The Great Eastern Essential Protector is a personal accident plan that offers coverage for injuries resulting from accidents.

Oh, make sure not to be confused with the Great Eastern Essential Protector Plus – the enhanced version of this plan.

In this review, we will dive into the key features and benefits of the Great Eastern Essential Protector to help you make an informed decision.

Read on.

My Review of Great Eastern Essential Protector

The Great Eastern Essential Protector is a simple personal accident plan that covers accidental death and disablement.

If you experience permanent disablement due to an accident, the Great Eastern Essential Protector provides a lump sum payout to your loved ones.

The payout is 2X your sum assured for accidents involving public conveyance or private motor cars and 3X your sum assured for air travel accidents.

In the worst-case scenario, if the insured passes away due to an accident, the death benefit under the Essential Protector policy offers different payout multiples based on the type of accident.

This provides financial support to your beneficiaries in the unfortunate event of accidental death, with the payout amount adjusted according to the circumstances of the accident.

The policy extends free coverage for Accidental Permanent Disablement to all your children below the age of 16 as long as the Great Eastern Essential Protector covers you and/or your spouse.

This means your children are also protected against accidental injuries.

Finally, signing up for the Great Eastern Essential Protector is hassle-free.

If you’re between 17 and 65 and don’t have mobility problems or physical disabilities, you’re guaranteed to be accepted into the plan without needing a medical check-up.

It’s important to note that personal insurance preferences and needs may vary from individual to individual.

While the Great Eastern Essential Protector may suit some, some may have better options.

I suggest reading our post on Singapore’s best personal accident plan to understand your other options.

Once you understand your available options, you should get a second opinion and explore other alternatives by speaking with an unbiased financial advisor.

Criteria

- Renewable annually

- Entry Age: 17 – 65 years

General Features

Premium Payment Terms

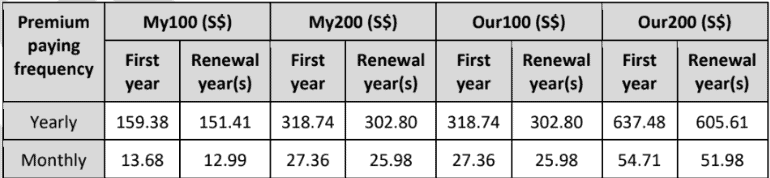

Depending on the plan you choose, the premiums for the Great Eastern Essential Protector will differ.

Below are the premiums for the different plans, payable monthly or yearly:

It’s important to note that the Great Eastern Essential Protector is not approved for MediSave use.

Also, the amount you pay for the insurance might change when it’s time to renew your policy. However, in case of changes, you will be notified at least 30 days before your policy renewal.

Policy Term

The Great Eastern Essential Protector is a yearly renewable plan – which means that every year, you will need to renew your policy.

You may renew this until you reach the age of 75.

Protection

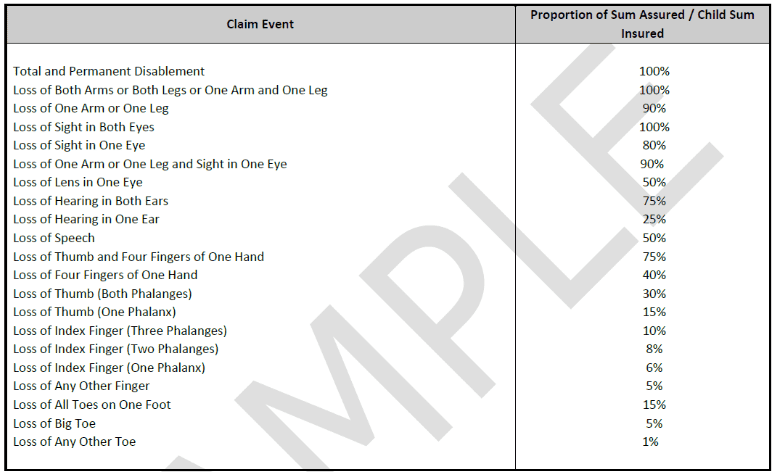

Under this policy, the policy provides benefits if the insured person experiences an injury due to an accident and it leads to any of the claimable events listed below within 365 days of the accident.

