The NTUC Income Mortgage Term is a non-participating term insurance policy tailored to protect your home.

It accommodates the unique needs of homeowners by offering a reduced sum assured annually.

Practically speaking, as you continue repaying your mortgage loan, the sum assured value decreases accordingly, providing you with money to more manage your remaining debt.

But there’s more to this plan.

As we review this policy, we’ll understand these benefits in detail and how this policy can be a strategic part of your financial planning.

Keep reading.

Criteria

- Minimum Entry Age (Insured): 18 years

- Maximum Entry Age (Insured): 64 years

- Minimum Entry Age (Policyholder): 16 years

It is important to note that the policyholder has no entry age limit.

General Features

Premium Terms

The NTUC Income Mortgage Term requires paying premiums until 2 years before your chosen policy term ends.

Premium rates are guaranteed throughout the policy term.

Additionally, you can pay your premiums monthly, quarterly, half-yearly, or yearly.

Policy Term

When purchasing the NTUC Income Mortgage Term, the coverage period is up to the age of 84.

For example, if you purchase this policy at age 40, it could provide coverage for up to 44 years, assuming the policy term commitment is in force and consistently paid.

Additionally, you can adjust your policy term based on your loan liability.

The policy term can be modified between 5 and 35 years, up to a maximum coverage limit age of 84.

However, what’s important here is that you must pay premiums until 2 years before the end of your chosen policy term.

Protection

Death Benefit

The NTUC Income Mortgage Term insurance includes a death benefit.

Should the insured pass away during the policy term, their beneficiaries will receive the reduced sum assured, as stipulated in the policy terms.

Total and Permanent Disability (TPD) Benefit

If the insured is diagnosed with TPD before the mark of the insured’s 70th birthday, and the TPD occurs during the policy term, the reduced sum assured will be paid.

The policy ends once it has paid out.

The Total and Permanent Disability (TPD) benefit under this policy has criteria for different age groups:

- For those under 65 years of age, you must be unable to perform any job to qualify for the TPD benefit.

It won’t pay out if you can’t do the same job as before or a job that fits your education, training, or experience.

- For those aged between 65 and 70, you must have a severe disability to qualify for TPD benefits.

However, in cases of total physical loss, the policy will pay the benefit if you are under 70 years old.

To qualify for this benefit, a medical practitioner must confirm the permanent disability for at least 6 months.

Note that the total TPD benefit payable on a single life, inclusive of all policies issued by Income and by any other insurer, cannot exceed $6.5 million.

This limit does not include bonuses.

Terminal Illness Benefit

If, unfortunately, the insured is diagnosed with a terminal illness, which inevitably results in death within a 12-month period during the valid policy, the reduced sum assured will be paid out.

After this payout, the policy ends.

Optional Add-On Riders

The NTUC Income Mortgage Term allows you to enhance coverage by attaching additional riders to your base policy for an extra premium.

Essential Protect (LBV3) Rider

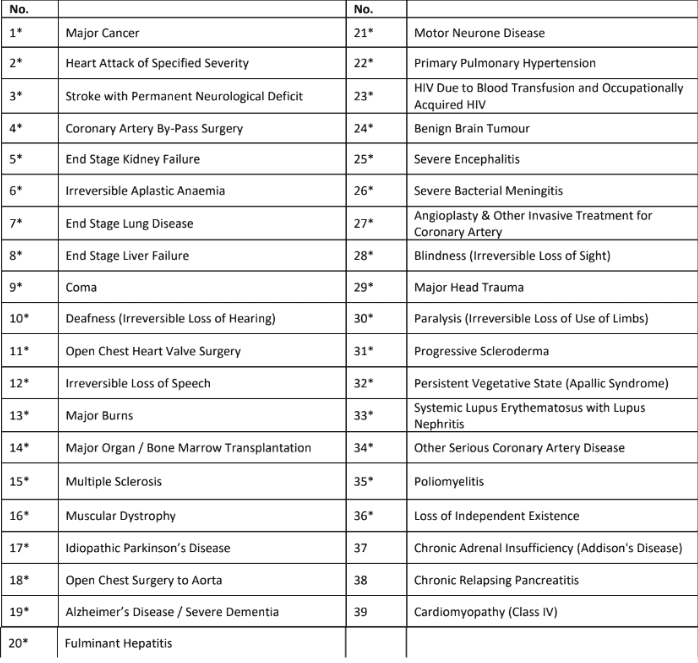

The Essential Protect Rider is a critical illness rider, giving you insurance coverage for when you’re struck with any of the covered 39 critical illness conditions.

However, this doesn’t include other invasive treatments for coronary artery and angioplasty.

Notably, the sum assured will be paid as a single lump sum, and the rider will end.

Suppose you need to undergo an angioplasty or any other invasive treatment for coronary artery disease during the duration of your rider.

In such an instance, you will be entitled to a one-time lump sum payment.

This payment will amount to 10% of the total sum assured by your rider, but it cannot exceed $25,000.

It’s crucial to remember that you can only claim this specific benefit once.

