Are you planning a trip and worried about potential mishaps or emergencies?

Travel insurance can provide you with peace of mind and financial protection in case of unforeseen events.

However, with so many travel insurance options available, it can be overwhelming to choose the right one for your needs.

That’s where FWD travel insurance comes in.

FWD travel insurance is a reputable and trusted provider that offers comprehensive coverage for travellers.

Whether you’re going on a short weekend getaway or a long international trip, FWD travel insurance has plans that can cater to your specific needs.

In this post, we will review the features, benefits, and drawbacks of FWD travel insurance to help you make an informed decision about your travel insurance provider.

By the end of this review, you’ll have a clear understanding of whether FWD travel insurance is the right choice for your upcoming adventures.

So, let’s dive in and explore the ins and outs of FWD’s travel insurance.

Key Features of FWD Travel Insurance Plans

- FWD Travel Insurance plans offer travel insurance for both single and annual trips

- There are 3 different tiers of plans that cater to different needs – Premium, Business, and First

- You can purchase FWD Travel Insurance plans for yourself (an individual), a couple, a family, and a group* of people

- You can conveniently pay for your policy easily with PayNow, GrabPay, or credit card/debit card (Visa and Mastercard)

- You can purchase your policy up to 180 days in advance

- FWD allows you to do cashless medical outpatient claims at Singapore panel clinics and worldwide emergency assistance with the FWD SG App

*Not available for annual trips

My Review of FWD Travel Insurance Plans

In this section, the insurers that we’re pitting FWD against are

- AIG Travel Guard Direct

- AIA Around the World Plus (II)

- Allianz Travel Bronze

- Klook TravelCare

- MSIG TravelEasy

- NTUC Income Travel Insurance

- Sompo Travel (COVID-19) Insurance

- Singlife Travel Insurance

- Etiqa TIQ Travel Insurance (with COVID-19 cover)

We also took only some of the more notable benefits for comparison.

The basis for this comparison will be on the coverage for an individual travelling to ASEAN for a week and the lowest-tiered plan across all insurers. There will also be an add-on for COVID-19 benefits.

Travel Insurance Plan | Total Premium | Overseas Medical Expenses | Accidental Death and TPD | Overseas Travel Delay ($100 for every 6 hours) | Trip Cancellation (death, illness, and natural disaster) | Baggage Delay ($200 every 6 hours) | Baggage Loss/Damage | Cost-to-Benefit Ratio |

AIG Travel Guard Direct Basic | $83.00 | $50,000 | NA | $200 | $2,500 | NA | $3000 | 671.08 |

Singlife Travel Insurance Lite | $49.36 | $250,000 | $50,000 | $500 | $5,000 | $500 | $3,000 | 6260.13 |

AIA Around the World Plus (II) Classic | $55.45 | $200,000 | $150,000 | $1,000 | $5,000 | $1,000 | $3,000 | 6492.34 |

Allianz Travel Bronze | $36.96 | $200,000 | $50,000 | $500 | $5,000 | $500 | NA | 6926.40 |

Sompo Travel (COVID-19) Insurance Essential | $48.00 | $200,000 | $200,000 | $800 | $5,000 | $1,200 | $1,000 | 8500 |

FWD Travel Insurance Premium + COVID-19 Enhanced Travel Benefits | $32.40 + $12.44 = $44.84 | $200,000 | $200,000 | $300 | $7,500 | $150 | $3,000 | 9168.15 |

NTUC Income Travel Insurance Classic | $36.60 | $250,000 | $100,000 | $1,000 | $5,000 | $1,000 | $3,000 | 9836.07 |

MSIG TravelEasy Standard | $37.20 | $250,000 | $150,000 | $500 | $5,000 | $600 | $3,000 | 10997.31 |

Etiqa TIQ Travel Insurance Entry (with COVID-19 cover) | $34.20 | $200,000 | $200,000 | $300 | $5,000 | $200 | $2,000 | 11915.20 |

Klook TravelCare Lite | $27.65 | $150,000 | $200,000 | $400 | $5,000 | $400 | $3,000 | 12976.49 |

In terms of cost-benefit ratio evaluation, you can see that FWD Travel Insurance is right smack in the middle for single trips.

So, it’s safe to say that they’re pretty average.

The only notable highlight is its highest trip cancellation benefit of $7,500 amongst the rest. It also has one of the top benefit limit amounts for Accidental Death and TPD and baggage loss/damage benefits.

Your best bet is to wait for any promo codes that do occasionally appear on their website, which helps you offset the total cost of the premium so that their travel insurance plans will be more value for money.

Next up, let’s compare the insurers for annual trips. (We’ve removed Sompo Travel Insurance here because they do not offer travel insurance for annual trips.)

The basis for this comparison will be on the coverage for a single individual travelling to ASEAN for an annual trip and the lowest-tiered plan across all insurers.

