Syfe, StashAway, and Endowus are 3 among the most popular Singapore-based robo advisors of today.

Syfe is comparatively newer (launched in 2019) than StashAway (founded in 2016), and Endowus (founded in 2017) which is the first digital advisor for CPF, SRS, and cash savings.

Here, we take a close look at the different aspects underlying these platforms to help you decide which one is best for you.

Investment Strategy

Syfe’s Investment Strategy:

Syfe builds its investment strategy based on its portfolios that are diversified across stocks, bonds, and commodities.

Syfe uses Automated Risk-managed Investments (ARI) as its investment strategy which is a combination of two leading investment approaches –Global Market Portfolio (GMP) and Risk Parity Portfolio (RP).

This investment strategy is designed to manage your portfolio’s downside risk, thereby providing enhanced risk-adjusted returns.

Its all-in-one portfolios hold 3 types of exchange-traded funds (ETF) being equities, bonds, and gold.

Syfe introduces 4 core portfolios –

- Equity100

- Core Growth

- Core Balanced

- Core Defensive

They follow three guiding principles while setting their portfolio algorithms for these core portfolios –

- Asset Class Risk Budgeting

- Smart Beta

- Stable asset allocation

As all their portfolios hold a distinguished objective and a unique investment strategy, it’s crucial to introduce a discussion on each one of them separately depending upon these grounds.

Equity 100:

With Syfe’s Equity100 Portfolio, the higher the risk you take, the higher the potential returns you get. The reason is that it is 100% allocated to global equities, and equities have greater potential for higher returns while conveying more risk.

Syfe’s Equity100 lets you invest in 1500+ top global stocks to generate better risk-adjusted returns using their Smart Beta strategy.

Core Growth:

This portfolio again provides you with higher potential gains while involving some risk management. It is designed to offer you long-term growth with higher return potential.

This core portfolio implements Factor Investing and Asset Class Risk Budgeting with a longer-term risk horizon to maximise risk-adjusted returns.

Core Balanced:

As its name suggests, this core portfolio is designed to balance return with risk, providing you with a moderate return while involving comparatively higher risk management.

This portfolio implements an Asset Class Risk Budgeting process and incorporates Factor Investing to achieve the ideal risk-reward management.

Core Defensive:

This portfolio enables you to get stable and steady returns with its highest risk management strategy. With it, you can invest primarily in high-quality bond ETFs, along with a lower percentage of stock and gold ETFs.

To manage this low-risk investment strategy, this portfolio uses Asset Class Risk Budgeting and Factor Investing.

Satellite Portfolio:

Apart from the 4 core portfolios, Syfe includes Satellite Portfolios that involve higher risk.

With its REIT+ portfolio, you can invest in 20 of Singapore’s largest REITs.

Again, they provide you with the option of a Thematic portfolio, with which, you can invest in global megatrends like ESG, Healthcare, Disruptive Tech, etc.

Apart from all these portfolios, Syfe presents you with the option to build a personalised portfolio by mix-matching the above-mentioned ones.

Three factors can impact your choice of these portfolios – your goals, investing timeline, and your risk appetite.

StashAway’s Investment Strategy:

When coming to investment strategy, Strashaway uses its Economic Regime-based Asset Allocation (ERAA) framework. According to the co-founder of StashAway Freddy Lim, this framework “leverages macroeconomic data to minimize risk and maximize returns for every portfolio throughout economic cycles.”

This framework focuses on asset allocation rather than securities selection. To allocate assets, their investment strategy depends upon current economic conditions decided upon four economic regimes –

Source: StashAway

According to their investment strategy, StashAway analyses your financial circumstances and risk selection using live and historical data. And using this information, they select the most suitable portfolio for you.

StashAway involves 5 different portfolios –

General Investing Portfolio:

This portfolio is based upon your selection of risk exposure you are willing to take on.

It again includes 2 different categories of portfolios, – Core and Higher Risk portfolios.

The difference between these two sub-categories of portfolios is that Core Portfolios have a StashAway Risk Index between 6.5% and 22%.

Whereas, Higher-risk Portfolios have a StashAway Risk Index between 26% and 36%.

Goals-based Investing Portfolio:

This portfolio is designed to strategise investment based on your life goals. It helps you to gain returns that meet your real-world needs.

