The Great Eastern’s Great Family Care policy is multi-generational critical illness coverage that helps you and your family cope with unexpected life challenges.

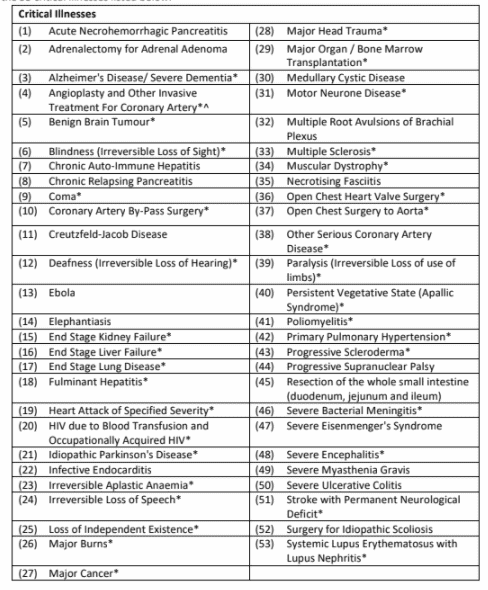

The policy covers up to 53 late-stage critical illnesses, terminal illnesses, total and permanent disability and death.

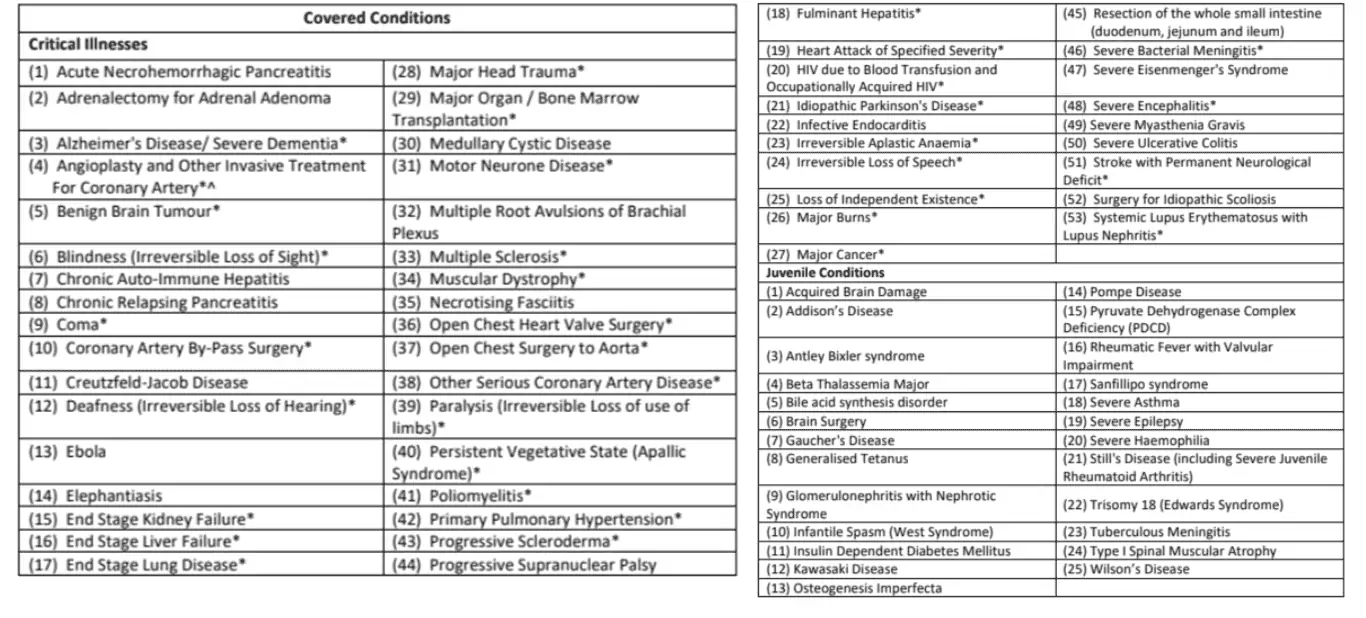

In addition, it offers your child or children protection against 25 juvenile illnesses and 53 critical illnesses.

Other than that, you can bump up your parent’s protection by opting for the Parent Protect Rider. What sets this cover apart from others is that your parents are insured without undergoing a laborious medical examination.

With a single plan, you can extend the cover to your parents and your children.

Here is a comprehensive review to help you have a clear understanding of the Great Eastern’s Great Family Care policy.

My Review of the Great Eastern Great Family Care

Great Eastern’s Great Family Care is a logical option for families because it’s an insurance product that does more than pay for your medical expenses.

Because of the affordable premiums, this policy is highly recommended for young families with budget constraints. It’s also a great choice for single parents caught up with the everyday demands of providing for their families.