Travel Insurance Plan | Total Premium | Overseas Medical Expenses | Accidental Death and TPD | Overseas Travel Delay ($100 for every 6 hours) | Trip Cancellation (death, illness, and natural disaster) | Baggage Delay ($200 every 6 hours) | Baggage Loss/Damage | Cost-to-Benefit Ratio |

AIG Travel Guard Direct Basic | $554.00 | $50,000 | NA | $200 | $2,500 | NA | $3000 | 100.54 |

Allianz Travel Bronze | $570.60 | $200,000 | $50,000 | $500 | $5,000 | $500 | NA | 448.65 |

NTUC Income Travel Insurance Classic | $495.90 | $250,000 | $100,000 | $1,000 | $5,000 | $1,000 | $3,000 | 725.95 |

Singlife Travel Insurance Lite | $460.00 | $250,000 | $50,000 | $500 | $5,000 | $500 | $3,000 | 769.57 |

AIA Around the World Plus (II) Classic | $460.50 | $200,000 | $150,000 | $1,000 | $5,000 | $1,000 | $3,000 | 781.76 |

MSIG TravelEasy Standard | $447.20 | $250,000 | $150,000 | $500 | $5,000 | $600 | $3,000 | 914.80 |

Etiqa TIQ Travel Insurance Entry (with COVID-19 cover) | $369.00 | $200,000 | $200,000 | $300 | $5,000 | $200 | $2,000 | 1104.34 |

FWD Travel Insurance Premium + COVID-19 Enhanced Travel Benefits | $259.55 + $37.54 = $351.88 | $200,000 | $200,000 | $300 | $7,500 | $150 | $3,000 | 1168.29 |

Well, in the case of annual trips, it’s a different story entirely!

It ranks first on the cost-to-benefit scale, offering the most value benefits at the cheapest premium.

What’s even better is that you’re already putting aside expenses for your long trip, so why wouldn’t you want a travel insurance plan that will be a bang for your buck?

And again, the same rules apply, if FWD does release promo codes that help you save a little more money, be sure to apply them at checkout.

Overall, my review of the FWD Travel Insurance plans is that they are a great option for anyone looking for travel insurance for their next trip.

They cover all the basics – from overseas medical coverage to travel disruptions and inconveniences.

But what sets them apart from the rest?

For starters, they have some great value-for-money plans, especially for annual trips.

Plus, it has some pretty notable add-ons you can supplement your plans with, such as relatively good sports equipment and pet care coverage – which is rarely seen in other insurance plans.

Not to mention, they have 3 plan tiers that can cater to different travellers’ needs, and you are also given the option to purchase this plan 180 days (i.e. 6 months) before the intended trip, which gives you enough time for consideration.

But of course, if you’re simply looking for the cheapest travel insurance plans, their premiums may not be the most suitable for you.

They also have subpar overseas medical coverage compared to other insurance plans like Singlife Travel Insurance or MSIG TravelEasy, which is an important factor in travel insurance.

Since there is no plan that is 100% perfect, it’s always wise to do your own research online and review your individual travel situation before you make your decision.

We recommend starting off by checking our posts below:

Criteria

- You must be at least 16 years old

- You hold a valid Singapore identification document

- NRIC, employment pass, work permit, long-term visit pass or student pass is accepted

Premium Rates

These premium rates are based on trips to ASEAN for a week.

| Premium | Business | First | |

| Individual | $32.40 | $46.80 | $58.80 |

| Couple | $64.80 | $93.60 | $117.6 |

| Family (2 adults and 1 child) | $74.20 | $107.17 | $134.65 |

| Group (4 people) | $129.60 | $187.20 | $235.20 |

These premium rates are based on an annual trip to ASEAN.

| Premium | Business | First | |

| Individual | $259.55 | $369.75 | $407.45 |

| Couple | $519.10 | $739.50 | $814.90 |

| Family (2 adults and 1 child) | $594.37 | $846.73 | $933.06 |

Benefits at a Glance

| Premium | Business | First | |

| Overseas Medical Expenses Benefit | |||

| Adults below 70 years old | $200,000 | $500,000 | $1,000,000 |

| Adults 70 years or older | $40,000 | $100,000 | $200,000 |

| Dental expenses (caused by Accident) sub-limit | $2,000 | $5,000 | $5,000 |

| Overall limit for Family Plans | $500,000 | $1,250,000 | $2,500,000 |

| Child < 21 years old and covered under Family Plans | $60,000 | $150,000 | $300,000 |

| Mobility aids sub-limit | NA | $500 | $1,000 |

| Medical Expenses Benefit (after returning to Singapore) | |||

| Adults 70 years or older | $6,000 | $15,000 | $30,000 |

| Dental expenses (caused by Accident) sub-limit | $1,200 | $3,000 | $6,000 |

| Overall limit for Family Plans | $2,000 | $5,000 | $5,000 |

| Child < 21 years old and covered under Family Plans | $15,000 | $37,500 | $75,000 |

| Mobility aids sub-limit | $1,800 | $4,500 | $9,000 |

| Adults 70 years or older | NA | $500 | $1,000 |

| Death or permanent disability caused by accident that occurred whilst overseas | |||

| Adults below 70 years old | $200,000 | $300,000 | $400,000 |

| Adults 70 years old or older | $40,000 | $60,000 | $80,000 |

| Overall limit for Family Plans (depends on the severity of the disability suffered) | $500,000 | $750,000 | $1,000,000 |

| Child younger than 21 and covered under Family Plans | $60,000 | $90,000 | $120,000 |

| Daily hospitalisation income | |||

| Daily hospitalisation income ($200 per day if hospitalised overseas) | $5,000 | $8,000 | $10,000 |

| Daily hospitalisation income ($100 per day if hospitalised in Singapore, x2 if hospitalised in intensive care or in quarantine) | $1,000 | $1,200 | $1,500 |

