The Great Eastern Pay Assure is a disability income policy focusing on providing you with financial support in case of disability.

Its purpose is to offer monthly income if you, as the insured, can’t work due to illness or injury, leading to a loss of income.

Here is our review of the Great Eastern Pay Assure.

My Review of the Great Eastern Pay Assure

Great Eastern Pay Assure is a reliable disability income insurance plan that provides a crucial safety net if you cannot work in your current occupation due to illness or injury, including mental conditions.

This insurance plan offers a monthly income benefit designed to help cover regular living expenses during challenging times.

What sets Pay Assure apart is its flexibility – you can customise the plan based on your needs and budget, with pre-benefit periods of 60, 90, or 180 days.

Additionally, you can receive the monthly benefit up to age 55, 60, or 65, providing a tailored approach to suit your unique circumstances.

In the event of illness or injury preventing you from continuing your current occupation, Great Eastern’s Pay Assure offers up to 75% of your average monthly salary during the coverage period.

Furthermore, if you can return to work in a reduced capacity, the policy pays a partial monthly benefit to supplement your income up to 85% of its original amount.

Pay Assure goes beyond income protection by offering a lump sum death benefit, providing financial security to your loved ones in the unfortunate event of your passing.

Additionally, the policy reimburses rehabilitation expenses, offering support of up to 3 times your monthly benefit to aid your recovery.

Overall, Great Eastern Pay Assure encompasses a comprehensive suite of features, addressing income protection, rehabilitation support, and a death benefit, ensuring peace of mind for you and your family.

However, it may not be the best fit for everyone, as different individuals have varying needs. What’s good for someone might not be good for you.

That’s why we always recommend getting a second opinion from an unbiased financial advisor to determine if the Great Eastern Pay Assure is the best disability income insurance policy for you.

If you’d like to get a second opinion, we partner with unbiased MAS-licensed financial advisors who are happy to assist you with this.

Click here for a free second opinion.

Now here’s more on the Great Eastern Pay Assure:

General Features

Policy Term

The policy term is

- Up to age 55, 60, or 65, or

- cessation of the disability, or

- death,

whichever is earlier.

Premium Payment Terms

The premium payment term aligns with the policy term, which is up to age 55, 60, or 65

Definitions

Okay before we continue breaking down the benefits offered, it’s important to understand the definitions of specific terms carefully, as this will impact your coverage.

Working Period

A Working Period is a continuous period of at least 30 days in which you are engaged in some form of work or occupation.

Non-Working Period

The Non-Working Period is a continuous period right after the Working Period or Period of Disability ends.

Working Disability

The Working Disability is defined as your inability to work due to any reason in your own occupation during the Working Period or the first 180 days of the Non-Working Period.

Non-Working Disability

The Non-Working Disability is your inability to work after the first 180 days of the Non-Working Period due to at least 2/6 Activities of Daily Living (ADLs).

Pre-Benefit Period

The Pre-Benefit Period is when you are disabled and before the benefits of the Great Eastern Pay Assure kick in.

This starts on the first day of the Working & Non-Working Disability.

You may select a Pre-Benefit Period of 60, 90, or 180 days.

Protection

Total Disability Benefit

The maximum payouts you’ll receive under this benefit will be 75% of your salary.

They will consider payouts from any other insurance policies (your own, company-issued, or government insurance policies), and any other income you’re earning before the disability.

This means that if you’re getting any other forms of income, Great Eastern will reduce this benefit so that you will receive up to 75% of your salary as total payments.

This benefit is also split into 2 – Total Working Disability Benefit and Total Non-Working Disability Benefit.

Total Working Disability Benefit

This benefit is payable if you meet the criteria for Working Disability and are not involved in any paying job.

Great Eastern will pay the Working Disability Amount at the end of each month during the period of Working Disability.

The Working Disability Amount is the monthly benefit you purchased on your policy.

This payout starts after the expiration of the Pre-Benefit Period (60 days, 90 days, or 180 days).

Total Non−Working Disability Benefit

If you are not working due to having a Non-Working Disability, Great Eastern will pay the Non-Working Disability Amount at the end of each month.

The Non-Working Disability Amount is determined as the lesser of these 2 options:

- Either 50% of the Working Disability Amount or,

- A fixed monthly payment of S$4,000.00.

Partial Disability Benefit

Like the Total Disability Benefit, this benefit will consider all forms of income you’re earning and pay you up to 85% of your salary.

This benefit consists of the Partial Working Disability Benefit and Partial Non-Working Disability Benefit.

Partial Working Disability Benefit

Suppose you experience a Partial Working Disability, meaning your Present Earnings are 85% or less of your Pre-Disability Earnings, at the end of each calendar month during the Working Disability period.

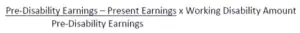

In that case, the disability amount paid is calculated as below:

Partial Non−Working Disability Benefit

Should you experience a Partial Non-Working Disability, where your Present Earnings are 85% or less than your Pre-Disability Earnings, the benefit amount at the end of each calendar month during the Non-Working Disability period will be as follows:

Rehabilitation Expenses Benefit

This reimbursement can be up to 3 times the Working Disability Amount and is offered during Total or Partial Disability.

However, to qualify, these Rehabilitation Expenses must be certified as necessary for rehabilitation by a physician.

It’s important to note that the reimbursement amount will be reduced by any funds received from other sources for the same rehabilitation purpose.

Waiver of premium

If the policyholder is currently receiving the disability benefit, any premium for this policy that becomes due during that time will be waived.

However, if the premium is scheduled during the Pre-Benefit Period, you will need to pay the premium in full.

Death Benefit

Upon the unfortunate death of the life assured, a Death Benefit equal to 6 times the Working Disability Amount will be paid.

How Pay Assure Works

Peter, a 35-year-old salesperson who earns $6,000 per month, purchases the Great Eastern Pay Assure.

There is a pre-benefit period of 90 days, during which he needs to wait before receiving benefits.

At age 40, Peter loses his job due to a spinal disorder, preventing him from performing outdoor sales tasks.

He starts receiving $4,000 as his monthly benefit, supporting him during his period of disability until he reaches the age of 60.

Peter is also eligible for up to $12,000 in reimbursement for rehabilitation expenses.

After the pre-benefit period, any premium for the policy that falls due while Peter receives the disability benefit is waived.

After 2 years, Peter secures a new role as an indoor telemarketer, earning an average income of $3,000 a month.

As his income is now reduced, he receives $2,000 monthly as a supplement through the Partial Disability Benefit.

Summary of Great Eastern Pay Assure

| Cash & Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawals | No |

| Health & Insurance Coverage | |

| Death | Yes |

| TPD | Yes |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |