The PRUPersonal Accident is a yearly renewable personal accident insurance plan that will protect you financially by giving support in death or injury caused by accidents.

In this post, we will see if PRUPersonal Accident is the best fit for you in terms of your financial protection and objectives.

Here is a comprehensive review of the PRUPersonal Accident to help you decide if it’s the right policy for you.

Keep reading.

My Review of Prudential’s PRUPersonal Accident

The Prudential PRUPersonal Accident is a comprehensive personal accident insurance plan that covers you for an array of scenarios.

This insurance plan stands out because it covers you 24/7 worldwide for accidental death, accidents, and up to infectious diseases like Hand, Foot, and Mouth Disease, and Dengue.

Additionally, it covers additional risks such as food poisoning, high-risk activities, and bites from animals and insects.

Hence, you have extra protection in situations that other insurance policies may not cover.

The insurance plan will also reimburse you for the medical expenses incurred due to the accident, including bills for Traditional Chinese Medicine treatments.

This helps alleviate the financial burden of your medical care.

Let’s not forget that the PRUPersonal Accident will not only double your sum assured but triple it in certain scenarios!

Finally, when you don’t make any claims for the first 5 years of the policy, you can enjoy a no-claims bonus.

This bonus allows you to receive up to 25% more coverage without any additional cost. It rewards you for maintaining a good claims history.

However, like all other personal accident plans, PRUPersonal Accident does not guarantee renewability, and Prudential can terminate your policy by giving you 30 days’ notice in writing.

Prudential’s PRUPersonal Accident plan is also on the more expensive side, so if you’re looking for something affordable, this might not be for you.

But in my opinion, the value and the coverage you get from the PRUPersonal Accident is worth it if you can afford it.

Nonetheless, it’s still best to compare the best insurance personal accident plans before deciding.

I would also suggest seeking the opinions of unbiased financial advisors and exploring alternatives for yourself.

If you’d like to compare policies to understand if there are better PA plans for you, we partner with unbiased financial advisors who can help you with this.

Click here for a non-obligatory comparison session.

Here’s more on what the PRUPersonal Accident covers in detail.

Criteria

- Age Requirement: 5 to 64 years old

- Annual renewal until you reach 75 years old

General Features

Premium Payment Terms

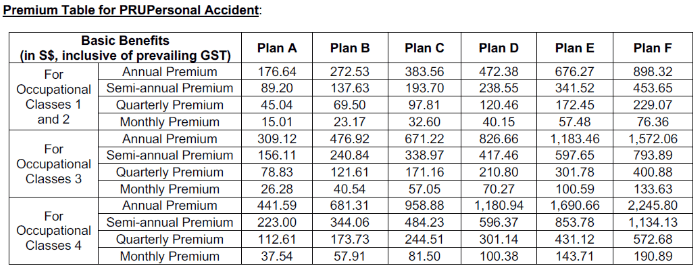

Below are the current applicable rates:

It’s not specified what occupations fall under each Occupational Classes.

It’s important to note that this policy doesn’t qualify for payment through Medisave, so you can’t use your Medisave funds to pay for the premium.

Your premiums can be paid monthly, quarterly, half-yearly, or yearly, depending on your preference.

Protection

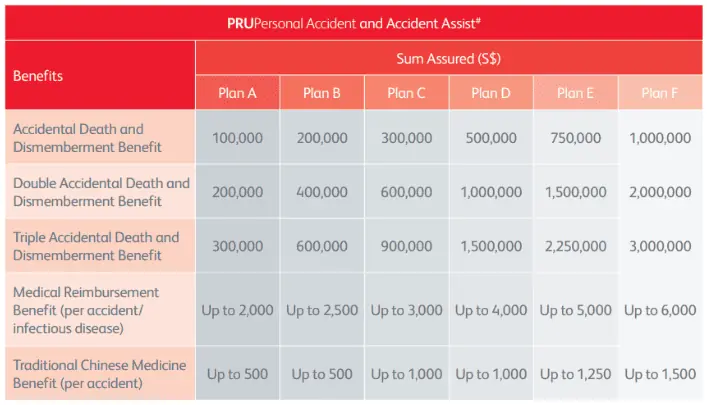

Table of Basic Benefits Sum Assured

The table below shows the sum assured for each benefit depending on your selected PRUPersonal Accident Plan:

