disbursed.

The benefit will be subtracted from the following:

- Any outstanding debts under the policy

- Adjustments made to basic sum assured (if any)

Summary of GREAT TripleCare MoneyBack

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawal Benefits | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

My Review of the GREAT TripleCare MoneyBack

GREAT TripleCare MoneyBack is an insurance plan that safeguards you and your loved ones from life’s uncertainties.

It offers a death benefit of up to $900,000 until you are 65.

Additionally, the MoneyBack benefit grants you 100% of the total premiums you’ve paid across the policy period, as long as you haven’t made any claims till you reach 65 years old.

These payouts will provide you with significant funds to support your desired lifestyle and your loved ones during retirement.

I like this policy because it is really a no-frills product, and it’s the only term plan giving you back your total premiums paid if you didn’t make any claims.

However, the GREAT TripleCare MoneyBack does not insure against other life events such as terminal illness or total permanent disability.

It also excludes coverage for adventurous, competitive, and military activities – all at high risk of getting into an accident.

So this is not for you if you are active in any of these.

I also think the premiums are quite expensive – perhaps 2X to 5X more expensive than other term plans in the market.

A $300,000 sum assured for a non-smoking male costs $2,105 per year in premiums.

Compare this to Singlife’s Elite Term, which charges only $535 per year for a $500,000 sum assured until you’re 70.

That’s more coverage for a longer period.

Okay, not a fair comparison because normal term plans don’t give you your premiums back. So let’s compare this to a whole life plan, which returns your premiums + investments.

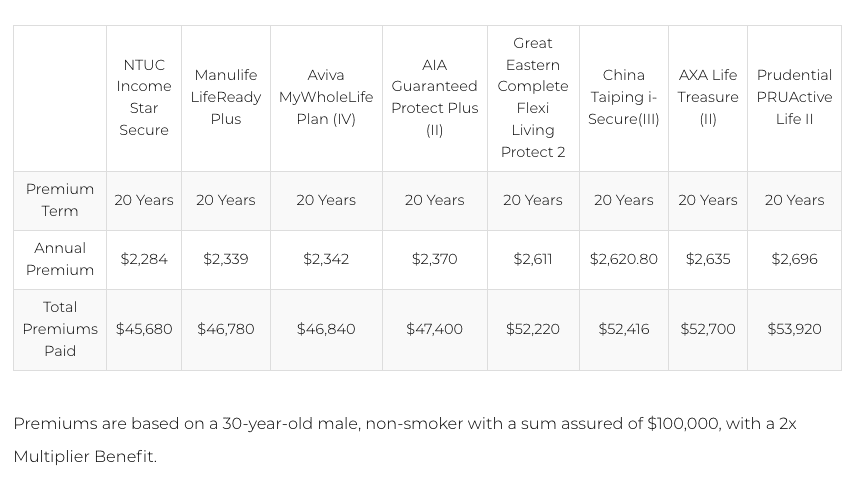

For a 30-year-old non-smoking male with a $100,000 sum assured, a 2X multiplier, and a 20-year premium term, it will cost you $2,284 per year in premiums for NTUC Income’s Star Secure.

In terms of premiums paid, you only make $45,680 in premiums in total.

As there are no multiples for the GREAT TripleCare MoneyBack, we took the $200,000 sum assured with an annual premium of $1,490.

This calculates $52,150 in total premiums – much higher than a whole life plan.

Let’s not forget you must pay this until you’re 65, and then your protection ends at 65. With the NTUC Income Star Secure, you only pay for 20 years to get a lifetime of coverage.

Also, with the NTUC Income Star Secure, you have an illustrated surrender value of $116,213 at 70, with $49,200 guaranteed.

Thus, in my opinion, I don’t think the GREAT TripleCare MoneyBack is recommendable to most consumers. Perhaps there is a target market for this policy that I’m just not seeing.

I personally would buy a cheaper term plan – the Singlife Elite Term – for $535, and invest the remaining $1,570 yearly into an investment plan.

Alternatively, buying a good whole life plan will give me more returns + my money back than the GREAT TripleCare MoneyBack.

Need help sourcing for a policy that matches your requirements and preferences?

We partner with MAS-licensed financial advisors to help you with this.

Click here to arrange an appointment.