The AIA Platinum Legacy (IX) is a single-premium traditional universal life plan that offers insurance protection while investing part of your premiums into a non-participating fund.

It comprises guaranteed and non-guaranteed returns – similar to a whole life plan.

This review explores AIA Platinum Legacy Platinum (IX) to help you decide if it’s the right policy for you.

Keep reading to find out more!

My Review of the AIA Platinum Legacy (IX)

If you want to secure your family’s financial future and leave a lasting legacy, the AIA Platinum Legacy (IX) plan may be just what you need.

By investing in this policy, you can grow your wealth and create a customised legacy plan that empowers your children to build upon your success.

With this policy, you’ll have the peace of mind of knowing that your assets are being protected and nurtured for future generations.

In addition, it lets you take control of your insurance policy by adjusting your insured amount to fit your changing needs.

AIA Platinum Legacy (IX) gives you an extra month (31 days) to make a payment if you miss one. That’s a nice cushion to have, just in case life gets in the way.

The provision of quarterly statements is a great way to stay informed about your policy’s financial health and make sure it meets your needs.

But it’s not all perfect.

The 6% premium charge for this policy seems high compared to other policies, charging only 3%.

While acknowledging the multiple benefits this policy offers, this difference in pricing may not be favourable.

In addition, the policy does not offer TPD coverage or add-on riders, which are crucial for a more comprehensive protection plan.

We understand that selecting the right wealth protection and accumulation plan can be daunting, given the many options available.

While there may not be a perfect policy, there are objective methods to help facilitate your decision-making process.

Nonetheless, whether you should purchase the AIA Platinum Legacy (IX) depends on your own financial goals, risk tolerance, and budget.

If you’re focused on the long term and like the flexibility it offers, it’s worth considering.

However, if the high fees or the lack of certain coverages bother you, you might want to look at other options.

That said, we highly recommend seeking a second opinion from an unbiased financial advisor to help you determine if the AIA Platinum Legacy (IX) is the best for you or if potential alternatives might better fit.

Click here for a free non-obligatory second opinion.

Here’s more on what the AIA Platinum Legacy (IX) offers:

Criteria

- Currency: United States Dollar

- Minimum Coverage Amount: $500,000

General Benefits

Premium Payment Terms

As the AIA Platinum Legacy (IX) is a single premium policy, the premium payment term is just a one-time payment at the start of your policy.

Policy Terms

The AIA Platinum Legacy (IX) covers you for your whole life, but has a minimum premium requirement period of 8 years.

Protection

Death Benefit

The death benefit will be paid out if death occurs before the insured celebrates his or her 122nd birthday. This benefit will be the higher of:

- The insured value

- Accumulation value.

The death benefit will be paid after deducting any debts owed to the policy.

If death occurs on or after the insured celebrates the 122nd birthday, the death benefit will consist of accumulation value minus debts owed to the policy.

Please note that the insured amount is calculated by taking into account the following;

- Partial withdrawals

- Terminal illness benefit payment

- Reduction or increase in insured amount.

Terminal Illness (TI) Benefit

A TI benefit is paid if the insured is diagnosed with a terminal illness.

Notably, a terminal illness is an ailment that can lead to death within 12 months. The Terminal Illness Benefit payable equals the death benefit minus debts owed to the policy.

It is crucial to note that the policy is automatically terminated once the Terminal Illness Benefit is disbursed.

This means that no additional benefits or riders will be applicable thereafter.

If the insured amount minus policy debts is more than the TI benefit limit, the policy will pay the TI benefit limit.

Please note that the Terminal Illness Benefit is capped at US$2,000,000.

Key Features

Guaranteed Crediting Rate

As of 17 April 2023, the current crediting rate is 3.70%. AIA provides you with a guaranteed crediting rate of 3.70% for the first 3 years, which will then be 1.50% for subsequent years.

