AIA Elite Secure Income is an investment-linked retirement plan designed to provide a secure monthly income and assist individuals in achieving their retirement goals.

The policy is available in Singapore dollars (S$) and US dollars ($), allowing you to invest in your preferred currency.

Moreover, AIA Elite Secure Income offers a flexible premium payment option, enabling you to choose between single premium, 5-year, or 10-year premium options.

This post reviews the AIA Elite Secure Income policy to help you decide if it’s the right policy to meet your needs.

Keep reading.

My Review of the AIA Elite Secure Income

The AIA Elite Secure Income is a comprehensive investment-linked annuity that provides individuals with guaranteed monthly income and capital growth.

With its capital guarantee feature, this plan offers stability and peace of mind, making it an attractive option for those seeking financial security.

One of this plan’s key highlights is its flexibility in terms of payout periods.

You can choose between receiving your monthly income over 10 or 15 years, allowing you to customise the plan based on your specific needs and preferences.

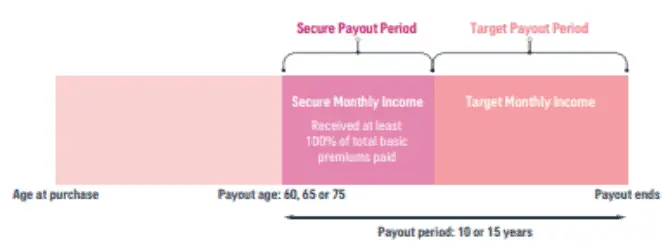

The monthly income consists of Secure Monthly Income and Target Monthly Income.

The Secure Monthly Income guarantees you will receive 100% of your basic premiums paid during the Secure Payout Period, regardless of market performance.

Even if your policy value falls to zero, you will still receive your guaranteed monthly income.

On the other hand, the Target Monthly Income allows you to continue enjoying your monthly income even after the Secure Payout Period ends.

In addition to the guaranteed income, the AIA Elite Secure Income offers a perpetual Power-up Bonus.

Starting from the 10th policy year and every 5 years after, this bonus boosts your capital, further enhancing your investment growth potential.

One of the standout features of the AIA Elite Secure Income is the ease of starting your investment journey.

No medical check-up is required, and no health questions are asked, making it convenient for individuals to get started without hassle.

The plan allows for customisation, which enables you to determine your monthly income amount, choose between SGD or USD investments, select your premium payment term, decide your desired payout age (60, 65, or 75 years old), and even choose the source of funds (Cash or SRS account).

Additionally, you can make regular or ad-hoc top-ups without limit, allowing you to grow your investment further.

While the AIA Elite Secure Income has many attractive features, it’s important to note some areas for improvement.

The plan lacks riders, which could be beneficial in enhancing your coverage.

Additionally, it does not include a Total and Permanent Disability (TPD) benefit, which may be an important consideration for individuals seeking comprehensive protection.

They also only offer 2 portfolios – the AIA Elite Balanced Fund or AIA Elite Conservative Fund.

This wouldn’t be a problem if the returns are great, since this is an investment-linked policy.

However, based on our analysis below, the former has a net return of 0.99% yearly, while the latter has a net return of -1.46% yearly.

This is just the fund-level returns. We have yet to include charges by this policy itself.

This defeats the entire purpose of an investment-linked annuity – as the goal is to get better returns than an annuity with the insurer’s participating funds.

Unfortunately, AIA’s participating funds have better returns than the portfolios here – so you’re better off choosing the AIA Retirement Saver IV.

We recommend exploring alternative annuity plans that might be better for you too.

Also, consult a financial advisor for a second opinion on whether the AIA Elite Secure Income is for you and whether there are better alternatives for you.

As this is meant for your retirement income, it’s better to be cautious so that you don’t make the wrong financial decisions that might affect your retirement.

If you need someone to talk to, we partner with unbiased financial advisors to assist you with this.

Click here to get connected for free.

Here’s more on the AIA Elite Secure Income:

Criteria

- Issue age: 0 – 65 years

- Premiums start at $313 per month

- Pay with SGD or USD

General Features

Premium Payment Terms

You can choose the following premium payment options:

- Single premium

- 5-year premium payments

- 10-year premium payments

This means that you’ll either make a single premium payment or choose between minimally paying premiums for 5 or 10 years.