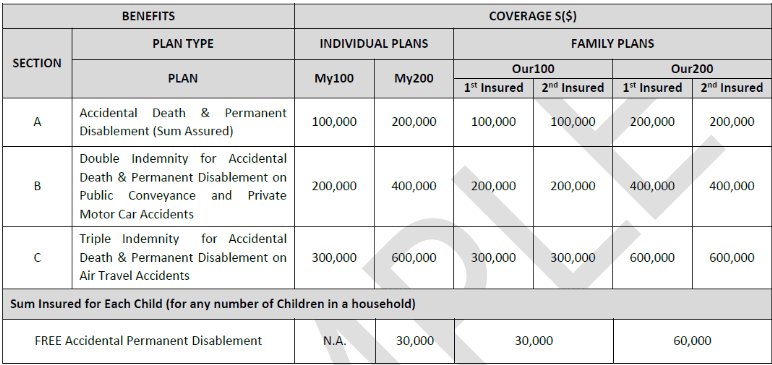

The policy has individual plans and family plan categories to choose from depending on your needs and choice.

Below are the sums assured for the different plans:

Death Benefit

Motor-Cycling Accidents Or All Other Covered Accidents

The policy pays the Sum Assured minus any benefits previously paid for permanent disablement resulting from the same accident.

However, it excludes death from public conveyance, private motor cars, and air travel accidents.

Public Conveyance Or Private Motor Car Accident

In the case of accidents involving public conveyance (e.g., buses or trains) or private motor cars, the payout is double the sum assured minus any benefits previously paid for permanent disablement from the same accident.

This excludes death from motorcycling accidents.

Air Travel Accidents

For accidents that occur during air travel, the policy provides a benefit triple the sum assured, minus any benefits paid for permanent disablement resulting from the same accident.

Permanent Disablement Benefit

Public Conveyance Or Private Motor Car Accident

In cases of permanent disablement resulting from accidents involving public conveyance (e.g., buses or trains) or private motor cars, the payout is double the proportion of the sum assured.

However, this excludes motorcycling accidents.

Additionally, in cases involving accidents related to public conveyance or private motor cars, the total benefits payable under death and permanent disablement benefits are limited to double the sum assured.

Motor-Cycling Accidents Or All Other Covered Accidents

For permanent disablement resulting from accidents other than public conveyance, private motor car, or air travel accidents, the payout benefit is equal to the proportion of the sum assured.

The total benefits payable for death and permanent disablement related to public conveyance or private motor cars shall not exceed the sum assured.

This criterion does not include public conveyance, private motor cars, and air travel accidents.

Air Travel Accidents

In the event of permanent disablement due to air travel accidents, the benefit is triple the proportion of the sum assured.

Summary Table of Compensation:

Free Child Cover

The Free Child Cover is an added benefit of the Great Eastern Essential Protector.

It provides coverage for your children if they suffer an injury due to an accident resulting in permanent disablement.

The policy will pay out a proportion of the child’s sum insured as specified in the Table of Compensation above.

This benefit is applicable if you and your child are insured under the My200 option of this policy.

Alternatively, they may also receive coverage if you are insured under either the Our100 or Our200 options of this policy.

THe doubling and tripling effect will not be applied under the Free Child Cover.

Terrorist Activities

In the unfortunate event that you or your child covered under the Free Child Cover benefit suffers a claim event as a result of a terrorist attack, the total benefits payable for that event are capped at $2,000,000 under this policy and all personal accident policies and riders associated with the same life assured.

Summary of the Great Eastern Essential Protector

| Cash & Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawals | N/A |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | Available |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |