The Great Eastern Prestige PACare plan gives you a year of insurance coverage to provide financial protection in case of unforeseen accidents resulting in injury.

This plan covers accidental death, permanent disability, medical expenses, and emergency assistance. It’s a good package that gives you peace of mind.

Keep reading for a comprehensive review of Great Eastern’s Prestige PACare!

Criteria

- Age limit: 17 – 65 years

- Renewable yearly up to age 75

General Features

Premium Payment Terms

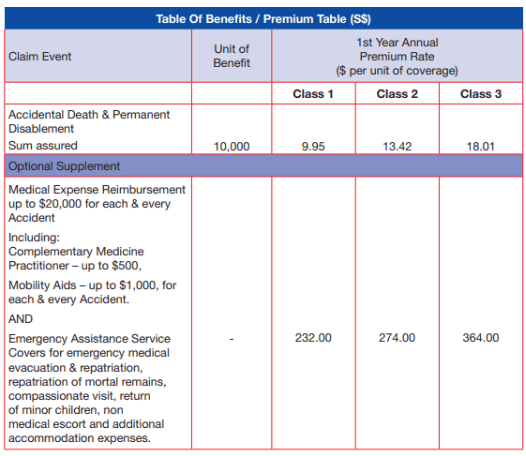

The premium rates are categorised depending on your current occupation or class, as shown in the following table:

| Class | Type of Job |

| Class 1 | Clerical, Administrative, Non-manual, Managerial, or Professional |

| Class 2 | Supervisors and those in non-Class 1 roles, who do not work with machinery or face special hazards, fall under a unique category. This group also includes sales personnel and other professionals who frequently travel. |

| Class 3 | Employees who engage in manual labour as long as it’s not hazardous. However, it may involve the use of machinery as well as tools. |

Below is a summary table of premiums payable annually against each claim or benefit under 3 coverage classes:

You can enjoy a 5% renewal discount on the premiums from the 2nd year onwards.

Policy Term

This plan is a yearly personal accident insurance plan. As long as you fall between the ages of 17 to 65, you can enjoy the comprehensive protection provided by the plan.

Furthermore, you can renew the plan annually until you reach the age of 75, ensuring continued coverage for an extended period.

Protection

If you have the Great Eastern Prestige PACare, you’ll get the financial help you need if you’re injured in a major accident.

It’s important to note that the benefits can be reduced by half (50%) if you suffer the claim event while;

- Serving under the Policy or Military service

- Motorcycling

- Sports coaching

Generally, these are considered high-risk activities.

These benefits will be paid within a year of the accident, and they cover the following events that can result in a claim:

Accidental Death

If the insured dies due to an accident, the beneficiaries will be paid the sum assured.

Note that any benefits already paid for permanent disability resulting from the same accident will be deducted from the sum assured.

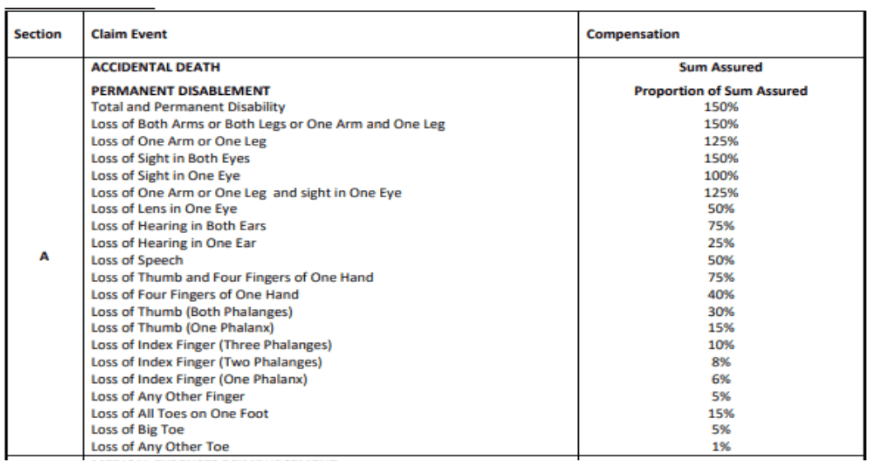

Permanent Disablement

In case of permanent disability caused by an accident, the insured person will receive a proportion of up to, but not exceeding, 150% of the insured amount.

