The AIA Prime Assured is an all-in-one standalone personal accident plan designed for seniors.

This plan offers a variety of benefits if you get injured in an accident, such as coverage for broken bones, being unable to do 3 or more basic daily activities and even permanent disability.

It also takes care of your needs as you get older by covering conditions like Alzheimer’s and Parkinson’s disease, broken bones, and inability to perform daily activities due to an accident.

Criteria

You must be between the age of 40 to 75 to apply for the AIA Prime Assured.

General Features

Premium Terms

There are 3 plans available, and the premiums for each differ.

You have the flexibility to pay the premiums on a monthly, semi-annual, or annual basis, depending on your convenience.

However, it’s important to note that this particular policy is not eligible for payment using Medisave.

Table of Premiums

| Payment/Plan | Plan A ($) | Plan B ($) | Plan C ($) |

| Monthly | 17.36 | 26.15 | 39.32 |

| Twice a year | 103.73 | 156.31 | 235.06 |

| Annually | 199.49 | 300.61 | 452.08 |

| Sum Assured | See the Below Table of Sums Assured Per Benefit | ||

Note that the premiums for this coverage may change over time, but you will be notified in writing at least 31 days before any changes take effect.

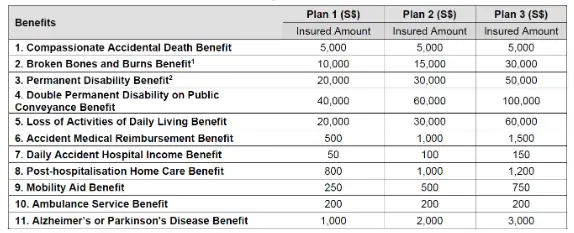

Table of Sums Assured Under Each Plan

Also note that, starting from the policy anniversary following your 81st birthday, there will be a 50% reduction in the coverage amount for all benefits.

Try to pick a plan and remember the insured amount you want – as that will be the basis of each section in our review.

Protection

Compassionate Accidental Death Benefit

If the insured gets injured in an accident and unfortunately passes away within a year of the accident, the coverage will pay a one-time lump sum of money.

The amount paid will be the same as the sum assured of the respective plans. This benefit is provided to help support the loved ones left behind during a difficult time.

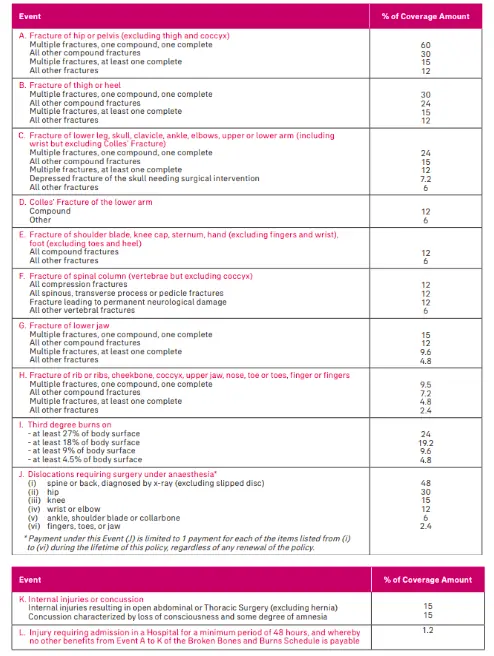

Broken Bones and Burns Benefit

Under this benefit, a payout is granted to the insured in the event of an injury occurring within 90 days from the date of an accident, specifically involving the injuries listed in the broken bones and burns schedule.

The payout amount is determined as a percentage of the insured sum specified in the policy, contingent upon the severity and nature of the sustained injury, as detailed in the Broken Bones and Burns Schedule.

The primary objective of this benefit is to extend financial support, aiding in the coverage of expenses associated with the treatment and recuperation from accidents resulting in broken bones and burns.

Below is the Broken Bones and Burns Schedule:

The following conditions also apply;

- Firstly, if multiple injuries occur from the same accident, the total amount payable for those injuries cannot exceed 100% of the insured amount stated in the policy.

- The total amount paid for this benefit within a policy year cannot exceed 100% of the insured amount.

- Throughout the policy, only 1 payment will be made for each event listed in the Broken Bones and Burns Schedule. This means that if there is a subsequent injury involving the same fractured bone or the same injury already claimed, only a payment will be made.

Key Features

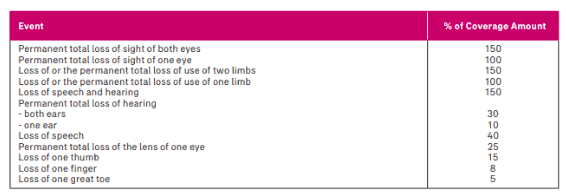

Permanent Disability Benefit

This benefit offers compensation if the insured person experiences an injury within 1 year from an accident resulting in specific body losses listed in the Permanent Disability Schedule.

The payment will be a percentage of the insured amount specified in the policy, depending on the nature and severity of the permanent disability suffered.

This benefit offers financial support in case of a long-term disability caused by an accident.

The following conditions also apply:

- When it comes to multiple disabilities resulting from the same accident, the total compensation is determined by adding the percentages assigned to each disability.

- If benefits are paid for events where the payout percentage is less than 100%, the policy will continue with the original insured amount.

- The total compensation for multiple disabilities cannot exceed 150% of the insured amount per policy year.

Double Permanent Disability

This additional benefit is eligible for compensation if the insured sustains an injury while riding on, in, boarding, or getting off from a public conveyance as a passenger.

This will be a percentage of the insured amount based on the Permanent Disability Schedule mentioned in the Permanent Disability Benefit above.

However, if any amount is already payable under the Permanent Disability Benefit due to the accident, the Double Permanent Disability on Public Conveyance Benefit will not be paid separately.

In other words, the policy will not provide double compensation for permanent disability resulting from the same accident if the Permanent Disability Benefit has already been paid out.

Loss of Activities of Daily Living Benefit

The Loss of Activities of Daily Living Benefit compensates for an inability to perform 3 or more Activities of Daily Living.

The inability should have been for a continuous period of at least 6 months, starting within 180 days from the date of the accident, to be eligible for compensation.

If the inability to perform these activities lasts for at least 6 months and it is determined that there is no hope of recovery, the policy will pay a one-time lump sum equal to the insured amount.

It’s important to note that this benefit does not cover psychiatric-related causes.

Activities of Daily Living Schedule

| Activity | Description |

| Transfer | Ability to independently get in and out of a chair without needing help from another person. |

| Mobility | Ability to move from one room to another without needing assistance from another person. |

| Dressing | Capability to put on and take off clothing without requiring any help from another person. |

| Bathing/Washing | Ability to wash oneself in the bath or shower, including getting in and out or using alternative methods, without needing assistance from another person. |

| Eating | Capacity to consume food independently after it has been prepared, without needing help from another person. |

| Toileting | Capability to use the toilet without requiring any assistance from another person. |

Accident Medical Reimbursement Benefit

This benefit reimburses reasonable medical and customary expenses incurred for medical treatment required due to an injury caused by an accident.

To be eligible for reimbursement:

- The expenses must be incurred within 52 weeks from the accident date.

- If treatment is sought from an acupuncturist or Chinese bonesetter, the reimbursement for such treatment will be limited to 25% of the insured amount per accident. This is in addition to any medical treatment received from a physician.

- The total reimbursements under this benefit for a single accident cannot exceed the insured amount stated in the policy.

Daily Accident Hospital Income Benefit

If you end up in the hospital because of an accident, the policy’s got you covered with a daily payment.

This means you’ll get some cash daily, the same as your insured amount for this benefit.

But hold on, there’s a limit!

You can get the daily payment for up to 365 days during your hospital stay. And remember, it won’t exceed the insured amount for each day.

So, you’ve got a safety net in place if you ever find yourself stuck in the hospital due to an accident.

Post-hospitalisation Home Care Benefit

This benefit applies if you are confined in a hospital for more than 7 consecutive days due to an injury caused by an accident.

The policy will provide a one-time lump sum payment equal to the insured amount for this benefit.

To be eligible for this benefit, the Daily Accident Hospital Income Benefit should be payable under the policy, and a physician must recommend the hospital confinement in writing.

This benefit will only be paid once, regardless of the number of hospital confinements or the duration of the same confinement resulting from the same accident.

Mobility Aid Benefit

If the insured person requires mobility aids due to an accident covered by specific benefits, the policy will reimburse the reasonable and customary cost of purchasing them.

The maximum payable amount is the insured amount.

However, if other sources provide refunds or reimbursements for these expenses, this policy will only cover the remaining amount not covered by those sources.

Ambulance Service Benefit

After an accident, this benefit kicks in to help you out with transportation to a nearby hospital in a medical ambulance (with attendants included).

They’ll pay you back for the reasonable and normal cost, but it won’t go over the insured amount.

If you got some money back from other sources like government programs or other policies for those expenses, the AIA Prime Assured will step in and take care of the rest, covering the leftover amount.

Alzheimer’s or Parkinson’s Disease Benefit

The Alzheimer’s or Parkinson’s Disease Benefit is a one-time lump sum payment equal to the sum insured.

To receive this benefit, the diagnosis must be supported by relevant medical records, which need to be submitted to and approved by AIA.

Summary of the AIA Prime Assured

| Cash and Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawal | No |

| Health and Insurance Coverage | |

| Death | Yes (Accidental) |

| Total Permanent Disability | Yes (Accidental) |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

My Review of the AIA Prime Assured

With the AIA Prime Assured, you can enjoy a range of benefits designed to provide coverage and support in case of accidents and health-related situations.

In the unfortunate event that the insured sustains an injury and passes away within 365 days of the accident, this benefit ensures that a lump sum payment equal to the insured amount is provided to the beneficiaries as a form of financial support during a difficult time.

However, if the insured only suffers an injury resulting in broken bones or burns within 90 days of an accident, they are eligible for reimbursement (percentage of the insured amount) to help cover medical expenses and other related costs.

Should one suffer an injury within 365 days from an accident that leads to permanent disability, the AIA Prime Assured ensures that he/she receives compensation.

The payment aims to provide financial assistance to help cope with the challenges associated with permanent disability.

If you’ve been in an accident and can’t carry out 3 or more Activities of Daily Living continuously for at least 6 months, you’ll also get a lump sum payment equal to the insured amount.

On top of the compensations, AIA Prime Assured offers reimbursements for medical treatment and cash benefits both during and after hospitalisation.

And that’s not all – there’s an additional provision if someone experiences Alzheimer’s Disease or Parkinson’s Disease.

So, you’ve got some extra support and coverage for those situations too.

Despite how good the AIA Prime Assured seems, it’s still best to compare different personal accident insurance plans in Singapore before you make your decision.

We also recommend getting a second opinion from an unbiased MAS-licensed financial advisor too.