The GREAT Junior Protector is a personal accident insurance plan that is designed specifically for your young ones.

The policy protects your child from sudden, unexpected, and involuntary sicknesses or injuries resulting from accidents.

Is it any good?

Here’s our review of the Great Eastern GREAT Junior Protector.

Keep reading.

My Review of Great Eastern’s GREAT Junior Protector

The Great Eastern GREAT Junior Protector is a great personal accident insurance plan for your child.

This insurance plan is designed to offer financial protection to your child in unforeseen accidents and injuries – something we all know is common when you have kids constantly running around.

This helps you deal with unexpected medical expenses and other financial challenges that may arise from such incidents.

This plan extends coverage to your baby from 15 days after birth or 15 days after discharge from the hospital, whichever is later.

This means your child can be protected from a very early age.

Your children up to the age of 16 are eligible for coverage, and acceptance into the plan is guaranteed and without a medical check-up process.

The coverage is renewable annually until your child reaches the age of 75.

This ensures that your child can maintain insurance protection throughout his/her life.

In the unfortunate event of accidental death or permanent disability due to certain accidents, the plan offers the possibility of receiving up to triple the payout.

This can provide additional financial support during difficult times.

The plan also provides a daily hospital cash benefit for a wide range of 41 specified Infectious Diseases, including conditions like COVID-19 and dengue.

It also covers hospitalisation due to accidents and other illnesses, helping you offset the financial burden of hospital stays.

In addition to hospitalisation expenses, the plan covers medical expenses and follow-up treatments.

This includes coverage for Complementary Medicine and Allied Health services, ensuring that your child receives the necessary care in various medical situations.

If you’re looking for a personal accident plan for your child, the GREAT Junior Protector is surely a pretty good plan to consider.

But as per usual, we always recommend getting a second opinion as there might be a better option for your child in the market.

When it comes to your child’s (and your pocket’s) safety, you definitely want to choose the best possible coverage for them.

We recommend checking out our post on the best personal accident plans in Singapore for potential alternatives.

Once you understand what’s in the market, you should get a financial advisor’s second opinion on whether you should get the GREAT Junior Protector or another PA plan.

We partner with unbiased financial advisors to help you with this.

Click here for a free second opinion.

Here’s more on what the GREAT Junior Protector offers:

Criteria

- The required minimum age is 15 days after the baby’s birth or discharge from the hospital, whichever comes first.

- Renewable annually until the age of 75.

- Must be a Singapore citizen or Permanent Resident.

General Features

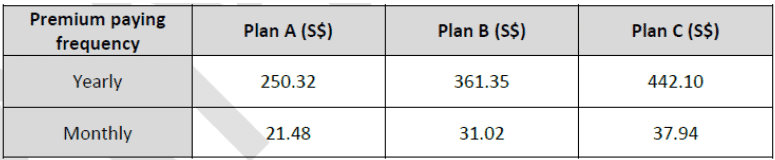

Premium Terms

Below are the premiums for the different plans, payable monthly or yearly:

This amount is not fixed and might change when you renew your plan.

However, for any changes, you will be notified at least 30 days before your plan renewal.

You cannot pay for the GREAT Junior Protector plan using your MediSave funds in Singapore.

Policy Term

The GREAT Junior Protector plan is renewable annually up to and including the age of 75.

This means that you will have to renew the policy every year or it will terminate.