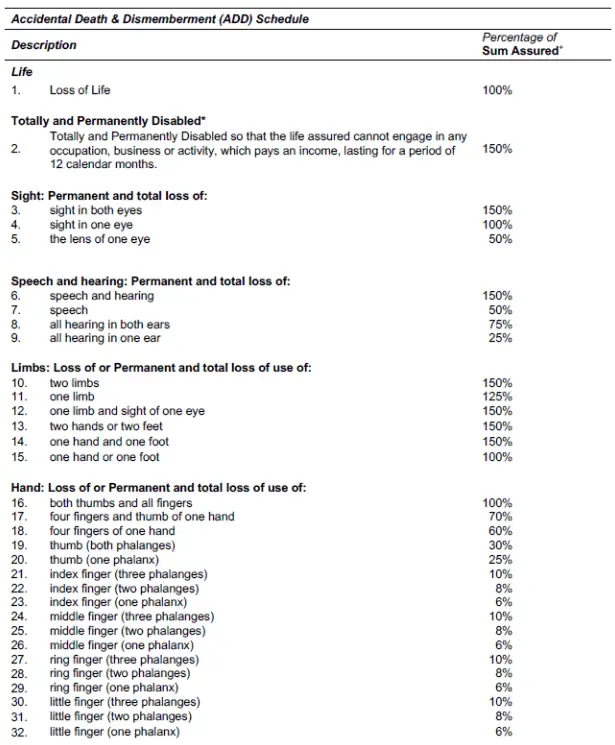

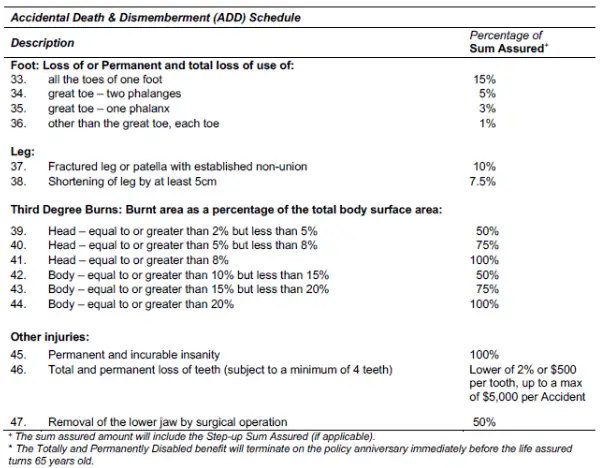

Accidental Death and Dismemberment (ADD) Benefit

The ADD benefit provides payment in the following situations:

- Accidental death.

- Accidental injury, but the life insured does not pass on within 30 days.

Hence, only the injury with the highest benefit will be considered if the insured person sustains multiple injuries in the same accident.

However, only the Loss of Life benefit will be paid if the insured person dies within 30 days after the accident.

In addition, if the insured has made previous ADD claims or has multiple policies with the same benefits, the total amount payable cannot be more than the lower of 150% of the sum assured and $4,500,000.

And if the insured is a juvenile, the claims payable under all personal accident policies with the same benefits cannot exceed $500,000.

To be eligible for the ADD benefit, the injury or death must occur within 12 months after the accident date.

Once 100% of the ADD sum assured is paid, the entire policy terminates.

Double Accidental Death and Dismemberment Benefit

Under specific circumstances, the PRUPersonal Accident plan offers a Double Accidental Death and Dismemberment (Double ADD) benefit.

This benefit is paid when accidental death or injury occurs in the following situations:

- While riding in your own car.

- While walking as a pedestrian.

- If there’s a fire at their home, a theatre, hotel, public hall, school, hospital (including smaller hospitals in communities), or shopping mall, and the person was inside when the fire started.

For insured individuals aged below 1 year to 16 years, the Double ADD benefit applies when accidental injury or death happens in the following circumstances:

- While inside the school premises on a regular school day or during activities organised and overseen by the school authorities.

- When participating in school activities organised and overseen by the school authorities, even if they take place outside the school premises.

- While travelling as a passenger on a school bus, private bus, or excursion bus to and from school or to locations where school activities are happening.

