Singlife Grow is now known as Singlife Sure Invest.

The Singlife Sure Invest is a single premium investment-focused investment-linked plan (ILP).

Although technically an ILP, it works like a combination of a robo advisor and cash management account – which we think it’s not for everyone.

Here’s our review of the Singlife Sure Invest, so keep reading.

My Review of the Singlife Sure Invest

Firstly, I’d like to say that although this is technically an ILP, I believe it works like a combination of a cash management account and a robo advisor.

This is because it charges a low management fee of 0.35% – similar to what a cash management account like Syfe Cash+ would charge.

You can also make no-obligation ad-hoc or regular investments like a robo advisor.

However, I personally don’t think the Singlife Sure Invest would be the best option to use as an investment platform, whether as an ILP or robo advisor, for a few reasons.

Firstly, there are only 9 funds to choose from. As an investor, you would want a range of funds or options so that you can adjust to your needs as time goes on.

These funds were only incepted in 2020, so they have little track record. Looking closely at each fund factsheet, about half of them have been giving negative returns since inception.

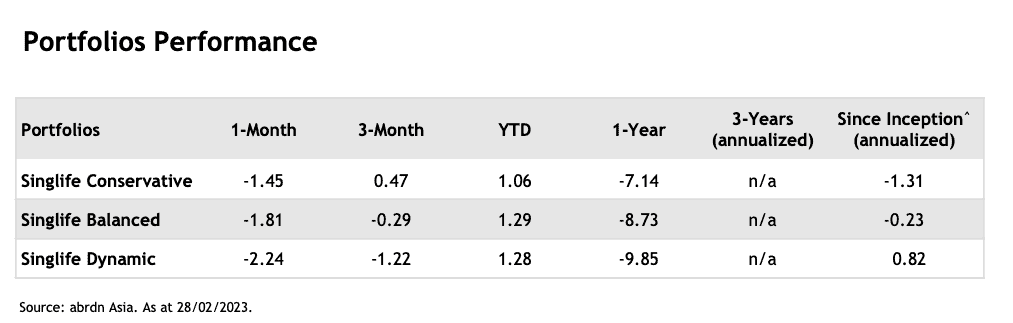

Singlife releases the report for its portfolios regularly, and according to the February 2023 report, they aren’t doing too well.

So if you’re looking for an investment option instead, opt for other ILPs in the market.

However, I would definitely use this as a cash management account to store my emergency funds, savings, or investment war chest.

Although your money is technically invested, no other product in the market guarantees 100% of your capital straight from the start should the company fail.

The Singlife Sure Invest is protected under the Policy Owner’s Protection Scheme, which is administered by the Singapore Deposit Insurance Corporation (SDIC).

This means that should Singlife fail, you’re protected for up to $75,000 under SDIC as long as you meet the laid-out conditions.

Yes, banks are protected by SDIC too, but savings accounts don’t offer the opportunity for my money to grow, while fixed deposits don’t give me the liquidity I need.

Also, there’s a low single premium ($1,000), low recurring top-ups ($100), and low ad-hoc top-ups ($100), which makes it great for those saving money.

Looking to get an ILP?

Talk to a MAS-licensed financial advisor.

Here’s more about the Singlife Sure Invest:

Criteria

- Aged 18 to 75

- Minimum Single Premium Amount: $1,000

- Minimum Recurring Single Premium (RSP): $1,000

- Minimum Ad-hoc Premiums: $100

General Features

Single Premium

As noted, Singlife Sure Invest is a single premium policy, and the minimum single premium is $1,000.

Recurring Single Premium (RSP)

As long as the policy is in force, you may opt to make recurring single premiums (AKA monthly investments) of minimally $100/month.

You may also increase or decrease this amount subject to Singlife’s approval.

Ad-hoc Premium

You may also make ad-hoc investments of minimally $100 into your Singlife Sure Invest policy.

Protection

Death Benefit

If death occurs during the policy tenure, your beneficiaries will receive the death benefit, which is the higher of;

- the account value

- 101% of the net premium.

