AIA Platinum Heritage Wealth (II) is a whole life insurance policy available in US dollars.

This policy offers financial protection up to the age of 100 and is designed for wealth accumulation.

Below is our complete AIA Platinum Heritage Wealth (II) review to help you decide if it’s the right policy to meet your needs.

Read on!

Criteria

- Entry age: 0 to 70 years

- Minimum Sum Assured: starts from S$500,000

- Life assurance: up to 100 years

General Features

Firstly, the AIA Platinum Heritage Wealth (II) is broken down into 2 parts – AIA Platinum Heritage Wealth (II) Accumulator and AIA Platinum Heritage Wealth (II) Assurance.

According to AIA,

“AIA Platinum Heritage Wealth (II) Accumulator is designed for wealth accumulation and provides insurance protection up to age 100.”

And

“AIA Platinum Heritage Wealth (II) Assurance is designed to provide maximum insurance protection at inception with decreasing Insured Amount throughout the term till Insured’s age 85”

The AIA Platinum Heritage Wealth (II) Assurance is a compulsory benefit to the AIA Platinum Heritage Wealth (II) Accumulator.

For simplicity, we will lump them together in our review here, and will only make distinctions when it’s needed.

Premium Payment Term

The AIA Platinum Heritage Wealth (II) comes with 2 ways to pay your premiums – a single premium or a 5-year premium payment term.

Protection

Death Benefit

If the unfortunate event of death occurs, the beneficiaries of the insured person will receive the higher of the following:

- The Minimum Death Benefit minus the Insured Amount of their AIA Platinum Heritage Wealth (II) Assurance, if any; or;

- The Insured Amount of their AIA Platinum Heritage Wealth (II) Accumulator, including any bonuses.

After any outstanding debts are settled, the beneficiaries will receive the Actual Death Benefit, which is the higher amount between the total death benefit and the total surrender value.

The policy will automatically terminate upon the policyholder’s death.

It’s important to note that the Minimum Death Benefit will decrease following the policy anniversary on or immediately after your 85th birthday.

This will depend on your policy, so check your policy documents or with your financial advisor for this amount.

Terminal Illness Benefit

In case of a terminal illness diagnosis, this policy will pay out a percentage of the death benefit, minus any amounts owed.

The acceleration percentage paid out will either be 100%, or the maximum terminal illness claim limit divided by the actual death benefit, whichever is lower.

This benefit will be combined with payouts from other policies issued by the same insurer on the insured’s life up to a maximum claim limit of $2,000,000.

Upon receiving a payout, the insured amount will be reduced to the residual percentage of the original amount, and any future benefits will be calculated based on the reduced amount.

Accidental Death Benefit

If an accidental death occurs before the 85th policy anniversary, an extra 25% of the Minimum Death Benefit will be paid alongside the Death Benefit.

There is a maximum of $2 million payable under all Platinum Heritage Wealth (II) policies issued for the same insured.

Key Features

Quit Smoking Benefit

If you successfully transition from a “smoker” to a “non-smoker”, you may be eligible for a Quit Smoking Benefit!

AIA will pay 5% of your AIA Platinum Heritage Wealth (II) premiums.

To qualify for this benefit, you must meet the following conditions:

- Have held “smoker” status from the policy’s issue date and have had the policy in force for at least 1 year from the same date.

- Applied to update and change your smoking status in AIA’s records

- Provide satisfactory evidence of your ‘’non-smoking” status for at least 12 months before submitting the form. This includes a urine cotinine test conducted by an appropriate physician registered with the local authority.

- Provide any other necessary documents or evidence to substantiate your “non-smoking” status as required.

Please note that this benefit can only be claimed once and is subject to the insurer’s discretion.

Maturity Benefit

The benefit will be paid out to you upon maturity of your AIA Platinum Heritage Wealth policy, subtracting any outstanding amounts owed to AIA.

Policies are considered mature and terminated once you reach 100 years old.

Bonuses

Reversionary Bonus (RB)

The Reversionary Bonus (RB) is a non-guaranteed bonus that may be credited to your policy on an annual basis.

Its rate for this bonus depends on the participating fund’s previous and expected investment returns.

Terminal Bonus (TB)

The Terminal Bonus is a non-guaranteed bonus that you may receive when making a claim, surrendering your policy, or when it matures.

The bonus is calculated as a percentage of the accumulated Reversionary Bonuses on the policy.

Similar to the RB, the rate depends on the performance of the participating fund.

AIA Platinum Heritage Wealth (II) Fund Performance

Asset Allocation

Usually, the premiums from your participating policy are invested in a variety of assets that align with the participating fund’s investment objectives.

As of 31 December 2021, the current investment mix and target mix are as stated below:

| Type of Investment | Allocation Goals “%” | Investment “%” |

| Bonds | 78 | 78 |

| Risky Assets | 22 | 22 |

| Total | 100 | 22 |

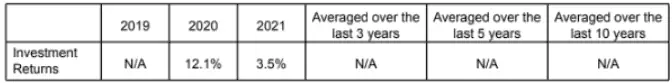

Investment Rate of Return

The table below illustrates the past investment rates of return (after deducting investment expenses only) for the Participating Fund:

This is probably a new participating fund, thus, there are no records available before 2020.

Compared to the geometric average net investment returns of other insurers, AIA has been performing well across 3, 5, and 10-year historical averages.

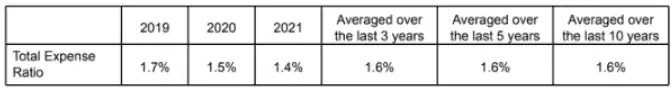

Total Expense Ratio

This ratio refers to the share of total costs of the Participating Fund relative to its assets.

These expenses may include investment costs, management expenses, distribution charges, taxes, and other expenses.

Here is a table of the Participating Fund’s past Total Expense Ratios:

When investing in a par fund, it’s highly advisable to compare its expense ratio with other expense ratios from major insurers in Singapore:

From the figures, AIA’s fund’s expense ratio ranks at the second position out of the 8 companies measured.

Summary of AIA Platinum Heritage Wealth (II)

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawal | Available |

| Health & Insurance Coverage | |

| Death | Available (Including Accidental Death Benefit) |

| TPD | N/A |

| Terminal Illness | Available |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

My Review of AIA Platinum Heritage Wealth (II)

If you’re looking for an insurance policy that can also accumulate wealth, AIA Platinum Heritage Wealth (II) might be a good fit for you.

With a lifetime coverage of up to 100 years, you can rest assured knowing you’re protected for your lifetime.

Your loved ones will benefit from both asset distribution and insurance proceeds when you choose AIA Platinum Heritage (II) for your estate.

On top of that, the mandatory supplementary benefit AIA Platinum Heritage Wealth (II) Assurance maximises your insurance protection until you’re 85 years old.

The biggest downside?

Historical fund performance figures are not available, and therefore not possible to evaluate the fund’s performance over the years.

I’d have to say that there aren’t many features on this policy apart from the Quit Smoking Benefit. Unless you’re a smoker, you don’t benefit much from it.

When it comes to choosing a policy, you shouldn’t just look at the returns and expenses but also consider the features offered.

That’s why it’s crucial to explore different options and compare various plans to ensure you find the best fit for your specific requirements.

There may not be a plan that can have all the features that you need, so I suggest starting off by reading our post on the different whole life insurance plans.

You may then wish to consult with a financial advisor or get a second opinion to understand if this policy is best for you.