The NTUC Income Star Term Protect is a non-participating term plan that safeguards against death, total and permanent disability, and terminal illness at a competitive price.

This replaced NTUC Income’s previous term plan – the NTUC Income iTerm.

Here’s our review of NTUC Income Star Term Protect.

Keep reading to see if it’s any good for you.

Criteria

- Minimum sum assured of 50k.

- Coverage is available for up to the age of 84.

*Subject to the maximum coverage age of up to age 84 (last birthday)

General Features

Policy Terms

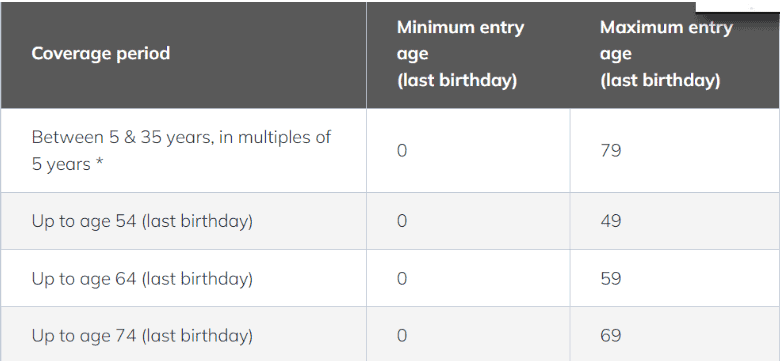

With NTUC Income Star Term Protect, you can select between a renewable or a fixed-term plan.

If you’re interested in the renewable term, it renews every 5 years, and you can renew it for between 5 to 35 years.

Your plan renews automatically with a 5-year term until you reach the age of 84.

If you’re like most and prefer a fixed term, you can select coverage for up to 54, 64, or 74 years old (last birthday).

Premium Payment Terms

As a policyholder, you must pay the premiums regularly throughout the term to keep your coverage.

The plan allows you to pay your premiums monthly, quarterly, semi-annually, or annually with guaranteed rates for the whole term.

Protection

Death Benefit

If the policyholder passes on during the term, the sum assured will be paid out, and the policy will be terminated afterwards.

It’s important to remember that the policyholder is not entitled to the death benefit in case of suicide within 12 months from the starting date of coverage.

The insurer will only refund the total premiums paid without interest minus any amount the policyholder owes.

Total and Permanent Disability (TPD) Benefit

The TPD benefit will be paid out to the insured on the diagnosis of total or permanent disability before age 70.

The cutoff date for the TPD benefit is the anniversary immediately after you reach 70.

You’ll receive the sum assured in terms of this benefit. After the TPD benefit is paid out, your policy will be terminated.

To be eligible for TPD benefit, the policyholder must have any of the following conditions:

- Total and permanent sight loss in both eyes.

- Loss of functioning of any 2 limbs at or above the ankle or wrist.

- Total and permanent sight loss in one eye coupled with loss of functioning of any 1 limb at or above the ankle or wrist.

As per the definition of TPD, if the policyholder’s age is under 65, they must be unable to carry out any occupation to be eligible for TPD benefits.

The benefit is not payable if the insured is merely (partially) unable to perform the same occupation as before or they cannot perform a job for which they have skills, training, and experience.

The insured is also not entitled to the TPD benefit if they are 65 or above but under 70 and are not suffering from a severe disability.

However, if the policyholder experiences total physical loss (total and permanent disability) before their anniversary immediately after reaching 70, the insurer will be responsible for paying the benefit.

Similar to most terms, the NTUC Income Star Term Protect doesn’t pay the TPD benefit of the claim results from or include the following conditions:

- Intentional or self-inflicted injuries or illnesses

- Suicide attempt

- Illegal acts

- Intentional exposure to danger

- Use of alcoholic substances or drugs

The policyholder can’t receive the benefit without getting certified as a totally and permanently disabled individual for 6 consecutive months by a registered medical professional.

After the benefit is paid, the policy will be terminated.

Terminal Illness (TI) Benefit

The insured will receive the sum assured on diagnosis for a covered terminal illness (TI).

The diagnosis of the insured must be conducted by a registered medical practitioner.

To qualify for the TI benefit, the policyholder must be diagnosed with a terminal illness that is expected to result in death within a year.

NTUC Income reserves the right to appoint a medical practitioner to diagnose the insured.

TI benefit is not payable for any terminal illness that includes or results from HIV (Human Immunodeficiency Virus).

