NTUC Income PA Assurance is a personal accident insurance policy designed to provide financial protection to insured persons and their families in case of death or injury resulting from accidents that occur during the policy period.

The amount of compensation paid out is subject to the terms and conditions of the specific plan chosen by the insured person, including any maximum benefit limits specified in the plan.

Here is a comprehensive review of NTUC Income PA Assurance.

Keep reading.

Criteria

To be eligible for NTUC Income PA Assurance, you must meet the following criteria:

- Hold a valid Singapore identification document.

- Be between 15 days old and 65 years old at the time of application.

- Living and working in Singapore and must not be away for more than 180 days at any 1 time.

It’s important to note that coverage under this policy can continue for individuals up to 75 years old, provided that the policy is still in force and all premiums are paid as required.

General Features

Premium Terms

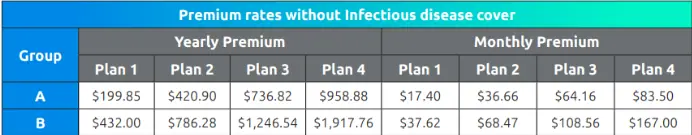

NTUC Income PA Assurance offers 4 plan types based on the nature of your profession or occupation.

Here are the 2 main groups:

Group A

- Professions or occupations of professionals, administrative, managerial, or clerical nature.

- Occupations of outdoor nature.

- Occupations involving light manual work without the use of tools or machinery.

Group B

- Professions or occupations involving manual work with the use of tools or machinery.

- Uniformed professions involving security or defence work.

- Occupations where the work environment is at a high altitude or of a hazardous nature.

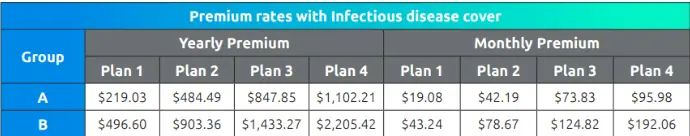

The above table is for plans without infectious disease cover, while the following shows you the premiums for the plans with it:

Please note that Plans 1 and 2 under NTUC Income PA Assurance only provide coverage for:

- Children under 18 years of age or

- Children under 25 years of age, unmarried, not in full-time employment, and primarily dependent on the policyholder for maintenance and support.

- Full-time students or national servicemen.

Every other demographic will have to choose from either Plan 3 or 4.

The premium for NTUC Income PA Assurance is non-guaranteed.

It’s important to note that this policy is not eligible for Medisave.

Policy Term

NTUC Income PA Assurance is a yearly renewable personal accident policy that can cover you until you’re 75 years old.

Protection

Accidental Death

Accidental Death coverage provides financial protection if the insured person is fatally injured in and passes away within 1 year of the accident.

The insurance policy pays 100% of the insured amount or plan amount as a lump sum, and the policy terminates.

Below is the maximum benefit payable for each plan.

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit | $100,000 | $250,000 | $500,000 | $1,000,000 |

This benefit is designed to provide financial support to the family or dependents of the insured person during a difficult and challenging time.

Permanent Disability Benefit

This benefit provides a payout to the insured in the event of permanent disability caused by an accident.

Below is the maximum benefit payable for each plan per policy year.

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit | $150,000 | $375,000 | $750,000 | $1,500,000 |

This benefit is designed to assist the insured in managing the financial consequences of their disability.

Medical Expenses Benefit

This feature helps cover medical expenses incurred if the insured person is injured and needs medical treatment.

The NTUC Income will cover the cost of your medical expenses, including doctor visits, hospitalisation, surgery, and other necessary medical care.

However, the total reimbursement amount is limited to the benefit amount specified in the plan as follows:

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit | $2,000 | $5,000 | $10,000 | $20,000 |

The benefit does not include charges for an ambulance, which are paid separately up to $200 per accident, irrespective of the plan type.

Complementary Medical Treatment Benefit

If you suffer an injury from an accident and need treatment by a chiropractor or a traditional Chinese medicine practitioner, this benefit comes into effect.

The reimbursement includes expenses for consultations, therapies, and other treatments related to the injury.

The total reimbursement amount is limited to the maximum benefit specified in the policy plan.

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit | $500 | $750 | $1,000 | $1,250 |

Daily Hospitalisation Income Benefit

This benefit provides a daily payout for each day you are hospitalised due to an accident.

The maximum number of days for which this benefit is payable per policy year is 365 days.

The daily amounts payable, depending on your plan, are as follows:

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit | $100 | $200 | $300 | $400 |

Weekly Income Benefit

This benefit is offered during the period you are recovering and may be unable to attend to your income-earning activities.

The maximum applicable period for each accident is 104 weeks in a row.

The amounts payable per week are as follows:

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit | $100 | $200 | $300 | $500 |

Emergency Medical Evacuation

This benefit applies when you are travelling, are injured in an accident, and require urgent medical evacuation.

Emergency medical evacuation typically involves transporting you to a medical facility where you can receive appropriate care.

The limit amount is set at $50,000 for any of the NTUC Income PA Assurance plans.

Mobility Aids and Home Modification Benefit

This component is designed to provide financial support if you are injured in an accident and require specific assistance and home modifications due to resulting disabilities.

Suppose your home needs to be modified physically or structurally to make it more accessible for you due to your injuries.

In that case, this benefit can also help cover your costs of those modifications.

| Plan Type | 1 | 2 | 3 | 4 |

| Maximum Benefit | $2,000 | $4,000 | $5,000 | $6,000 |

Physiotherapy And Counselling Benefit

This benefit is meant to provide financial assistance if you are injured in an accident and require physiotherapy for recovery.

The maximum amount payable for this benefit is capped at $1,000, $2,000, $3,000, and $5,000 for plans 1, 2, 3, and 4, respectively.

If you require counselling due to the accident trauma, this policy offers a separate benefit for Trauma counselling expenses capped at $5,000 for either of the plans.

Child Support Fund

This benefit pays out a lump sum in the event of the life assured’s death caused by an accident.

The lump sum is set at a maximum of $5,000, $15,000, $25,000, and $35,000 for plans 1, 2, 3, and 4 respectively.

Optional Add-on Benefits

Infectious Disease Cover

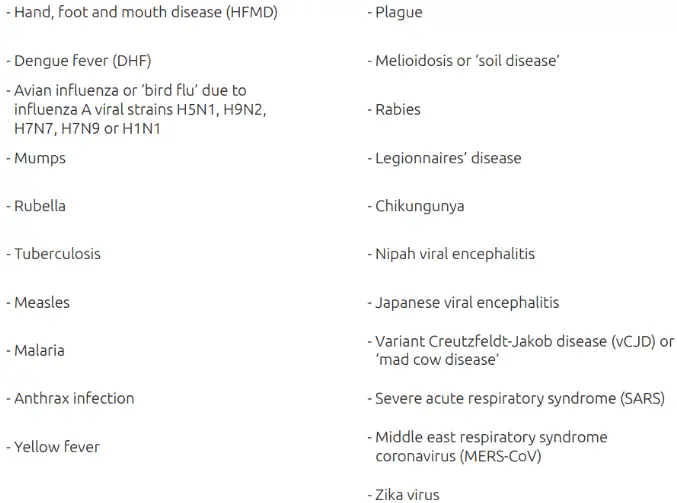

The Infectious Disease Cover in NTUC Income PA Assurance enhances your protection by adding coverage for 21 specific infectious diseases.

Adding this option to your policy can provide you with more comprehensive protection against various health risks.

Below is a list of covered infectious diseases:

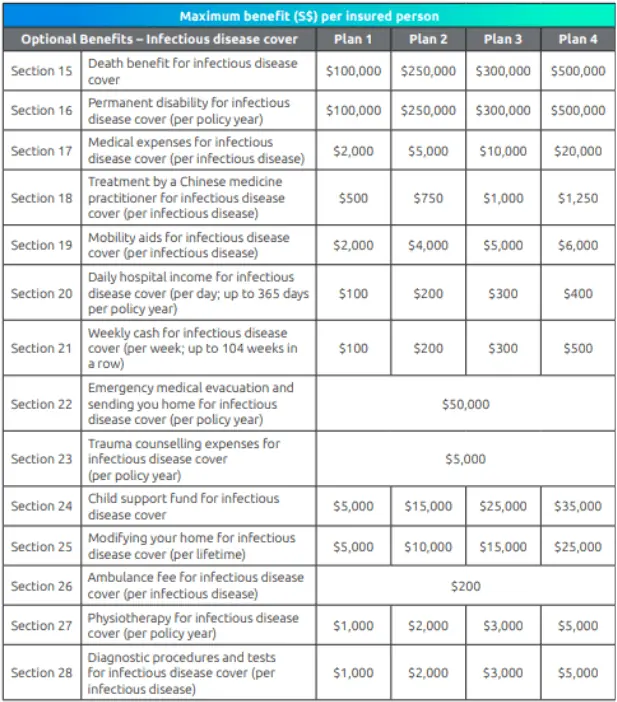

The table below highlights the increased coverage on each NTUC Income PA Assurance benefit when you choose to add the Infectious Disease Cover.

The amount payable varies with your chosen plan:

Summary of the NTUC Income PA Assurance

| Cash & Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawals | N/A |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | Available |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

My Review on NTUC Income PA Assurance

NTUC Income PA Assurance is a comprehensive personal accident insurance policy, especially for high-risk workers and manual labourers, designed to provide financial protection in case of accidents.

The NTUC Income PA Assurance offers coverage starting from $0.55 a day, making it accessible for you and your family to protect yourselves against the financial impact of accidents.

If you become permanently disabled due to an injury caused by an accident, NTUC Income’s PA Assurance provides a payout of up to $1,500,000.

This benefit can help you cope with the financial challenges associated with long-term disability.

In the unfortunate event of death due to an accident, the policy pays out up to $1,000,000.

‘Additionally, there’s a lump sum payment of up to $35,000 to support the educational needs of dependent children, offering peace of mind for the insured’s family.

The policy provides coverage for expenses related to physiotherapy and home modification arising from an accident.

This can be valuable in helping with recovery and adapting to lifestyle changes.

NTUC Income PA Assurance also offers the option to enhance your protection by adding coverage for 21 infectious diseases.

This is particularly relevant given the global health concerns surrounding infectious diseases.

Families can benefit from the policy as well.

Insuring your children under the same policy with either you or your spouse can lead to a 40% discount on your child’s premiums, allowing you to ensure the well-being of your entire family more affordably.

You get all these at a relatively affordable premium – making it a really attractive personal accident plan!

Overall, NTUC Income PA Assurance seems to offer a well-rounded package of benefits to address various accident-related scenarios, from medical costs and disability to support your family’s financial needs.

However, like other insurance policies, it is important to review the policy carefully to ensure it meets your specific needs and circumstances.

You can also read our post comparing the best personal accident insurance plans.

You should also consider getting a second opinion from an unbiased financial advisor to understand if the NTUC Income PA Assurance is good for you.