It’s important to note that either the ADD or Double ADD benefit will be paid.

Triple Accidental Death and Dismemberment Benefit

This benefit applies only when the accident happens while you travel on public transportation, like buses, trains, or aeroplanes.

Hence, if the insured sustains a serious injury or death due to an accident while travelling on public transportation, the policy provides the insured or your family with extra compensation.

If the accident meets the criteria for both the Double ADD benefit and the Triple ADD benefit, the policy only pays the higher payout between the 2.

Any additional claims paid out under these circumstances won’t be counted towards the maximum claimable limit specified in the policy.

Medical Reimbursement Benefit

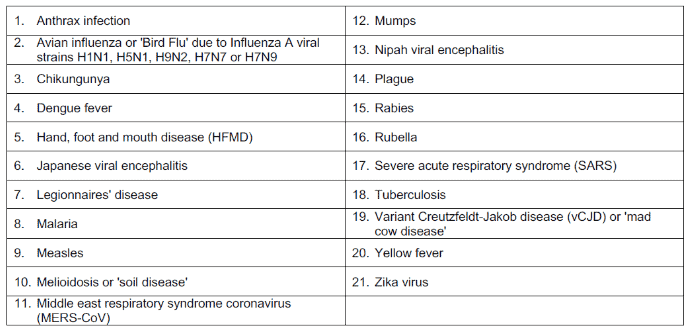

This benefit reimburses the medical expenses you incur if you sustain bodily injuries or are diagnosed with certain infectious diseases.

Each type of plan has a specific limit or maximum amount to reimburse for medical expenses.

The injury and disease must be within 12 months of the accident. You must file the claim for medical reimbursement within 180 days of receiving the medical treatment.

Even if you have received a claim payout for the ADD benefit related to the same accident, you can still receive reimbursement for your medical expenses.

However, once you have fully claimed the sum assured for the ADD benefit, the Medical Reimbursement benefit will no longer be available.

List of infectious diseases:

Traditional Chinese Medicine Benefit

Under this benefit, the policy will reimburse you for the expenses incurred for Traditional Chinese Medicine treatment.

Each type of plan has a specific limit for TCM treatment related to accidents.

The TCM treatment for the accidental injury must occur within 12 calendar months from the accident date.

You must file the claim for TCM treatment reimbursement within 180 days of receiving the TCM treatment.

The TCM treatment reimbursement benefit is separate from the Accidental Death and Dismemberment (ADD) benefit.

You can receive reimbursement for TCM treatment even if you have already received a claim payout for the ADD benefit.

However, once you have fully claimed the sum assured for the ADD benefit, the TCM treatment benefit will no longer be available.

This means that the TCM benefit ends when the entire coverage amount for the ADD benefit is paid out.

Optional Add-On Riders

You may attach the optional Recovery Aid or Fracture Care PA benefits for more comprehensive coverage and benefits.

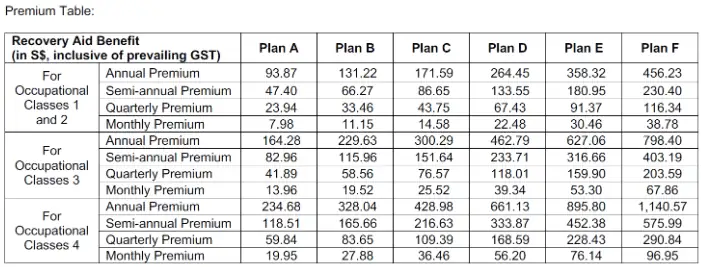

Recovery Aid Rider

The Recovery Aid is a supplementary benefit that covers specific health benefits. The premiums payables vary with the plan chosen and your occupational class.