Income Portfolio:

This portfolio lets you supplement your income over the long run. Furthermore, it provides you with the opportunity to build a dependable income stream from carefully selected assets.

Responsible Investing (ESG) Portfolio:

This particular portfolio enables you to invest for both profit and purpose without sacrificing returns. With it, you can invest in ethical, responsible, and sustainable businesses, thereby doing your part to provide the world with positivity.

This is suitable for long-term investing and building your core wealth as well.

Thematic Portfolio:

StashAway’s Thematic Portfolio is a relatively new addition. It is suitable for long-term investment to maximise your income by investing in industries you understand and believe in.

With their investment strategy, StashAway provides you with maximised returns with minimised risk.

Furthermore, StashAway includes a Risk Index percentage that refers to the 99% probability of not losing percentage for a portfolio. According to that, they provide you with a maximum of 36% risk index.

StashAway invests in Government bonds, agency bonds, investment-grade corporate bonds, real estate investment trusts, and high dividend yield stocks listed on the Singapore stock exchange.

Endowus Investment Strategy

Endowus has four strategic portfolio types in which clients can invest their Central Provident Funds (CPF), Supplementary Retirement Scheme (SRS), and cash according to their specific financial goals, risk tolerance, and timeline.

- Endowus Core Portfolios (general)

- Endowus Income Portfolios (passive income)

- Endowus Sattelite Portfolios (general)

- Endowus Cash Smart (cash management)

Here is a detailed breakdown of each portfolio type:

Endowus Core General Investing Portfolios:

Flagship

This is the first choice portfolio for most clients. It accepts cash, CPF, and SRS. Clients can choose from 6 risk levels (from very conservative which is 100% fixed-income, to very aggressive which is 100% equities) with varying proportions of equities and fixed income. 10-year returns range from 4.7 to 12.2% based on risk level.

ESG

This portfolio type accepts cash and SRS, and provides access to ready-made portfolios built with the best sustainable and climate funds. Like the flagship option, there are a total of 6 risk levels to choose from.

Factor

These portfolios are implemented by Dimensional, a top-performing global fund manager in quantitative investing renowned for its long track record, implementation expertise, and affordability.

These portfolios provide clients with globally diversified investments that are systematically managed towards risk premiums. Clients can invest with cash and SRS. 10-year returns range from 2.7 to 11.0% based on risk level.

Endowus Income Portfolios:

These 3 cash portfolios allow clients to receive monthly payouts while growing or preserving their capital. They are focused on income generation, market volatility endurance, and stability.

Stable Income

100% fixed income. This is a low-risk option, intended for older investors who need access to income in the short term. Total returns are estimated between 3.5 and 7.0%.

Higher Income

20% equities, 80% fixed income. This fund is focused on moderate long-term capital appreciation. Returns are estimated between 3.5 and 9.0%.

Future Income

40% equities, 60% fixed income. This fund is the highest risk-highest returns option. It is intended for clients who have long-term growth goals. Returns are estimated between 4.0 and 10.0%.

Endowus Sattelite Portfolios:

The Endowus Satellite portfolios target specific regions, themes, and trends. Endowus currently offers portfolios in 6 categories:

Global Real Estate – Endowus offers curated 100% equity funds that capture global real estate markets. The portfolio requires cash investment and is considered very aggressive in terms of risk. The top fund allocation is the Janus Henderson Horizon Global Property Equities Fund (50%).

Technology – These funds offer clients access to invest in the world’s top technologically innovative companies. There are 5 funds to choose from. The most popular funds include Fidelity Global Technology, Franklin Technology Fund, and the BlackRock BGF Next Generation Technology Fund. Cash investments are required.

China Equities – These 5 funds are very aggressive. They capture China’s high growth potential and are 100% equities.

China Fixed Income – These very conservative funds capture Chinese corporate and government bonds. They are 100% fixed income.

Megatrends – These funds invest in future driven economic shifts such as healthcare, clean energy, and AI. They are 100% equities. Currently, Endowus offers 6 different megatrend funds to choose from.

Low Volatility Fixed Income – These are hyper-defensive, conservative, 100% fixed income funds.

Endowus Cash Smart:

This fund accepts cash and SRS, and allows clients to access a money market and short duration bond funds. Clients can choose from 3 options:

Secure– Invests in institutional fixed deposits with Singapore’s best money market funds. This option is focused on stability with a yield at a projected return of 0.7 to 0.8%.

Enhanced– This option combines a short duration fund with money market funds, for a higher yield of 1.4 to 1.6%.

Ultra– This offers the highest yield rate of 2.0 to 2.2%.

Endowus Fund Smart:

Endowus also provides Fund Smart, a curated list of 269 different mutual funds in order for clients to customize their fund allocations at a low cost.

Asset Classes

Both Syfe and StashAway invest in exchange-traded funds. The difference between the two is the asset classes and individual components of their selected ETFs. Endowus, on the other hand, invests primarily in mutual funds and unit trusts.

Syfe’s Asset Classes:

Syfe is known for offering the first and only exclusive Singapore real estate investment trusts (REIT) based portfolio in their REIT+ portfolio.

So if you’re interested in getting some exposure to REITs, then their REIT+ portfolio is something you should consider.

Let’s now discuss their asset allocation policies related to all their core portfolios –

Equity100:

With a 100% equity allocation policy, Syfe’s Equity100 portfolio primarily focuses on technology (QQQ) and US stocks (S&P500). However, you’ll still have exposure to global stocks across different sectors and even Chinese equities.

Core Growth:

This portfolio follows a diverse allocation of assets, although it is for the most part based on equity. It is allocated 69.0% on equity, 25.1% on bonds, and 5.9% on commodities.

Core Balanced:

Being a relatively higher risk management portfolio, this particular portfolio is allocated towards bonds for a considerable part. It is based 50.0% on bonds, 38.2% on equity, and 11.8% on commodities.

Core Defensive:

As this portfolio involves the highest risk management, it is based 70.9% on bonds, 19.1% on equity, and 10.0% on the commodity.

StashAway’s Asset Classes:

StashAway’s portfolio is focused on the allocation of assets, where there are 4 main asset classes –

- International Equities

- Equity Sectors (US)

- Real Estate

- Commodities

With this, they can focus on the performance of a combination of assets from a wide range of classes and markets instead of an individual asset.

StashAway’s asset classes are based upon their Economic Regime-based Asset Allocation policy that places the risk-factor as the basis of the investment strategy. As mentioned in the previous section, it depends upon four economic regimes for allocating the assets.

This ERAA framework follows a re-optimisation technique, according to which, your portfolio’s asset allocation will change to prepare for the current or upcoming regime while maintaining your risk preferences.

This re-optimisation is triggered by one of these 3 events –

- An economic regime change

- Uncertain economic conditions flagged by StashAway’s Risk Shield

- A change in the valuation of an asset class

Like Syfe, StashAway invests in global equities with a focus on the US market.

Endowus Asset Classes:

Endowus invests clients’ money in mutual funds ( unit trusts), which are either equity/stock-based or fixed income (bond) based. Endowus Core portfolios allow clients to choose from 6 asset distribution tiers based on client risk tolerance and investment timeline.

- Very conservative (100% fixed income (bonds))

- Conservative (20% equities, 80% fixed income)

- Measured (40% equities, 60% fixed income)

- Balanced (60% equities, 40% fixed income)

- Aggressive (80% equities, 20% fixed income)

- Very aggressive (80% equities, 20% fixed income)

Endowus Satellite, Income, and Cash Smart portfolios have locked asset distributions, as seen above. So you’ll be investing in mostly stocks and bonds.

In addition to stocks, Endowus also offers portfolios of equities of global REITs. Endowus global real estate portfolios also allocate investments to property developers and infrastructure. The US is the top regional allocation followed by Japan. Singapore accounts for 4.0% of the regional real estate investment portfolios.

Like Syfe and StashAway, Endowus invests in global equities. Some Endowus portfolios such as the Flagship, ESG, and Factor portfolios have a strong focus on the US market (over 45% of allocation).

Fees

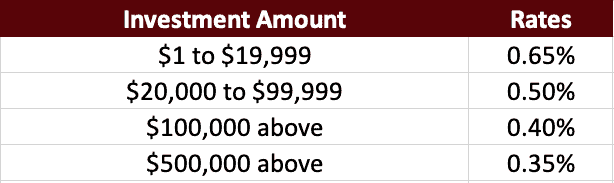

Syfe’s Fee Structure:

Syfe is a platform holding some of the lowest and most attractive fees among all robo advisors in Singapore. This is the reason that it is more recommendable to beginner investors than StashAway.

Management fees at Syfe range from 0.65% to 0.4%. However, those who use its basic plans will have to pay more in management fees than the ones having either gold or platinum accounts.

Here’s a table showing the annual charge rates –

So, Syfe is designed with the principle of investing more and getting charged less.

Syfe has no minimum investment amount for any of their portfolios as long as you transfer your funds in SGD.

But, in case you undertake to transfer your funds in USD, there is a minimum investment amount of $10,000.

Endowus’ Fee Structure:

Governed by one of the 8 key principles of the Endowus investment philosophy, which is to maximise returns by minimising cost, Endowus strives to bring fees down as low as possible.

Endowus has no upfront sale or transaction fees. Clients are charged a per annum fee based on the value of their assets.

Endowus offers a 100% trailer rebate to maintain the dignity of portfolio recommendations.

The minimum initial investment amount required is SGD1,000.

For Endowus Core, Satellite, and Income portfolios, clients incur a flat fee of 0.40% when investing with CPF or SRS.

For cash, there is a pricing tier based on the asset values.

| Investment Amount | Rate |

| Less than $200,000 | 0.60% |

| $200,000 to $1,000,000 | 0.50% |

| $1,000,000 to $5,000,000 | 0.35% |

| Above $5,000,000 | 0.25% |

For the Endowus Fund Smart, a single fund purchase incurs a fee of 0.30% for cash, CPF, and SRS. Multi-fund portfolio fees are the same as core, income, and satellite fees. For Cash Smart portfolios, there is a flat fee of 0.05% for both cash and SRS.

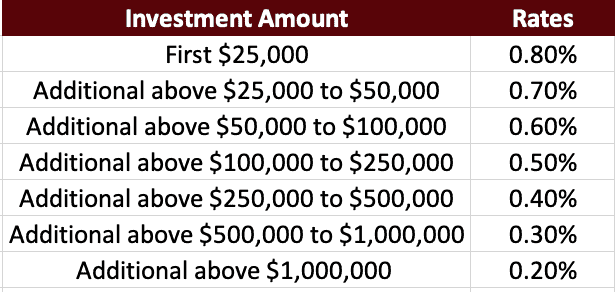

StashAway’s Fee Structure:

With Stashaway, all the investors have to pay are the annual management fees. However, they don’t charge any maintaining balance, withdrawal fees, and platform fees.

But if you invest a small amount with this platform, you will end up giving a heavy amount of management fees. This will lead you to spend a huge amount of money at the end of the year. It charges those with investments lower than a million with 0.80% in fees.

Here’s the detailed fee structure of StashAway –

It’s important to note that, unlike Syfe which reduces their total fees based on the amount you have invested, StashAway charges you on a staggered basis.

So, if you are ready to invest a lot, your fees will be much less.

Potential Returns

As their official sites say, Syfe Equity100 has a backtested average annual return of 14.7% in the last 10 years, whereas Stashaway’s 36% Risk Index Portfolio provides an annual return of 17.10% in 2020 since inception.

Potential Returns with Syfe:

Equity100:

The average annual return of this Syfe portfolio based on the last 5 years is 13.32% according to Syfe, beating the MSCI World Index benchmark of 11.36%.

Core Growth:

This portfolio gave an average annual return of 10.6% based on the last 5 years.

Core Balanced:

This portfolio shows an average annual return of 7.9% on the last 5-year basis.

Core Defensive:

This Syfe portfolio has an average five-year annual growth of 5.4%.

Potential Returns With Endowus:

- Endowus Core portfolios gave a 10-year (Jan 2012-Dec 2021) return between 2.7 to 12.2% depending on the specific funds selected and risk tolerance allocated.

- Endowus Income portfolios have an estimated total return between 3.5 and 10.0%.

- Endowus Satellite portfolios gave an average annualised 10-year return of 17.62%.

- Endowus Cash Smart portfolios have a projected return rate between 0.7 and 2.2% after all fees.

Potential Returns with Stashaway:

In each portfolio, StashAway introduces 2 types of return, – time-weighted return and money-weighted return. Basically, with StashAway, the potential return is based on the risk you are willing to take, and that you choose while registering.

As Stashaway founds its investment policy on the grounds of asset allocation, you can see good potential growth with its investments.

Although the year 2020 was stressful because of the COVID 19 pandemic, still StashAway claims to have shown an impressive return with their portfolios, that is 24.10% with a 36% Risk Index.

Other Features

Let’s look at some other important features related to these platforms in this part –

Syfe:

- With Syfe, stock trade clients are under the protection of Securities Investment Protection Corporation, (SIPC) for up to US$500,000 when they enrol their portfolio with Syfe. The protection states stock investors can claim compensation of up to US$500,000.

- Clients are offered free consultations from Syfe’s investment advisors, and those with S$20,000 or above can get personalised advice based on individual goals in addition.

- Syfe provides you unlimited access to the free consultation of wealth experts depending on your tier.

- Have $500,000 to $1,000,000 to invest? Syfe’s Private Wealth gives you access to lower fees and non-retail investments with personalised advisory.

- If you’re savvy, you get the option to build your portfolio with a wide range of ETFs available.

- Moreover, this robo advisor offers you Syfe Trade, an online brokerage for US markets.

StashAway:

- StashAway allows you to invest with SRS funds.

- With Stashaway Reserve facilities (minimum $50,000), you can have access to exclusive institutional-level private investments such as venture capital and private equity, and personalised wealth advisory.

Endowus:

Out of the 3 robo advisors, Endowus is the only one that allows you to invest with SRS, CPF, and cash.

Endowus portfolio strategies are heavily based on evidence and not market speculation. In addition, Endowus implements its portfolios by accessing leading fund managers with proven success.

Endowus allows clients to pick and choose additional mutual funds to invest in from a variety of over 250 unit trusts in its Fund Smart collection. Fund Smart includes Endowus Exclusive funds; funds and strategies that are available to Endowus clients only.

Like Syfe, Endowus also offers a private wealth investment plan.

Conclusion

Now that you know the features offered by both Syfe, Endowus and StashAway, you should have a better idea of which you’d prefer.

Both Syfe and Endowus offer expansive fund markets for clients to build customised fund portfolios.

This may appeal to investors who want to enjoy the hands-off approach that robo advisors offer but also want the opportunity to choose their own funds and stocks from time to time or as they gain more investment knowledge.

The major difference between Syfe and Endowus fund markets is that Syfe’s fund market is ETF based (passively managed) while Endowus’ fund market is unit trust-based (actively managed); these differences may lead to slight differences in return.

Endowus has a minimum initial investment amount of SDG1,000. Syfe on the other hand has no minimum investment amount and its fee scale ranges from 0.4 to 0.65% based on your client tier and asset values.

With StashAway, you will have to pay a minimum of 0.8%. Syfe is by far the most affordable option if you do not have a lot of money to invest upfront.

Their portfolios have been claimed to have outperformed Syfe over the past 5 years with an annualised return of 17.1% as compared to Syfe’s 13.32% and Endowus’ 12.18% (100% equities core portfolio).

StashAway’s asset allocation is also much safer than what Syfe’s Equity100 offers, with diversification across REITs and commodities. Endowus however, offers 6 risk tiers for each core portfolio, offering clients more opportunities to mould the core portfolios to match their specific requirements.

Ultimately, your selection should be based on the time horizon you have, the fees you’re willing to incur, and the investment strategy that you prefer.

Personally, I prefer Syfe due to the lower investments and lower fees involved. I also enjoy the differences between the Core and the Thematic portfolios offered.

I’d opt with Endowus to invest my SRS funds because well… they’re the only ones I can go with.

Nevertheless, if I’d have a large amount of cash to invest (more than $1 mil to average down the fees), then I’ll probably go for StashAway.

Their portfolios have been claimed to have outperformed Syfe over the past 5 years with an annualised return of 17.1% as compared to Syfe’s 13.32%.

Its asset allocation is also much safer than what Syfe’s Equity100 offers, with diversification across REITs and commodities.

The trade-off?

Much higher fees.

Regardless, these are my personal opinion and they shouldn’t affect your selection.

Your selection should be based on the time horizon you have, the fees you’re willing to incur, and the investment strategy that you prefer.

Choosing Syfe? Sign up here: Syfe.com

Choosing StashAway? Sign up here: Stashaway.sg

Choosing Endowus? Sign up here: Endowus.com

Not sure if robo advisors are for you? Get a financial advisor to help you invest instead.