This applies to all claim events resulting from accidents that occur during the insured person’s lifetime.

Here’s the table of compensation for accidental death and permanent disablement:

Optional Add-On Riders

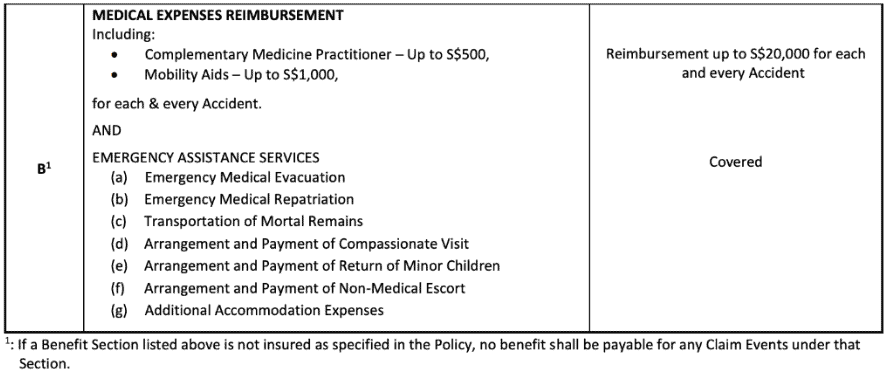

There is one rider available, and the rider provides both Medical Expenses Reimbursement and Emergency Assistance Services below.

Although this is optional, it’s what makes the Great Eastern Prestige PACare. The basic insurance features are well… basic.

Medical Expenses Reimbursement

In the event of an accident that leaves the insured person injured, the policyholder will be reimbursed for the medical expenses they incur up to the limits below:

Only the policyholder will be reimbursed, no direct payments will be made to hospitals, doctors, or other medical providers for treatment.

The total amount paid out under this policy, including reimbursement of medical expenses from other sources such as MediShield, other insurance policies, and employee benefits, must not exceed the actual expenses incurred for any claim made under this policy.

Complementary Medicine Reimbursement

For injuries sustained in an accident, the Great Eastern Prestige PACare will reimburse medical expenses incurred through any Complementary Medicine Practitioner.

This covers registered TCM and chiropractor practitioners.

The medical expense must be for the reasonable and necessary medical treatment provided to you.

It’s important to note that this reimbursement is subject to a limit of not more than S$500 for each accident.

This reimbursement is also part of this policy’s overall limit for Medical Expense Reimbursement.

Mobility Aids Reimbursement

In the unfortunate event of an accident that results in the policyholder requiring mobility aids, the Great Eastern Prestige PACare provides reimbursement for the medical expenses incurred for any physician-prescribed mobility aids.

Note that this reimbursement is subject to a limit of not more than S$1,000 for each accident and forms part of the overall limit for Medical Expense Reimbursement.

Emergency Assistance Services

These services are offered when the insured experiences a severe injury or sudden illness or requires urgent medical, legal, or administrative help while travelling outside their home country or country of residence.