The amount paid is minus debts owed to the policy, and then it subsequently terminates.

Terminal Illness Benefit

If, in the unfortunate event, you are diagnosed with a terminal illness while the policy is still running, you will receive the death benefit as the terminal illness benefit.

After payment, the policy ends.

Key Features

9 Funds to Choose From

Unlike other ILPs in the market, Singlife Sure Invest makes it easy for you by only having 9 funds to choose from.

Whether this is a good or bad thing depends on how savvy you are, as there is no financial advisor managing this ILP for you.

- Allianz Global Investors Fund – Allianz Best Style Global Equity Fund

- BlackRock Global Funds – US Dollar High Yield Bond Fund

- Eastspring Investments – Global Low Volatility Equity Fund

- Fidelity Funds – World Fund

- JPMorgan Funds – Asia Pacific Equity Fund

- Neuberger Berman Strategic Income Fund

- Nikko AM Shenton Global Opportunities Fund

- United Asian High Yield Bond Fund

- United SGD Fund

Select from 3 portfolios – Conservative, Balanced, Dynamic

Based on the above funds, Singlife Sure Invests offers you 3 portfolios: Conservative, Balanced, and Dynamic.

These portfolios use the mentioned funds and differ by asset allocation, and you should choose one based on your risk appetite.

Conservative Portfolio

The Conservative Portfolio invests in 20% equities and 80% fixed-income funds, with the objective of preserving your capital.

This policy is best for those who are risk-averse (such as those nearing retirement).

Balanced Portfolio

Next comes the Balanced Portfolio, which invests in 50% equities and 50% fixed-income funds.

The Balanced Portfolio offered by Singlife Sure Invest aims to achieve capital growth while taking on some market risk.

As such, this portfolio is best for those with a moderate risk tolerance or those looking for investment returns and comfortable with taking some risk.

Dynamic Portfolio

The last portfolio is the Dynamic Portfolio, which invests in 80% equities and 20% fixed-income funds to achieve significant capital appreciation.

This is best for those with high risk tolerance and long-term investment horizons.

Maturity Benefit

You will receive the maturity benefit during the policy anniversary on which you celebrate your 100th year birthday.

Subsequently, the policy ends.

Partial Withdrawal

You may request a partial withdrawal of up to 95% of your account value during the policy tenure, provided you meet the minimum partial withdrawal of $1,000.

Your account value after partially withdrawing should also be at least $1,000.

If your account value falls below $1,000, the withdrawal is deemed a full surrender, and the policy ends.

It’s important to remember that partial withdrawals reduce your benefits and, ultimately, the surrender value.

Fund Switching

You can switch from one fund to another with no fees.

Singlife Sure Invest Fees and Charges

Insurance Charge

Currently, the policy has no insurance charge.

Management Charge

The management charge is 0.25% per quarter of the account value.

Remediation Payment

The remediation payment is charged should your policy goes into default (account value below $500) and if you’d like to bring it out of default.

Should you want to bring it out of default, you will pay a redemption payment of S$500 to bring your policy out of default.

The plan allows you to pay the termination or redemption fee 60 days after the policy defaults.

Failure to pay leads to termination and is deemed as a full surrender.

Subsequently, you will receive the balance after charges and debts to the policy are deducted.

We’re not too sure if this payment is made to Singlife or your account, but we believe it should be made directly to your account as the minimum value is $1,000.

Summary of the Singlife Sure Invest

| Cash and Cash Withdrawal Benefits | |

| Cash Value | Yes |

| Cash Value Benefits | Yes |

| Health and Insurance Coverage | |

| Death | Yes |

| Total Permanent Disability | No |

| Terminal Illness | Yes |

| Critical Illness | No |

| Early Critical Illness | No |

| Health and Insurance Coverage Multiplier | |

| Death | No |

| Total Permanent Disability | No |

| Terminal Illness | No |

| Critical Illness | No |

| Early Critical Illness | No |

| Optional Add-on Riders | No |