For example, you can get a S$100,000 insurance cover by paying S$609 per year, a reasonable amount for many parents.

Another advantage of this policy is that it provides coverage for up to 53 illnesses and, therefore, an excellent option if your family has a history of critical illnesses.

If you are a working adult with other dependents, chances are you may have extra financial responsibilities requiring immediate attention. This policy is a great choice because it matches your financial demand and those of your dependents.

In addition, you can opt for the Parent Protect rider for your parents in case of an unfortunate event of illness in their old age.

On the flip side, there are some drawbacks of the Parent Protect rider. First of all, it’s not a fully-fledged CI policy and therefore only covers 3 critical illnesses.

However, users will appreciate that there’s no medical assessment required to enrol parents, thereby saving them the agony of undergoing many tests.

Another shortcoming of this policy is that it doesn’t allow claims in the early stages of critical illness. However, it’s worth noting that this is common with critical Illness insurance policies (note: not ECI).

For example, you will receive a payout if you are diagnosed with stage 4 of cancer. However, you’ll not receive payouts for stage 1 or 2.

If you are looking for a policy that covers illnesses in the early stages, you can consider early critical insurance riders or multipay plans.

Comparing Great Eastern Great Family Care Plan and FWD Big 3 Critical Illness

The table below provides a comparison of the Great Family Care vs. other cheap CI policies in Singapore to help you understand the differences.

| Critical Insurance Plan | Features | Annual Premium |

| FWD Big 3 Critical Illness | Additional S$20,000 death benefit

Get full payout for Heart attack of specified severity, stroke leading to irreversible neurological problem, all stages of cancer. |

Starts at S$275.50 |

| Great Eastern GREAT Family Care | Free coverage for children for 53 conditions and 25 juvenile conditions.

Pays up to 25% of the sum assured Optional Parent Protect rider |

Starts at S$603 |

Premiums are based on a 35-year old non-smoking male with sum assured of S$100,000 to age 85

Without a doubt, Great Eastern’s Great Family Care and FWD Big 3 Critical Illness policies are some of the cheapest on the market. However, GREAT Family Care scores more points thanks to the Parent Protect rider and the Child Protect benefit.

Also, it covers up to 53 critical illnesses and 25 juvenile conditions. On the other hand, FWD Big 3 Critical Illness only covers heart attack, stroke, and cancer.

Okay, it might not make sense for us to be comparing the GREAT Family Care with FWD Big 3, but hear us out.

The GREAT Family Care is meant to cover multiple generations, yes, but at the expense of lesser overall ECI/CI conditions covered.

With the rapid advancement in healthcare and the ability to detect ECI conditions earlier, it’s almost recommend to get covered for more ECI conditions if you can afford it.

This means getting a multipay plan for yourself so that you get covered for 120+ conditions, and getting your parents covered by the FWD Big 3 CI plan (if they can still get covered for it).

And if you’re worried about your kids, most multipay plans provide coverage for juvenile conditions for your children too.

This combination is going to be a lot more expensive, but it’s much more comprehensive.

So if you can afford it, you can consider this route instead.

However, if your parents have difficulties getting ECI/CI coverage for themselves due to pre-existing medical conditions, then the GREAT Family Care is an excellent workaround for this.

Overall, whereas no critical illness policy is 100% perfect, Great Eastern’s GREAT Family Care policy is simple, easy to understand, and convenient for most people.

Just make sure you understand your alternatives before committing to an insurance policy – you don’t want to be paying premiums for the next 20 to 30 years for a policy that isn’t good enough for you.

I recommend starting your research by reading our post on the best critical illness insurance plans in Singapore.

Once you’re done, look for a second opinion from an unbiased financial advisor to determine if whether the GREAT Family Care is truly good for you and your family.

If you need someone to get a second opinion from, we partner with MAS-licensed financial advisors to help you with this.

Click here for a free non-obligatory chat.

Let’s now dive into what the Great Eastern GREAT Family Care has to offer.

Criteria

The minimum sum assured starts at S$50,000.

Policy Entry Age

- Policyholder: 18 years to 65 years

- Child: 0 to 17 years

Basic Product Features

Coverage Term

- Policyholder: 18 years to 85 years

- Child: 0 to 18 years

- Parents: Up to 80 years

Premium Terms

- Payable throughout the term of the policy

- It is possible for CI premiums to be non-guaranteed, as with all CI premiums

Protection

Death Benefit

In the event of death, a lump sum amount is paid, and subsequently, the policy terminates.

Unlike most critical illness plans, the Great Eastern GREAT Family Care’s death benefit is equivalent to your sum assured.

This means that it works like a term life insurance plan, with a focus on critical illnesses.

Therefore, you should take its death benefit into consideration into your entire financial planning should you decide to get this policy.

Total and Permanent Disability Benefit

You will be paid a lump sum if you suffer from a total and permanent disability (TPD).

