Here is what CPF shielding is about, why it is so attractive, its downsides, and some best practices recommended by the CPF Board.

Understanding the CPF Retirement Sum Scheme and CPF LIFE

To better illustrate how the concept of shielding comes into play, we would first like to walk you through the CPF Retirement Sum Scheme and CPF LIFE.

Retirement Sum Scheme (RSS)

On top of your existing CPF accounts – the Ordinary Account (OA), Special Account (SA), and Medisave (MA) – the CPF Board will open a Retirement Account (RA) on your behalf when you turn 55 years old.

Your RA would consist of a Full Retirement Sum (FRS) that will be obtained from your SA and OA.

As of 2022, the FRS is $192,000, and this amount is subjected to yearly change.

CPF Lifelong Income For the Elderly (CPF LIFE)

If you are born in 1958 or later, you will be automatically enrolled into CPF LIFE once you turn 65 years old.

If you do not fall under the above cohort, you may still opt into the scheme before your 80th birthday, or remain in the CPF Retirement Sum Scheme.

Funds in this longevity insurance annuity scheme will be obtained from your RA in the following fashion. Your CPF LIFE will reimburse monthly payouts for as long as you live.

Source: CPFB

What is CPF Shielding?

CPF shielding is a strategy that Singaporeans have devised to get the biggest bang for their buck from the national retirement scheme.

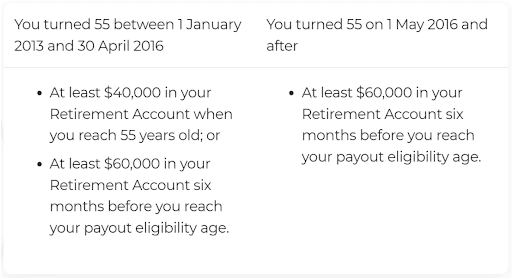

Singaporeans who wish to adopt CPF shielding will withdraw all possible funds from their SA for investment when they turn 55 years old, leaving only the minimum required sum of $40,000 in their SA.

In creating your Retirement Account, the CPF Board will only be able to extract $40,000 from your Special Account to form the FRS.

The CPF Board will hence have to obtain the outstanding FRS amount from your Ordinary Account.

Once the CPF Board has completed the deduction, the account holder then ports back his money into the SA by selling off his investments.

With that, the account holder has successfully “shielded” his SA from the CPF Board’s deduction.

Why is CPF Shielding so Attractive?

The main attraction in CPF shielding lies within the SA’s risk-free interest rate of 4% per annum. With the SA offering returns that are close to double of that which the OA offers (2.5% per annum), Singaporeans stand to yield an additional interest of $2,280 [($192,000 – $40,000) x 1.5%] for the first year, with subsequent returns that compound annually.

| Shielding (4%) | Without Shielding (2.5%) | Difference | |

| Year 1 | [($192,000 – $40,000) x 4%] =

$6,080 |

[($192,000 – $40,000) x 2.5%] =

$3,800 |

$6,080 – $3,800 =

$2,280 |

| Year 5 | $7,397.25 | $4,299.35 | $3,097.90 |

| Year 10 | $8,999.89 | $4,864.32 | $4,135.57 |

As you can see from the above, the difference you make on the first year of shielding is already $2,280, and by the time it’s 10 years later, you’ll make a difference of $4,135.57.

That’s a 185% difference!

Now, we assume your CPF Life starts paying out at 65, and that compounding stops after.

But since compounding in your CPF doesn’t stop, the difference keeps on growing yearly!

How CPF Shielding is Done

Upon turning 55, you withdraw all available funds in your SA, you can place your SA monies in the following investment products:

- Unit trusts,

- Investment-linked insurance products (ILPs),

- Annuities,

- Endowment policies,

- Singapore Government Bonds (SGBs),

- Treasury Bills (T-bills),

- Exchange-Traded Funds (ETFs),

- Fixed Deposits,

- Stocks,

- Real Estate Investment Trust (REITs), and

- Bonds,

Each product varies in the maximum investible savings you may use to invest and the risk level.

Click on each link above to understand the risks involved in each type of product available.

You may read more about CPFIS in our comprehensive guide!

Once your Retirement Account is created, you sell off all your investments to return your funds back into your Special Account.

This way, you’ll generate risk-free returns of 4% instead of 2.5% in your OA!

Downsides to CPF Shielding

While CPF shielding seems to be a genius hack to grow your wealth, gaming the system has its pitfalls.

Firstly, investment products that offer to grow the money you have “shielded” may charge high transaction fees.

This differs depending on the investments you choose above and the respective fees it comes with, so be sure to take this into consideration if you’re looking to shield.

Secondly, shielding has its risks. Given that shielding entails the immediate buying and selling of your funds after the CPF Board creates your RA, it might not seem risky to do so.

However, depending on the CPFIS you opt for, these investments may be of high risk, causing you to incur losses.

So again, the selection of your investment matters here.

The SA was designed to temporarily hold funds for the short term. With its higher interest rate, account holders can accumulate the FRS for enrolment into CPF LIFE.

With shielding being an increasingly popular technique, the CPF Board has heightened its alert.

It announced that it would come down harshly on financial advisors that fail to explain the risk of CPF shielding to their clients.

For all we know, the Board might begin altering its rules to patch the system’s loophole, since the misuse has caught their attention…

Best Practices Recommended by CPF Board

Think Twice Before Executing CPF Shielding

Instead of making large-sum withdrawals in a spur of the moment, the CPF Board encourages account holders like yourself to seek its advice before doing so.

Fill Your SA Instead of Emptying It

Since the SA earns you a higher interest of 4%, topping it up maximises the interest you can earn from the account, increasing your retirement savings and monthly payouts.

With interest compounded annually, you get to earn interest on the interest!

With every dollar you put into your SA, it will yield double in 20 years’ time.

So if you put in $10,000 in your CPFSA today, 20 years from now it will be $21,911.23 with 4% compounded interest!

You can choose to top up your SA with cash in one lump sum or via small top-ups through GIRO.

Alternatively, you may transfer funds from your OA to your SA. However, do note that the one-way transfer is irreversible.

You will be entitled to tax relief of up to $7,000 annually if you top up your SA before 31 December.

Make Early Top Ups

Leveraging on the power of compounding interest, topping up your SA earlier in the year maximises the interest you can earn.

You can yield up to 20% more in 10 years by topping up your SA in January instead of December!

This is because CPF compounds your funds monthly and pays these interests on the 1st of January yearly, which means that you’re losing quite a bit!

For example, depositing $7,000 annually in January for 10 years will accrue a total interest-earning of more than $20,000.

However, if you were to top up the same $7,000 every December instead, the total interest you earn will be approximately $4,000 less.

Should you CPF Shield?

Ultimately, the decision lies on you.

- Are you interested in earning additional income from CPF shielding?

- What investments will you use to conduct CPF shielding?

- Do you understand the risks involved in doing so?

- Would you prefer to be on the safe side and follow the traditional way CPF has intended it to be?

Answering these questions will help you think back and reflect on whether you should do this.

Conclusion

We hope that this post has helped you understand CPF shielding better and whether you should do it.

There are many ways to go about retirement planning and there is no “better” way to do so.

It’s what best for you.

Want to know how you can best plan for your retirement?

Speak to our trustworthy partner financial advisors!

They will conduct an objective assessment of your needs and recommend schemes that align with your preferences.

References

https://www.cpf.gov.sg/member/retirement-income/monthly-payouts/cpf-life

https://www.straitstimes.com/business/invest/no-more-shielding-of-cpf-soon