The AIA Platinum Generations II (USD) is a participating whole life insurance policy that allows you to grow your money while securing financial protection for your loved ones.

This USD-denominated, limited-pay whole-life policy allows you to make just 10 years of premium payments for benefits extending up to 100.

Here’s our take on the AIA Platinum Generations II (USD) to help you determine if it’s the right policy for you and your family.

Keep reading!

Criteria

- Issue age: 0 – 60 Years Old

- 10 year of regular premium payments

General Features

Premium Payment Term

The AIA Platinum Generations II has a premium payment term of 10 years and must be paid in US dollars.

You can pay monthly, quarterly, semi-annually, or annually.

Protection

Death Benefit

In the unfortunate event that the insured passes away, the death benefit will be the higher amount of either:

(a) the policy’s coverage amount, or

(b) the total sum of all premiums paid on the policy up until the date of death, minus any coupon payments received.

The payout will also factor in any terminal dividends, coupons, or annual dividends that have accumulated after deducting any amounts owed.

Once the Death Benefit is paid out, the policy will automatically terminate.

Terminal Illness Benefit

If the insured is diagnosed with a terminal illness while the policy is active, they will receive the sum assured once the proof of the illness has been verified, minus any amounts owed to the policy.

This advance payout offers financial relief during challenging periods and is an early release of the full sum assured.

Once the full insured amount is paid out, any annual dividends and coupons that have accumulated with AIA will also be paid out, and the policy will end automatically.

Total & Permanent Disability (TPD) Benefit

If the insured unfortunately becomes totally and permanently disabled (TPD) while the policy is active and before they turn 70, the TPD Benefit payout will be equal to the insured amount.

This payment will also include any terminal dividends from the basic policy minus any amounts owed under the policy.

If the insured person has multiple insurance policies with AIA, the payouts from all the policies’ TPD benefits are consolidated, but the total payout cannot exceed US$3,000,000.

Key Features

Coupon Benefit

Starting in the 10th year of the policy and continuing as long as your policy is active, you will receive an annual guaranteed Coupon Benefit of 2% of the insured amount!

This benefit will only be paid if all the premiums due have been fully paid by the most recent policy anniversary.

Before paying out the Coupon Benefit, any amounts owed will be deducted.

You have the flexibility to take this benefit in cash or allow it to earn interest at the current rate.

Maturity Benefit

Should the insured individual reach the milestone of their 100th birthday with an active policy, a lump sum payout will be issued!

This will be the greater of either the insured amount or the total annual premiums paid over the life of the policy.

Unlike other benefits, this payout will not accrue any interest.

It will, however, be adjusted downward for any coupon payments, including annual dividends from the prior year and any terminal dividend.

After accounting for debts or outstanding amounts, accumulated annual dividends will also be included in this payout.

Annual Dividend

Each year, you may be eligible for an annual dividend. This dividend is not guaranteed – it depends on how well the participating fund performs.

Once declared, it’s added to your policy and becomes a guaranteed benefit that won’t be affected by any future changes.

You enjoy the flexibility to either withdraw the Annual Dividend whenever you like, apply it towards your policy premiums, or allow it to grow by earning interest at the current rate.

Terminal Dividend

Should you surrender your policy, file a claim, or reach the policy’s maturity date, you may receive a Terminal Dividend.

Similar to the Annual Dividend, this is also performance-based and not guaranteed.

However, all guaranteed benefits, including dividends already credited to your policy, will be provided regardless of how well the fund performs in the future.

Surrender Value

If you want to, you can surrender your policy and receive the cash value it is currently worth. Once you surrender your policy, it will be terminated automatically.

The surrender value differs for each policy, so make sure to check with AIA or your financial advisor.

AIA Platinum Generations II (USD) Fund Performance

Asset Allocation

The premiums you pay for participating policies are contributed to a participating fund.

This fund is invested in a range of assets and reflects the investment objectives.

Here is a summary of the participating fund’s asset allocation as of December 2021:

| Type of Assets | Allocation Target (%) | Actual Target (%) |

| Bonds | 78 | 76 |

| Risky Assets* | 22 | 24 |

| Total | 100 | 100 |

*Risky assets comprise listed stocks, investments into funds, private equity, and real estate.

Understanding the asset allocation can give you insight into the fund’s investment strategy and risk profile to help you decide if this is the right investment avenue for you.

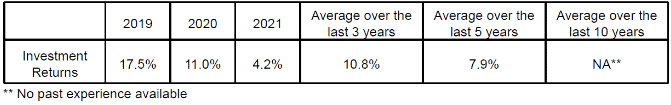

Investment Rate of Return

Below is how the participating fund has performed after deducting the investment expenses. The percentage returns are as of December 31, 2021:

AIA has shown a strong track record in the past few years with an impressive 10.8% and 7.9% performance.

These figures are especially noteworthy considering that they were generated over 3-year and 5-year periods.

Nevertheless, due to its relative newness within these markets, there is no 10-year data yet available on the performance metrics of this fund.

When you examine the geometric net investment returns of par funds in Singapore for different insurers, you can note that AIA is performing well.

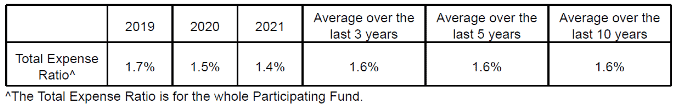

Total Expense Ratio

The Total Expense Ratio (TER) is the percentage of the Participating Fund’s total expenses compared to the fund’s total assets.

These expenses are already factored into the premiums you pay for your policy, so it’s not an extra charge to you.

However, if the actual expenses end up being significantly different from what was expected, it could impact the non-guaranteed benefits you receive.

Here are the past years’ ratios:

Based on the above expense ratios, AIA participating funds have been performing better in managing costs each consecutive year.

Analysing figures in a vacuum can be misleading, but when we compare them to other metrics, it gives us insight into the bigger picture.

To help you gain clarity on this data, here’s an informative table:

The comparison shows that AIA provides one of the most cost-effective insurance choices on the market, ranking in 3rd place behind NTUC Income and Tokio Marine Life with a low average expense ratio.

AIA Platinum Generations II (USD) Fees and Charges

It’s important to note that this plan is linked to the performance of the participating fund.

This means that any expenses incurred by the plan can be charged to the policy, including commissions related to participating policies and costs of acquiring new participating businesses.

Additional expenses may include:

- Policy maintenance fees

- Investment management charges

- Tax-related expenses

- Overhead and administrative costs

- Claim processing fees

- Any other expenses deemed appropriate and directly related to the participating fund.

The fees for the AIA Platinum Generations II (USD) have already been included in your premiums.

How AIA Platinum Generations II (USD) Delivers Multi-generation Protection

Dr Monte is a 45-year-old IT specialist and has chosen AIA Platinum Generations II (USD) to secure a financial legacy for his family across 2 generations.

With an initial insured amount of US$250,000, he pays an annual premium of US$28,300 for 10 years and names his 12-year-old son, Sam, as the insured.

Generation 1: (Dr Monte and Wife)

At the end of the 10th policy year and onwards, Dr. Monte receives guaranteed annual coupons of US$5,000 (2% of the insured amount), which he uses for yearly travels with his wife.

He also chooses to leave any annual dividends received with AIA to earn interest.

Generation 2: (Sam)

Dr. Monte decides to assign Sam ownership of the policy at age 30 and, like his dad, opts to continue receiving annual coupons of US$5,000.

He also chooses to leave any annual dividends received with AIA to earn interest.

Generation 3: (Jane)

When Sam passed away at the age of 80, his daughter June received benefits from his policy.

These benefits include a guaranteed death benefit of US$250,000, 68 years’ worth of accumulated annual dividends (US$876,480), and US$1,495,293 in terminal dividends.

In total, the benefits amounted to US$2,621,773.

| Policy Year | Beneficiary | Event | Amount |

| 10th | Dr Monte at 55 | Annual coupons start

Retains dividends |

US$5,000 p.a |

| 18th | Sam at 30 | Named policyholder

Annual coupons Retains dividends |

US$5,000 p.a |

| 68th | June | Guaranteed death benefit | US$250,000 |

| Accumulated annual and Terminal dividends | US$2,371,773 | ||

| Total Maturity Benefits to June | US$2,621,773 | ||

From the above illustration, we can see that Dr. Monte managed to leave a legacy of financial security and peace of mind for his family across 2 generations.

He has secured a tangible way to ensure the wealth he built will be passed on to Sam and, afterwards, his granddaughter June.

Summary of the AIA Platinum Generations II (USD)

| Cash & Cash Withdrawal Benefits | |

| Cash Value | Available |

| Cash Withdrawal | Available |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | Available |

| Terminal Illness | Available |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

My Review of AIA Platinum Generations II (USD)

With AIA Platinum Generations II (USD), you commit to paying premiums for only 10 years, yet the policy provides coverage until you reach age 100.

The amount of coverage you choose can act as a financial safety net for your loved ones in the event of your passing.

After the 10th year of premium payment, the plan provides an annual coupon payment, which is equal to 2% of the coverage amount until the insured person reaches age 100.

You can choose to receive this payment in cash or leave it with AIA to accumulate interest for potential growth.

AIA Platinum Generations II (USD) also offers potential non-guaranteed annual dividends, which you can choose to receive in cash or leave with AIA to grow over time.

Additionally, there may be a potential one-time payment, called a terminal dividend, when the policy matures, is surrendered, or a claim is made.

I have to say, their participating funds are pretty impressive, generating 7.9% in annualised returns over 5 years.

In 2021, it did drop to 4.2%, but given that the pandemic was at its peak there and the AIA Platinum Generations II (USD) managing to generate those returns are nothing but short of impressive – especially when other participating funds didn’t perform too well.

For added protection, the policy also covers Terminal Illness and Total and Permanent Disability.

Should you be diagnosed with a terminal illness or suffer total and permanent disability, an accelerated benefit payment will be issued, equal to the basic coverage amount (less any debts associated with the policy).

However, if you are looking for a more flexible insurance policy, AIA Platinum Generations II (USD) may not be the best option as it requires you to hold the policy for a long time before you hit the breakeven point.

Hence, you may be unable to withdraw cash from the policy without incurring surrender charges, especially in the early years.

I mean, if you’re looking for a whole life policy and can afford the AIA Platinum Generations II (USD), it’s pretty good.

Otherwise, you’ll need to consider other whole life policies if a whole life plan is what you’re looking for.

Alternatively, you can check out endowment plans or annuities if you want a low-risk investment option.

Lastly, if capital growth is what you’re after, an investment plan might be what you need.

It’s worth exploring different options and comparing various plans to ensure you find the best fit for your specific requirements.

You can consult with a financial advisor or get a second opinion to understand if there are better alternatives for you.