For presumptive TBD, you will enjoy the coverage for the entire policy term. In this case, presumptive TPD means that you are completely incapacitated, and the disability may include the following situations,

- When you lose the functions of both eyes and become completely blind

- When you lose the function of two limbs, at or above your ankle or wrist

- When you lose the function of one eye and one limb at or above your ankle or wrist.

For the presumptive TPD to be verifiable, it must meet the following condition;

- Be an opinion of a registered doctor

- Be total without the possibility of recovering

For other forms of total and permanent disability (TPD), you’ll only enjoy the benefit before you celebrate your 65th birthday.

In this case, the TPD refers to the incapability to perform any income-generating activity.

The benefit is capped at S$5,000,000 for each person covered by all Great Eastern policies.

Terminal Illness Benefit

You’ll be paid the death benefit as a lump sum amount after a diagnosis of an illness that can lead to death within 12 months after a diagnosis. Subsequently, the policy comes to an end after the lump-sum payment.

For the claim to be considered valid, you must present a registered doctor’s report. In addition, Great Eastern can appoint medical personnel to confirm the illness.

Critical Illness Benefit

You will be paid one lump sum amount if you are diagnosed with any of the 53 critical illnesses under the policy. Have a look at the table below;

For invasive Coronary Artery and Angioplasty treatment, you’ll be paid only 10% of the basic sum assured. After a claim settlement, the premium and basic sum assured reduces.

Subsequently, after this claim, you won’t get any other benefit for invasive coronary artery and angioplasty treatment under this policy.

On a related note, the maximum payment you can get under this condition shall not exceed S$25,000 under the policy and other policies with Great Eastern.

It’s worth noting that the maximum benefit you can get for critical illness payouts by Great Eastern is S$3,000,000.

Child Protect Benefit

If your child is diagnosed with any critical illnesses covered, you’ll be paid 25% of the basic sum assured or up to $50,000 per child.

However, you’ll only benefit if your child’s diagnosis occurs before their 18th birthday.

Likewise, your child must be diagnosed with any of 25 juvenile conditions or 53 critical illnesses also known as covered conditions as highlighted in the table below.

There are some exceptions to the Child Protect benefit. For example;

- You’ll not be paid if your child is diagnosed with any of the covered conditions in the first year of the policy.

- You’ll get 50% of the payout amount if your child is diagnosed with the covered condition in the second year of the policy.

- For your child to benefit, they must be biological or adopted as stipulated in Singapore laws.

- Your child must survive for a total of 14 days after a diagnosis of the covered ailment.

- The premiums and basic sum assured remains the same.

- The payment is only made once per child. However, this excludes treatment for Angioplasty and coronary artery in the first claim. For the second claim, the amount payable will be less than the previous payout. Subsequently, no other payment will be made for the child.

- Like all other policies, you must provide identification documents for the child to prove you are the parent.

Add-On Riders

Great Eastern allows you to add on optional riders to the Great Family Care like any other insurance policy. At purchase, you can opt for the Parent Protect Rider as a supplemental benefit.

Parent Protect Rider

You can boost your parent’s coverage in their old age with the optional Parent Protect rider. However, this covers only a few conditions and not the entire 53 critical illnesses under this policy.

In the event of a critical illness such as Alzheimer’s, Severe Dementia, Parkinson’s or Major Cancers, a lump sum amount will be paid once to a maximum of S$50,000 per parent and life insured.

Subsequently, after the payment, the rider terminates. Similarly, the total capping per parent under this rider is S$100,000.

The good thing about this rider is that there is a guarantee of coverage even without a medical assessment.

After a diagnosis of these ailments, you may receive up to 15% of the sum insured or a lump sum amount equivalent to $15,000, whichever is higher.

Here is an illustration to help you understand

If you purchase S$50,000 coverage under the Parent Protect Rider, you’ll receive a payout of S$15,000. As you already know, S15,000 is higher than 15% of S$50,000, which is equal to S$7,500.

On the other hand, if you purchase a S$200,000 policy, you’ll get a payout of S$30,000, which is 15% of S$200,000.

To qualify for this rider, you must meet the following conditions;

- Your parent must be less than or equal to 80 years

- The diagnosis of the CIs must occur before your parents attain the age of 100

A Summary of the Great Eastern Great Family Care

| Cash value & withdrawal benefits | |

| Policy cash value | Not available |

| Surrender or maturity value | Not available |

| Renewable or convertible features | Not available |

| Health & Insurance coverage | |

| Death benefit | Available |

| Terminal Illness benefit | Available |

| Critical Illness coverage | Available |

| Total and Permanent Disability coverage | Available |

| Early Critical Illness coverage | Not available |

| Optional rider(s) | |

| Insurance riders to boost coverage | Available |

| Other features | |

| Parent Protect rider | Available |

| Child protect benefit | Available |