The policyholder doesn’t qualify for TI benefit if their claim arises from:

- Intentional or self-inflicted illnesses

- Intentional exposure to danger

- Use of drugs or alcoholic substances

- Suicide attempt

After the benefit is paid, the policy will be terminated.

Guaranteed Renewability Benefit

Your policy renews automatically on the expiry of your previous term if you don’t have any claim during that term.

The guaranteed renewability benefit remains valid up to the age of 84.

However, if your policy is not in multiple of 5 years, or if your renewable term’s expiry date exceeds the age of 84 (last birthday), the insurer will renew your policy for a shorter term (in multiples of 5 years) to keep in under age 84 (last birthday).

You’re not eligible for the renewability benefit if you reach or exceed the age of 84 (last birthday) because, in that case, your term will expire at the age of 85, which is beyond the coverage limit.

Optional Add-On Riders

Star Term Protect plan offers a variety of optional riders to enhance your coverage and get extra protection.

Hospital CashAid Rider

As the name implies, the Hospital CashAid rider helps policyholders pay their hospitalisation costs. Following are some key benefits of the Hospital CashAid rider:

Hospital Cash Benefit

Under this benefit, the insured is paid out the sum assured of the rider for each day of hospitalisation.

The benefit is valid for up to 750 days.

You don’t qualify for this benefit if you’re hospitalised before or within a month of the policy’s starting date.

Additional Intensive Care Unit Benefit

The Additional Intensive Care Unit benefit pays double the sum assured to the policyholder for each day in the ICU (Intensive Care Unit).

You will not qualify for this benefit in case of hospitalisation before or within a month of the policy’s starting date.

You’re not eligible for the ICU benefit if you have received Hospital Cash Benefit for 750 days in the same hospital you intend to get admitted into the ICU.

Recovery Benefit

The policyholder is paid an additional sum assured for each event of hospitalisation.

The benefit is unavailable for you before or within 30 days of the policy’s starting date.

Major Impact Benefit

Major impact benefit covers surgical procedures or unknown infectious diseases requiring you to be admitted into the ICU for 5 or more days in a single hospitalisation.

This benefit can only be availed once a policy year.

You’re not eligible for that benefit if you’re hospitalised before or within 90 days of your policy’s starting date.

Essential Protect Rider (CI Rider)

The Essential Protect Rider pays a lump sum to the insured in the event of death, a TPD (before age 70), a TI (Terminal Illness), or a specified CI covered:

Death due to dread diseases (angioplasty or other invasive coronary artery treatment are excluded) is covered by this rider.

This rider does not cover the major types of cancer, heart diseases, bypass surgery, and angioplasty if the insured is diagnosed within 3 months of the policy’s starting date.

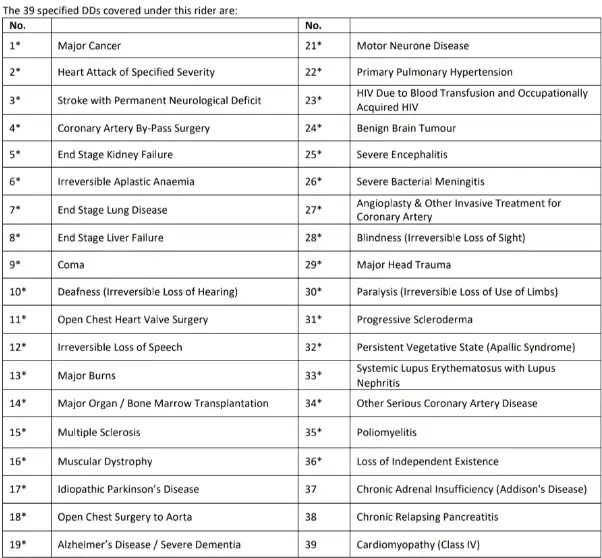

Total Protect Rider (ECI Rider)

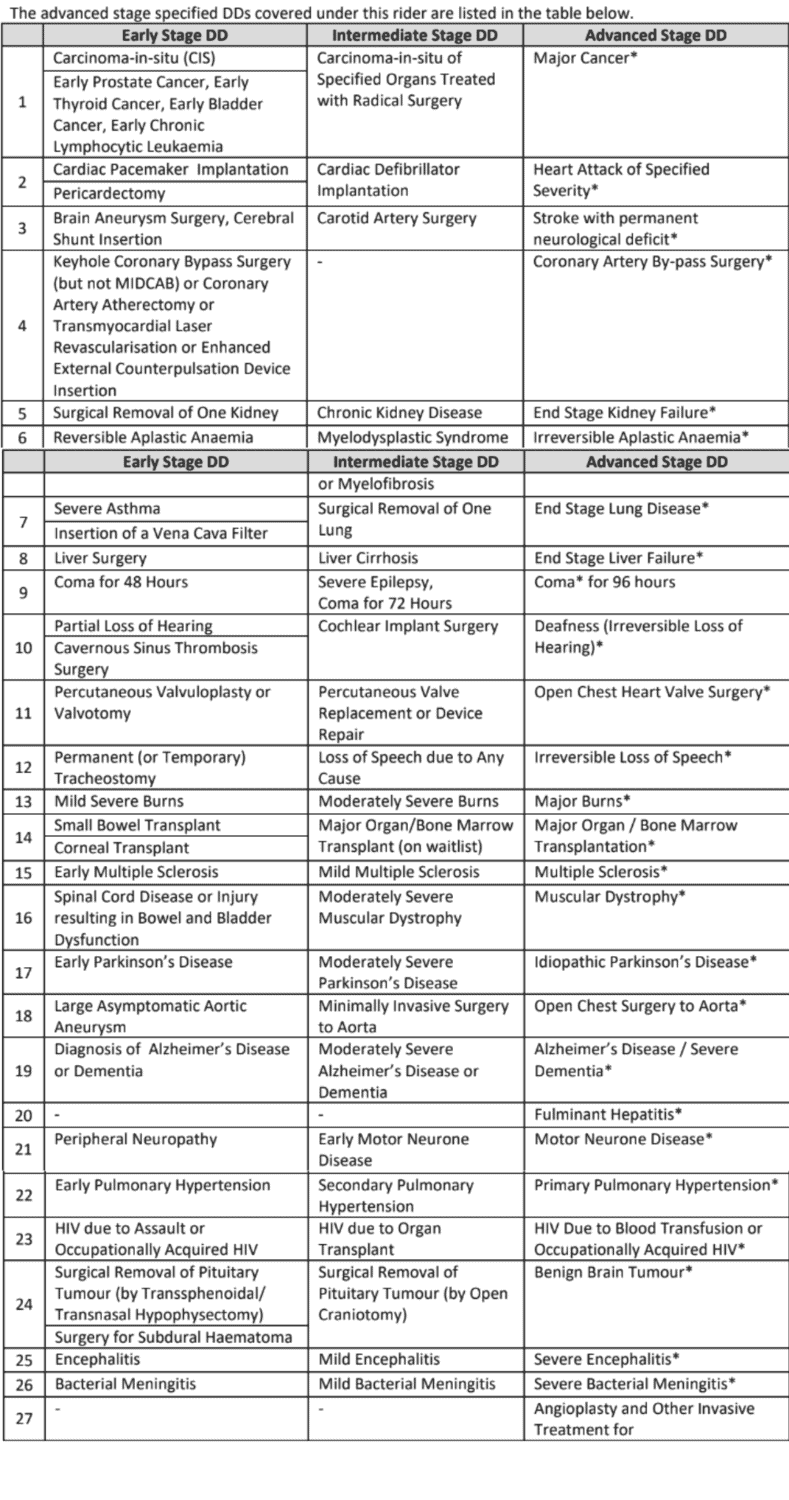

You’re eligible for total protection rider benefit on diagnosis for 105 specified dread diseases (excluding angioplasty or coronary artery invasive treatment).

It covers protection against early, intermediate, and advanced dread diseases.

Besides this, the Total Protect rider offers additional coverage for stroke coupled with permanent neurological impairment, major cancer, and heart attack.

Dread Diseases Benefit

During the diagnosis of Dread Diseases during the term, the rider’s sum assured will be paid.

Here are the conditions covered:

However, this excludes angioplasty and other coronary artery invasive treatment.

If you need treatment for the latter, 10% of the rider’s sum assured will be paid up to $25,000 and will only be payable once.

If you are diagnosed with early/intermediate specified DD, you get a one-time sum assured payout, reducing this benefit to zero.

Successful claim ends all benefits (except advanced restoration). Premiums stop, and advanced restoration benefits can be applied.

The maximum payout is S$350,000, and a 90-day waiting period for claims for critical illnesses.

