The Prudential PRUMortgage Refund Premier is a non-participating, single premium decreasing term plan that provides financial protection for your mortgage liability should death, Terminal Illness, or Disability occur.

The premium payable depends on the mortgage interest rate and the policy term selected at the start of the policy.

The nice thing is that if you don’t ever submit a claim, you are entitled to receive a full refund of all the premiums you’ve contributed, excluding interest charges.

Not many plans allow for this feature.

Here’s our review of it.

Keep reading.

General Features

Premium Terms

The once-off single premium must be fully paid before the inception date of the policy coverage.

Policy Term

The policy term can be between 10 to 35 years, or until you reach the age of 80 – whichever event occurs first.

Protection

Death Benefit

If the life assured passes away during the policy term, the policy pays out either:

- The predetermined sum assured listed on the Certificate of Life Assurance or,

- The total amount of premiums paid up until the date of death, whichever is greater.

Before the Death Benefit is paid, any outstanding payments are deducted.

The premium would also be reduced in line with the sum assured that has already been reduced.

The adjusted lower premium is treated as if it had been paid since the policy was issued.

If the sum assured has been reduced more than once, the most recent revised lower premium amount is considered.

The entire policy ends automatically upon payment of the death benefit.

Terminal Illness Benefit:

Should you be diagnosed with a terminal illness during your policy term, the terminal illness benefit will be paid out.

In this case, the payout would be the higher of 2 amounts:

- The sum assured is listed on your Certificate of Life Assurance.

- The total amount of premiums you’ve paid until the diagnosis date.

However, any outstanding payments owed related to this policy will be deducted before the Terminal Illness Benefit is paid out.

What if your sum assured has been reduced previously?

If you’ve previously reduced your sum assured, your premium would also be reduced.

The premium would also be reduced in line with the sum assured that has already been reduced.

After a claim for a terminal illness is settled, the Terminal Illness Benefit ends.

Following this, the insured amounts for both the Death Benefit and Disability Benefit are proportionately reduced.

Disability Benefit

If your Certificate of Life Assurance specifies that you’re covered for Disability Benefit, and you become Totally and Permanently Disabled, the payout is determined by the higher of the following 2 amounts:

- The sum assured as listed on your Certificate of Life Assurance.

- The total amount of premiums you’ve paid until the date of Disability.

The date of Disability is when a registered medical practitioner certifies your disability.

This payout will only occur if your disability happens before your policy’s expiry date or before the policy anniversary before your 65th birthday, whichever comes first.

If you’ve previously reduced your sum assured, your premium would also be reduced.

The adjusted lower premium is treated as if it had been paid since the policy was issued.

The disability benefit will be paid out 6 months after your disability has been confirmed.

This is known as the “Deferment Period”.

However, any outstanding amounts you owe with this policy will be deducted first.

The Deferment Period has some exceptions.

It’s not applicable if your disability results from:

- Total and irreversible blindness in both eyes, as verified by an ophthalmologist.

- The loss of either limb, except for hands and feet.

- Total and irreversible blindness in either eye, validated by an ophthalmologist, combined with losing either limb, excluding hands and feet.

You’ll be classified as “Totally and Permanently Disabled” if the following applies to you:

- You’re completely and irreversibly disabled, making it impossible for you to engage in any profession, business, or activity that generates income, or

- You’ve experienced absolute and irreversible loss of use of:

- Both of your eyes.

- Either limb, except hands and feet.

- Either eye along with either limb, not counting hands and feet.

After your claim has been processed and paid, the Disability Benefit coverage ends.

Consequently, the guaranteed amounts for both the Death Benefit and Terminal Illness Benefit will be proportionately reduced.

Key Features

Refund of Premium Benefit

Under this benefit, if no claims related to Terminal Illness or Disability have been made when the policy ends, all the paid premiums will be returned without the added interest.

But remember that any outstanding debts linked to this policy will be deducted from the refund first.

Moreover, if the sum assured were decreased at any stage, the premium would have correspondingly reduced.

It will be refunded based on the lower premium amount paid at policy inception.

If you’ve previously reduced your sum assured, your premium would also be reduced.

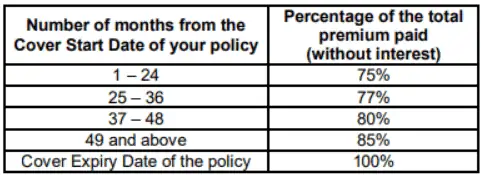

Surrender Benefit

If you choose to surrender your policy before its Cover Expiry Date, a certain percentage of your total premium will be paid back to you without the interest accrued.

This percentage depends on how many months the policy has been active.

However, any debts related to this policy will be deducted from the surrender value before it’s paid out to you.

You have the option to surrender your policy anytime you want.

Here’s how the surrender value is determined:

If you’ve previously reduced your sum assured, your premium would also be reduced.

The surrender value will be refunded based on the lower premium amount paid at policy inception.

If the sum assured was decreased more than once, the calculation will be based on the most recent lower premium.

Joint Coverage

One added feature of PRUMortgage Refund Premier is its Joint Lives Coverage.

This benefit will pay if:

- The life-assured individual passes away.

- The life-assured becomes fully and permanently unable to work.

- The life-assured is diagnosed with a terminal illness while the policy is active.

However, once benefits are paid out, the coverage for the other assured person automatically ends.

And in a scenario where both insured persons simultaneously face these unfortunate circumstances?

Only the first person named on the Certificate of Life Assurance will receive the benefits.

The policy has a single payout limit, and it goes to the first person listed.

Worth noting, is a discount of 25%, which is provided on the lesser of 2 premiums when the policy is taken on a joint life basis.

Summary of PRUMortgage Refund Premier

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

My Review of PRUMortgage Refund Premier

The PRUMortgage Refund Premier is possibly the only mortgage insurance plan in Singapore that offers comprehensive financial protection while refunding your premiums if no claims were made.

One of the critical features of the PRUMortgage Refund Premier is its flexibility in determining a suitable sum assured based on a range of interest rates.

This ensures that your outstanding mortgage loan repayment is adequately covered, providing peace of mind for you and your family.

By selecting an appropriate interest rate, you can tailor the policy to match your specific mortgage loan requirements.

PRUMortgage Refund Premier coverage extends to unfortunate circumstances such as death, terminal illness, or disability.

The policy operates on a single premium basis for a term that ranges from 10 to 35 years or until the insured individual reaches the age of 80.

The Joint Lives Coverage feature is another feature that makes this plan attractive.

This ensures that benefits are paid out if either of the assured individuals encounters an unfortunate event, such as death, terminal illness, or total and permanent disability (TPD).

A unique aspect of the TPD coverage is the “Deferment Period”.

This means the disability benefit becomes payable 6 months after the disability has been confirmed, subject to certain exceptions.

The Refund of Premium Benefit makes this policy desirable to many.

This guarantees a return of all premiums paid at the end of the policy term, provided no claims have been made.

The policy also includes a Surrender Benefit, which allows the policyholder to end the policy before its expiry date and receive a percentage of the total premium paid.

The disadvantage of PRUMortgage Refund Premier is that it does not offer additional benefits, such as policy add-ons or riders that can enhance your coverage.

This is the main difference from the PruMortgage Refund policy.

Overall, the PRUMortgage Refund Premier is a well-rounded insurance policy designed to provide robust financial protection against unforeseen events while ensuring the return of premiums paid if no claims are made during the policy term.

However, given the complexities of these policies and the long-term commitments you’ll have to make, it’s advisable to get a second opinion from an unbiased financial advisor.

We partner with them to provide guidance based on your specific needs and circumstances, ensuring you choose the insurance plan that offers the best protection for you and your family.

Click here for a free non-obligatory consultation.