Great Eastern’s Essential Protector Plus is a yearly renewable personal accident plan that is dedicated to your accident protection.

Not to be confused with the Great Eastern Essential Protector, the basic but still comprehensive version of this policy.

This plan covers accidental death, serious injuries, medical bills for fractures, dislocations, and burns, and offers support during hospitalisation, including aid for mobility devices.

This review delves into the complete coverage of Great Eastern’s Essential Protector Plus to help you decide if it aligns with your protection and financial objectives.

Keep reading.

My Review of the Great Eastern Essential Protector Plus

The Great Eastern Essential Protector Plus is a pretty comprehensive personal accidental plan offering you coverage for death, disabilities, and medical expenses reimbursement due to accidents.

Women will get an exclusive 20% boost in coverage in specific areas (girl power!).

Whether at home or abroad, this plan covers medical expenses after accidents, even doubling the amount for overseas treatment.

Eligibility is simple: ages 17 to 65, good health, no mobility issues, or physical disabilities – no tedious paperwork.

In summary, the Great Eastern Essential Protector Plus is a simple, fuss-free personal accident plan that offers a comprehensive, flexible, and convenient insurance solution with a global reach, ensuring you and your family are well-protected in various situations.

However, not everyone will have the same experiences or will find that the Great Eastern Essential Protector Plus is the best for them.

There are also more personal accident insurance options that might be better for you.

As different individuals have varying needs, a policy that’s good for someone might not be good for you.

For a personal accident policy, it’s essential to choose a plan that’s suited to the lifestyle that you’re living so that you’re protected against any scenarios that you’re likely to encounter.

We suggest getting a second opinion from experienced and unbiased financial advisors to see if Great Eastern’s Essential Protector Plus is the best fit for you.

We partner with MAS-licensed financial advisors who have helped hundreds of our readers in similar situations as you.

If this interests you, we can connect you to them free of charge!

Click here for a free second opinion.

Criteria

- Renewable annually

- The person covered by the policy must be below 75 years old.

General Features

Premium Payment Terms

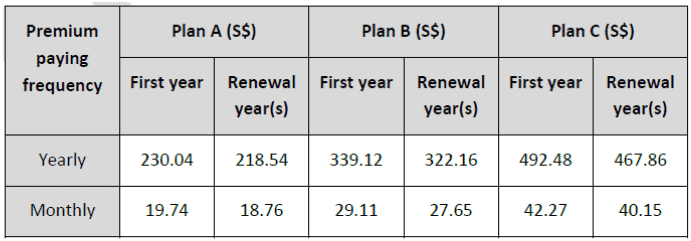

Below are the premiums for the different plans:

Notably, this policy cannot be paid for using MediSave.

Also, the amount you pay for the insurance might change when it’s time to renew your policy. However, in case of changes, you will be notified at least 30 days before your policy renewal.

Policy Plans

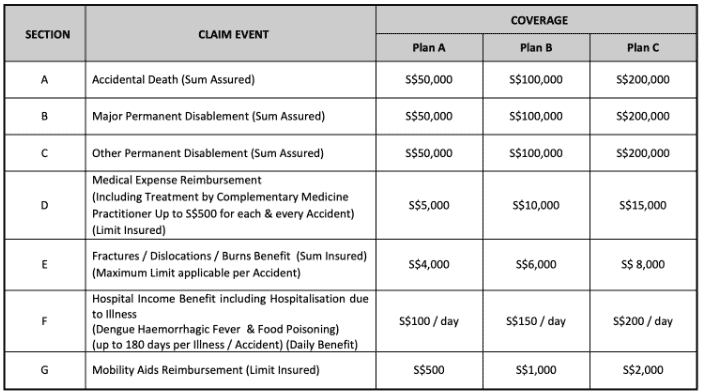

Depending on your plan of choice, here are the sums assured under the 3 plans for different claim events.

Accidental Death Benefit

In the unfortunate event of the insured’s death due to the accident, the sum assured will be paid as a lump sum.

However, it’s important to note that any payouts made for Permanent Disablement and Other Permanent Disablement benefits from the same accident will be deducted from this sum.

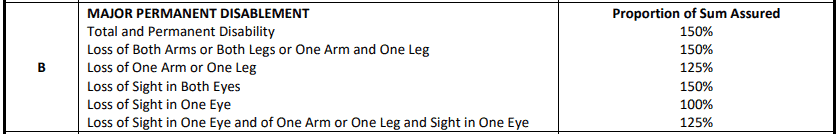

Major Permanent Disablement Benefit

Suppose the insured is involved in an accident that leads to a serious, long-term disability, such as losing a limb or having a condition that affects them for the rest of their life.

This plan provides compensation to help with the financial challenges that come with this disability.

However, if the same accident also caused other disabilities, the benefit is reduced to take into account the benefits paid for those.