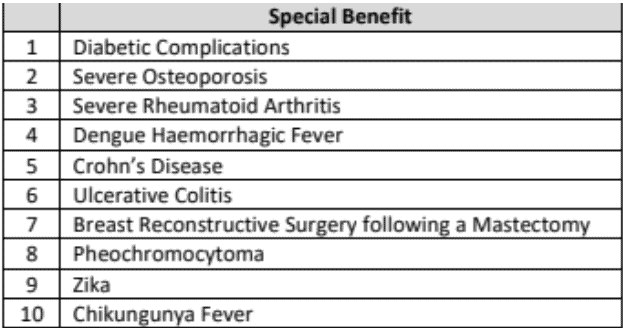

Special Benefit

Upon diagnosis or procedure before age 85, 30% of the rider’s sum assured is paid, with no reduction in the sum assured.

NTUC Income pays a maximum of S$30,000 per special benefit, with a limit of 5 claims for distinct medical conditions among the 10 covered:

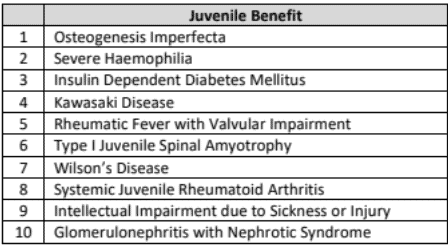

Juvenile Benefit

Upon diagnosis of a covered medical condition before age 18, 20% of the juvenile benefit rider’s sum assured will be paid.

Each claim under the juvenile benefit will not decrease the rider’s sum assured.

NTUC Income will reimburse a maximum of S$30,000 for each insured individual, regardless of the number of policies covering them.

A maximum of 5 claims can be made under the juvenile benefit as long as they are different conditions.

This benefit covers 10 specific medical conditions:

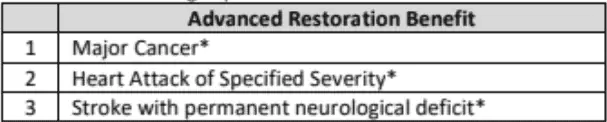

Advanced Restoration Benefit

If you are diagnosed with any of the specified advanced-stage DDs listed below, 50% of the rider’s sum assured will be paid.

A claim for this benefit is only valid if a successful claim has been made for the early and intermediate stage DD benefit and the rider is still in effect:

A waiting period of 24 months applies from the date of diagnosis or surgical procedure, whichever occurs first, for any of the early and intermediate stages specified DDs.

Additionally, a survival period of 7 days is required from the date of diagnosis or the medical procedure for the advanced stage specified DD.

Payor Premium Waiver

With this rider, you’re not required to make premium payments for the basic policy you purchased for a loved one if you pass away or become TPD (before age 70).

Enhanced Payor Premium Waiver

As the name suggests, it’s the enhanced form of payor premium waiver rider.

It covers your future premium payments for the basic policy you’ve purchased for a loved one if you pass away, become TPD (before age 70), or are diagnosed with a dread disease.

Angioplasty and coronary artery invasive treatment are not covered under this benefit.

Dread Disease Premium Waiver

Under this rider, your future premium payment for the basic insurance policy you’ve purchased for a loved one will be covered if you become a TPD (before age 70) or are diagnosed with a dread disease.

Angioplasty and coronary artery invasive treatment are not covered under this benefit.

Summary of NTUC Income’s Star Term Protect

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | Yes |

| Critical Illness | Yes, with rider |

| Early Critical Illness | Yes, with rider |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

My Review of the NTUC Income Star Term Protect

The NTUC Income Star Term Protect is a comprehensive and affordable term life insurance plan covering you for death, terminal illness, and total and permanent disability (TPD).

This is also appealing for individuals seeking robust life and ECI/CI coverage as it covers up to 105 early, intermediate, and late-stage critical illnesses for up to $350,000 – the highest in the market.

Moreover, the lower initial premiums make it a financially prudent option compared to other insurance policies.

If you aim to fortify your insurance coverage or address gaps in your insurance portfolio, NTUC Income Star Term Protect offers a suitable solution.

However, if your priorities lean towards aspects like long-term cash accumulation, consider the NTUC Income Star Secure Pro instead!

It gives you the best of both worlds, with coverage for up to 152 critical illness conditions while growing your capital.

However, that comes with more expensive premiums.

Otherwise, consider getting the NTUC Income Star Term Protect with an investment-linked policy to get insurance coverage while investing for retirement.

Of course, this is just my opinion and not advice for you.

In the end, it’s your coverage needs that matter the most. What’s for me might turn out wrong for you.

Do you need assistance in choosing the best term life insurance in Singapore suited for your goals?

You should talk to an unbiased financial advisor to get a second opinion and explore alternatives.