Tencent Holdings Limited is a Chinese multinational technology company headquartered in Shenzhen, Guangdong Province. It is China’s largest Internet company by revenue and social media platform.

Its core businesses include online games, mobile apps, instant messaging, social networking, cloud computing, payment processing, digital content distribution, e-commerce, advertising, music, video streaming, and online education.

Tencent has become one of the top companies in the world because it has mastered the art of monetising its massive user base. They’ve done this by creating great products and services that users love. And they’ve done this while also investing heavily in research and development.

If you’re interested to invest in Tencent but want to avoid investing in them through the Chinese markets, you can purchase them via the US OTC markets through TCTZF and TCEHY!

In this post, we’re gonna explain the differences between TCTZF and TCEHY.

| Stock | TCTZF | TCEHY – ADR |

| Current NAV | $46.54 | $46.26 |

| Average volume | 58.13K | 4.99M |

| All-time high | $89.4288 | $97.64 |

| Market Cap | $453.51B | |

| Yield | 0.33% | |

| Dividend | $0.20 | |

| P/E Ratio | 13.40 | |

| P/B | 4.42 | |

Key Highlights As of 18th April 2022

About Tencent Holdings Ltd

Both TCTZF and TCTZF are stocks offered by Tencent Holding Ltd which is an investment holding company that offers online advertising services and Value Added Services (VAS).

The VAS division mainly deals with providing mobile and online games and apps via different online and mobile platforms.

On the other hand, the online advertising division engages in display and performance-based promotions. The other divisions relate to the provision of cloud-related and payment services.

The company is one of the largest tech giants in China.

Because it’s a large company, it has listed its shares in multiple security exchanges around the world. Each security has a unique ticker symbol which can be confusing for new or even old investors.

Listing

The company Tencent has a listing on the Hong Kong Exchange under the ticker 0700.

However, in the US, Tencent is traded in the over-the-counter (OTC) market under the tickers TCTZF and TCEHY.

TCTZF are traded like ordinary shares while TCEHY is an American Depositary Receipt (ADR).

The OTC market is divided into Pink Open Market, Venture Market, and Best Market. In this case, both TCTZF and TCEHY are listed in the Pink market.

The advantage of OTC markets for companies is that they operate loosely with less stringent regulation.

However, OTC markets are more difficult for retail investors to access as they require a broker-dealer transaction as compared to using centralised exchanges via online brokerage accounts.

Also, there is lesser liquidity in OTC markets, making stocks traded there highly volatile.

Trading Fees

The main difference between an ADR and regular stock is that ADRs attract extra fees to compensate for custodial services offered by the depository bank.

US-based depository banks

As earlier noted, TCEHY is listed as an ADR.

What is an ADR? The American Depositary Receipts or ADRs allow foreign-owned equities or securities to be traded on the US stock exchanges.

These are held by a US-based depository bank outside the US.

Because these securities are issued by non-US companies, they may have risks such as exchange currency risk should your country’s currency or the currency of the stock you invested in fall below the US dollar.

However, despite this risk, the ADR offers investors a chance to invest in global securities.

For US investors, ADRs are a great choice since you have an opportunity to invest in foreign firms that are not directly traded on the US-based security exchanges.

Voting rights

Whether you buy TCTZF or TCEHY, there is a unique factor that binds the two.

ADRs such as TCEHY represent the prices of the foreign firm shares but don’t grant you ownership or voting rights like normal or ordinary stocks. In this case, you’re not a direct stockholder and therefore can’t vote.

Besides the differences, both TCTZF and TCEHY securities are part of the VIE (Variable Interest Entity) structure which is a legal business unit where you can have controlling interest but lack voting rights.

So if having voting rights is something you care about, then these might not be for you.

Performance Charts

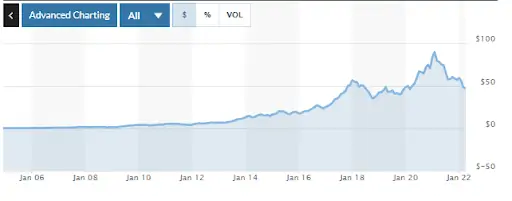

Both shares have shown great performance over the last 10 years as shown in the charts below.

TCEHY

TCTZF

As you can see, both performances are extremely similar as they are tied to Tencent’s 0700 performance.

When you look at the annual returns of Tencent Holdings Ltd, it was positive from 2019 to 2021. However, there was a decline in 2021 due to the effects of the COVID-19 pandemic and the government crackdown on Chinese stocks.

Dividend Payouts

The company has paid dividends for the last 10 years and therefore, as an investor of either TCEHY or TCTZF, you’re entitled to dividends.

Nonetheless, the difference comes in the currency in which you receive the dividends.

The main difference is that TCEHY pays dividends in USD($) whereas TCTZF pays dividends in HKD.

Both stocks have a yield of 0.33% in the 12-month trailing period and paid a dividend rate of $0.2.

Therefore, with fluctuations in exchange rates, you may receive a higher or lower amount than what you are anticipating.

For example, if you buy TCTZF, you may receive lower dividends should the Hong Kong Dollar devalues.

On the other hand, buying TCEHY may be in your favour since dividends paid are in US dollars.

If you are a dividend investor, this information is very crucial to keep in mind.

Trading Volume

Generally, OTC stocks have lower trading volumes because the process of trading is quite complicated.

Even though both are traded in the US, TCEHY is more liquid when looking at the average traded volume. Whereas TCTZF has an average volume of only 58.13K, TCEHY has recorded an impressive rate of 4.99M.

High liquidity comes with greater advantages which may influence your choice. For instance, high liquidity trading lets you enter or exit a position quickly without significant changes in the price.

Hence, they are an advantage for day traders or investors in general.

Naturally, investors and traders will go for the most liquid stock and in this case, TCEHY is a great choice.

Conversion to ordinary shares

Unlike TCEHY shares that can be changed to ordinary shares, TCTZF can’t. Therefore, if you want to reduce your ADRs holding, you can convert the TCEHY shares to 0700 ordinary shares.

The process is easy as you only need a brokerage firm with pink sheets on the HKE. The current rate of conversion for both shares is 1-to-1.

Despite this, there are applicable charges such as creation, processing, and cable wire fee. Other risks of conversion include price and exchange rate fluctuations.

The amount you incur here depends on the broker facilitating the conversion, so make sure to look for the most affordable option available.

In the news

Like other ADRs of tech companies such as Alibaba and Baidu, the Tencent ADR has presented excellent growth for investors. In the past, Chinese companies have not had a good reputation and there was increased scrutiny for such firms.

Also, due to geopolitical tensions between US and China, several companies were delisted from the US securities exchanges by the Trump administration through executive orders.

However, in the recent past, there have been several developments. For example, China has recently lifted the 9-month freeze on gaming licences after the market leader Tencent adjusted its business practices following economic fallouts.

Although there’s a lot of uncertainty in the Chinese markets, it’s undeniable that many Chinese stocks are currently undervalued as many have dropped more than 50% since their all-time highs.

Is it a good time to invest in China?

This is something that’s up to you.

If it’s up to us, we’d choose TCEHY as it’s much more liquid than TCTZF.

However, we think it’s better to purchase 0700 through the Hong Kong Exchange.

Why?

It’s cheaper, we own a share of Tencent, and it’s much easier to get invested via a brokerage account like moomoo.