| Chinese medicine, physiotherapist and chiropractor expenses benefit | |||

| Chinese medicine, physiotherapist, and chiropractor ($50 per visit) | $300 | $500 | $500 |

| Other benefits | |||

| Liability for harm or damage you accidentally cause | $500,000 | $750,000 | $1,000,000 |

| Fraudulent personal credit card usage | $300 | $600 | $1,000 |

| Worldwide emergency assistance | |||

| 24-hour emergency assistance | √ | ||

| Emergency medical evacuation & repatriation | Unlimited | ||

| Emergency phone charges | $200 | $300 | $400 |

| Travel disruption coverage (You can only claim either of these benefits ONCE, whichever is the highest amount) | |||

| Trip cancelled before you leave Singapore (and loss of deposit) | $7,500 | $10,000 | $15,000 |

| Trip cancelled before you leave for Singapore for Family Plans | $18,750 | $25,000 | $37,500 |

| Trip postponed before you leave Singapore | $500 | $1,000 | $1,500 |

| Trip cut short after you have left Singapore | $5,000 | $10,000 | $15,000 |

| Trip cut short after you have left for Family Plans | $12,500 | $25,000 | $37,500 |

| Trip disruption | $1,000 | $2,000 | $3,000 |

| Insolvency protection | $1,000 | $3,000 | $5,000 |

| Automatic policy extension | 7 days | 14 days | 21 days |

| Travel inconveniences | |||

| Baggage delay ($150 for every 6 hours of delay overseas and $150 after 6 hours of delay in Singapore) | $150 | $600 | $900 |

| Travel delay ($100 for every 6 hours of delay overseas and $100 after 6 hours of delay in Singapore) | $300 | $500 | $1,000 |

| Missed connections ($100 for every 6 hours you are stranded) | $300 | $500 | $500 |

| Trip diversion ($100 for every 6 hours you are diverted overseas) | $500 | $1,000 | $1,500 |

| Loss of passport, travel documents & theft of money | $300 | $600 | $1,000 |

| Payment of rental car excess if you have an accident | NA | $500 | $1,000 |

| Theft or damage to your personal belongings | |||

| Overall Limit for Theft of or damage to your personal belongings | $3,000 | $5,000 | $7,500 |

| Sub-limit for 1 laptop/tablet | $1,000 | $1,000 | $1,000 |

| Sub-limit for 1 mobile phone | $300 | $500 | $500 |

| Sub-limit for jewellery (in total) | $300 | $500 | $500 |

| Sub-limit for all other items (per item) | $300 | $500 | $500 |

| Overall limit for Family Plans for theft or damage to personal belongings | $7,500 | $12,500 | $18,750 |

| Emergency family travel benefit | |||

| Flying a loved one to your side if you hospitalised | $5,000 | $7,500 | $10,000 |

| Flying your child home if you are hospitalised or deceased | $5,000 | $7,500 | $10,000 |

| Flying a loved one to repatriate your remains if you die | $5,000 | $7,500 | $10,000 |

Benefits Explained

Overseas Medical Expenses Benefit

What is covered:

This standard coverage is offered in all travel insurance plans in Singapore.

This benefit is paid out if you suffer an unexpected illness/injury and need necessary medical treatment because of it.

The benefit is also paid for a period of up to 30 days from the first date of the treatment and the following:

- Dental treatment (only if medically necessary to treat injury caused by accident)

- Reasonable costs of ambulance transportation

- Treatment by a medical specialist but only if referred by a general practitioner (not required in an emergency)

- Mobility aids (not including prosthesis)

- Medical equipment to aid recovery

What is not covered:

- Dental treatment due to tooth/gum/oral diseases or from normal teeth-wearing

- Dental expenses related to non-natural teeth, such as dentures, bridges, implants, fillings, and crowns

Medical Expenses Benefit (while in Singapore)

What is covered:

Same as Overseas Medical Expenses Benefit, only difference is if:

- you have received medical treatment overseas for the same illness or injury that is being treated in Singapore or

- you seek medical treatment within 48 hours of returning to Singapore for the illness or injury suffered overseas

What is not covered:

Same as Overseas Medical Expenses Benefit.

Trip Cancellation and Loss of Deposit

What is covered:

This benefit is paid when the entire trip has to be cancelled or if there is a change to the travel companion who is travelling with you due to any of these events happening within 30 days before the scheduled departure date:

- You or your travel companion suffers a serious injury or illness and is medically unfit to travel as confirmed by a medical practitioner in writing

- You, your travel companion, or your family member dies

- Your family member suffers a life-threatening illness or injury as confirmed by a medical practitioner in writing

- You or your travel companion needs to be a witness in court during your scheduled period of travel

- You or your travel companion’s home is seriously damaged by fire or natural disaster, and as a result, you cannot travel or have to cut short your trip

- A serious public event happens in Singapore or at 1 of your travel destinations, which prevents you from starting or continuing your trip

- Your onward flight is cancelled by the airline due to airport, runway or airspace closure, or poor weather conditions, which forces the airplanes to be grounded

The benefit paid includes only the costs you paid in advance, which you can’t get back or are legally responsible for paying.

What is not covered:

The benefit will not be paid if your trip is cancelled because:

- The aircraft you are on board is hijacked for > 12 hours

The benefit is also not paid if you buy your policy < 3 days before the scheduled departure date.

The benefit also does not cover:

- Additional transport and accommodation expenses (economy class for transport and standard room for hotel) you pay because of your early return to Singapore

- Any rebooking fees so that you can reorganise the trip (same destination as the original trip) to a date within 180 days from your original scheduled departure date

Trip Postponement

What is covered:

This benefit is paid if you postpone your entire trip or change the travel itinerary due to any of these events happening within 30 days before the scheduled departure date:

- Same as Trip Cancellation and Loss of Deposit excluding the last point

The benefit paid includes the costs you paid in advance which you can’t get back, or are legally responsible for paying, as well as any rebooking fees so thay you can reorganise the trip (same destination as the original trip) to a date within 180 days from your original scheduled departure date.

What is not covered:

The benefit will not be paid if your trip is cancelled because:

- Your onward flight is cancelled by the airline due to airport, runway or airspace closure, or poor weather conditions, which forces the airplanes to be grounded

- The aircraft you are on-board is hijacked for > 12 hours

The benefit also does not cover:

- Same as Trip Cancellation and Loss of Deposit excluding the last point

Benefit for Trip Cut Short

What is covered:

This benefit is paid if you are overseas and you have to return to Singapore before your scheduled return date due to any of these events happening:

- Same as Trip Cancellation and Loss of Deposit excluding last point

- The aircraft you are on-board is hijacked for > 12 hours

FWD pays you the costs you paid in advance which you can’t get back, or are legally responsible for paying, as well as additional transport and accommodation expenses (economy class for transport and standard room for hotel) you pay because of your early return to Singapore.

What is not covered:

The benefit will not be paid to you if you buy your policy < 3 days before scheduled departure date.

Insolvency Protection Benefit

What is covered:

This benefit is paid

- when your trip is cancelled before your scheduled departure date, or

- trip is disrupted while you are overseas during your trip

because a travel agent, transport provider, tour operator, or accommodation provider who is responsible for part or all of your trip, is declared insolvent.

Insolvent in this case means they have completed ceased operations because they are bankrupt, convicted for a fraudulent/dishonest act or the owner has ran away with monies belonging to the business.

What is not covered:

The benefit will not be paid if you buy your policy < 3 days before the scheduled departure date.

Trip Diversion Benefit

What is covered:

This benefit is paid if:

- You are travelling on a scheduled public transport; and

- Are diverted to another destination for 6 continuous hours or more

before you eventually reach your scheduled destination.

Remember that you must have checked in on time for the public transport you booked in your original itinerary.

What is not covered:

This benefit will not be paid if you, your family member, or your travel companion were the cause.

Travel Delay Benefit

What is covered:

This benefit is paid if your trip is delayed for 6 continuous hours or more if:

- Your scheduled public transport is delayed; or

- You are forced to travel at another time because your scheduled public transport is overbooked

before you eventually reach your scheduled destination.

You must also show them written proof of the delay from the public transport operator or your handling agent. It needs to show the number of hours of travel delay and the reason for the delay.

What is not covered:

Same as Trip Diversion.

Missed Connections Benefit

What is covered:

This benefit is paid only if:

- You miss your travel connection as a result of your scheduled public transport arriving late to the transit terminal

- You are stranded for 6 continuous hours or more because there are no available travel alternatives

What is not covered:

Same as Trip Diversion.

Trip Disruption Benefit

What is covered:

This benefit is paid if your trip is disrupted while you are in Singapore or overseas, and you are forced to change your itinerary because of 1 of these events happening:

- You suffer a serious injury or illness and are medically unfit to travel, and this must be confirmed by a medical practitioner

- A serious public event happens in Singapore or at 1 of your travel destinations

- Your flight is cancelled by an airline because the airport, runway, or airspace is closed; or poor weather conditions

FWD also pays you the following:

- Additional transport and/or accommodation expenses (the same transport class, and standard hotel room) you have to pay to continue your trip

- Any costs you have paid in advance, which you can’t get back because of the itinerary change

- Any costs you are legally responsible for paying because of the itinerary change

What is not covered:

- Any additional expenses you incur to extend your trip longer than you originally planned.

- Any amounts or compensation for customer loyalty points.

- Any expenses to upgrade you to a better class or category of transport or accommodation compared to your itinerary. This means, for example, changing your flight from a budget airline to a full-service airline.

Baggage Delay Benefit

What is covered:

This benefit is paid if your checked-in baggage is:

- Delayed, misdirected, or temporarily misplaced by any public transport provider, and

- It reaches you 6 continuous hours or more after you arrive at your scheduled destination (including your final return to Singapore).

The length of the delay is calculated by counting the number of hours between your original scheduled arrival time and the actual time of your baggage.

Also, this benefit is paid out on a per-claim basis and not per piece of baggage you bring.

FWD also pays one person the baggage delay benefit even if multiple persons share the same baggage.

What is not covered:

The benefit will not be paid if you buy your policy < 3 days before the scheduled departure date.

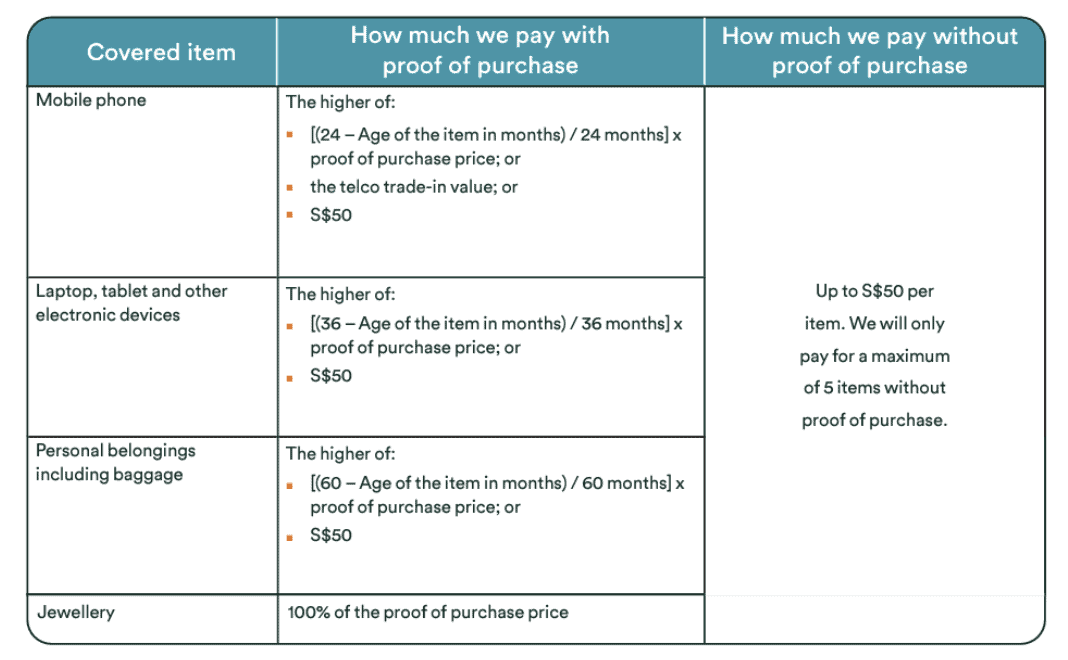

Benefit for Theft or Damage to Baggage or Personal Belongings

What is covered:

This benefit is paid if:

- Your baggage or personal belongings are stolen or accidentally damaged during your trip

- Your baggage is lost while in the custody and care of any airline operator

FWD also decides on the benefit in this manner:

- They decide whether to replace, repair, or pay a cash amount for the stolen or damaged items.

- They may treat a damaged item as beyond repair. If they do so, they will treat it as lost, and they will become the owner of that item.

- They will treat items that are a pair or a set as 1 item for the purpose of this benefit, and only 1 amount will be payable for the pair or set.

- They will use the table below to determine the items’ fair value.

Source: FWD Travel Insurance

What is not covered:

- Perishables or consumables (including food, skincare products, perfume, contact lenses, and toiletries)

- Motorised vehicles of any form or its accessories

- Traveller cards, credit value-loaded cards, prepaid debit cards, prepaid gift cards, transportation cards, and any value that is loaded onto any such card

- Loss or damage caused by wear and tear or gradual deterioration

- Musical instruments or their accessories or casing

- Unauthorised phone costs or charges after its loss or theft

- Items that do not belong to you

- Sports equipment

- Business goods or equipment

- Information stored on storage devices

- Unexplained loss or mysterious disappearance of any baggage or belongings

Benefit for Loss of Passport, Travel Documents & Theft of Money

What is covered:

This benefit is paid if you lose your passport, other travel documents, and/or your money or travellers’ cheques are stolen.

This is also under the condition that these items must all be stolen while being carried by you.

FWD pays the benefit in terms of:

- The value of stolen cash or travellers’ cheques

- The costs to replace a passport or other travel documents

- The costs or penalties charged by a transport provider to issue replacement travel tickets

- The following costs that are paid to organise for the replacement of lost passport or travel documents:

- transport (economy class) or hotel accommodation (standard room);

- communication expenses;

where these costs are reasonable.

What is not covered:

No other expenses you pay to organise replacements will be paid.

Benefit for Fraudulent Personal Credit Card Usage

What is covered:

This benefit is paid if unauthorised charges are made on your credit card while you are overseas on a trip.

Keep in mind that you have to report those unauthorised changes to both your credit card issuers and the police in the country where the theft/loss happened within 24 hours, or else the claim won’t be paid by FWD.

What is not covered:

Unauthorised charges made by your family member, travel companion, or any person you entrusted your credit card details with.

Emergency Medical Evacuation & Repatriation Benefit

This benefit is paid if you suffer from a life-threatening condition as a result of an unexpected illness or injury that happens while overseas on a trip, and:

- FWD believes it is medically necessary to move you to a medical facility in Singapore or overseas, or

- You need to return to Singapore for continued treatment after having been moved to an overseas medical facility for treatment, or

- You die while overseas.

FWD pays the following:

- The costs involved in arranging and paying for an air ambulance, surface ambulance, regular air transport, railroad, land or sea transport, or any other appropriate method to move you to a medical facility for treatment; and

- any administrative fees charged by an airline or travel agent to change your travel dates and/or destinations if the existing return ticket can be used to travel back to Singapore.

- any reasonable costs charged by an overseas mortician or undertaker to prepare the body for transport if you die, such as:

- embalmment,

- cremation (if chosen by your legal representative); and

- a basic casket or urn.

Benefit for Personal Liability while on your trip

What is covered:

This benefit is paid when you are held legally responsible for

- The accidental death of another person

- Bodily injury to another person

- Loss or damage to another person’s property

While you’re overseas on a trip.

FWD will pay

- any damages awarded against you by a court of competent jurisdiction (except for punitive damages); and

- the legal costs and expenses that FWD agrees to pay for representing or defending you.

What is not covered:

Same as in Chinese Medicine Practioner, Physiotherapist, and Chiropractor Expense Benefit.

The benefit also does not cover:

- Any damages resulting from a criminal proceeding

- Any claim for loss of or damage to property in your care or custody.

- Any legal responsibility that results from you owning or using:

- firearms;

- animals;

- motorised vehicles;

- watercraft;

- aircraft of any description including drones;

- remote-controlled motorised devices; or

- bicycles.

- Any damages that are connected to you engaging in your trade, business, or profession.

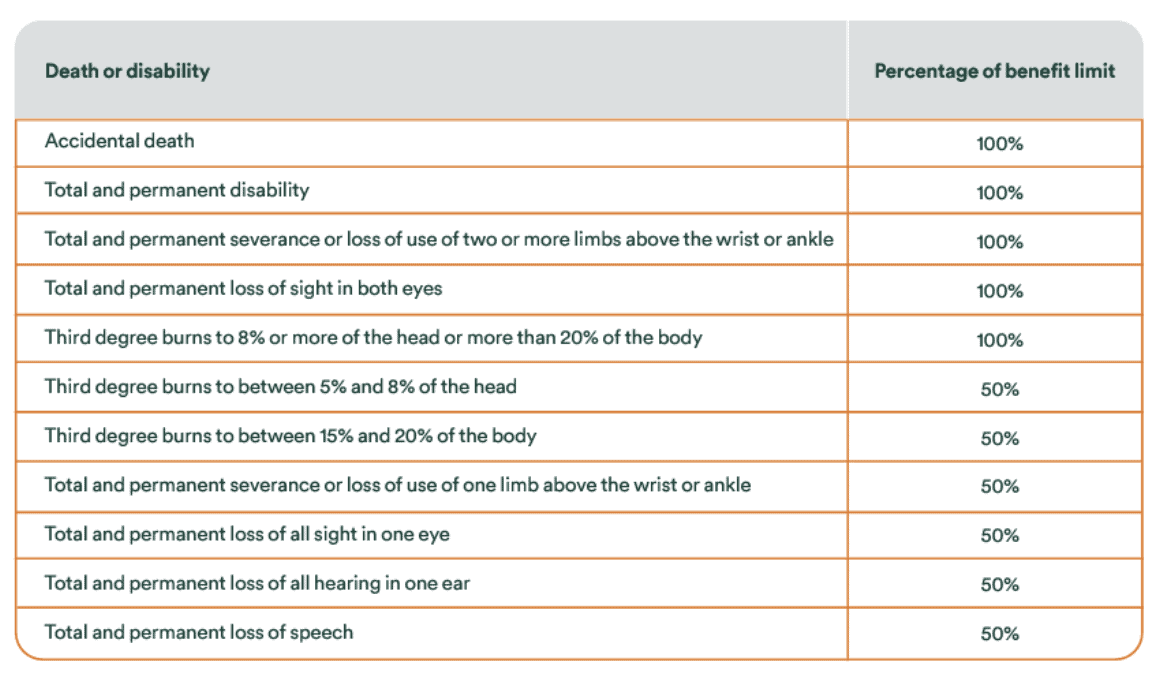

Personal Accident Benefit

What is covered:

This benefit is paid in a lump sum if you suffer an accident that:

- Causes death or

- Leads to total and permanent disability (TPD) within 90 days of the accident.

FWD will pay the lump sum according to the % of benefit limit shown in the table below for that death or accidental injury.

Source: FWD Travel Insurance

What is not covered:

The benefit will not be paid if the death, total permanent severance or loss of use occurs after 90 days of the accident.

If your death, total permanent severance or loss of use is not diagnosed by a medical practitioner approved by FWD, or if you are curable, the benefit will not be paid.

Overseas Daily Hospital Cash Benefit

This benefit is paid for every continuous 24-hour period that you are confined to an overseas hospital.

The hospital confinement must be because of an unexpected illness or injury you suffer while overseas on a trip, and the admission to the hospital must be medically necessary.

This benefit is also doubled for each 24-hour period you are confined in an intensive care unit (ICU).

Daily Hospital Cash Benefit (while in Singapore)

This benefit is paid if you are confined to a hospital in Singapore:

- within 48 hours of your return to Singapore; or

- within 30 days after you return from a trip if you had sought medical treatment during your trip

as a result of an unexpected illness or injury you suffered while overseas on a trip, FWD will pay this benefit for every continuous 24-hour period that you are confined to a hospital in Singapore. The admission to a hospital must be medically necessary.

Doubling of the benefit works the same as in Overseas Daily Hospital Cash Benefit.

Automatic Policy Extension Benefit

This benefit is where the period of insurance is extended for free if:

- your return to Singapore is delayed by a serious public event, or

- you are confined to a hospital overseas upon the advice of a medical practitioner.

Emergency Phone Charges Benefit

This benefit is to reimburse the costs of the phone calls you make while overseas. These include:

- Calls to our Emergency Assistance hotline to get advice on medical assistance or to replace lost travel documents.

