Embarking on the journey of personal finance in Singapore can often feel like navigating through a dense jungle, with a myriad of options and paths to choose from.

But fret not, because I’ve ventured through this jungle myself, and I’m here to guide you with a map that lights the way.

In this post, you’ll discover:

- The top personal finance blogs in Singapore that cater to a wide array of financial interests and needs.

- Insightful analysis and in-depth reviews to inform your financial decisions.

- A variety of perspectives that enrich your understanding of investments, savings, and budgeting.

Armed with this knowledge, you’ll not only avoid the pitfalls that many fall into but also carve out a path to financial freedom and success.

So if you’re eager to take control of your financial destiny in the Lion City, read on and join me on this enlightening journey.

Disclaimer: The sequence of the blogs is not indicative of any hierarchical ranking.

#1: Dollar Bureau

Best for: Those who are looking for credible, comprehensive, and accurate personal finance guides

Launched in 2019, Dollar Bureau is dedicated to enhancing the financial literacy of Singaporeans. We specialise in areas like insurance, financial planning, and also investment strategies for everyone.

Our mission stems from a genuine concern for those who have fallen victim to financial missteps, such as being misled or overcharged by investment and insurance plans.

And because we are led by a group of everyday Singaporeans, we share a commonality with most average Singaporeans (like you and me!) who are not enveloped in the financial world but eager for clarity.

We recognise that there is a myriad of financial knowledge online, which can often be lacking in transparency. Thus, the Dollar Bureau team (which includes me) ensures that each article is carefully written and edited, and reviews of financial products are reliable and impartial as well.

Besides our blog, Dollar Bureau has also established a Telegram channel – giving you the latest articles and financial updates – which has garnered over 1,000 subscribers to date!

#2: DollarsAndSense

Best for: Those who are interested in personal finance

DollarsAndSense serves as a dedicated personal finance guide, providing concise and insightful bite-sized content that covers a wide spectrum of topics including insurance, investing, property, CPF, credit cards, savings, and more.

Besides the blog, they also have a YouTube channel that shares meaningful insights and perspectives of financial-affluent individuals and influential people in Singapore.

#3: MileLion

Best for: Those who are looking for credit card travel hacks

Want to learn how you can unlock the best travel deals? The MileLion is a premier Singapore-centric travel hack resource that offers comprehensive guides on how to travel better for less.

With a focus on diverse facets such as miles, credit card rewards, airline, and hotel loyalty programs, MileLion is committed to sharing knowledge and strategies that empower individuals to elevate their travel experiences without compromising on financial resources.

#4: MoneySmart

Best for: Those looking for the best credit cards for various purposes

MoneySmart is a personal finance platform that facilitates easy and secure comparisons of the best financial products available on the market.

They’re also best known for their credit card comparisons, regardless of whether you’re looking for credit cards in aspects like travel, cashback, shopping, entertainment or overseas spending. You can also apply directly to these credit cards via MoneySmart.

MoneySmart also has an exclusive membership program so that you can get personalised financial product recommendations, high cashback rates, unlimited blog access, earn exclusive reward points to exchange for attractive products or e-vouchers.

#5: Money Sense

Best for: Those looking to strengthen their financial literacy

Established in 2003, MoneySense is Singapore’s national financial education programme. Its overarching aim is to help Singaporeans proficiently manage their money and make sound financial decisions on their own.

They offer a multitude of resources, such as financial literacy quizzes, infographics, guides, and articles that Singaporeans can use to strengthen their financial literacy and demystify complicated financial jargon.

#6: The New Savvy

Best for: Women who are interested in personal finance and investing

The New Savvy is dedicated to promoting heightened awareness and cultivating healthier financial habits among women. Their overarching mission is to provide a platform that bridges the gap between modern women and finance.

Their content revolves around resources, events, 101 guides, and short guides that address topics like investments, property, career, budgeting, retirement, and more – all of which recognise the nuanced financial needs of women.

#7: Investment Moats

Best for: Budding and seasoned investors

Established in 2005, Investment Moats is a distinguished platform that follows the personal experiences of avid finance enthusiast Kyith Ng. He delves into topics such as wealth building, financial security, investing, long-term market trends, dividend income investing and more.

Best of all, Kytih Ng provides valuable insights by sharing his personal strategies, advice, and transparent disclosure of his current portfolio, catering to a diverse audience of novice and seasoned investors.

#8: Seedly

Best for: Those who wish to join communities of like-minded individuals interested in personal finance

Initially an expense-tracking app that helped users to synchronise their cash flow, Seedly has now become an established community-led personal finance brand for Singaporeans.