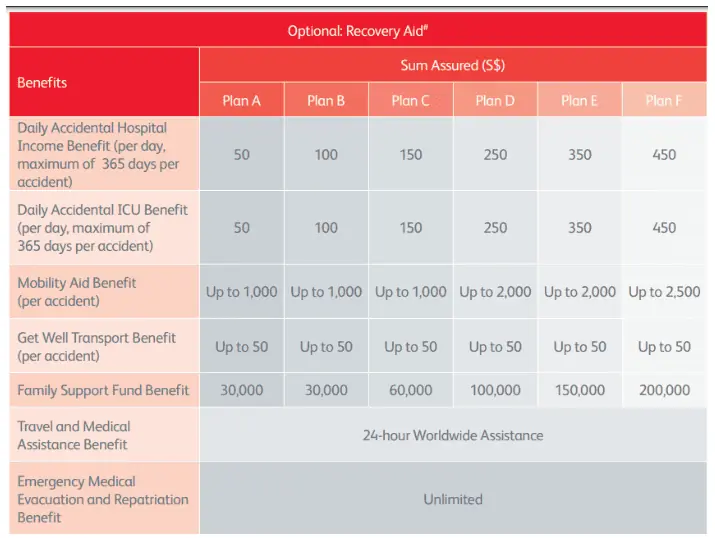

This rider comes with the following benefits and limits based on your selected plan:

Daily Accidental Hospital Income

This benefit pays a certain amount of money for each day of your hospital stay if you are hospitalised due to an accidental injury from the same accident and up to 365 days.

Daily Accidental Intensive Care Unit

This benefit pays a certain amount of money for each day you spend in the ICU, up to a maximum of 365 days for the same accident.

This benefit is in addition to the Daily Accidental Hospital Income Benefit.

Mobility Aid

This benefit reimburses the purchase or rent of mobility aids recommended by a doctor for any reasonable and customary expenses incurred.

The reimbursement amount is up to the coverage limit specified in your plan and applies to each accident.

Get Well Transport

This will reimburse you for the transportation expenses from the hospital to your home.

However, the policy must still be active when the injury occurred.

Family Support Fund

In the unfortunate event of accidental death, the policy will pay a specific amount to the designated beneficiary.

Travel and Medical Assistance

This benefit provides a 24-hour emergency helpline that you can use when travelling abroad and needing emergency assistance.

The helpline can provide guidance and support during unexpected situations.

Emergency Medical Evacuation and Repatriation

Suppose you encounter a medical emergency while travelling abroad.

AIA will arrange emergency assistance for medical evacuation or repatriation.

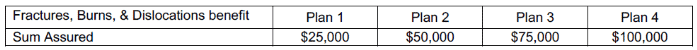

Fracture Care PA Rider

The Fracture Care Personal Accident (PA) Rider is an additional coverage option that can be added to your PRUPersonal Accident policy.

This rider specifically provides coverage for 4 types of benefits that result from accidents.

Here’s what it covers:

Fractures, Burns, and Dislocations

If you sustain any of these injuries directly from an accident, the rider will provide coverage for the associated medical expenses.

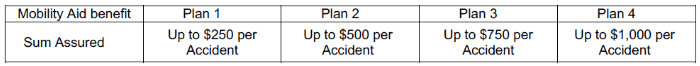

Mobility Aids

If the accident leads to a need for mobility aids like crutches, wheelchairs, or walkers, the rider will cover the costs of purchasing or renting these aids.

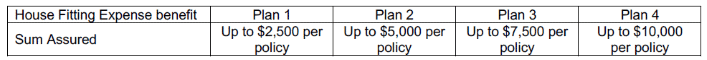

House Fitting Expenses

When your home requires modifications or adjustments to accommodate your condition caused by an accident, the rider will cover reasonable expenses for necessary house fitting.

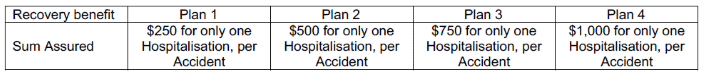

Hospitalisation Recovery

If you are hospitalised due to the accident, the rider will provide additional benefits to help with your recovery.

These benefits may include coverage for daily hospital income or other related expenses.

Added Features

Step-up Sum Assured

When you renew your policy at each Policy Anniversary, you get an Accidental Death and Dismemberment coverage increase of 5% of the original sum assured – as long as no claims have been made.

However, the maximum limit to this increase is 25% of the original sum assured.

Summary of Prudential’s PRUPersonal Accident

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal Benefits | No |

| Health and Insurance Coverage | |

| Death | Yes (Accidental) |

| Total Permanent Disability | Yes (Accidental) |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |