For most of us living, working and doing business in Singapore, we would probably have received notices from the Inland Revenue Authority Singapore (IRAS) reminding us to file our individual income tax return yearly.

However, do you actually understand how your income tax return is calculated? Do you know the types of tax deductions and personal reliefs you can receive to reduce your tax payables? Want to find out how you can maximise these tax savings and obtain tax efficiency?

This is where tax planning comes in!

What is personal tax planning?

Personal tax planning is the process of obtaining tax efficiency for an individual by optimising the current tax policies offered. Tax planning requires the careful analysis of a person’s financial position and plan from a tax point of view, so as to maximise the tax deductions, reliefs, and exemptions allowed.

Timing of important dates, such as filing date, basis period, and payment date during the tax seasons are also taken into consideration under tax planning.

Adhering to the correct dates for submission of tax returns and tax payments helps to prevent the incursion of unnecessary extra charges or penalties.

By doing tax planning, you ensure that all elements of your financial plan work together to obtain the highest tax efficiency and minimise the amount of tax payable for the individual.

Benefits of personal tax planning in Singapore

Personal tax planning gives you both short and long term benefits.

The most obvious short term benefits would be a reduced tax liability for yourself for the year. Actions such as making approved donations can reduce your tax bill.

By knowing and understanding tax regulations and implications, you can plan and make the best-informed decision for tax efficiency while also avoiding penalties.

In the long term, tax planning helps you to see the big picture for better tax planning. By understanding the ever-changing regulations, you can look for ways to minimise tax payments.

This in turn helps you save money for your future and retirement. The money can also be saved for your children, as inheritance is not taxable in Singapore.

Also, you are able to save the money for better use such as capital gains from investments, which are also not taxable. Not only do you pay less tax, but this also helps you grow your money too!

Basic understanding of individual tax return calculations

In order to have a better understanding of tax planning, we will first have to understand how tax returns are being calculated and taxed.

For personal tax, the year in which tax is tabulated and charged is called the year of assessment (YA). This is based on the “basis period” which is 1st January to 31st December of the previous year.

For example, tax declared this year in YA 2021 would be based on the income amount earned by you from 1st January 2020 to 31 December 2020.

Sources of income taxable and exemption

As a general guide, all forms of incomes received and found to be sourced from or in Singapore are taxable. The income can be derived from your employment, trade/business, property, investments, royalties, and many others.

However, some exceptions to this rule are incomes from your lottery winnings (such as 4D or TOTO) or capital gains from stocks investment, etc.

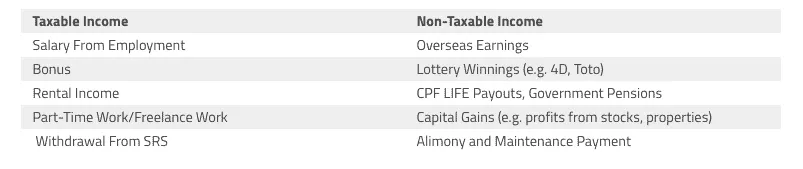

Credit: Dollars and Sense

The above is a non-exhaustive table showing a general list of income sources that are taxable and non-taxable. If you are unsure if your income source is taxable or not, you may refer to the IRAS website here.

If you are earning less than $22,000 in a year, you will be exempted from paying tax for that YA. Although you do not need to pay any tax for the particular year, do note that you will still need to declare your derived income for the year.

General format of income tax calculations (2021)

Tax calculations might seem really complicated, but knowing the general format of how the calculations are done can make it easier to understand.

The first step would be to calculate your assessable income for the year. Assessable income is essentially your net income for the year, minus approved donations. You obtain your net income amount, also called statutory income, by adding all your earned income and then subtracting all your allowable expenses in the same year.

The table below may help you better visualise the tax calculation process.

| Total Employment Income |

| Less: Allowable Employment Expenses |

| Net Employment Income |

| Total Trade, Business, Vocation or Profession Income |

| Less: Allowable Business Expense |

| Net Trade, Business, Vocation or Profession Income |

| Total Other Income (Eg, Dividends, Rental, Royalties, etc) |

| Net Total Income (Statutory Income) |

| Less: Approved Donations |

| Assessable income |

| Less: Personal Tax Reliefs |

| Chargeable Income |

| Tax payable on Chargeable Income

(Determined Tax rate multiplied by Chargeable Income) |

| Less: Rebates |

| Net Tax Payable |

Next, you will have to figure out your chargeable income for the year. Chargeable income for the year is tabulated by deducting personal reliefs from your assessable income.

Your final chargeable income is the amount we refer to, in order to determine the tax rate to be charged.

The tax rates can be found on the income tax rates table on the IRAS website (More on tax rates in the next section).

By multiplying the determined tax rate with your chargeable income, you can compute your tax payable for the year.

Should you have allowed rebates on your taxes, you can further deduct them from your calculated tax payable.

Personal Income Tax Rates (2022)

Personal income tax rates differ greatly depending on whether you are a tax resident in Singapore or not.

| Period of stay/employment in Singapore | Considered Tax Resident? |

| At least 183 days in the year | Yes, for that YA |

| At least 183 days spanning over 2 years | Yes, for both YA |

| Continuously for 3 consecutive years | Yes, for all 3 YA |

From the table, you can see the criteria which determines if someone who works or lives in Singapore is a tax resident or not.

Singapore Tax Resident

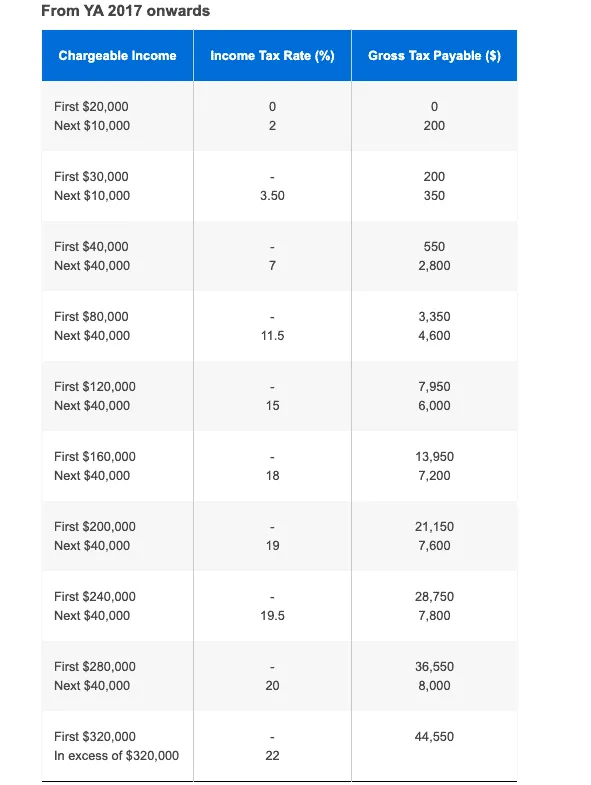

From: IRAS – Individual Income Tax Rates

Based on the table above, you can observe that individual tax rates for Singapore tax residents are progressive, which means that rates increase as you move up to higher income brackets.

Singapore Non-Tax Resident

For Singapore non-tax residents, your employment income will be taxed at the higher of a flat 15% rate or your determined tax rate based on the tax residents rates table seen above.

Certain kinds of income sources, such as Director’s fee and consultation fees are taxed at 22% for non-tax residents. However, there are a few types of income sources that are taxed at other rates, which can be found on the IRAS website.

Personal Tax Savings

Now, let’s talk about the most interesting portion of the tax calculations. Tax savings are the deductions, reliefs or rebates that you can receive, based on the current tax policies, which helps to reduce your tax payable amount.

Approved Donations

Besides helping a charity for a cause you care about, your donations might also help reduce your assessable income.

Every dollar donated to an approved Institution of a Public Character (IPC), or the Singapore Government for causes that benefit the local community is eligible for a deduction from your assessable income of 2.5 times ($2.50).

You can visit the Charity Portal to find out if the charity you donate to is an approved IPC, as not all charities are automatically an approved IPC.

You will also be happy to know that approved donations are automatically inputted into your tax return. The donations do not need to be declared, as IRAS is no longer accepting donation receipts.

Read more on how you can reduce tax by donating to charities here.

Personal Tax Reliefs

Personal tax reliefs are typically policies rolled out by the Government to encourage certain social or economic behaviours or objectives.

Personal tax relief amounts are deducted from your assessable income. This reduces your chargeable income that may result in a lower tax rate bracket.

For example, the Qualifying Child Relief (QCR) was implemented to help parents in supporting their children. Either parent can claim up to $4,000 per child under QCR.

However, there are certain criteria to fulfill for you to claim QCR under your child, as listed below.

- Your child will have to be under the age of 16 or studying full time in the basis year

- Your child must not have received an annual income of more than $4,000

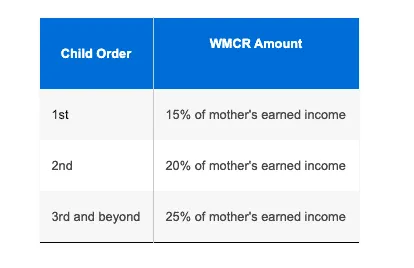

Another example would be the Working Mother’s Child Relief (WMCR) which was introduced to encourage mothers with children who are Singaporean citizens, to rejoin and remain in the workforce.

From: IRAS – Working Mother’s Child Relief

The table above shows the amounts of WMCR that a working mother can claim for every child, provided she fulfills all the necessary criteria.

There are many other reliefs that you might be eligible to claim. There is a helpful infographic on the IRAS website which summarises all the reliefs and deductions for YA 2021, you can check it out here.

Alternatively, you can fill in your details into the Personal Relief Checker on IRAS, in order to find out all the reliefs you may be able to claim as tax deductions.

Tax Rebates

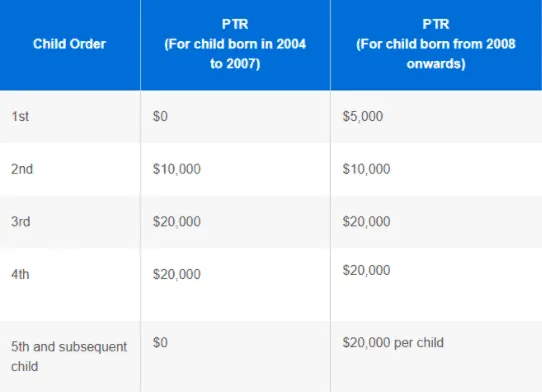

Tax rebates are amounts subtracted from your tax payable on chargeable income. For YA 2020, Parenthood Tax Rebate (PTR) is the only rebate that can be claimed. The PTR was introduced as a one-time claim to encourage tax residents to have children.

As seen above, the rebate amounts that tax residents can claim under each child increases until the third child, afterwhich the rebate amount stagnates at $20,000 per child.

If your PTR amount exceeds your tax payable for the year, the remaining rebates will automatically be brought forward for deductions in future years.

Furthermore, you are also able to share the PTR amount based on an agreed ratio between you and your spouse. As mothers are able to claim for WMCR, it might make sense for fathers to have a larger allocation of PTR.

This would help to reduce tax payable amounts for both parents. So both you and your spouse should calculate how much each should utilise in order to receive the most tax benefits combined.

Tax policies changes from year to year

Every year the Singapore government launches a Budget, whereby the implementation of new financial policies or changes made to the current policies are announced.

This also means that tax policies change from year to year. The tax savings you receive this year may not be the same as the savings you receive the following year.

Just to give an example, tax deductions from your approved donation made in the year 2015 (YA 2016) were 3 times your donation amounts.

However, approved donations made from 1 January 2016 onwards till 31 December 2023 (YA 2017 to YA 2024) will only be 2.5 times your donation amounts. Thus, we will have to wait for further announcements regarding tax savings from donations made after 31 December 2023.

As tax policies change every single year, you will need to have thorough knowledge of the tax rules and their implications on your tax liability, as well as your financial plans.

Also, you will have to constantly keep yourself updated with the changing tax regulations in Singapore and what they would insinuate.

Conclusion

As said by Francis Bacon, “Knowledge is Power”, having good knowledge and understanding tax regulations is key to tax planning. Nevertheless, having to do your own research might prove to be too tedious for many of us.

This is where an accredited financial advisor, who is certified in tax planning comes in. Besides maximising your tax savings, an experienced financial advisor can also incorporate a tax planning strategy into your financial plan.

As all of us have to pay taxes yearly, consulting a certified financial advisor will surely prove to be a worthwhile investment.

Furthermore, there are so many other policies and schemes that have been rolled out by the Government that can help reduce our taxes, our network of friendly financial advisors would be happy to provide you with the best advice and course of action, after assessing your financial position and goals.