Protection

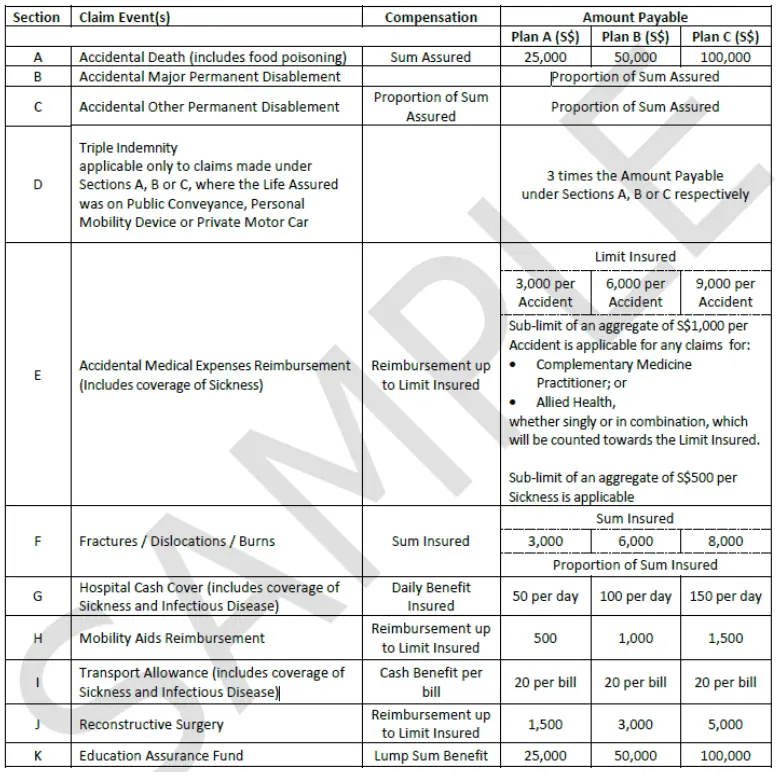

The GREAT Junior Protector plan provides benefits if your child experiences an injury due to an accident and it leads to any of the following claimable events within 365 days of the accident.

Here is the table of compensation:

Accidental Death

GREAT Junior Protector’s Accidental Death coverage pays out a lump sum equal to your preferred plan’s sum assured.

The lump sum is set at $25,000, $50,000, and $100,000 for Plans A, B and C respectively.

This benefit applies if the life insured passes on due to injuries from an unfortunate accident or food poisoning.

However, any benefits already paid out for Accidental Major Permanent Disablement or Accidental Other Permanent Disablement resulting from the same accident will be deducted from this payout.

When your child turns 21, the sum assured for Accidental Death, Accidental Major Permanent Disablement, and Accidental Other Permanent Disablement will be doubled on the renewal date.

This means the coverage amount will increase to provide more financial protection as the insured individual ages.

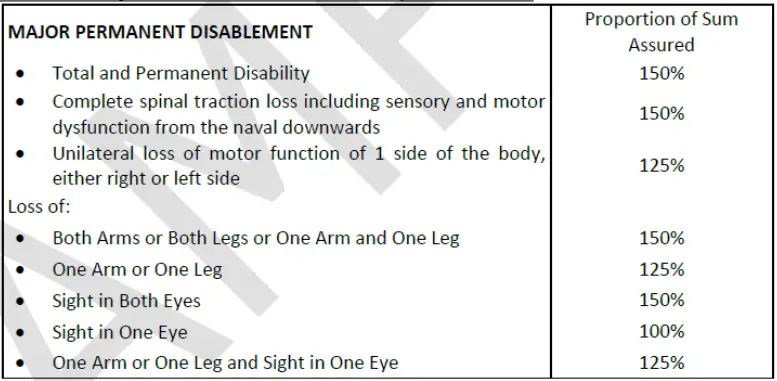

Accidental Major Permanent Disablement Benefit

This coverage under the GREAT Junior Protector plan provides a payout that is a portion of the sum assured associated with your selected Plan Type.

However, any benefits already paid out for Accidental Other Permanent Disablements resulting from the same accident will be deducted from this payout.

This benefit is designed to provide financial support in the event of a significant and permanent disability resulting from an accident.

Below is the Accidental Major Permanent Disablement Compensation schedule:

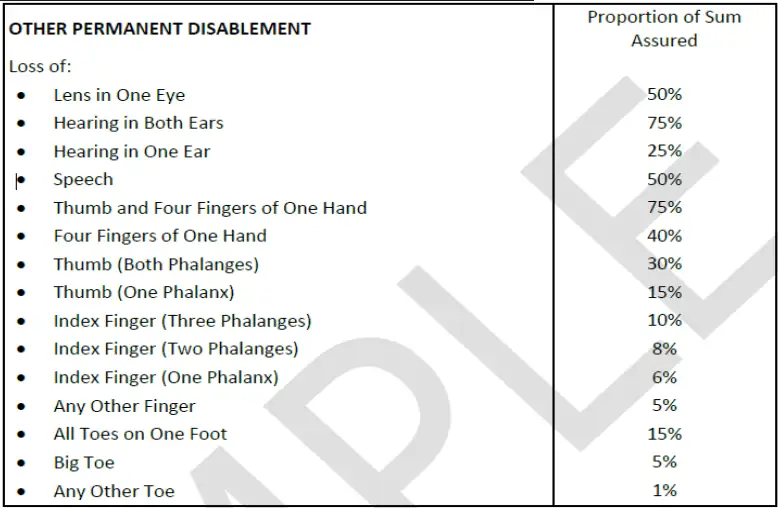

Accidental Other Permanent Disablement

Great Junior Protector’s Accidental Other Permanent Disablement coverage pays out a portion of the sum assured based on your selected plan type.

