The AIA Platinum AccidentCare personal accident insurance plan that provides you with worldwide protection for up to $5,000,000.

Not sure if this is for you?

Here’s our review of the AIA Platinum AccidentCare so you’ll make an informed decision.

Criteria

- Entry Age: 16 – 70 years old

General Features

Policy Term

The AIA Platinum AccidentCare plan has a 1-year policy term, which is renewable up till the age of 79.

Premium Payment Terms

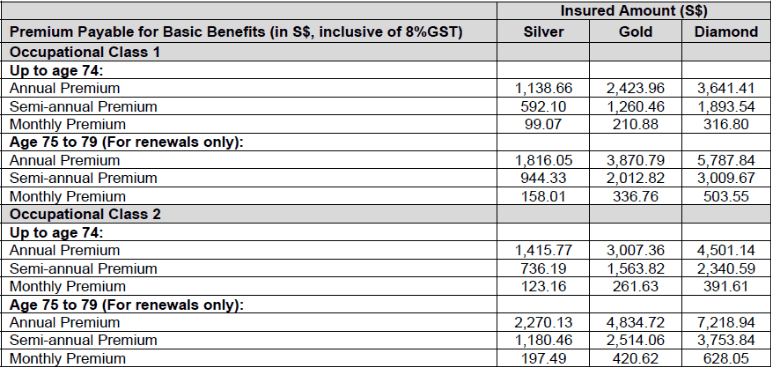

Under the AIA Platinum AccidentCare, your premiums for your chosen plan type are not fixed and can vary depending on your occupational class.

You can pay these premiums annually or monthly, and the amount you pay will depend on the premium rates corresponding to your payment frequency.

Premiums are also payable annually, half-yearly or monthly, with the corresponding premium rates listed below:

Definitions for Occupational Classes are not available publicly.

This policy is not approved for Medisave, which means you cannot use Medisave funds to pay your premium for this policy.

Hence, you’ll need to use other sources of funds to pay for your premiums.

Protection

Accidental Death

Accidental Death coverage protects the insured individual if they are fatally injured and pass on within 1 year of the accident.

The insurance policy pays you 100% of the coverage amount as a lump sum, after which the policy ends.

This benefit is tailored to provide you and your family dependents financial support during a difficult time – helping them cover immediate expenses and provide financial stability after losing a loved one.

Here are the limits:

| Plan Sum Assured | |||

| Benefit | Silver ($) | Gold ($) | Diamond ($) |

| Accidental Death Dismemberment and Burns | $1,000,000 | $3,000,000 | $5,000,000 |

Accidental Dismemberment and Burns Benefit

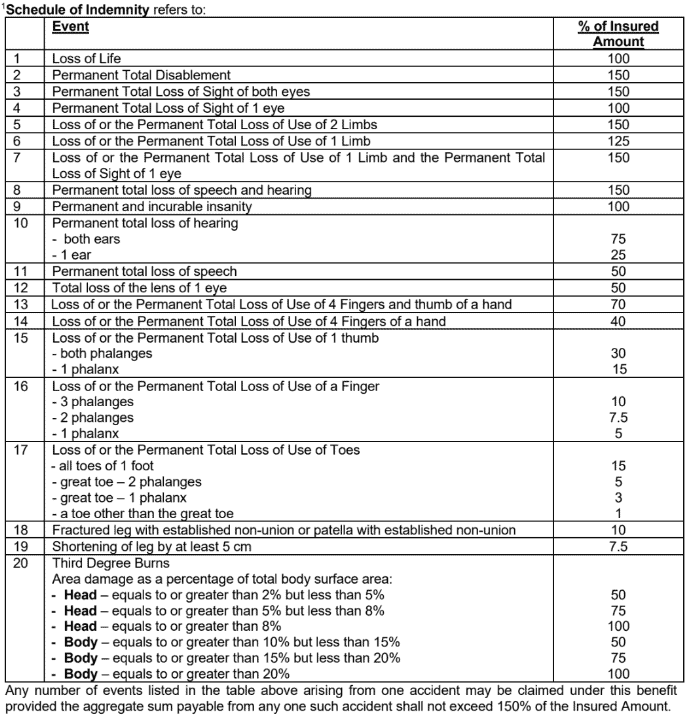

This benefit provides compensation if you or your beneficiary is injured, leading to specific types of physical losses or disfigurement that occur within 365 days from the accident date.

This benefit covers a range of injuries or losses outlined in the Schedule of Indemnity:

These could include dismemberment (losing a limb or body part) or burns, among other specific injuries listed in the schedule.

If you experience one of the covered injuries listed in the schedule, the insurance company will pay a portion of the specified amount insured.

| Plan Sum Assured | |||

| Benefit | Silver ($) | Gold ($) | Diamond ($) |

| Accidental Death Dismemberment and Burns | $1,000,000 | $3,000,000 | $5,000,000 |

Aviation Accident Benefit

This is an additional benefit of the AIA Platinum AccidentCare policy that provides extra coverage in the event of an accident-related death should you be a passenger during a commercial air flight.

The covered accident must occur at most within 365 days from the accident date in order to qualify for this benefit.

In addition to the benefits provided under the Accidental Death, Accidental Dismemberment, and Burns Benefit, this Aviation Accident Benefit offers an extra payment equal to 1 time of the amount specified in your policy for Loss of Life.

Here are the limits:

| Plan Sum Assured | |||

| Benefit Type | Silver ($) | Gold ($) | Diamond ($) |

| Aviation Accident | $1,000,000 | $3,000,000 | $5,000,000 |

Accidental Medical Reimbursement Benefit

This feature helps cover medical expenses incurred if you are injured and need medical treatment.

To qualify for this benefit, the accident must not be more than 365 days from the accident date.

AIA will refund you for your medical expenses, including doctor visits, hospitalisation, surgery, and other necessary medical care.

The benefit may also cover costs associated with hiring a registered/graduate nurse, and charges for an ambulance up to $1,000.

However, the total reimbursement amount is limited to the Insured Amount specified in the policy for this benefit.

Here are the limits:

| Plan Sum Assured | |||

| Benefit Type | Silver ($) | Gold ($) | Diamond ($) |

| Accidental Medical Reimbursement | $15,000 | $20,000 | $25,000 |

Complementary Medical Reimbursement Benefit

Should you suffer an injury from an accident and need treatment by a chiropractor or a traditional Chinese medicine practitioner, this benefit comes into effect.

However, this treatment must not happen beyond 365 days from the accident date.

The reimbursement includes expenses for consultations, therapies, and other treatments related to the injury.

The total reimbursement amount is limited to the insured amount specified in this benefit’s policy.

Here are the limits:

| Plan Sum Assured | |||

| Benefit Type | Silver ($) | Gold ($) | Diamond ($) |

| Complementary Medical Reimbursement | $3,000 | $4,000 | $5,000 |

Mobility Aids and Home Modification Benefit

This component of AIA Platinum AccidentCare is designed to provide financial support in case you are injured in an accident and require specific assistance and home modifications due to resulting disabilities.

For instance, should your home need to be modified physically or structurally to make it more accessible for you due to your injuries.

In that case, this benefit can also help cover the costs of those modifications.

These modifications are specifically aimed at making it easier for you to be mobile around your home.

It’s important to note that these expenses must be incurred no more than 90 days from the accident date.

To qualify for this benefit, a certified practitioner in rehabilitative services must confirm the need for mobility aids or home modifications due to the disabilities resulting from the accident.

Finally, for home modification expenses to be eligible for reimbursement, at least 50% of the insured amount in this policy under the Accidental Death, Accidental Dismemberment, and Burns Benefit (excluding Death) must have been paid or become payable.

Here are the limits:

| Plan Sum Assured | |||

| Benefit Type | Silver ($) | Gold ($) | Diamond ($) |

| Mobility Aids and Home Modification | $5,000 | $8,000 | $10,000 |

Rehabilitation Support Benefit

This benefit is meant to provide financial assistance in the event that you are injured in an accident and requires various types of therapy or treatment for recovery.

However, this treatment must not go beyond 365 days from the accident date.

This benefit can help cover the expenses for therapy or treatment by:

- Psychiatrist for mental health-related issues.

- Physiotherapist to address physical rehabilitation.

- Occupational therapist to aid in regaining daily living skills.

- Speech therapist for speech and communication issues.

To be eligible for this benefit, a claim equivalent to at least 50% of the insured amount under the Accidental Death, Accidental Dismemberment, and Burns Benefit (excluding Death) must have been paid or become payable due to the accident.

Here are the limits:

| Plan Sum Assured | |||

| Benefit Type | Silver ($) | Gold ($) | Diamond ($) |

| Rehabilitation Support | $3,000 | $5,000 | $10,000 |

Compassionate Visit Benefit

This benefit caters for visitation by a relative or friend to you if you are injured in an accident and need hospitalisation outside of Singapore.

The hospitalisation must be for at least 7 consecutive days without an accompanying adult.

If you meet the hospitalisation requirement, the insurance company will reimburse the expenses for a visit by a relative or friend.

This visit can include

- One return economy class ticket.

- One standard hotel room accommodation for the visiting relative or friend.

The total reimbursement amount is limited to the insured amount specified in the policy for this benefit.

Kindly note that the visit expenses must be approved and organised by an External Service Provider unless it’s impossible due to an emergency.

Here are the limits:

| Plan Sum Assured | |||

| Benefit Type | Silver ($) | Gold ($) | Diamond ($) |

| Compassionate Visit | $10,000 | $10,000 | $10,000 |

Emergency Medical Evacuation and Repatriation Benefit

Emergency Medical Evacuation

This benefit applies if you as the insured, is travelling outside of Singapore, and you are injured in an accident which requires urgent medical evacuation.

Emergency medical evacuation typically involves transporting you to a medical facility where you can receive appropriate care up to the limit amount set in the plan.

The evacuation expenses covered include:

- Transportation costs, such as air ambulance services.

- Costs relative to medical services.

- Expenses for necessary medical supplies.

The insurance company or an external service provider may provide and arrange the evacuation.

Repatriation of Mortal Remains

This benefit applies in the event of your untimely death. This benefit is valid within 365 days of your death due to injuries sustained in an accident while travelling abroad.

The insurance company will cover transporting your mortal remains.

These expenses can include:

- Transporting your body back to Singapore.

- Returning your body to your home country.

- Burial expenses at the place of death if that option is chosen by your family/next of kin.

The insurance company or an external service provider may provide and arrange the repatriation of your mortal remains.

Here are the limits:

| Plan Sum Assured | |||

| Benefit Type | Silver ($) | Gold ($) | Diamond ($) |

| Emergency Medical Evacuation and Repatriation | Unlimited | Unlimited | Unlimited |

Optional Add-On Riders

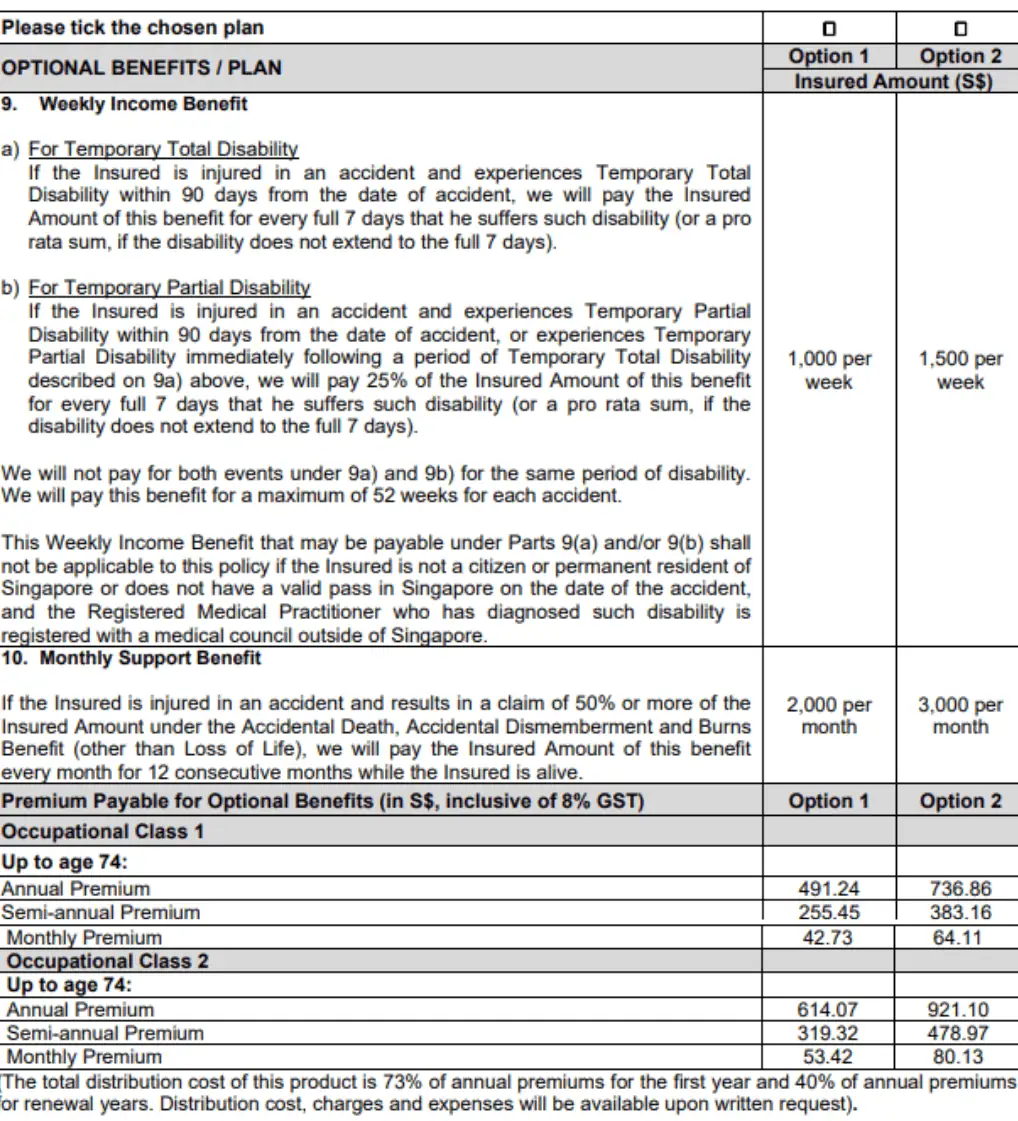

You can add a rider to your AIA Platinum AccidentCare basic policy.

The rider comes with 2 tiers – Option 1 and Option 2, which we’ll explain in the later sections.

But first, here are the premiums and what they cover:

Take note that once you reach the age of 75, the optional benefits will no longer be active or available as part of your policy.

Weekly Income Benefit

This benefit is offered to either the Temporary Total Disability or Temporary Partial Disability event, but not both, for the same period.

Additionally, for each accident, the maximum applicable period is 52 weeks.

Temporary Total Disability

The Weekly Income Benefit for Temporary Total Disability provides financial support in the event of an accident leading to temporary total disability within 90 days from the accident date.

Temporary total disability typically means that you cannot work and earn income due to injury, and payment is made every 7 days, during which you experience temporary total disability.

A pro-rata sum will be paid if it does not extend to the full 7 days.

If you selected Option 1, you’ll get $1,000/week. If you select Option 2, you’ll get $1,500/week.

Temporary Partial Disability

This benefit applies where you are injured in an accident and experience temporary partial disability within 90 days from the accident date.

Alternatively, this benefit applies when a temporary total disability due to an accident, transitions to a temporary partial disability immediately following the period of temporary total disability.

If you selected Option 1, you’ll get $1,000/week. If you select Option 2, you’ll get $1,500/week.

Definitions for both partial and total disability are not provided.

Monthly Support Benefit

This benefit is activated when you are injured, and the resulting claim for your injuries meets or exceeds 50% of the insured amount under the specified benefits related to accidental death, dismemberment, or burns.

The monthly payments will equal the insured amount specified in the policy and will continue for 12 consecutive months as long as you are alive during this period.

If you selected Option 1, you’ll get $2,000/month. If you select Option 2, you’ll get $3,000/month.

Summary of AIA Platinum AccidentCare

| Cash and Cash Withdrawal Benefits | |

| Cash Value | N/A |

| Cash Withdrawals | N/A |

| Health and Insurance Coverage | |

| Death | Yes (Accidental) |

| Total Permanent Disability | Yes (Accidental) |

| Terminal Illness | N/A |

| Critical Illness | N/A |

| Early Critical Illness | N/A |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | N/A |

| Critical Illness | No |

| Early Critical Illness | No |

My Review of the AIA Platinum AccidentCare

AIA Platinum AccidentCare is a comprehensive personal accident insurance policy offering substantial local and worldwide coverage.

It provides financial protection, medical coverage, and assistance for you and your families during challenging times, ensuring peace of mind and financial security.

This policy is available for individuals between the ages of 16 to 70 years old.

This broad age range allows a wide range of individuals to access its benefits.

It offers high coverage of $1 million for the silver plan and up to $5 million for the diamond plan for accidental death, dismemberment, and burns coverage.

In the unfortunate event of a covered accident, the policy provides substantial financial protection for policyholders or their nominated beneficiaries.

Additionally, the policy provides double coverage amounts for accidental events while you travel commercially in flight.

This feature enhances financial protection during air travel, which can be especially reassuring for frequent flyers.

If you are injured while travelling, the policy covers the cost of emergency medical evacuation to ensure you receive necessary medical treatment.

If, in the event that you unfortunately pass away, it also covers repatriating your remains to the place chosen by your family or next of kin.

Regarding flexibility in seeking treatment, the policy also covers the services of traditional Chinese medicine (TCM) practitioners and chiropractors, besides reimbursing the cost of hospitalisation, medical treatment and nursing care.

Some serious accidents require rehabilitative treatment by health specialists, home modification, and mobility aids (such as wheelchairs or prosthetics).

The AIA Platinum AccidentCare covers all these costs too, up to the set limit.

The only drawback about this policy would just be the price.

For a 30-year-old non-smoking male with coverage up to 80 years old, the premiums for the diamond plan $3,641.41 yearly.

If you add Option 1 as a rider, that’s an additional cost of $491.24, making the total yearly premium to be $4,132.65.

I guess that’s the trade-off for such comprehensive coverage – so if you think you can afford it and it’s what you want, go for it.

If you want to explore alternatives, click here to read our comparison of the best personal accident insurance plans in Singapore.

You should also take some time to get a second opinion to understand if there are better options for you.