After you receive this payment, the total sum your rider assures will be reduced accordingly.

The following table shows the 39 specified dreaded diseases under the Essential Protect (LBV3) rider:

It also protects in the event of the insured’s death, TPD, and TI during the term of the rider, up to the age of 70.

The conditions to qualify for TPD are the same as those of the base cover.

Please note that if you are 65 years or older when the rider is due for renewal, NTUC Income won’t renew the rider.

Dread Disease Premium Waiver (WSV2) Rider

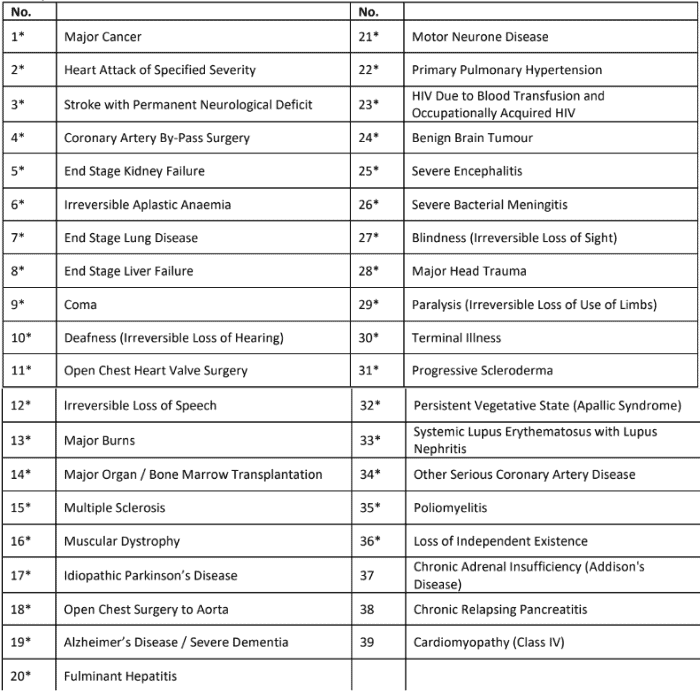

The Dread Disease Premium Waiver is a non-participating, regular premium rider designed to absolve you from future premium payments for your policy for the remaining duration of the rider in case of a diagnosis with a specified dread disease (DD).

The available age for this rider ranges from 2 years up to 84 years.

Importantly, note that the maximum entry age is 74, calculated from the last birthday, and the rider should not extend beyond the 84th birthday or the premium term of the policy, whichever comes first.

For optimal coverage, it is recommended to align the rider term with the premium term of the basic policy.

The specified dreaded diseases are shown in this table:

Payor Premium Waiver

With this rider, if the policyholder passes away or suffers from Total Permanent Disability (TPD) before reaching the age of 70 during the term of the rider, all future premiums for the basic policy will be waived.

However this waiver applies if the insured is not the policyholder.

What means is that the insured will not be required to pay future premiums.

Enhanced Payor Premium Waiver

If the policyholder unfortunately passes away, becomes Totally and Permanently Disabled (TPD) before reaching the age of 70, or is diagnosed with a dread disease (excluding other invasive treatment for coronary artery and angioplasty), during the term of this rider, all future premiums for the basic policy will be waived.

However, this waiver applies if the insured is not the policyholder. What means is that the insured will not be required to pay future premiums.

Key Features

Policy Surrender/Termination

You can surrender and terminate your policy at any time.

If you choose to end your policy before the next premium is due, the termination will take effect from the next premium due date.

After that, there will be no refunds for any unused premium.

Option To Choose Different Loan Interest Rates

With NTUC Income Mortgage Term policy, you can select from a range of loan interest rates, varying from 1% to 7%.

The flexibility will ensure that your mortgage facility can be covered, regardless of the interest rate changes or financial circumstances changes.

Summary of NTUC Income Mortgage Term

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Riders | |

|

Yes |

My Review of the NTUC Income Mortgage Term

The NTUC Income Mortgage Term policy is a fairly comprehensive mortgage plan designed to provide financial security for your mortgage loan.

You must pay premiums up to 2 years before your chosen policy term ends, and you have the flexibility to pay your premiums monthly, quarterly, half-yearly, or yearly.

You can adjust your policy term based on your loan liability, with the term modifiable anywhere between 5 and 35 years, up to a maximum coverage limit of until you’re 84 years old.

The policy provides robust coverage benefits, including death, Total Permanent Disability (TPD), and Terminal Illness (TI).

In addition, the policy offers several riders for maximised coverage.

This broad coverage ensures that you and your loved ones are protected financially in various difficult circumstances.

NTUC Income Mortgage Term appears reliable, and one cannot emphasise enough the flexibility this policy offers, especially for those looking to protect their mortgage loan.

However, as with any insurance policy, it’s crucial to seek a second opinion from an unbiased financial advisor who will help you review the terms and ensure it meets your specific needs.

This is a long-term policy, and it’s essential to weigh your options before you commit to it.

Get a free non-obligatory consultation here.