However, the total benefits payable under Accidental Death, Accidental Major Permanent Disablement, and Accidental Other Permanent Disablement combined shall not exceed 150% of the sum assured under Accidental Death.

Hence, the total compensation for these 3 benefits cannot exceed 1.5 times the sum assured for Accidental Death coverage.

This benefit is intended to offer financial assistance in the event of a permanent disability resulting from an accident not classified as a “major” permanent disability.

Here is the schedule for this benefit:

Triple Indemnity

Under the GREAT Junior Protector plan, the Triple Indemnity benefit triples the payable amount for a valid claim made under Accidental Death, Accidental Major Permanent Disablement, and Accidental Other Permanent Disablement.

This enhanced payout applies if the life assured sustains injuries from accidents while:

- Travelling by train, bus, or any other means of public transportation.

- Acting as a rider or pedestrian involved in an accident related to a personal mobility device.

- Serving as a passenger or an authorised driver with a valid driver’s license in an accident involving a private motorcar.

The amount payable under this Triple Indemnity benefit will not exceed:

- 300% of the sum assured for claims related to Accidental Death and Accidental Other Permanent Disablement.

- 450% of the sum assured for claims related to Accidental Major Permanent Disablement, considering any previous claims paid under Accidental Other Permanent Disablement.

This benefit provides additional financial support when the accident occurs due to the specified circumstances, effectively tripling the compensation for the covered accidents.

Accidental Medical Expenses Reimbursement

The Accidental Medical Expenses Reimbursement benefit covers medical expenses incurred due to an accident.

The benefit amount for medical expenses depends on the limit specified in the Compensation table, corresponding to the chosen Plan Type.

The benefit payable for medical expenses, when combined with expenses covered by other sources like MediShield Life, other insurance policies, or employee benefit provisions, should not exceed the actual expenses.

There are aggregate sub-limits for certain types of medical expenses.

For instance, for treatment by a Complementary Medicine Practitioner or Allied Health Professional, the sub-limit is $1,000 per accident.

And, for treatment related to sickness (non-accident), the sub-limit is $500 per sickness.