In such cases, the emergency assistance services tabulated below will be arranged and covered:

| Emergency Assistance Service | Coverage | Sub-Limit |

| Medical Evacuation | Transportation to the closest hospital, especially when health conditions are very bad. | US$1,000,000 |

| Medical Repatriation | Bringing the person back to their home country after being evacuated to another country for medical treatment. | |

| Mortal Remains Repatriation | Transportation of the deceased person’s body from where they passed away to their home country. | |

| Compassionate Visit | Arrange and cover the cost of a round-trip economy class flight for a family member or friend of the person who has been hospitalised in a different country, and the hospitalisation exceeds 7 consecutive days. | US$10,000 |

| Return of A Minor | Cover for up to 3 one-way economy class flights, including pickup to and from the airport to bring a minor child back to their home country | |

| Non-Medical Escort | If there is an emergency medical evacuation, and minor children (below 10 years old) are left without supervision, the plan will cover the expenses for one round-trip economy class flight for a relative to accompany the minor back to their home country. | |

| Excess Accommodation Expenses | Cost of hotel accommodation for a relative or friend who is visiting the person hospitalised outside their home country or their usual country of residence. |

Note that this assistance will not be given if the trip was undertaken against the advice of a physician or for the purpose of intentionally obtaining any medical or surgical treatment abroad.

Key Features

Terrorist Attack Benefits

If a claim event happens due to a terrorist attack, the maximum amount you can receive from this policy is S$2,000,000.

This applies to both the main insurance policy and any additional coverage related to accidents for the same person.

Renewable Privileges

As long as you’re between 17 and 65 years old on your next birthday, you can keep enjoying the great coverage from Prestige PACare.

You can renew it every year until you reach 75 years old

Extensive 24-hour Global Protection

Wherever you are in the world, day or night, if something goes wrong and you need medical help, legal advice, or any kind of assistance when you’re away from home for work or fun, Great Eastern’s Prestige PACare has got your back.

Prestige PACare can arrange for the help you need and even cover the costs, so you don’t have to worry about being too far from support when you’re abroad.

How Great Eastern’s Prestige PACare works

Peter, a management consultant, has a Great Eastern Prestige PACare policy. The policy covers S$1,000,000, and Peter pays S$1,325 as the yearly premium for the insurance.

While on a business trip in Germany, Peter has an accident that causes a head injury and leaves him paralysed.

Because of his Prestige PACare policy, Peter’s family receives a lump sum payment of up to S$1,000,000.

This money is meant to help support them financially since Peter can no longer work and provide for them.

In addition to the lump sum payment, Peter’s family is also reimbursed up to S$20,000 for his medical expenses related to the accident.

Even though Peter’s life has changed due to the accident, and he can no longer work, the large payout from the policy helps cover the costs of his ongoing care and living arrangements.

This ensures that his family will be taken care of during this challenging time.

Summary of Great Eastern’s Prestige PACare

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal Benefits | No |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | Yes |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

My Review of Great Eastern’s Prestige PACare

Great Eastern’s Prestige PACare is a great personal accident insurance plan for individuals seeking financial security and protection against accidents.

As long as you are between 17 and 65 years of age on your next birthday, you are eligible for this insurance plan.

Additionally, you can renew your coverage until you reach the age of 75, thus ensuring you have ongoing protection for a long time.

It offers coverage of up to S$3.5 million in case of death or permanent disability, and you can customise the plan to fit your specific needs and budget.

The plan also includes services such as reimbursement for medical expenses (up to $20,000) and non-medical escort assistance.

With this comprehensive package, you can have peace of mind, knowing that any unexpected financial burdens arising from emergencies and accidents will be taken care of.

Even better – renewing your policy can help you save! You’ll receive a 5% discount on your premiums from the second year onwards if you renew your policy.

Whether you’re travelling abroad for work or leisure, knowing that help is not too far away is always comforting.

If you ever need emergency medical, legal, or administrative assistance outside your home country, Prestige PACare can assist you in getting the necessary help and cover the expenses.

While the Great Eastern Prestige PACare could be suitable for your protection needs, it’s important to consider that other insurance plans may offer features and benefits more relevant to your needs and are potentially more budget-friendly.

It’s worth exploring different options and comparing various personal accident plans to ensure you find the best fit for your specific requirements.

You may wish to consult with a financial advisor or get a second opinion to understand if this policy is best for you.