Premiums can be paid monthly, quarterly, biannually, or annually.

You may use cash or your SRS account to pay for the AIA Elite Secure Income if you opt for the single premium policy, or cash only for 5 and 10 year policies.

Here is a table showing the minimum regular premiums for both the 10-year Pay Policy and the 5-year Pay Policy:

| Payment Frequency | 10-year Pay Policy | 5-year Pay Policy |

| Annual | $3,600 | $4,800 |

| Semi-annual | $1,872 | $2,496 |

| Quarterly | $938 | $1,250 |

| Monthly | $313 | $418 |

Choose Your Retirement Age

You can select your preferred payout age, which can be 60, 65, or 75 years old.

This means once you hit the selected age, the monthly payouts will begin.

Additionally, you have the option of choosing either a 10- or 15-year payout period. Once payouts begin, it will last for either 10 or 15 years.

Protection

Death Benefit

In the unfortunate event of the insured’s death, AIA Elite Secure Income provides a death benefit. The death benefit payout will be the higher of 2 options:

- 105% of the current value of the policy.

- Alternatively, the policy will pay out 100% of the total premiums after deducting any Secure Monthly Income (covered later) already paid or considered paid. Additionally, any applicable fees and charges will be subtracted from this amount.

Accidental Death Benefit

An accidental death benefit is available when the insured passes away due to an injury within 90 days of an accident occurring within 5 years of the policy’s issue date.

In addition to the death benefit, 50% of the regular premiums will be paid.

Terminal Illness Benefit

If the insured is diagnosed with a terminal illness, the policy will pay them the Terminal Illness Benefit.

The Terminal Illness Benefit is an accelerated payment of the death benefit.

Key Features

Monthly Income Benefit

With AIA Elite Secure Income, you can start receiving your monthly income as soon as you reach the payout age. This income comprises:

- Secure monthly income

- Target monthly income

Secure Monthly Income

During the secure payout period, you will receive the secure monthly income.

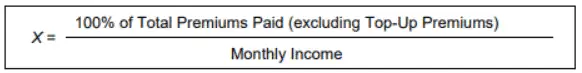

The secure monthly income is paid during the secure payout period, which is calculated using the following formula:

Please note that X is the secure payout period rounded to the nearest whole number.

Even if your policy value drops to zero during the secure payout period, your policy will not terminate.

You’ll still receive your secure monthly income until the end of the secure payout period.

A minimum of 100% of the basic premium invested will be received as Secure Monthly Income.

To receive the Secure Monthly Income, the following conditions must be met:

- Your policy must be active and should not have activated a Premium Holiday.

- No partial withdrawal from regular premium and bonus units should exist.

- Your policy cannot have been reinstated in the past.

Target Monthly Income

The target monthly income is a benefit you will receive if the secure payout period does not exist or has ended.

During this period, you will receive a monthly income until your policy value reaches zero and the policy terminates automatically.

You can opt not to receive the subsequent monthly income payments if your policy has been running for at least a year before or during the payout period.

If your policy accepts this request, you cannot redeem units during the payout period. Additionally, certain conditions will apply:

- If the value of the regular premium balance and bonus units is more than that of the secure monthly income for any given month, the relevant regular premium balance as well as the bonus units will be reinvested.

- If the value of the regular premium balance and bonus units is more than that of the secure monthly income for any given month, both the remaining regular premium balance as well as the bonus units will be reinvested and added reinvested units.

- The reinvested units will have a value equal to the secure monthly income. Furthermore, the quantity of units converted and added will be determined depending on the current bid price.

- Each secure monthly income payment that has not been paid will still be considered paid for the Death Benefit. This ensures that the Death Benefit is not affected by any missed secure monthly income payments.

After the payout age, you can resume receiving your monthly income by submitting a written request.

You can withdraw from the reinvested units without affecting the secure payout period.

It’s important to understand that, like other ILPs, the value of your policy will entirely depend on the performance of the ILP sub-fund.

Power-up Bonus

If your policy is active and you have paid all your premiums, you will be eligible to receive the Power-up Bonus starting from the 10th policy year and every 5 years after that.

This bonus will be added to your policy as additional units, enhancing its value.

| Premium Payment Term | Single Premium | 5-Year Premium Payment Term | 10-Year Premium Payment Term |

| Power-up Bonus Percentage Rate | 2.5% of single premium | 12.5% of annual premium | 25% of annual premium |

Regular Premium of 10 Years

To calculate the Power-up bonus for a regular premium of 10 years, you will need to consider the adjustment factor and a quarter of the annual premium.

![]()

Regular Premium of 5 Years

To calculate the Power-up bonus for a regular premium of 5 years, you will need to consider the adjustment factor and 12.5% of the annual premium.

For both 5-year and 10-year policies, the annual premium is determined by adding up the monthly, quarterly, or semi-annual premiums paid throughout the policy year.

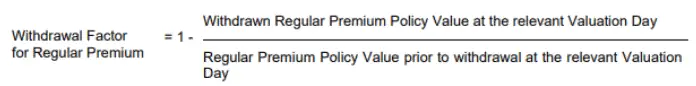

The adjustment factor is calculated by multiplying the total withdrawal factor for each partial withdrawal made after the 5th policy year.

Here is the formula to calculate the withdrawal factor for regular premiums:

Single Premiums

Consider the adjustment factor and 2.5% of the single premium to calculate the Power-up bonus for a single premium.

![]()

Here is the formula to calculate the withdrawal factor for single premium:

Ad-hoc Top-Ups

You can request top-ups on an ad-hoc basis for all the policies, provided you have no outstanding premium payments.

Please note that there is a 3% charge for this service. The minimum amount you can top-up is $1,000.

It’s important to remember that top-up premiums will not impact your secure payout period or secure monthly income.

Full Surrender

You can submit a written request to surrender your policy for its surrender value.

The surrender charge rate will be applied based on the premium payment option.

After deducting the surrender charge, the net redemption proceeds will be payable to you.

We will share the surrender charges in the fees & charges section.

Partial Withdrawal

You can request a partial withdrawal from your insurance policy while the policy is still active.

The rates for this withdrawal will vary depending on the premium payment option.

It’s important to note that the minimum amount you can withdraw is $1,000, and your policy value must be at least $10,000.

Remember that a partial withdrawal will effectively reduce the Power-up bonus associated with your policy. Additionally, withdrawing from the bonus or single premium units will impact your secure monthly income.

We will share the surrender charges in the fees & charges section.

Capital Guarantee

The AIA Elite Secure Income plan provides a unique guaranteed capital option feature.

Capital is guaranteed if you have paid all premiums due, haven’t withdrawn from your basic premium unit or bonus unit, and haven’t previously reinstated the policy.

AIA Elite Secure Income Fund Selections

With the AIA Elite Secure Income, you have 2 portfolios to choose from – the AIA Elite Conservative or AIA Elite Balanced.

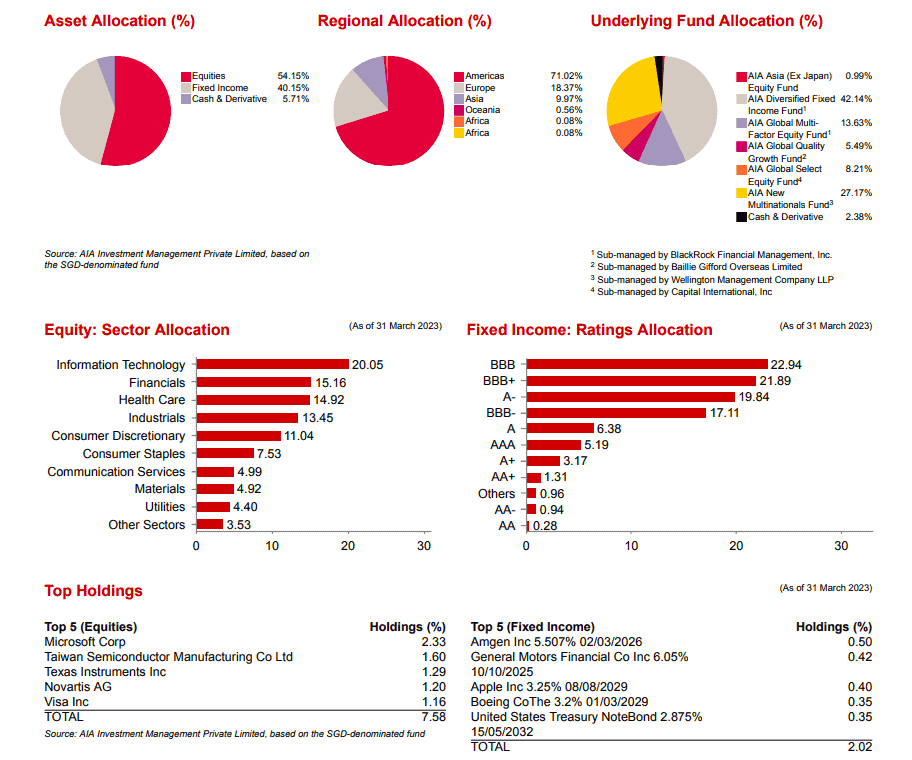

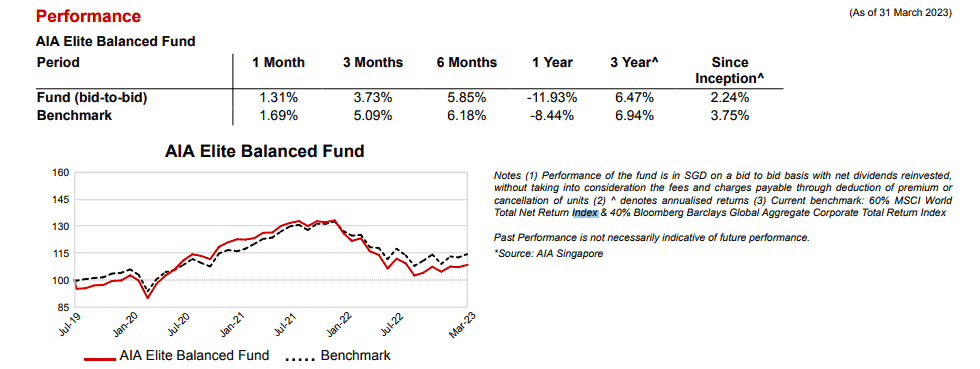

AIA Elite Balanced Fund

This balanced fund invests about 50% in equities and 50% in fixed income, cash, and cash derivatives.

Similarly, it invests in its own AIA sub-funds.

Here are the returns from the fund as compared to its benchmark. Since inception, the annualised returns are at 2.24% p.a, before fees.

The fees are at 1.25% p.a of the overall asset value. Since returns are before fees and charges, this fund’s annualised returns since inception are about 0.99% p.a.

Information is accurate as of 31 March 2023.

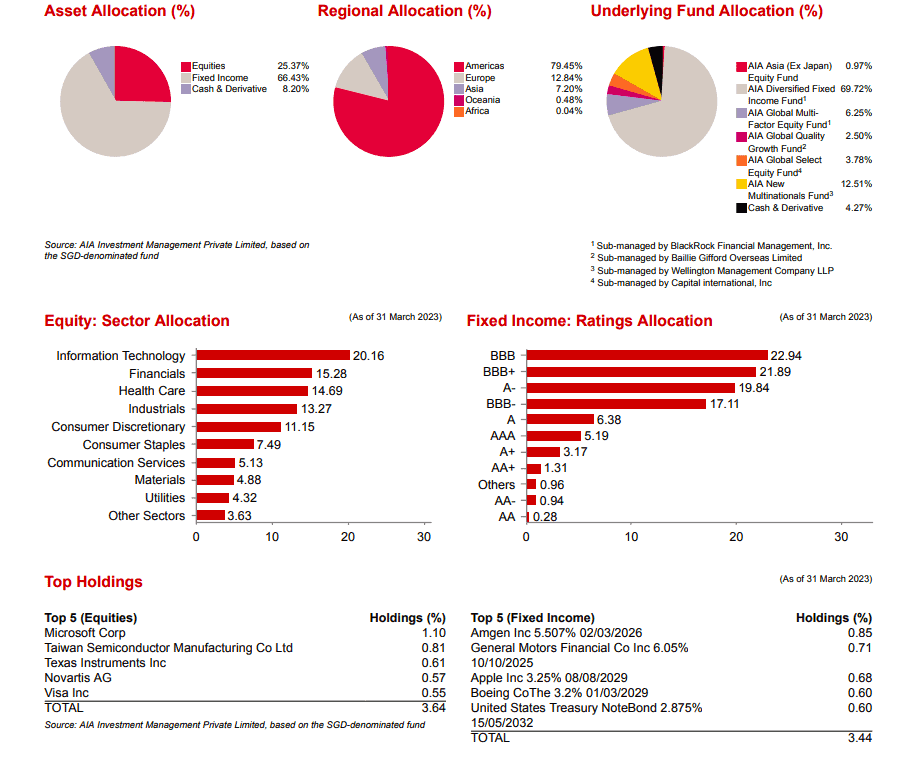

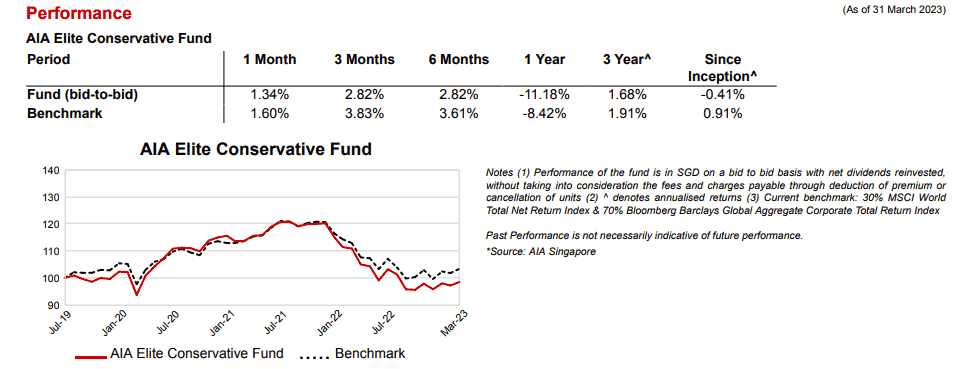

AIA Elite Conservative Fund

This is the most conservative fund available.

Here are the returns from the fund as compared to its benchmark. Since inception, the annualised returns are at -0.41% p.a, before fees.

The fees are at 1.05% p.a of the overall asset value. Since returns are before fees and charges, this fund’s annualised returns since inception are about -1.46% p.a.

Here are the fund allocations of the AIA Elite Conservative Fund:

Information is accurate as of 31 March 2023.

AIA Elite Secure Income Fees and Charges

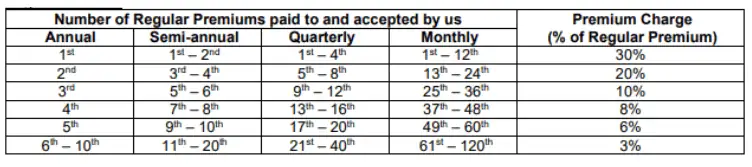

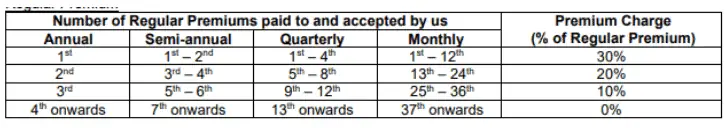

Premium Charge

For regular premium, the premium charge depends on a certain percentage of the regular premium as indicated in the following table:

10-year Pay Premium Payment Option

5-year Pay Premium Payment Option

For top-up premiums, a flat premium charge of 3% is applied.

Single Premium Premium Payment Option

A premium charge of 5% is applicable for single premium policies.

Top-Up Charge

A 3% premium charge is imposed when you top-up your premiums.

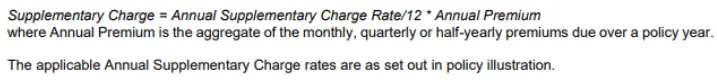

Supplementary Charge

The supplementary charge is deducted from your policy value monthly for the first 10 years of the policy.

It also applies during any premium holiday period if applicable.

The exact charges are not disclosed and will depend on your policy. Check your documents or with your financial advisor for these charges.

Premium Holiday Charge

The premium holiday charge applies to regular premiums when a payment is missed.

If you miss a payment, the charge will be deducted from your monthly policy units until you resume payment.

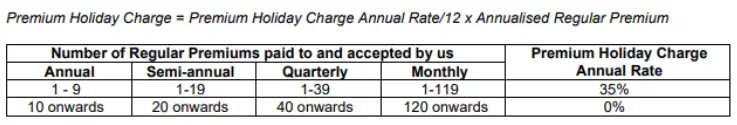

10-year Pay Premium Payment Option

Here is a formula to calculate the premium holiday charge for a 10-year policy:

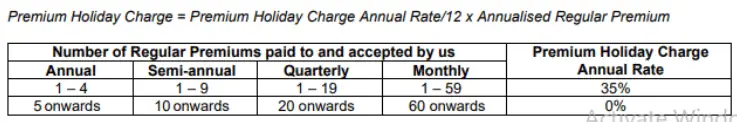

5-year Pay Premium Payment Option

Here is a formula to calculate the premium holiday charge for a 5-year policy:

Full Surrender Charge

The full surrender charge is a fee deducted from the policy value when you surrender your policy before its maturity date.

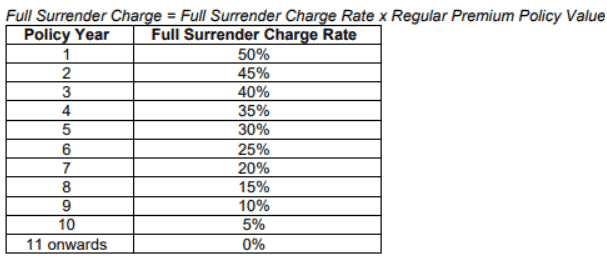

5-year Pay and 10-year Pay Premium Payment Options

The following table shows the formula for calculating the full surrender charge for 10-year- and 5-year Pay policies:

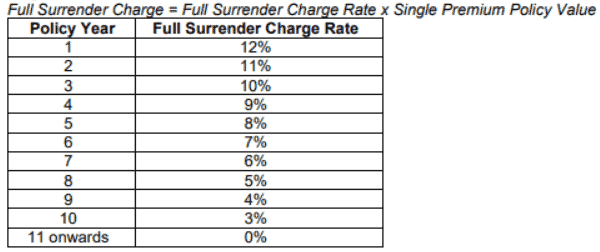

Single Premium Premium Payment Option

The following table shows the formula for calculating the full surrender charge for a Single Premium payment:

It’s worth noting that the full surrender charge does not apply to top-up premiums.

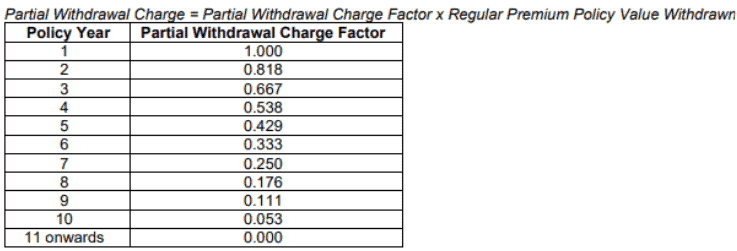

Partial Withdrawal Charge

The partial withdrawal charge is a fee that is deducted from the policy value when you choose to partially withdraw before its maturity date.

5-year Pay and 10-year Pay Premium Payment Options

The following table shows the formula for calculating partial withdrawal charges for 10-year Pay and 5-year Pay premium payment options:

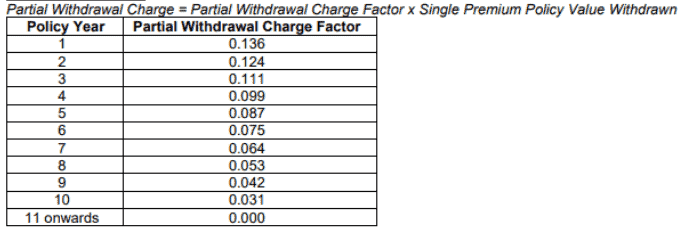

Single Premium Premium Payment Option

The following table shows the formula for calculating the partial withdrawal charge for the Single Premium payment option.

Notably, the partial withdrawal charge does not apply to top-up premiums.

Fund Management Charge

The fund management charge is a fee that is deducted from the net asset value of each Investment-Linked Policy (ILP) sub-fund.

This ranges between 1.05% to 1.45% p.a., depending on the fund chosen.

Summary of AIA Elite Secure Income

| Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Withdrawals | Yes |

| Health and Insurance Coverage | |

| Death | Yes (Including Accidental Death) |

| Total Permanent Disability | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders | No |