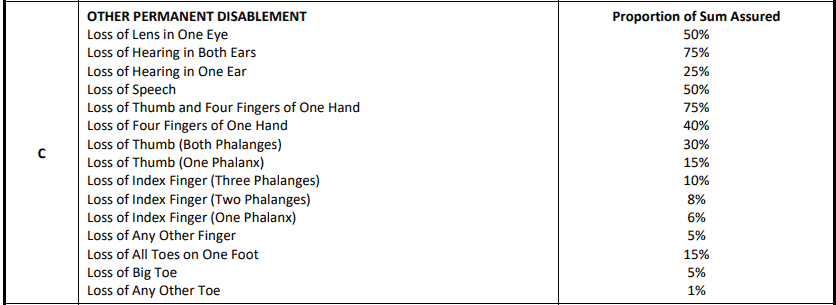

Other Permanent Disablement Benefit

If the accident is not as severe, however, it still causes a lasting disability that affects the person insured’s life, you will also receive assistance under this benefit.

To avoid overcompensating for multiple disabilities from the same accident, a proportion of the sum assured is used to determine how much to pay for each type of disability.

Hence, you won’t get more than 150% of the total sum assured you have for all the disabilities combined, including accidental death, major permanent disablement, and other permanent disablement.

Key Features

Medical Expense Reimbursement

![]()

If you must pay for medical treatments because of an accident within a year, the Great Eastern Essential Protector Plus will help cover those costs.

This also includes treatments by certain Complementary Medicine Practitioners, but only up to $500 for each accident.

These are either traditional Chinese medicine practitioners registered with the Ministry of Health in Singapore or a chiropractor with the right qualifications and registered with a recognised chiropractic organisation.

Now, if the accident happens when you are outside Singapore and you get your first treatment in that country, the insurance will double the amount it covers.

This extra coverage also applies to any follow-up treatments related to the same accident.

However, this extra coverage doesn’t work for treatments by Complementary Medicine Practitioners.

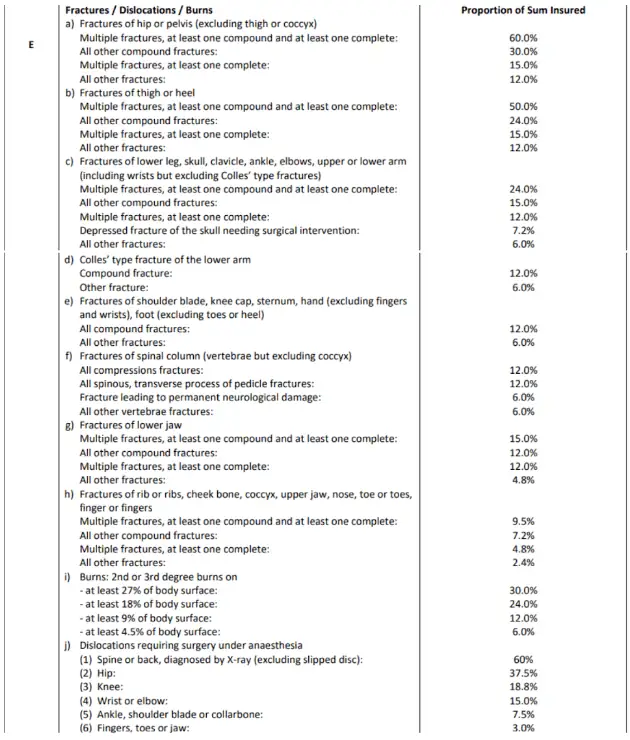

Fractures/Dislocations/Burns Benefit

This benefit will be given if you have injuries like fractures, dislocations, or burns due to an accident.

This benefit only applies if the injury occurs within 90 days of the accident.

Also, Great Eastern will pay for any number of injuries from an accident, but it won’t give more than the sum assured mentioned in the policy for each type of injury:

Hospital Income Benefit

![]()

As a result of an accident or illness such as dengue fever or food poisoning, this benefit can be helpful if you have to stay in the hospital.

For each accident or illness, the policy pays a daily amount for each day you’re hospitalised for a maximum of 180 days.

Please note that there is a waiting period, which means you won’t get this daily benefit for the first 30 days after starting or renewing the insurance.

Additionally, you must be in the hospital for at least 12 hours to get this benefit.

Mobility Aids Reimbursement

![]()

This insurance benefit helps cover the cost of equipment that you move around if you’ve been hurt in an accident.

This equipment could include things like crutches, wheelchairs, or artificial legs.

If a doctor says the mobility aids are medically necessary, insurance will cover the rental or purchase.

Under this policy or any other policies that offer similar benefits, the insurance will only pay for one artificial leg during the person’s lifetime.

Female Extra Coverage

If you’re a female, you will get a little extra protection. The policy will increase the amount of money you get if you have an accident or disability by 20%.

This applies to benefits like accidental death, permanent disability, and other disabilities, as well as any limits on these benefits.

Terrorist Activities

In case the person covered by the policy is affected by a terrorist attack, the total amount they can claim on all events suffered is capped at $2,000,000.

This applies to this policy and any other personal accident policies they have with Great Eastern and connected to the same person.

Summary of the Essential Protector Plus

| Cash & Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawals | N/A |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | Available |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |