AIA Pay Protector is a disability income insurance policy offering income protection in the event of illness or injury, providing financial support when you cannot work.

AIA Pay Protector provides a monthly benefit aimed at helping you maintain your financial stability by replacing a portion of your lost income during the disability period.

Here is a detailed review of AIA Pay Protector.

Read on.

Criteria

- Issue Age: 16 – 50 Years Old

General Features

Premium Terms

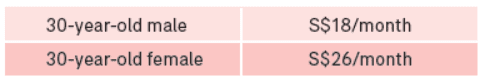

Premiums depend on gender, smoking status, occupation, and sum assured.

You can choose between monthly, quarterly, bi-annually, or yearly premium payments – and these will last for as long as the policy is active.

Here’s an example of the premium for non-smokers with a coverage amount of $1,000 (monthly income payout) in occupational class 1.

Occupational classifications are not available online.

This policy is not Medisave-approved, which means you cannot use your Medisave funds to pay the premiums for this policy.

Policy Term

The policy is guaranteed renewable yearly and covers your monthly income till age 65.

Protection

Disability Benefit

AIA Pay Protector provides income protection in case of disability due to illness or injury.

There is a 90-day Deferment Period before the Disability Benefit becomes payable.

This means you’ll have to wait 90 days before the AIA Pay Protect starts paying you.

The total payments under the Disability Benefit cannot exceed more than 60 months (5 years) of the Insured Amount during your lifetime.

This limit applies regardless of policy renewals or any subsequent disabilities.

If the Disability Benefit is payable for a period of less than a month, the payment will be calculated on a daily rate, with 1/30 of the monthly Disability Benefit payable for each day.

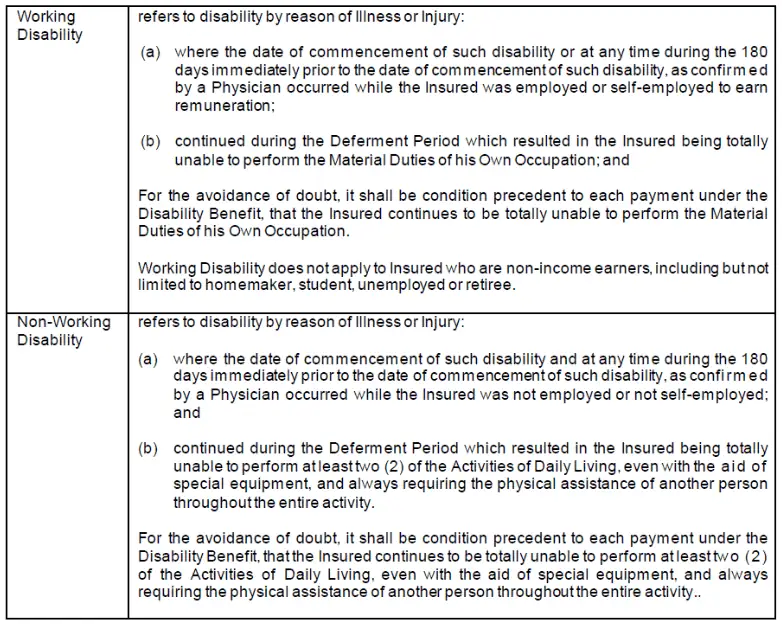

This benefit will cease to be payable when you no longer satisfy the requirements for a Working Disability or Non-Working Disability.

However, if within 12 months, the insured person suffers a disability due to the same or a related cause, it will be treated as a continuation of the earlier disability and benefit payments will resume.

But, if the disability is due to an unrelated cause, it will be treated as a new disability, and a fresh Deferment Period will apply.

The table below provides the definitions of Working disability and Non-working disability:

Key Features

Guaranteed Monthly Income Payouts

AIA will pay you your monthly income based on your chosen plan regardless of any changes to your income in the future or if you have payouts from other disability income policies.

This is great because disability income plans are usually tied to your salary at the time of claim.

So if your income is reduced, you’ll have more payouts than your current salary!

Waiver of Premium Benefit

AIA will waive the premium payments for your policy when payments are being made under the Disability Benefit.

This waiver starts from the policy month immediately following the Deferment Period.

Any premiums you have already paid for when premiums are waived will be refunded to you.

Once the Disability Benefit ceases to be payable, you are required to resume payment of premiums for your policy.

If, however, a premium becomes payable after the disability benefit ceases to be payable, AIA may offset that premium from the disability benefit at its discretion.

The frequency of premium payments for your policy will automatically change to a monthly mode when the Disability Benefit is payable.

This change aligns with the monthly payment schedule of the Disability Benefit.

Premium Adjustments

Premium adjustments may apply for AIA Pay Protector policies integrated with AIA Vitality.

Cumulative Premium Percentage

This is a percentage applied at the policy’s inception or each policy anniversary, starting from the first policy anniversary.

| Minimum Cumulative Premium Percentage | 85% |

| Maximum Cumulative Premium Percentage | 100% |

It is used to adjust the premium based on the integration of AIA Vitality.

This percentage is applied to the premium before any adjustment due to the integration of AIA Vitality.

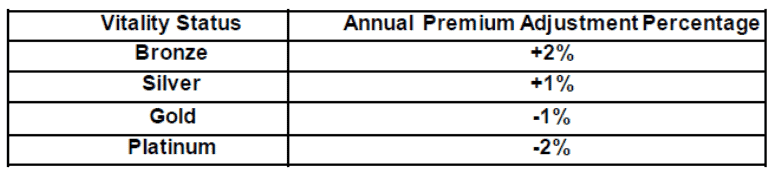

Annual Premium Adjustment Percentage

This percentage is applied at each policy anniversary, starting from the first policy anniversary.

The specific percentage applied depends on the Insured’s Vitality Status as of 45 days before the relevant policy anniversary.

It further adjusts the premium based on the policyholder’s Vitality Status.

If you do not have a Vitality Status as of 45 days before a policy anniversary due to the termination of your AIA Vitality membership, the Cumulative Premium Percentage applied at that specific policy anniversary will be set at 100%.

Summary of the AIA Pay Protector

| Cash & Cash Withdrawal Benefits | |

| Cash Value | No |

| Cash Withdrawals | No |

| Health & Insurance Coverage | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Health & Insurance Coverage Multiplier | |

| Death | No |

| TPD | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Additional Benefits | |

|

Yes |

My Review of the AIA Pay Protector

The AIA Pay Protector is a simple and reliable solution to protect your income in case of short-term disability or illness.

One of the key advantages of AIA Pay Protector is its comprehensive coverage.

It caters to both illness and injury-related disabilities, ensuring that you are protected in a wide range of scenarios.

This flexibility provides peace of mind, knowing that you are covered regardless of the cause of your disability.

In the event of a short-term disability or illness that affects your ability to work, this plan provides fixed monthly income payouts for up to 5 years.

This financial support can help you maintain financial stability during a challenging period.

Regardless of any future changes to your income or any other sources of income you may receive, the plan guarantees that you will receive the monthly income based on the plan you’ve chosen.

Furthermore, AIA Pay Protector can be integrated with AIA Vitality, a wellness program that offers additional benefits.

Also, premium adjustments may occur based on AIA Vitality integration, which will help you get a better deal for its benefits.

Additionally, the Waiver of Premiums provides crucial financial relief if you cannot work due to disability, ensuring that you do not have to worry about paying your policy premiums during this challenging period.

While this policy provides valuable coverage in the event of disability, it does not include a death benefit or optional riders that can increase your coverage.

You will also only get a fixed amount based on your chosen plan, which can be a double-edged sword.

If your income increases, you’ll only receive payouts based on the plan you purchased, so that’s less than your current salary.

Because of this, the AIA Pay Protector shouldn’t be your main source of protection. Instead, it should be good to have on top of your current policies.

You should still get a shield plan, a life insurance policy, and an ECI/CI policy as your base coverage.

By combining different policies, you can create a more robust insurance portfolio that might fit what you are looking for when it comes to your protection and financial objectives.

We recommend taking time to research policies you should first have, followed by alternatives to the AIA Pay Protector if you already have sufficient base coverage.

You should also get a second opinion on whether the AIA Pay Protector is suitable for you, as this is a long-term financial commitment.

If you need someone to assist you, we partner with unbiased MAS-licensed financial advisors to help you with this.

Click here for a free, non-obligatory chat.