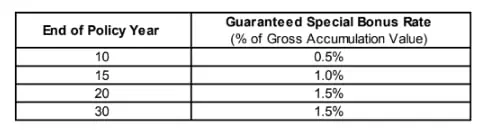

Guaranteed Special Bonus

While your AIA Platinum Legacy (IX) policy is still running, you will receive a special bonus with varying rates, as shown in the following table:

Premium Top-ups

After paying the initial single premium, you can do top-ups subject to meeting minimum premium limits.

Notably, the limit may depend on your smoker status, risk level, gender, country of residence and entry age.

However, you must consistently pay in the first 8 years.

Policy Surrender

Surrendering your policy is possible anytime, but remember that a surrender charge may apply. This charge is calculated based on each layer and added up for a total amount.

We’ll cover the exact charges later.

Once the charge is deducted, you will receive the cash surrender value equal to the accumulation value minus any indebtedness.

Remember that once you surrender your policy, it will be terminated.

This means that no additional benefits or riders will be applicable thereafter.

Partial Withdrawal

After your first year, you can request a partial withdrawal. Just be aware there may be charges.

However, a unique feature kicks in from the 11th policy year — each year, you can make a free partial withdrawal of up to 4.5% of your accumulation value, provided that you don’t carry over any unused limit to the following year.

Keep in mind that making a partial withdrawal will reduce your cash and accumulation value as well as your insured amount.

It’s important to note that the policy reserves the right to terminate or suspend this at anytime.

Adjusting Your Insured Amount

This policy allows you to adjust your insured amount up or down at any time after the first year, pending approval.

If you wish to increase your coverage, you’ll need to provide evidence of insurability, and the increased amount must be no less than U$100,000.

Every increase will generate a new layer with fees calculated according to the effective date.

In the event that you want to reduce your coverage, the policy will first decrease the first layer by the specified amount and then follow the same process for any additional layers in order.

Nevertheless, it’s worth noting that your insured amount can’t drop below U$500,000, and partial withdrawal charges may apply to each layer, lowering your accumulation value.

Change of Insured

If you are considering changing the Insured on your policy, you can submit a written request after your policy has been active for one year.

If you’re an individual, you can only make a change during the policy period.

If you’re an Entity, you can make multiple changes.

There are some things you should keep in mind:

- First of all, the policy will assess the new Insured’s insurability and acceptance requirements before approving the change. An administration fee will also be applied based on the new Insured’s age and smoking status.

- Secondly, Insurance Risk Charge (IRC) rates for the new Insured depend on various factors such as their gender, attained age, country of residence, smoker status, and rating classes. Fortunately, the rates won’t exceed the maximum IRC rate for Standard Lives.

- While partial withdrawal and surrender charges will be based on the first Insured, they are subject to change.

- Once the change of Insured is made, the periods indicated under suicide and incontestability provisions will begin.

Policy Loan

If your life insurance policy has a cash surrender value, you may be eligible to apply for a loan after the first year.

The loan amount will be approved based on your policy’s cash value, and the policy won’t approve more than 80% of that value.

However, please note that there is a minimum borrowing amount of $1,000.

AIA will determine the interest rate for the loan.

31-day Grace Period

With this policy, you can rest assured that your policy will stay active even if any of the following events occur:

- Insufficient accumulation value to cover monthly charges after 5 policy years

- Not enough cash surrender value to pay monthly charges after 5 policy years

- The outstanding loan and interest exceed the accumulation value during the initial 5 policy years

- The outstanding loan and interest exceed cash value after the first 5 policy years

- The minimum premium isn’t met at the end of each policy year within the first 8 policy years

You will receive a notification at least 14 days beforehand and be informed of how much premium is necessary to maintain your coverage.

Quarterly Statements

As part of your insurance policy, you’ll receive a Quarterly Statement every 3 months from the start date.

This statement provides you with a detailed report on the performance of your policy, including premiums received, charges deducted, and interest credited since the previous statement.

AIA Platinum Legacy (IX) Fees and Charges

The following fees are applicable for your AIA Platinum Legacy (IX) plan;

Premium Charge

A 6% premium charge will be added to all premiums received before they are allocated to the accumulation value.

This charge applies to both your initial premium and any additional premiums.

Administration Charge

With the AIA Platinum Legacy plan (IX), you will need to pay an administration charge for the first layer of your policy and subsequent layers created for increases in your insured amount.