They are best known for producing in-house content, including thought leadership articles, SeedlyTV, and SeedlyComics, aimed at empowering Singaporeans to make informed personal finance decisions.

They also have a unique community forum feature which allows users to crowdsource knowledge from peers before making a financial decision. Some of these forums touch on a wide range of topics, such as investing, property, promo codes, adulting, and even cryptocurrency.

#9: The Singaporean Investor

Best for: New investors and traders who can learn from a seasoned expert

Lim Jun Yuan is the founder of The Singaporean Investor and has been a full-time retail investor and trader since 2017. Through his blog, he is dedicated to providing comprehensive insights into Singapore-listed companies, offering in-depth analyses derived from personal experiences and dabbles in the financial markets.

Beyond company analyses, he also shares valuable advice on investing and trading – aiming to empower new investors or traders seeking informed decision-making in their financial endeavours.

He also encourages his readers to explore his long-term portfolio, which reflects the culmination of his strategic investment approach and commitment to sustainable wealth creation.

#10: The Woke Salaryman

Best for: Those who are looking for easily digestible, bite-sized personal finance content

The Woke Salaryman (TWS) is a platform dedicated to delivering finance content through easily digestible comics and relatable Singaporean slang. Their mission is to educate those making less than $4,500 a month to have a healthy relationship with money and make wiser financial decisions.

Using humour and animated icons as personas for the average salary-making Singaporean, their content broaches on difficult topics, mostly on finances, other related topics and even useful life lessons.

Besides its blog, you can also find its content via various social media platforms such as Facebook and Instagram, as well as a YouTube channel and podcasts.

#11: ValueChampion

Best for: Those who are looking for financial product analyses

Value Champion is a finance blog headed by a team of financial research analysts who come from finance and economic backgrounds. They aim to provide information to help individuals make informed financial decisions.

Think of them as your personal financial analysts, as they provide in-depth reviews of credit cards, loans, bank accounts, insurance, and more. They also touch on other general topics, such as telco comparisons or the latest news and happenings in Singapore.