- Calls to the police, medical facilities, consulates, or family member(s) in Singapore to get assistance or support as a result of you suffering a serious illness or injury during a trip.

Hospitalisation Benefit

This benefit is to reimburse the costs of an adult family member who travels to be with you if:

- you suffer an unexpected illness or injury while overseas on a trip;

- as a result of that illness or injury, you are confined to a hospital for a least 5 continuous days;

- a medical practitioner confirms that you cannot return to Singapore for further treatment; and

- you have no adult family member with you.

Child Companion Benefit

This benefit is to reimburse the costs of an adult family member who travels to be with you if:

- you suffer an unexpected illness or injury while overseas on a trip; and

- as a result of that illness or injury, you are confined to a hospital for at least 5 continuous days; and

- a medical practitioner confirms that you cannot return to Singapore for further treatment; and

- you are travelling with 1 or more children, and you are the only adult.

Compassionate Travel Benefit

What is covered:

This benefit is to reimburse the costs of an adult family member who travels to arrange the return of your bodily remains to Singapore or to your home country if:

- you die from an unexpected illness or injury suffered while overseas on a trip; and

- there is no other adult family member on the trip.

What is not covered:

If the return transport is not economy class or a standard room or if the hotel accommodation is not of a standard room, this benefit will not be paid.

The payment of the benefit will also stop at the earliest of the following dates:

- 30 days have passed since you were first confined to a hospital; or

- the date a medical practitioner confirms you are fit to continue the trip or to return to Singapore.

Chinese Medicine Practitioner, Physiotherapist, and Chiropractor Expenses Benefit

What is covered:

There are 2 parts to this benefit:

– | Treatment while on a trip or within 48 hours of returning to Singapore | Treatment must be sought overseas or within 48 hours of returning to Singapore |

Benefit is paid if |

|

|

What is covered:

The benefit will not be paid if the other person involved is an interested party.

Optional Add-ons

Keep in mind that the add-ons mentioned in this section are not available for a group of people going on an annual trip.

COVID-19 Enhanced Travel Benefit

The benefits included in this add-on are as follows:

- Before your trip

- Up to $5,000 for trip cancellation and loss of deposit

- During your trip

- Up to $5,000 for trip disruption

- Overseas hospital cash income: $100 per day up to 14 days

- Overseas quarantine allowance: $50 per day up to 14 days

- Emergency medical evacuation & repatriation: Up to $200,00

- After your trip

- Hospital cash while in Singapore: $100 per day up to 14 days

- Medical expense: Up to $200,000

- Automatic policy extension

- Extended policy cover in some situations: Up to 21 days

These prices are based on a trip to ASEAN for a week.

| Price | |

| Individual | $12.44 |

| Couple | $24.87 |

| Family (2 adults and 1 child) | $31.09 |

| Group (4 people) | $49.74 |

These premium rates are based on an annual trip to ASEAN.

| Price | |

| Individual | $70.00 |

| Couple | $140.00 |

| Family (2 adults and 1 child) | $175.00 |

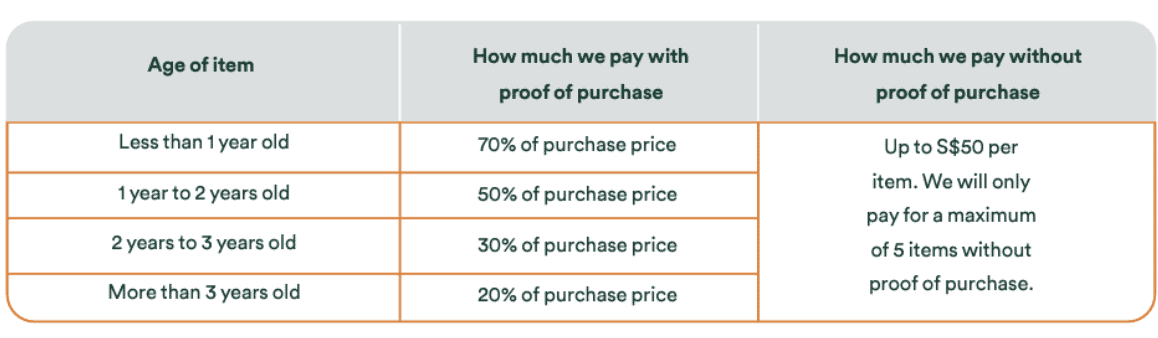

Sports Equipment Protector

What is covered:

This add-on covers up to $2,000 if your sports equipment gets damaged or stolen.

It also includes up to $100 daily for rental replacements if you get any.

The sports equipment that is covered includes:

- Golf clubs

- Diving gear

- Skis boards and poles

- Snowboards

- Wakeboards

- Bicycling

- Fishing tackle equipment

- Specialist apparel for diving, skiing and snowboarding

- Any other equipment previously agreed in writing before the trip starts

The benefit paid also depends on the age of the sports equipment and the proof of purchase. Here’s a table breakdown:

Source: FWD Travel Insurance

What is not covered:

FWD does not cover any damage that happens while your sports equipment is in use, whether for practice or play.

Costs

These prices are based on a trip to ASEAN for a week.

| Price |

Individual | $8.17 |

Couple | $16.34 |

Family (2 adults and 1 child) | $18.71 |

Group (4 people) | $32.68 |

These premium rates are based on an annual trip to ASEAN.

| Price |

Individual | $37.54 |

Couple | $75.08 |

Family (2 adults and 1 child) | $85.97 |

As you can see, this add-on covers quite an extensive range of sports equipment – perfect for thrill-seekers or those looking to bring them overseas for friends/family.

Plus, FWD is the only insurer on the market that provides this type of coverage.

Pet Care

What is covered:

This add-on provides $50 for every 6 hours your trip home is delayed to cover additional kennel/pet hotel costs for up to $150.

The length of the delay is calculated by the number of hours between your original scheduled arrival time and your actual arrival time.

Costs

These prices are based on a trip to ASEAN for a week.

| Price |

Individual | $1.00 |

Couple | $2.00 |

Family (2 adults and 1 child) | $2.29 |

Group (4 people) *1 pet per person | $4.00 |

These premium rates are based on an annual trip to ASEAN.

| Price |

Individual | $3.22 |

Couple | $6.44 |

Family (2 adults and 1 child) | $7.37 |

This add-on is pretty niche and would only be suitable for anyone considering putting their pets in a kennel, in the case of any travel inconveniences that arise which cause delay in picking them up.

Just like the Sports Equipment Protect add-on, FWD is the only insurer on the market that provides this type of additional coverage.

Home Contents Cover

What is covered:

Home contents, in this case, means all household furniture and furnishing, domestic electronic appliances and personal belongings owned by you and in your home.

This add-on protects your home from fire and theft for up to $6,000 while you’re away on the trip.

The benefit paid is also dependent on the age of the home content item and the proof of purchase. Here’s a table breakdown:

Source: FWD Travel Insurance

What is not covered:

Cash and travellers’ cheques are not considered home contents.

Costs

These prices are based on a trip to ASEAN for a week.

| Price |

Individual | $1.77 |

Couple | $3.54 |

Family (2 adults and 1 child) | $4.05 |

These premium rates are based on an annual trip to ASEAN.

| Price |

Individual | $3.57 |

Couple | $7.14 |

Family (2 adults and 1 child) | $8.18 |

Looking at the prices above, I would say that the prices are pretty affordable for that extra protection.

Singapore may be one of the safest countries in the world, and you may think that a break-in will never happen to you – but it never hurts to be safe than sorry.

This also applies to fire incidents, where an act of negligence may very well be the reason for a fire breaking out in your home.

Car Rental Excess

What is covered:

Car rental excess is basically the amount of money you would be responsible for paying in the event of damage or theft of a rental car.

As such, this add-on covers you if you:

- become legally responsible to pay a car rental excess or deductible because of accidental loss or damage to a rented car from a licensed operator;

- were a named driver or co-driver of the rental car;

- were legally allowed to drive in the overseas country;

- were driving when the accidental loss or damage happened; and

- followed the rules of the rental agreement, and the laws of the country where you were driving the car.

Costs

These prices are based on a trip to ASEAN.

| Price |

Individual | $4.67 |

Couple | $9.34 |

Family (2 adults and 1 child) | $10.69 |

Group (4 people) | $18.68 |

These premium rates are based on an annual trip to ASEAN.

| Price |

Individual | $20.22 |

Couple | $40.44 |

Family (2 adults and 1 child) | $46.30 |

If you’re planning to rent a car for a long period during your trip, it might be a good choice to supplement your coverage with this add-on.

It’s also helpful to consider the nature of the country or area you’re travelling to and whether car break-ins are more likely.

This is because FWD only pays you the benefit only if you were driving when the accidental loss or damage happened.

Keep in mind that you also need to provide copies of the car rental agreement, original receipts showing the amount paid for rental excess, along with any reports related to the loss or damage to the rental car.

Exclusions

The exclusions in FWD Travel Insurance are as follows:

- Pre-existing conditions

- Mental disorders/illness

- Unnecessary dental expenses

- Pregnancy, childbirth, or related complications events, unless the mother is put at risk

- Travelling when medically unfit

- Unlawful acts

- Suicide or self-inflicted act

- Failing to protect property and self

- Acts of customs or other officials

- Wear and tear or damage from cleaning or repair

- Incidental charges that FWD has not specified

- Professional or paid sporting activities

- High-altitude hiking or trekking

- War, riot or revolution

- Military or military-related services or training

- Claims covered by other insurance or service providers

- STDs or HIV

- Alcohol or substance abuse

- Consequential or indirect loss

There is also no benefit if you are travelling to or transiting through:

- Any country that the Ministry of Foreign Affairs of Singapore advises against travelling to, or recommends travel to be postponed;

- Afghanistan

- Cuba

- Democratic Republic of Congo

- Iran

- Libya

- Liberia

- North Korea

- Somalia

- South Sudan

- Sudan

- Syria

- Yemen

How to Claim FWD Travel Insurance

To submit a claim with FWD, you have 2 options:

- You can dial their Customer Service number at +65 6820 8888 or their Emergency Assistance number at +65 6322 2072.

- Download the FWD SG app or visit their official website to log in to FWD Online Login Portal and follow a detailed guide of instructions.

Other things to note about FWD

FWD Singapore has a strong reputation as an excellent financial service provider and was assigned an “A-” rating from Standard & Poor’s (S&P) in 2023.

This can be greatly seen from the sufficiency of information about their travel insurance plans on their website, with each benefit limit amount for each benefit category laid out in great detail.