This charge will be deducted from your accumulation value each month for 10 years starting from the effective date of each layer.

The administration charge rates for the first and subsequent layers are based on your age and smoking status at the policy date at the effective date of each layer.

Insurance Risk Charge (IRC)

With this policy, you’ll notice a monthly deduction from your accumulation value due to the IRC.

This rate depends on your gender, age, location, smoking habits, and rating at the policy date.

It’s applied to the sum at risk on the issue date and every monthly deduction day.

Your current insured amount without indebtedness is deducted from the accumulation value (post-administration charge and pre-IRC deduction) to calculate the sum at risk.

On or after your 122nd birthday’s policy anniversary, the sum at risk becomes zero.

The IRC rates are guaranteed for the first 5 years of your policy, but they are non-guaranteed thereafter.

The current IRC rates for standard life are listed in the policy illustration and won’t exceed the maximum limits shown.

If you have a non-standard life, you’ll be charged higher IRC rates and maximum limits, which will be included in a separate endorsement.

Partial Withdrawal and Surrender Charge

When it comes to making changes or ending your policy, there are a few things to keep in mind.

Firstly, a partial withdrawal or full surrender will result in a deduction from the accumulation value of your policy.

Additionally, if you choose to reduce your current insured amount or fail to pay your premiums before the grace period expires, a withdrawal/surrender charge will apply.

Simply put, your policy will have less value accumulated.

Bear in mind that the exact charge will vary depending on your gender, country of residence, smoker status, class of risk, and attained age.

This rate will also be affected by the number of years since the effective date of the layer from which you’re withdrawing.

It’s worth noting that this charge will be applicable during the first 15 years from the effective date of each layer.

Additionally, partial withdrawals from the eleventh year may be exempted from charges if you meet certain requirements.

For a partial withdrawal to be allowed, the following conditions must be met:

- The amount should be more than US$1,000

- Shouldn’t involve premiums received less than a year from the date of the withdrawal.

- Your sum assured should be reduced to less than US$500,000.

- After deducting the charges, the balance of your cash surrender value should be sufficient to cover the following month’s charges.

- The initial 8 policy years shouldn’t result in your inability to cover your minimum premium requirement at the conclusion of a policy year when the withdrawal is made.

- The current insured amount shouldn’t be below $500,000 after a terminal illness claim.

Illustration of How AIA Platinum Legacy (IX) Works

Meet James, a 50-year-old with a staggering net worth of $23 million. His wealth is a result of multiple assets, including a prosperous family business, valuable properties, and other investments.

The following table shows his wealth distribution:

| Type of Portfolio | Value |

| Cash | $5 million |

| Investments | $4 million |

| Properties | $8 million |

| Family Business | $6 million |

| Total | $23 million |

Looking to secure his financial future and protect against life’s uncertainties, James has invested in an AIA Platinum Legacy (IX) plan.

By paying a single premium of $3 million, he can enjoy coverage of up to $10 million for his entire lifetime.

James’ Wealth Distribution With AIA Platinum Legacy (IX)

The following table shows his wealth distribution:

| Type of Portfolio | Value | ||||

| AIA Platinum Legacy (IX) | $10 million | ||||

| Cash | $2 million | ||||

| Investments | $4 million | ||||

| Properties | $8 million | ||||

| Family Business | $6 million | ||||

| Total | $30 million | ||||

| Child 1 | Child 2 | Child 3 | |||

| $10million | $10 million | $10 million | |||

| Leaves a legacy for his children | |||||

James made a wise decision by investing $3 million in AIA Platinum Legacy (IX). This move has increased his total wealth by 30%, bringing it up to an impressive $30 million.

AIA Platinum Legacy (IX) is an excellent universal life plan that not only diversifies and stabilises existing investment portfolios, but also offers immediate liquidity.

This means that James can access his funds whenever he needs them, providing him with financial flexibility and peace of mind.

Summary of the AIA Platinum Legacy (IX)

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawal | Available |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | N/A |

| Terminal Illness | Available |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |