GREAT Golden Protector is a yearly renewable personal accident insurance plan designed for those aged 40 years up to 75 years old, providing coverage for injuries resulting from accidents.

The policy provides substantial coverage, but the exact coverage amounts, premiums, and policy terms would depend on the specific plan you choose and your individual circumstances.

Keep reading our review to see if the GREAT Golden Protector aligns with your protection needs.

Criteria

- Minimum age of 40

- Renewable annually until age 75.

- Must be a Singapore citizen or Permanent Resident.

General Features

Policy Term

The GREAT Golden Protector has a policy term of just 1 year, which is renewable annually until you turn 75.

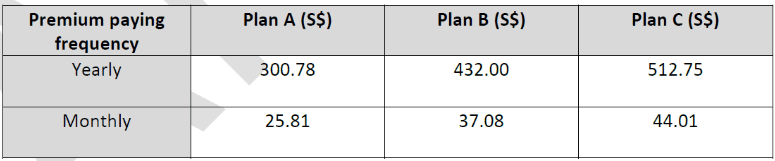

Premium Payment Terms

Below are the premiums for the different plans, payable monthly or yearly.

Also, the amount you pay might change when it’s time to renew your policy. However, in case of changes, you will be notified at least 30 days before your policy renewal.

It’s important to note that this policy is not eligible for MediSave payment.

Protection

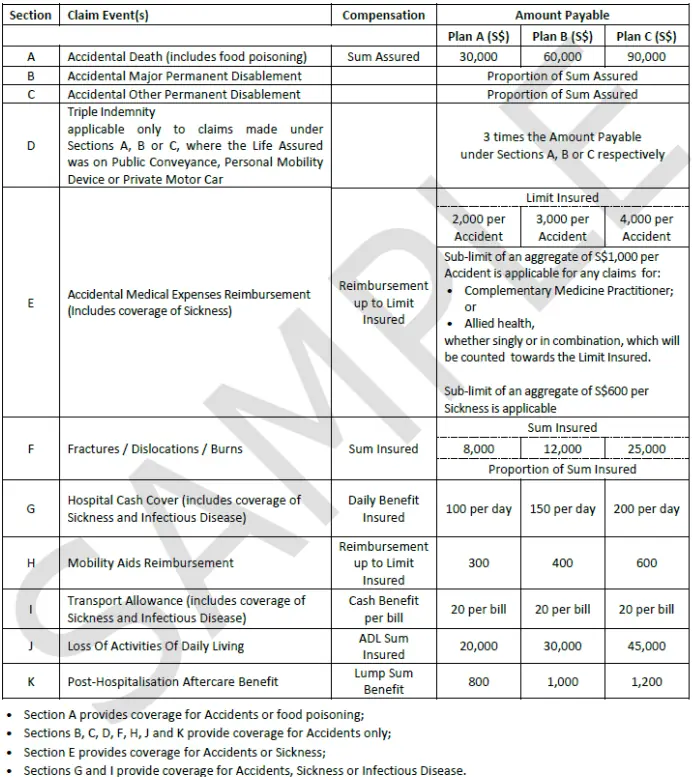

The policy provides benefits if you experience an injury due to an accident and it leads to any of the following claimable events within 365 days of the accident.

Here’s the table of compensation for other coverage types offered by Great Eastern’s GREAT Golden Protector:

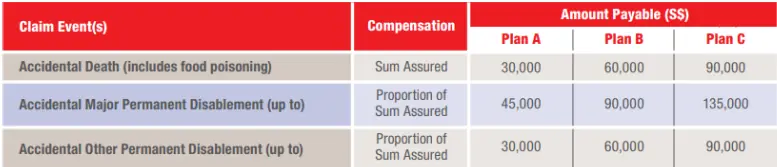

Accidental Death

Accidental Death coverage under the GREAT Golden Protector plan provides a lump sum payout equal to the sum assured specified for the chosen plan type.

The lump sum is set at $30,000, $60,000 and $90,000 for Plans A, B and C respectively.

This benefit applies if the insured passes on due to injuries sustained from an accident or food poisoning.

However, any benefits already paid out for Accidental Major Permanent Disablement or Accidental Other Permanent Disablement resulting from the same accident will be subtracted from this payout.

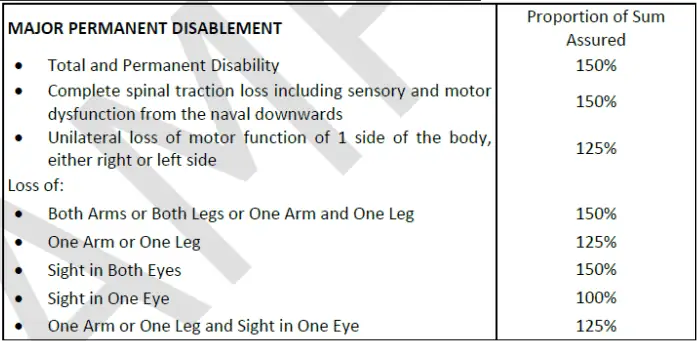

Accidental Major Permanent Disablement Benefit

This coverage under the GREAT Golden Protector provides a proportion payout depending on the plan type.

However, any benefit already paid out for Accidental Other Permanent Disablement resulting from the same accident will be subtracted from this payout.

This benefit is designed to provide financial support in the event of a significant and permanent disability resulting from an accident.

Below is a table used to determine the proportion of the sum assured to be paid out as the Accidental Major Permanent Disablement benefit:

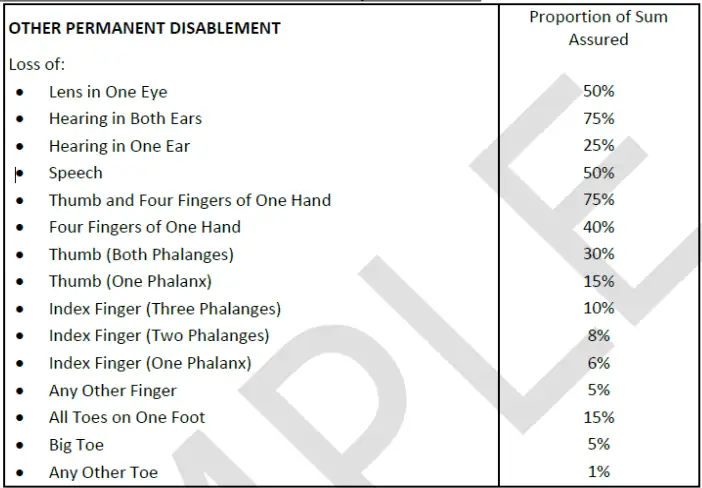

Accidental Other Permanent Disablement

Under the GREAT Golden Protector, Accidental Other Permanent Disabilities coverage provides a payout that is a portion of the selected plan type’s sum assured.

However, the total benefits payable under Accidental Death, Accidental Major Permanent Disablement, and Accidental Other Permanent Disablement combined shall not exceed 150% of the sum assured under Accidental Death.

Hence, the total compensation for these 3 benefits cannot exceed 1.5X the sum assured for Accidental Death coverage.

This benefit is intended to offer financial assistance in the event of a permanent disability resulting from an accident not classified as a “major” permanent disablement.

Triple Indemnity

Under the GREAT Golden Protector, the Triple Indemnity benefit triples the payable amount for a valid claim made under Accidental Death, Accidental Major Permanent Disablement, and Accidental Other Permanent Disablement.

This enhanced payout applies if the life assured sustains injuries from accidents while:

- On a public conveyance as a passenger.

- Acting as a rider or pedestrian involved in an accident related to a personal mobility device.

- Serving as a passenger or an authorised driver with a valid driver’s license in an accident involving a private motor car.

The amount payable under this Triple Indemnity benefit will not exceed:

- 300% of the sum assured for claims related to Accidental Death and Accidental Other Permanent Disablement.

- 450% of the sum assured for claims related to Accidental Major Permanent Disablement, considering any previous claims paid under Accidental Other Permanent Disablement.

Accidental Medical Expenses Reimbursement

The Accidental Medical Expenses Reimbursement benefit covers medical expenses incurred due to an accident.

The benefit amount for medical expenses is subject to the limit specified in the Compensation table, corresponding to your selected plan type.

The benefit payable for medical expenses, when combined with expenses covered by other sources like MediShield Life, other insurance policies, or employee benefit provisions, should not exceed the actual expenses incurred by the insured.

There are aggregate sub-limits for certain types of medical expenses.

For instance, for treatment by a Complementary Medicine Practitioner or Allied Health Professional, the sub-limit is $1,000 per accident. And, for treatment related to sickness (non-accident), the sub-limit is $600 per sickness.

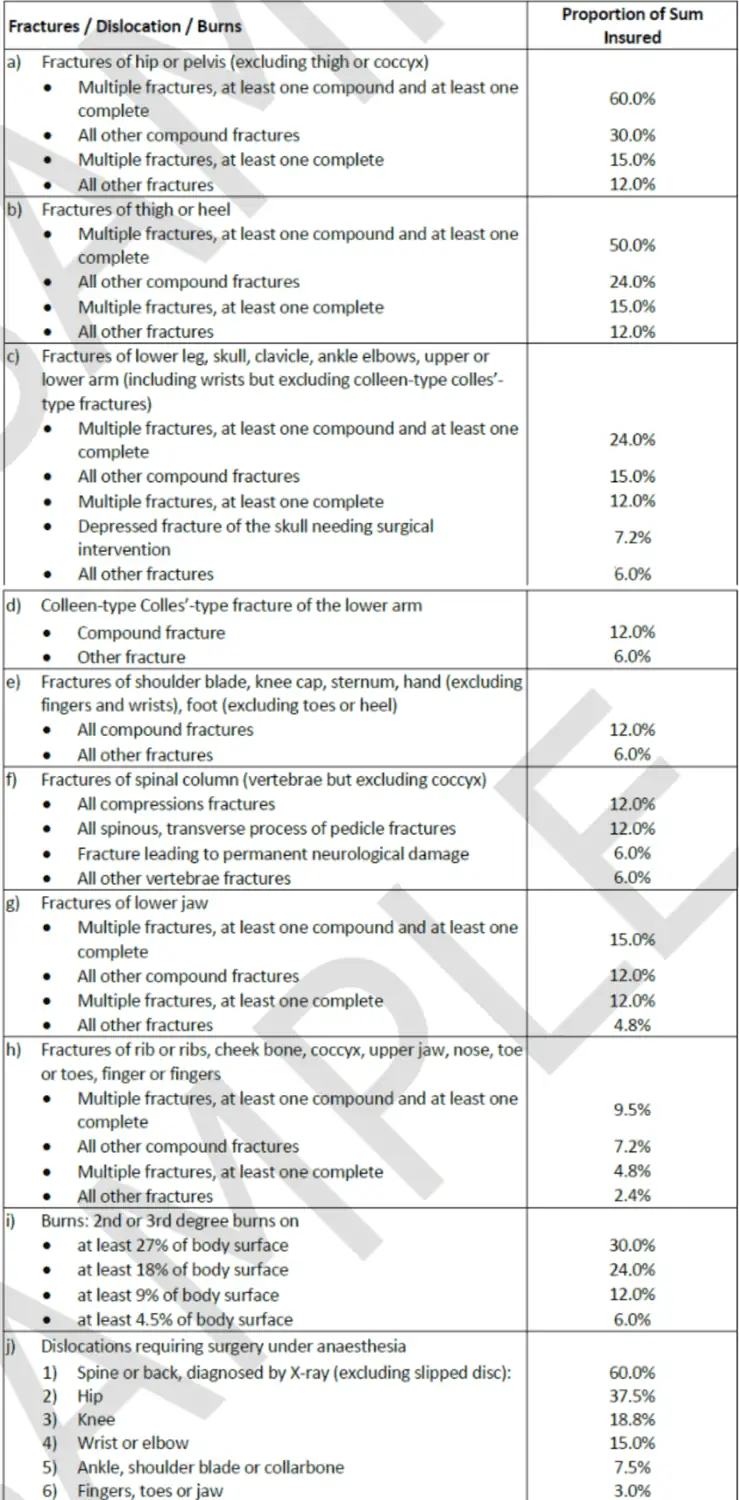

Fractures / Dislocation / Burns

The Fractures / Dislocation / Burns benefit covers specific types of injuries, including fractures, dislocations, and burns.

The benefit is provided as a proportion of the sum assured for each specific injury up to $25,000, depending on your plan.

To be eligible for this benefit, the injury must result from an unforeseen and involuntary event, independent of any illness or disease.

The benefit will only be paid if the claim event, which is the specific injury, occurs within 90 days from the date of the accident.

The table below shows the percentage compensation for Fractures / Dislocation / Burns:

Hospitalisation Cash Cover

The Hospital Cash Cover offers a daily cash payout for each day you are hospitalised.

The daily cash payment limit is set at $100, $150, and $200 for plans A, B and C respectively.

This payout aims to help cover the additional expenses associated with hospitalisation.

The benefit applies to hospitalisation due to the following circumstances:

- due to any Accident where you are hospitalised for a continuous period of 12 hours or more.

- due to Sickness or Infectious Disease including conditions like COVID-19 and dengue. However, no daily benefit is payable during the initial 30-day waiting period for such hospitalisation.

- for a medically necessary surgical procedure related to an Accident, Sickness, or Infectious Disease.

The maximum period for which the daily benefit is payable is typically set at 180 days for each hospitalisation event.

Mobility Aids Reimbursement

The Mobility Aids Reimbursement benefit provides coverage for the cost of mobility aids due to an Accident up to the limit specified in the policy.

The payment limit is set at $300, $400 and $600 for plans A, B, and C, respectively.

To qualify for reimbursement, the mobility aids must be prescribed by a medical practitioner as necessary to aid in the assured recovery or mobility.

Specifically, only the expenses incurred for the rental or purchase of an artificial leg will be reimbursed during the lifetime of the life assured.

This limitation applies not only to this policy but also to all other policies issued by the insurer for the same life assured that provides similar benefits.

Transport Allowance

This cash benefit is designed to help offset the costs related to transportation when receiving necessary medical care.

The benefit is limited to 1 bill per day, meaning that if you have multiple medical treatment bills on the same day, the benefit will apply to only one of them.

The maximum amount of the cash benefit per Accident, Sickness, or Infectious Disease is $20.

However, the insurer must deem the trip for medical treatment as medically necessary. This ensures that the benefit is provided for legitimate medical needs.

Provisional Cover

This Provisional Cover is put in place during the time between your application and the issuance of the full policy.

This period typically lasts until Great Eastern reviews your application and determines your eligibility.

While under Provisional Cover, you have some level of insurance protection.

Suppose an accident or sickness occurs during the Provisional Cover Period.

In that case, Great Eastern will consider paying benefits related to that only if the policy ends up being issued and the full annual premium is paid.

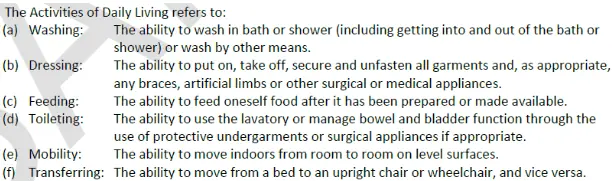

Loss Of Activities Of Daily Living

This benefit pays the sum insured if you experience permanent disability to the extent that you cannot independently perform 3 or more Activities of Daily Living (ADLs) for a continuous period of at least 6 months.

The permanent disability has to be certified by a medical practitioner,

ADLs typically refer to basic everyday tasks and functions that individuals normally perform independently, as described below:

Post-Hospitalisation Aftercare Benefit

The Post-Hospitalisation Aftercare Benefit in the policy provides a lump sum benefit if you are hospitalised due to an accident for 4 or more consecutive days.

This benefit is designed to support the insured person during the recovery period after a significant hospitalisation.

If there are multiple hospitalisations separated by less than 180 days, they will be considered as 1 continuous period of hospitalisation unless it was due to different accidents.

Summary of the Great Golden Protector

| Cash & Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawals | N/A |

| Health & Insurance Coverage | |

| Death | Available |

| TPD | Available |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health & Insurance Coverage Multiplier | |

| Death | N/A |

| TPD | N/A |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

My Review of Great Eastern’s GREAT Golden Protector

The Great Eastern GREAT Golden Protector is a good personal accident insurance plans for seniors in Singapore.

Once you hit your Golden Age, the GREAT Golden Protector plan is designed to offer financial protection to you in the occurrence of accidents and injuries for as low as $0.82 per day.

This helps you deal with unexpected medical expenses and other financial challenges that may arise from such incidents.

The coverage is renewable annually until you reach the age of 75.

This ensures flexibility and the option of maintaining insurance protection until you reach the maximum age of insurability.

In the event of an accident, this policy can provide you with financial support of up to $405,000 (135,000 with triple indemnity) to cover medical expenses, rehabilitation costs, and other related expenses, helping you focus on your recovery without worrying about the financial impact.

GREAT Golden Protector offers comprehensive post-accident benefits to provide you with financial peace of mind during your recovery. In the event of an accident, you are covered for up to $4,000 per accident.

And if you suffer from fractures, dislocations, or burns due to an accident, you can receive coverage of up to $25,000.

You can receive up to $1,000 for treatments by Complementary Medicine Practitioners or Allied Health professionals.

This benefit can be valuable if you require specialised treatments beyond traditional medical care.

You may also need continued care after being discharged from the hospital following an accident.

This policy provides a benefit of up to $1,200 to support your aftercare needs, ensuring you receive the necessary treatments and follow-up care.

The plan also provides a daily hospital cash benefit for various Infectious Diseases, including conditions like COVID-19 and dengue.

It also covers hospitalisation due to accidents and other illnesses. This benefit helps offset the financial burden associated with hospital stays.

In the unfortunate event of accidental death or permanent disablement due to an accident, the plan offers the possibility of receiving up to triple the payout.

Overall, Great Eastern’s GREAT Golden Protector lives up to its name; it offers great protection for those in their Golden Age and offers a wide range of coverage when it comes to aiding you financially in times of need.

As with any insurance policy, it’s crucial to carefully review the policy terms and conditions, including coverage limits, exclusions, and renewal provisions.

You may also want to compare this policy with others available in the market to ensure it aligns with your needs and budget.

However, the terms might be too technical for many.

I suggest talking to an unbiased financial advisor to get a second opinion and to make comparisons easier for you.