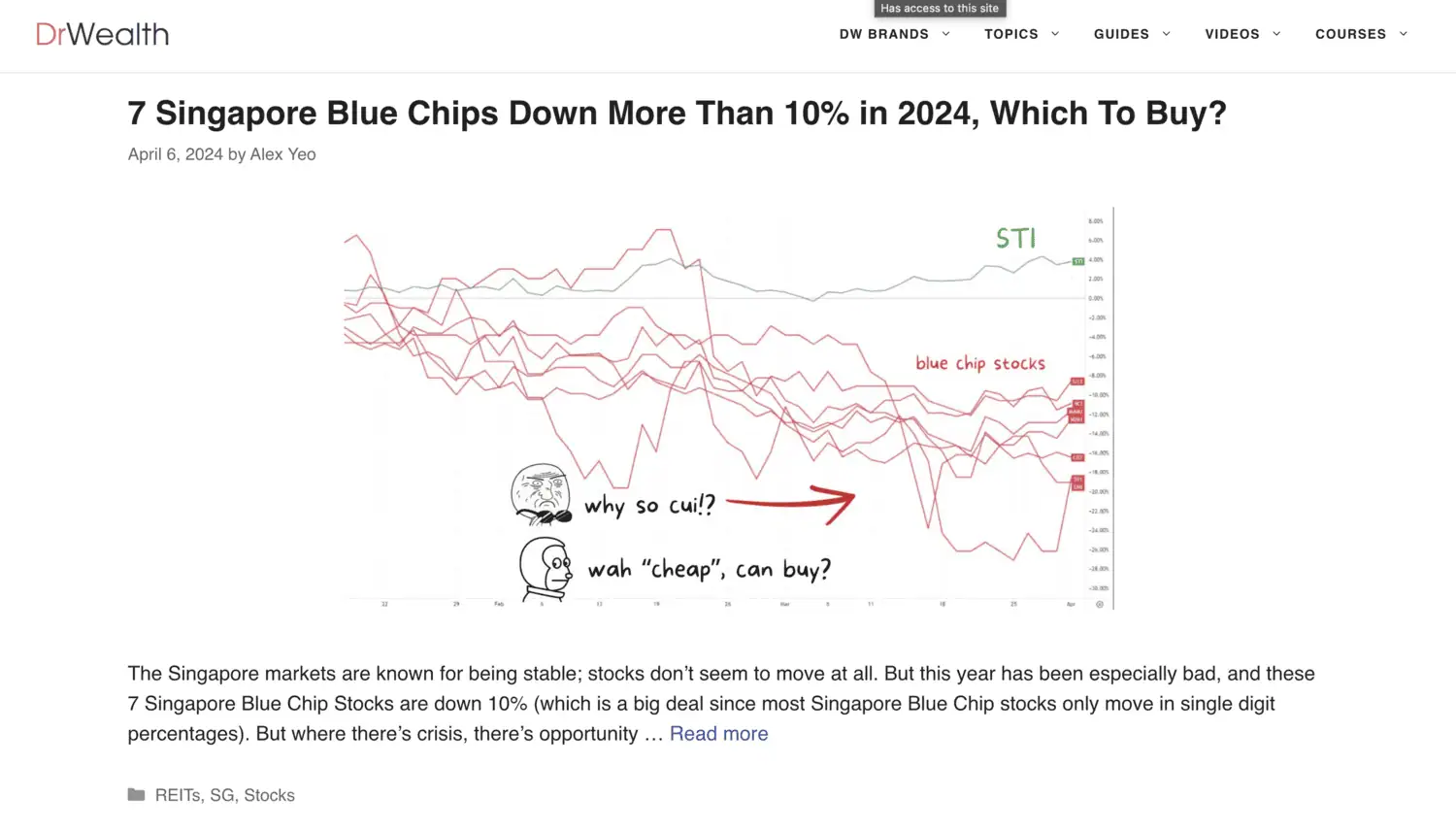

#12: Dr Wealth

Best for: Those who are looking for investing courses and workshops

Founded by Alvin Chow, an investor with over 14 years of experience, Dr. Wealth is dedicated to delivering esteemed financial education to individuals who wish to enhance their understanding of the financial landscape.

His blog mainly covers investor-centric guides, tips and tricks, and valuable insights for beginner investors to get them started on their journey. He also holds regular masterclasses and investment courses in Singapore, which impart meticulously researched and actionable investment methodologies to his students.

#13: The Unique Bunch (T.U.B) Investing

Best for: Those who want expert suggestions and guidance on where and when to invest, or in small-scale companies

T.U.B Investing offers comprehensive and carefully researched articles centred around investment opportunities and strategies for generating passive income.

Its primary objective is to elevate the well-being of its readers by providing expert recommendations and guidance on optimal investments and timing.

The founder of this blog is also a contrarian investor, and prides themselves in their focus on small cap companies rather than big tech firms, diverging from the conventional.

Because of that strategy, it allows for the identification and capitalisation of companies that possess substantial growth potential.

#14: The Asia Report

Best for: Those who are interested in investing insights, perspectives, and trends

The Asia Report was established by Richard, a former portfolio manager turned full-time investor.

In his blog, you can expect to gain original insights and analysis from an avid investor with over a decade of experience in successful investing across regions.

#15: Investment Stab

Best for: Those who are interested to learn more about personal finance, CPF, and retirement

Investment Slab is a student-led blog which distributes content about personal finance.

Like most finance blogs, they aim to break down complicated jargon, fine print, and information about personal finance on the internet that are too complicated for the average Singaporean.

Their main focus is on CPF matters (such as your SA and OA accounts), retirement, credit cards, and insurance.

#16: The Smart Investor SG

Best for: Those looking to brush up on their investing knowledge

The Smart Investor SG is a blog that was formed in late 2019 from the ashes of the late Motley Fool Singapore.

However, instead of focusing on Singaporean equities as they did before with Motley Fool, their focus has shifted to providing a more extensive range of general investment methods and ideas – making them a reliable source for investors.

As its name implies, this blog aims to educate Singaporeans on investing wisely by providing interesting articles on investing education, investing stab, stock commentary, and market coverage.

#17: TheFinance.sg

Best for: Those who want a consolidated platform of useful articles on personal finance and investments

TheFinance.SG is a finance aggregator blog and platform created by Derek, an IT engineer passionate about finance and investing. Think of TheFinance.SG as a curated library from which you can browse useful articles on personal finance.

It is also a great platform for like-minded people, be it first-time finance enthusiasts, seasoned traders, or even experienced investors. His blog also features content based on his own personal experiences, such as portfolio updates or even top-ups of his CPF accounts!

#18: SingSaver

Best for: Those looking for money-saving tips and information about financial products

SingSaver’s blog strives to enhance Singaporeans’ understanding of personal finance through accessible reads, tools, and money hacks. They’re also the largest one-stop finance platform that allows you to view financial products in great detail.

Just like MoneySmart, they’re also best known for their credit card comparisons, and in helping you find the best credit cards for your ever-changing needs. You can also get some of the best deals available as you apply directly to these credit cards via SingSaver.

#19: ShareInvestor

Best for: Those who want in-depth analyses of stocks

ShareInvestor is an online investment knowledge platform that provides financial news services for shares and stocks. You can get access to real-time stock quotes, stock charts, company fundamentals, company insights, financial results, and even market-moving financial news.

They have even shared some of the best-performing stocks for various time horizons, which is especially useful for both budding and seasoned investors.

#20: Financial Horse

Best for: Those looking for reviews and news on financial investments, specifically REITs, shares, fixed income, and macro-economic trends

All content presented on Financial Horse is derived from firsthand experience, reflecting a steadfast commitment to endorsing quality financial products.

The portfolio managed by Financial Horse encompasses diverse asset classes, including equities in the United States, China/Hong Kong, and Singapore, S-REITs, CPF, as well as an emergency fund strategically allocated across savings accounts and bonds.

Financial Horse has maintained a prominent position among Singapore’s foremost finance and investment bloggers, a testament to the platform’s unwavering dedication to providing valuable insights. In recognition of its excellence, Financial Horse was also bestowed with the prestigious accolade of SGX’s Best Digital Platform/Go-to Site in 2021.

#21: The Simple Sum

Best for: Those who are looking for easily digestible, bite-sized personal finance content

The Simple Sum was established in Singapore with the primary objective of empowering young adults, like millennials and Gen Zs to navigate their personal finances adeptly.

They do so by taking a tongue-in-cheek approach, complemented by practical tips disseminated through various mediums, including bite-sized articles, comics, podcasts, and videos.

#22: The Fifth Person

Best for: Those looking for sound investment knowledge

Managed by a team of 6 (funnily enough, not 5), The Fifth Person is a platform that aims to provide Singaporeans with sound investment knowledge, financial literacy tips, and intelligent money habits.

As investors themselves, they are fully transparent with some of the winning stock investments that they have made – and also their losses. Each of these investments also comes with its own respective analyses which can serve as a great reference to other investors.

They have also been featured in the media, including Channel NewsAsia, The Business Times, AsiaOne, Business Insider, NewsLoop, and on national radio on Money FM 89.3 and 938LIVE.

#23: Heartland Boy

Best for: Those who resonate with an individual’s personal finance experiences

As the name suggests, Heartlandboy.com follows the compelling journey of a true-blue heartlander from Singapore striving towards financial independence.

With a fervent ambition to achieve financial freedom before the age of 40, the blog’s creator is committed to providing a transparent narrative and insightful guidance, aiming to secure the option of retiring on one’s own terms rather than succumbing to premature societal expectations.

As such, his blog mainly documents his analyses on stocks, REITs, property for investment, banking and insurance, and all things that are value for money.

#24: Stacked Homes

Best for: Those looking for property advice and knowledge

Whether you’re looking for inspiration for your new home, aesthetic home layouts, property tours, or information on new property launches, Stacked Homes is the one-stop platform for you to source all that.

They’re all about making life easier for folks in Singapore looking to buy, sell, or rent homes. They keep things real by consistently researching and sharing what they find in the property landscape to help you make smarter decisions. This information comes in the form of user-friendly guides, articles, and beautiful imagery!

Since their articles are written in-house, and they don’t receive any sponsorship deals, their info is unbiased and trustworthy that you can rely on.

#25: The Financial Coconut

Best for: Those who prefer an alternative way of picking up financial literacy

If you’re someone who loves listening to podcasts to learn instead of reading, this channel might just be for you. Founded by Reginald Koh, The Financial Coconut is Singapore’s First Financial Literacy Podcast Network.

Its podcasts (which also translate to the articles on its website) focus on debunking financial myths, discovering the best financial practices, and discussing financial strategies that will fit one’s unique life.

Some of the influential topics that they cover include budgeting, investing, retirement planning, career trajectory, e-commerce, and even franchising!

Conclusion

In wrapping up our journey through the vibrant landscape of personal finance blogs in Singapore, it’s evident that whether you’re a seasoned investor, a savvy saver, or just starting to dip your toes into the world of finance, there’s a wealth of knowledge and resources waiting for you.

From the comprehensive, down-to-earth content from Dollar Bureau, all the way to the innovative financial literacy platforms like The Financial Coconut, each blog brings a unique flavour and perspective to help you navigate your financial journey.

We’ve explored a variety of topics, from investment strategies and financial planning to budgeting hacks and property advice, all tailored to the diverse needs and interests of Singaporeans.

Remember, the sequence here isn’t a ranking but a showcase of the rich diversity and expertise available at your fingertips.

So, dive in, explore these resources, and arm yourself with the knowledge to make informed financial decisions!