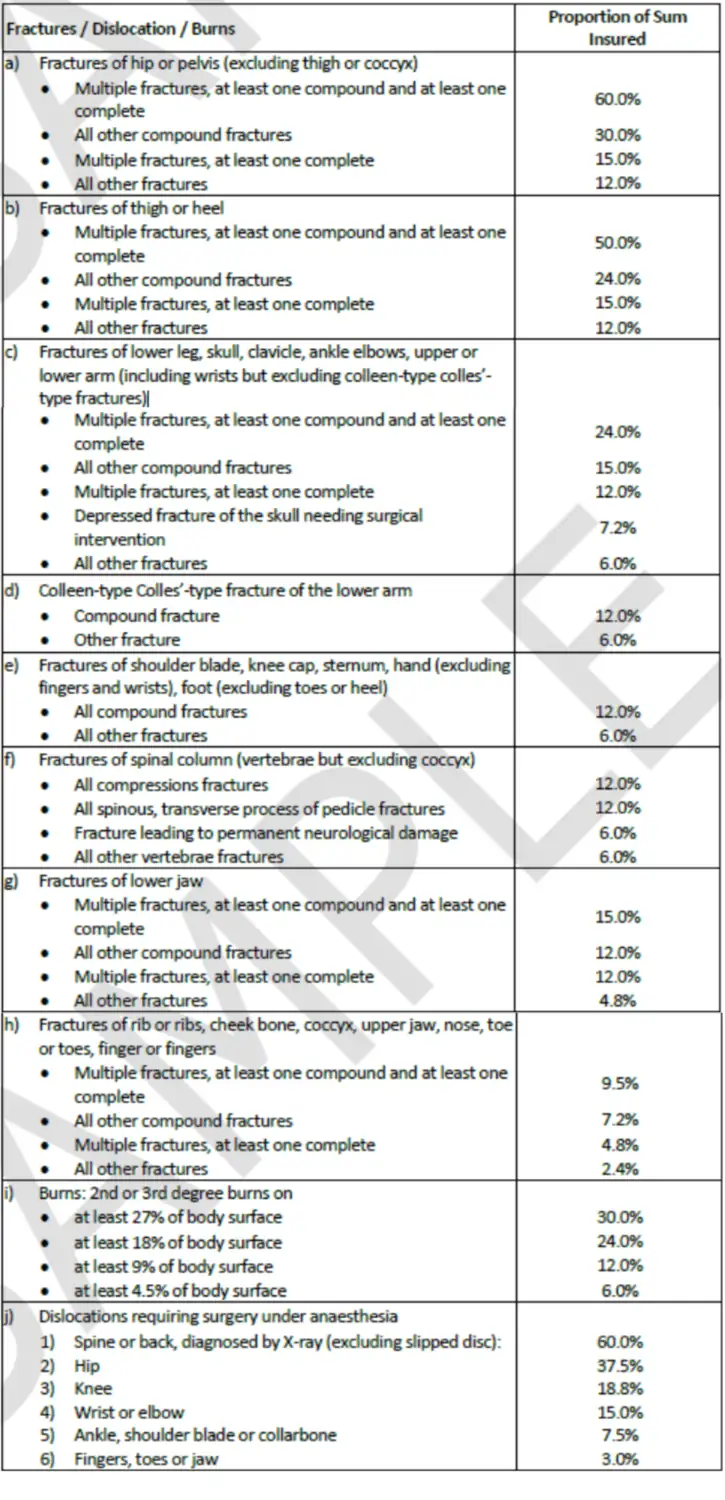

Fractures / Dislocation / Burns

The Fractures / Dislocation / Burns benefit covers specific types of injuries, including fractures, dislocations, and burns.

The benefit is provided as a proportion of the sum assured for each specific injury.

To be eligible for this benefit, the injury must result from an unforeseen and involuntary event, independent of any illness or disease.

The benefit will only be paid if the claim event, which is the specific injury, occurs within 90 days from the date of the accident.

The table below shows the percentage compensation for Fractures / Dislocation / Burns:

Hospital Cash Cover

The Hospital Cash Cover offers a daily cash payout for each day the life assured is hospitalised.

The daily cash payment limit is set at $50, $100, and $150 for plans A, B, and C, respectively.

This payout aims to help cover the additional expenses associated with hospitalisation.

The benefit applies to hospitalisation due to the following circumstances:

- Due to any accident, the life assured is hospitalised for a continuous period of 12 consecutive hours or more.

- Due to selected sicknesses or infectious diseases.

However, no daily benefit is payable during the initial 30-day waiting period for such hospitalisation.

- For a medically necessary surgical procedure related to an accident, sickness, or infectious disease.

The maximum period for which the daily benefit is payable is typically set at 180 days for each hospitalisation event.

Mobility Aids Reimbursement

The Mobility Aids Reimbursement benefit provides coverage for the cost of mobility aids due to an accident up to the limit specified in your chosen plan.

The payment limit is set at $500, $1000, and $1500 for plans A, B, and C, respectively.

To qualify for reimbursement, the mobility aids must be prescribed by a medical practitioner as necessary to aid in the assured recovery or mobility.

Specifically, only the expenses incurred for the rental or purchase of an artificial leg, per leg will be reimbursed during your lifetime.

This limitation applies to this plan and to all other policies issued by Great Eastern for the same life assured that provides similar benefits.

Transport Allowance

The maximum amount of the cash benefit per Accident, Sickness, or Infectious Disease is $60.

However, Great Eastern must consider the trip for medical treatment as a medical necessity.

This ensures that the benefit is provided for legitimate medical needs.

Reconstructive Surgery

This benefit provides reimbursement for certain types of surgery, specifically facial reconstruction due to an accident and skin grafting due to accidental burns.

The reimbursement covers reasonable and customary expenses associated with the specified Reconstructive Surgery, and the limit is set at $1,500, $3,000, and $5,000 for plans A, B, and C, respectively.

Great Eastern will only consider this benefit if it is medically necessary to set limits depending on the chosen plan.

Education Assurance Fund

This benefit pays out a lump sum in the devastating event of the life assured’s death caused by an accident.

The lump sum is set at $25,000, $50,000, and $100,000 for plans A, B, and C respectively.

The Education Assurance Fund benefit is available until your child reaches the age of 21 on the next birthday that falls on a renewal date of the plan.

Thereafter, this benefit will cease.

Provisional Cover

This Provisional Cover is put into place during the time between your application for insurance and the issuance of the full plan.

This period typically lasts until Great Eastern reviews your application and determines your eligibility.

While under Provisional Cover, you have some level of insurance protection.

However, this coverage is often restricted compared to what the full plan would offer.

Suppose an accident or sickness occurs during the Provisional Cover Period.

In that case, Great Eastern will consider paying benefits related to that specific event only if the plan is issued and the full annual premium is paid to date.

Summary of the GREAT Junior Protector

| Cash & Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawals | N/A |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | Available |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |